$KDP (+6,77%)

$7751 (+0,6%)

$NXPI (+2,38%)

$WM (-3,53%)

$CDNS (-0,18%)

$BN (+0,46%)

$SOFI (+5,06%)

$UNH (+0,78%)

$AMT (-1,01%)

$UPS (+2,26%)

$BNP (+1,78%)

$NVS (-1,33%)

$DB1 (+0,13%)

$MSCI (+0,69%)

$ENPH (+1,15%)

$BKNG (+2,46%)

$LOGN (+1,87%)

$V (+0,35%)

$MDLZ (+1,11%)

$PYPL (+1,26%)

$000660

$MBG (+0,63%)

$BAS (-0,58%)

$UBSG (+1,33%)

$SAN (+1,91%)

$CVS (+0,85%)

$OTLY (+1,11%)

$GSK (+0,9%)

$ETSY (+2,31%)

$CAT (+0,5%)

$KHC (+1,01%)

$ADYEN (-0,93%)

$ADS (-0,12%)

$AIR (+0,57%)

$SBUX (+1,16%)

$CMG (-0,31%)

$META (+1,79%)

$KLAC (+3,21%)

$MELI (+5,8%)

$WOLF (+5,16%)

$GOOGL (+3,9%)

$EQIX (+0,47%)

$MSFT (+1,5%)

$CVNA (+0,85%)

$EBAY (+0,26%)

$005930

$6752 (-0,29%)

$KOG (-0,67%)

$VOW3 (+1,29%)

$GLE (-0,02%)

$LHA (-0,3%)

$STLAM (+0,33%)

$SPGI (+1,45%)

$MA (-0,06%)

$PUM (-0,8%)

$AIXA (+0,09%)

$FSLR (+2,13%)

$AAPL (+2,1%)

$REDDIT (-1,16%)

$AMZN (+1,47%)

$NET (+3,38%)

$MSTR (+1,56%)

$GDDY (+0%)

$TWLO (+1,43%)

$COIN (+1,29%)

$066570

$CL (-0,45%)

$ABBV (-0,41%)

$XOM (+0,15%)

Discussione su KHC

Messaggi

49Quarterly figures 27.10-31.10.25

Milka manufacturer wants to significantly reduce advertising expenditure with AI

The Milka manufacturer Mondelez $MDLZ (+1,11%) wants to use artificial intelligence (AI) to reduce the cost of creating advertising content by 30 to 50 percent. The food company developed the corresponding AI tool last year together with the advertising agency Publicis Groupe and the IT consultancy Accenture.

The new technology is already being used in social media in Germany for the chocolate brand Milka and in the USA for Chips Ahoy cookies. An eight-second Milka video shows chocolate waves spilling over a wafer, with the background varying depending on the target group.

Mondelez expects the tool to be able to create short television spots for next year's holiday season, and possibly for the 2027 Super Bowl. The cost of animation would be "in the hundreds of thousands," Halvorson said. "This type of production is orders of magnitude cheaper."

Competitors such as ketchup manufacturer Kraft Heinz $KHC (+1,01%) and Coca-Cola $KO (+0,1%) are also experimenting with AI for their advertising. Coca-Cola ran AI-generated Christmas ads in 2024, but their computer-generated characters were ridiculed by some consumers for their lack of emotion.

Source text (excerpt) & graphic: Handelsblatt, 25.10.25

New dividend portfolio

I would like to start a completely new portfolio that will primarily revolve around dividends.

As a core I was thinking of $TDIV (+0,64%)

Would you say this is a good core?

If not I would add $VHYL (+0,52%) add.

Additionally I would like to have a CC ETF as a kind of support, probably $JEGP (+0,12%) and or $SXYD (+0,67%)

I would like to represent the NASDAQ with $EQQQ (+1,79%) but I will represent it with $ASML (+1,87%) and $2330 will be added.

Allianz $ALV (+1,01%) and Munich Re $MUV2 (+0,62%) I definitely want to include, but they are too expensive for me financially, so I was thinking of the $EXH5 (+0,89%)

Oil shares are represented by $VAR (+1,17%) and one more.

Do you have any recommendations?

I am thinking about $CVX (-0,25%)

$EQNR (-0,73%) and $PETR4 (+0,41%)

I would also like renewable energies, but I'm not familiar with them.

Do you have any suggestions?

Becoming a defensive company $ULVR (+0,07%)

$D05 (+1,1%)

$O (+0,21%) and of course $NOVO B (-0,65%) Being.

$BATS (+0,34%) I already have in a portfolio, would it be too much of a lump to add $MO (-1,42%) to add to it?

I still have $KHC (+1,01%) on the watchlist but the split is not going so well, would it be wise to start with a savings plan?

Apart from that $RIO (+1,19%)

$NKE (-0,85%)

$1211 (+1,8%)

$SOFI (+5,06%) and $HAUTO (+0,37%) will be represented with smaller positions.

What is your opinion?

Would you improve anything?

What else would you add, especially in EE and defensive stocks?

Feedback is very important to me here, so far I have just been wandering aimlessly around the stock market without a fixed plan and strategy.

This is my first attempt to build something serious.

Greetings to all Getquins out there!

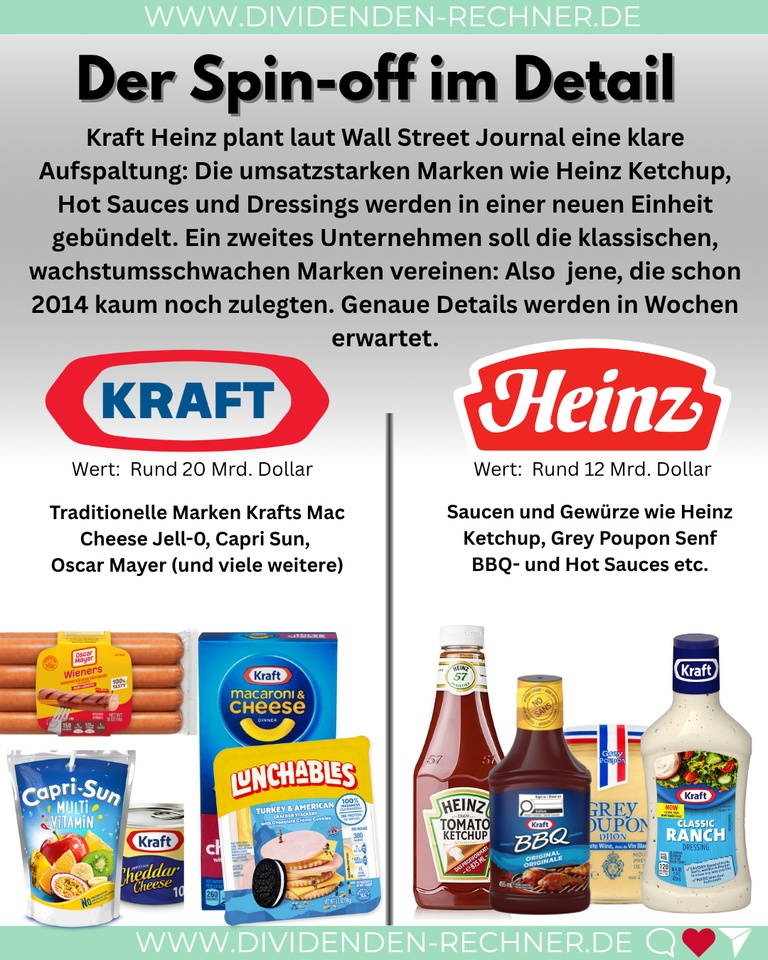

What's going on at Kraft Heinz? A review.

$KHC (+1,01%) was never an investment for me. As tempting as the high dividend is, I always had a bad feeling. And it wasn't just because of Kraft's lunch labels, which give me a stomach ache just looking at them. Here's why in pictures and text.

+ 7

KHC - Company split?

$KHC (+1,01%) - I have just come across an article from the Handelsblatt.

To be honest, I don't quite know what to make of it. It seems to me that every time things aren't going well operationally, someone from the management comes up with the same suggestion: let's split the company up and focus on 'the core brand'. At $ULVR (+0,07%) has similar considerations with the spin-off of the ice cream division. A few years later, the new management regularly comes along and orders the company to diversify or 'broaden its base' and then things go in the other direction again and new business areas and brands are acquired (see Kelloggs and Ferrero, for example).

A capable management should actually be able to improve its own portfolio and the sales of its products. Selling off parts of the company seems a bit unimaginative to me, even if you might be able to make a little money in the short term.

Here is the link to the article:

Ketchup producer: Kraft Heinz wants to split up https://share.google/LI0N7qKkIImgox9EI

Are you invested in $KHC?

Diamante grezzo italiano

$NWL (+0,7%) Plasmon torna ad essere italiana, con l'ingresso di Newlat nella borsa inglese e l'acquisto dello stabilimento Plasmon a Latina da $KHC (+1,01%) ,la società reggiana prosegue la sua politica di crescita ed acquisizioni per accrescere le proprie quote di mercato, seppur non sia un'azienda che elargisce dividendi me ne sono innamorato subito. Ancora sotto il miliardo di capitalizzazione ma di questo passo mi aspetto molte soddisfazioni da questa società, al momento sembra intenta a reinvestire tutte le risorse per crescere, appena si stabilizzerà inizierà sicuramente a distribuire come tutte le aziende del settore food

Sell Kraft Heinz?

I'm currently down 27% (after dividends) or 29% (purely by price) on Kraft Heinz, but I have an investment horizon that ideally could span several decades. In view of the high dividend, the relatively low P/E ratio and a potential turnaround, it wouldn't be a shame to part with the stock at a loss if it's not actually a piece of junk and will pay me dividends every year that would theoretically put any call money account in the shade, even if the stock market is poor.

I am aware of the irrational component of my considerations (realizing losses is painful, ergo stupid), but at the same time I have a rational component, namely: if I were not already invested, would I currently be considering buying Kraft Heinz, as it may soon be going up again!

Do you think the downturn is already over or will Kraft Heinz sink ever deeper towards the bottom? If the downturn is over, how realistic is growth, at least at industry level, in the next 5-10 years?

Instead, think about whether you have better things to do with the money, or whether KHC is already the ultimate best investment you can imagine for this part of your portfolio.

Kraft Heinz Company

$KHC (+1,01%) : Navigating a Shifting Landscape – What's Next?

The Kraft Heinz Company (KHC) is a name synonymous with household staples, a giant in the packaged food industry. From Heinz ketchup to Oscar Mayer, their brands are deeply embedded in our kitchens. However, like many legacy food companies, KHC has been on a journey of adaptation, facing evolving consumer preferences, supply chain complexities, and intense competition. This post will delve into the current state of Kraft Heinz, what analysts are saying about its trajectory, and what the future might hold.

A Look Back and the Current State

For a period following its 2015 merger, Kraft Heinz faced significant headwinds, including write-downs of its brand assets and a struggle to innovate quickly enough to meet changing tastes. Consumers were increasingly shifting towards healthier, fresh, and more adventurous food options, often from smaller, agile brands. This led to a period of declining sales and a loss of market share.

In recent years, KHC has undertaken a significant transformation under new leadership. The company has focused on divesting non-core assets, streamlining its portfolio, and investing in its most profitable and promising brands. There's been a clear push towards efficiency, cost control, and a renewed emphasis on marketing and innovation for key products. The pandemic, surprisingly, offered a temporary boost to many packaged food companies as "at-home" consumption surged. However, as economies reopen, the challenge for KHC is to maintain that momentum and prove its long-term relevance.

What Are Analysts Saying?

The sentiment among financial analysts regarding Kraft Heinz is generally one of cautious optimism, a departure from the more skeptical views of a few years ago. Many acknowledge the significant progress made in debt reduction and portfolio optimization.

One key area analysts are watching closely is organic sales growth. While cost-cutting measures have improved profitability, sustainable long-term growth hinges on KHC's ability to drive genuine demand for its products. Analysts are keen to see if the company's investments in marketing and product innovation (such as expanding into healthier or more convenient formats for existing brands) are translating into consistent top-line expansion.

Another point of focus is pricing power. In an inflationary environment, KHC's ability to pass on rising costs to consumers without significant volume declines is crucial. Its strong brand recognition provides some leverage, but competitive pressures remain.

Furthermore, analysts are evaluating KHC's capital allocation strategy. Beyond debt reduction, questions linger about future M&A activity (though less likely to be large-scale) and shareholder returns, including dividends and share buybacks. The general consensus is that KHC is now in a more stable financial position, allowing for more strategic flexibility.

The Future of Kraft Heinz

The future for Kraft Heinz will likely be characterized by continued evolution. We can expect to see:

* Further Portfolio Rationalization: KHC may continue to shed underperforming brands and double down on those with strong growth potential or market leadership.

* Innovation within Core Brands: Expect to see more variations, healthier alternatives, and convenience-focused options for iconic brands like Heinz, Philadelphia, and Lunchables. This is about meeting consumer needs without completely abandoning their heritage.

* Increased Focus on E-commerce and Digital Marketing: The shift to online grocery shopping is irreversible. KHC will need to continue investing heavily in its digital presence and direct-to-consumer capabilities.

* Sustainability Initiatives: Consumers are increasingly conscious of the environmental and social impact of the brands they choose. KHC, like its peers, will face growing pressure to demonstrate progress in areas like sustainable sourcing, packaging, and waste reduction.

* Strategic Partnerships: Collaborations with smaller, innovative food companies or even technology firms could offer avenues for growth and diversification.

What Do YOU Think?

Kraft Heinz is a company in constant motion, striving to remain relevant in a dynamic industry. Given its history, its recent efforts, and the broader trends in the food sector, what are your thoughts on The Kraft Heinz Company?

* Do you believe their transformation efforts are sustainable in the long run?

* Which of their strategies do you think will be most impactful?

* As a consumer, how have your perceptions of Kraft Heinz changed, if at all?

* What challenges or opportunities do you see for them moving forward?

Share your insights and opinions in the comments below!

My only concern is whether consumers are not increasingly shifting towards no-name products which will make it hard for the traditional household brands to maintain their pricing policy.

Titoli di tendenza

I migliori creatori della settimana