$PDD (-6,86%)

$601318

$EH

$OKTA (-5,44%)

$MDB (-5,84%)

$3690 (-7,17%)

$KSS (-8,16%)

$ANF

$CRWD (-4,63%)

$SNOW (-4,44%)

$HPQ (-5,92%)

$NTNX (-1,79%)

$NVDA (-6,14%)

$DHER (-2,56%)

$LI (-3,79%)

$DELL (-4,8%)

$S (-4,35%)

$IREN (-9,15%)

$ULTA (-2,84%)

$MRVL (-5,93%)

$AFRM (-9,72%)

$ADSK (-3,77%)

$BABA (-8,67%)

Discussione su KSS

Messaggi

12Quarterly figures 25.08-29.08.25

Was that the beginning or the end

$KSS (-8,16%) today partly with +80% currently we are at +35%

Kohls is one of the most shorted stocks on the market. Are we seeing the beginnings of a short squeeze here? Extremely high volume today with 11 million trades. That is almost 15x the normal volume for the stock.

Is greed winning out here or are investors showing diamond hands?

Personally, I entered 2 months ago with a mini position simply because of the high short rate and the poor results and was actually speculating that some big player would make a takeover bid and I could get a few % out of it

Kohl’s Q4'24 Earnings Highlights

🔹 Adj. EPS: $0.95 (Est. $0.77) 🟢

🔹 Revenue: $5.18B (Est. $5.18B) 🟢

🔹 Comparable Sales: -6.7% YoY

FY25 Guidance

🔹 Net Sales: -5% to -7% (Est. -0.55%) 🔴

🔹 Comp Sales: -4% to -6% (Est. -0.55%) 🔴

🔹 EPS: $0.10 to $0.60 (Est. $1.24) 🔴

🔹 Operating Margin: 2.2% to 2.6%

🔹 CapEx: $400M to $425M

🔹 Dividend: $0.125/share (Payable April 2, 2025)

Operational Performance

🔹 Gross Margin: 32.9% (+49 bps YoY)

🔹 SG&A: $1.5B (-4.5% YoY); 28.5% of revenue (+148 bps YoY)

🔹 Operating Income: $126M (-57.9% YoY); 2.3% margin (-270 bps YoY)

🔹 Inventory: $2.9B (+2% YoY)

🔹 Operating Cash Flow: $596M

Management Commentary

🔸 CEO Ashley Buchanan: "We are taking action in 2025 to reposition Kohl’s for future success, focusing on delivering great products, value, and experience to our customers."

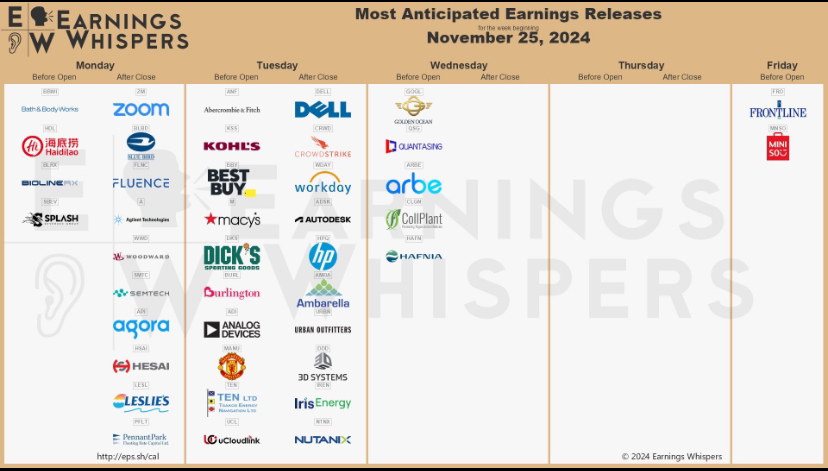

The eagerly awaited quarterly figures for the week of March 10, 2025

A number of important earnings releases are scheduled for the coming week. The focus will be on:

📌 Adobe ($ADBE (-3,29%) )

📌 Oracle ($ORCL (-3,03%) )

📌 DocuSign ($DOCU (-3,89%) )

📌 D-Wave Quantum ($QBTS (-7,49%) )

📌 ZIM Integrated Shipping ($ZIM (-4,42%) )

📌 ULTA Beauty ($ULTA (-2,84%))

📌 Kohl's ($KSS (-8,16%) )

📌 Dollar General ($DG (+0,11%))

📌 UiPath ($PATH (-10,71%) )

📌 SentinelOne ($S (-4,35%))

Which of these companies are you following with particular interest? Do you have positions in any of these stocks?

🔗 Source: Earnings Whispers

52-week lows

The following shares reached a 52-week low during the course of the day today:

Nike $NKE (-4,98%)

Novo Nordisk $NOVO B (-3,44%)

Dollar General $DG (+0,11%)

Hershey Foods $HSY (-0,19%)

Biogen $BIIB (-2,47%)

Diageo $DGE (-0,24%)

Krispy Kreme $DNUT (-5,03%)

Kohl's $KSS (-8,16%)

$KSS (-8,16%) | Kohl’s Corporation Q3 Earnings Highlights:

🔹 EPS: $0.20 (Est. $0.30) 🔴

🔹 Revenue: $3.51B (Est. $3.85B) 🔴; DOWN -8.8% YoY

🔹 Comparable Sales: -9.3% (Est. -5.19%) 🔴

CUTS FY24 Guidance:

🔹 Net Sales: -7% to -8% (Prev. -4% to -6%) 🔴

🔹 Comparable Sales: -6% to -7% (Prev. -3% to -5%) 🔴

🔹 Operating Margin: 3.0% to 3.2%

🔹 Diluted EPS: $1.20 to $1.50 (Est. $1.86) 🔴

🔹 Capital Expenditures: ~$500M

Key Q3 Metrics:

🔹 Gross Margin: 39.1%; UP +20 bps YoY

🔹 SG&A as % of Revenue: 34.8%; UP +125 bps YoY

🔹 Operating Income: $98M; DOWN -37.6% YoY

Shareholder Returns:

🔹 Dividend: $0.50/share; payable December 24, 2024

CEO Commentary:

🔸 "Sales softness in apparel and footwear offset strong growth in categories like Sephora, home decor, and gifting. Aggressive actions are being taken to reverse declines."

Strategic Updates:

🔸 CEO Tom Kingsbury to step down in January 2025, succeeded by retail veteran Ashley Buchanan.

🔸 Expansion of Sephora partnership and addition of Babies “R” Us shops in 200 locations.

Key Challenges:

🔹 Eleventh consecutive quarter of declining same-store sales.

🔹 Continued pressure from higher consumer costs and reduced foot traffic.

$KSS (-8,16%) what's wrong with stock? Value trap?

Looks like a fair chance of a stock price increase within the next 12-18 months

The week summarized:

Monday

- Oracle Corp. ($ORCL (-3,03%) ) published quarterly results.

Tuesday

- NFIB Small Business Optimism Index (February)

- Consumer Price Index (February)

- Quarterly results of On Holding AG ($ONON (-3,87%) ), Kohl's ($KSS (-8,16%) ), Manchester United PLC ($MANU (+1,1%) ) and LoanDepot Inc. ($LDI (+0%) )

Wednesday

- Dollar Tree ($DLTR (-2,48%) ), Lennar Corp. ($LEN (+0,32%) ) and Williams-Sonoma Inc. ($WSM (-4,63%) ) publish quarterly results.

Thursday

- Retail sales in the USA (February)

- Producer Price Index (February)

- Business inventories (January)

- Quarterly results from Adobe ($ADBE (-3,29%) ), Dollar General ($DG (+0,11%) ), Ulta Beauty Inc. ($ULTA (-2,84%) ) and Dick's Sporting Goods Inc. ($DKS (-5,27%) )

Friday

- Empire State Manufacturing Survey (March)

- Import Price Index (February)

- Industrial Production (February)

- Consumer sentiment (March)

- Capacity utilization (February)

- Quarterly results from Jabil Inc. ($JBL (-5,69%) )

OPEC's main task is to coordinate the production volumes of its member countries in order to influence the global oil market and oil prices. By setting production quotas, OPEC can control supply and demand on the oil market and thus influence prices. This power enables the organization to exert both economic and political influence, which can have a global impact.

Titoli di tendenza

I migliori creatori della settimana