JSC Kaspi kz Global Sponsored Reg S Kazakstan

Price

Discussione su KSPI

Messaggi

22Allocation by Irish sale

The idea of further diversifying my portfolio had solidified somewhat in recent weeks. $IREN (+11,25%) I left it at my self-imposed partial sell target of EUR 55 and started to build up the first positions on Friday. I am sticking to my target of investing around EUR 5k in each position. $IREN (+11,25%) remains in the portfolio with 500 shares and will (probably) not be touched in the near future. $DEFI (-0,57%) Now also full with 5,500 shares.

19k liquidity left and will still be invested in top-ups + new shares.

Individual shares are now:

$DSFIR (+0,56%) possibly increase

$MUM (-0,29%) possibly increase

$FSLR (+4,46%) Increase if necessary

$NICE Increase if necessary

Does anyone else have an idea for a share, possibly also from the German-speaking region? The Asian region would also be very interesting, although I am looking a little at $1810 (-2,49%) look at.

vg and have a nice WE

Micha

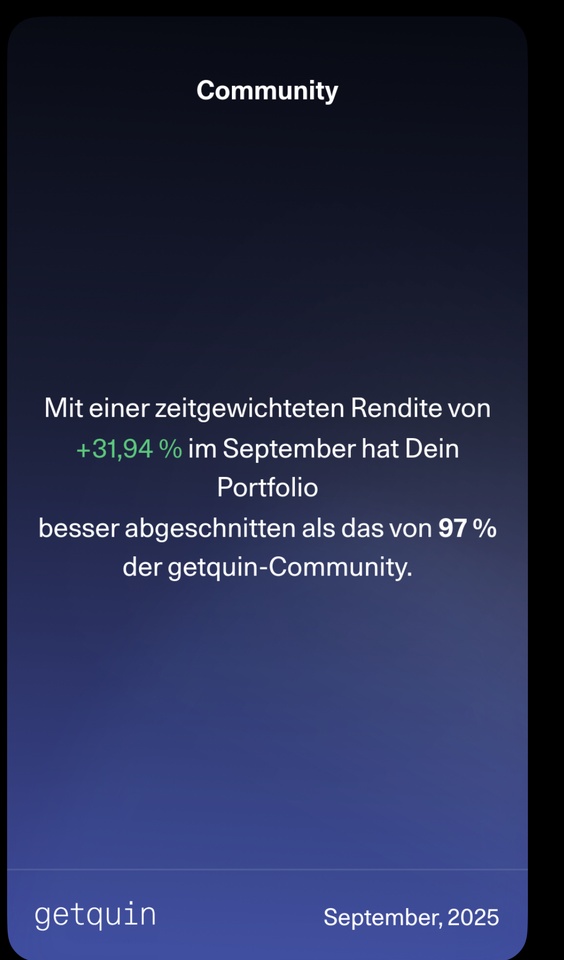

Next step 150k

After September also provided a decent return, I'm hoping for 150k at the end of the year. I have also recently started betting on a boost of $DEFI (-0,57%) . $KSPI (+0,47%) is out for me with +20% after a good run.

A bit of "stability" is provided by $DSFIR (+0,56%) and $MUM (-0,29%) although I hope to have bought them at a relatively low level. We will see...

Otherwise, onwards:

good investment to all!

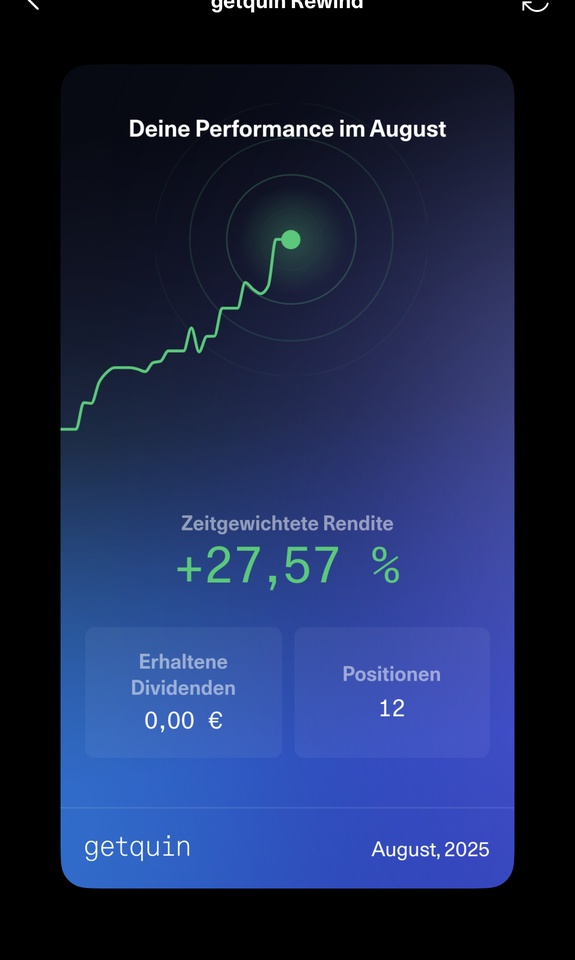

August cracks the 100 ytd

Thanks to a clear overweight $IREN (+11,25%) August was also very satisfactory. $KSPI (+0,47%) Sold at exactly the right time and got back in today. First tranche today $FSLR (+4,46%) . Very good position to get another boot in the door in the Renew. E. to get a boot in the door.

In addition, the 100k was cracked in August, which was my target for 2025. It won't always be like this, so I'm more than satisfied and grateful!

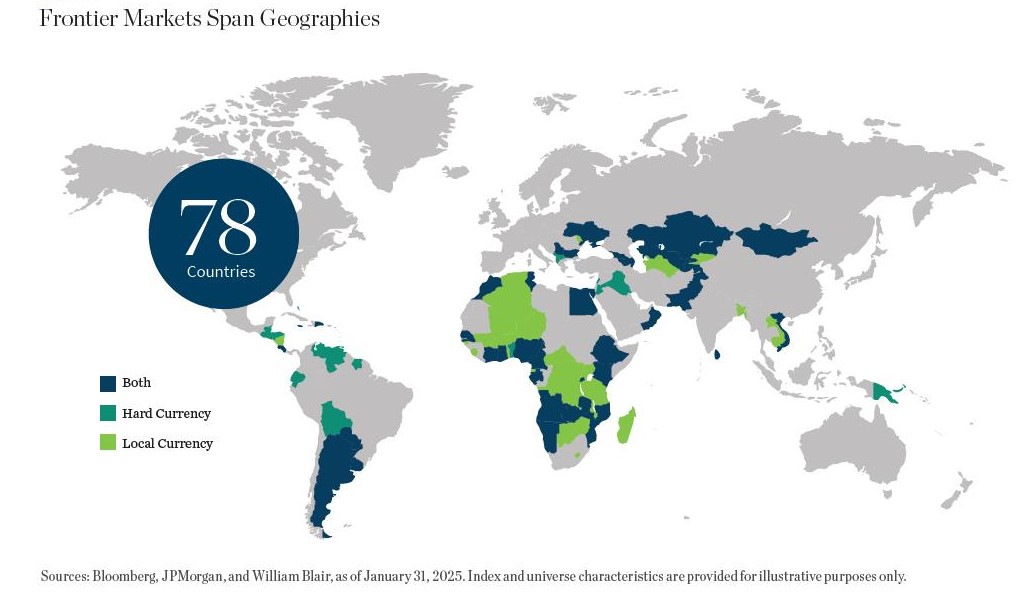

Frontier boom: Where early birds get the best returns

Hello dear Getquin Community,

today I would like to introduce you to the exciting topic frontier markets which is currently on everyone's lips. Anyone who follows the flow of money will quickly realize that there is no way around these markets in the future. After thorough research, I would like to introduce you to 10 shares and 5 ETFs with enormous potential.

Significance

Frontier markets are the bridge between emerging and industrialized countries. The MSCI Frontier Markets Index comprises 233 companies from 28 countries and covers around 85 % of the freely tradable market capitalization. They are still at the beginning of their capital market development, but this is precisely where the appeal lies.

Development and potential

In 2024, the index achieved a return of just under 10 % in USD. Individual companies such as Kaspi.kz, OMV Petrom and Vinhomes are already generating billions in profits and proving that frontier markets are no longer an exotic fringe phenomenon, but platforms for sustainable growth. For investors, this opens up opportunities for uncorrelated returns and the chance to enter future emerging markets at an early stage.

Sectors and regions

The strongest segments are Banks & Fintechs (Kaspi.kz, Attijariwafa, Banca Transilvania), Commodities & Energy (Kazatomprom, OMV Petrom), Real Estate (Vinhomes) and Industrials & Pharmaceuticals (Hoa Phat, KRKA). Vietnam, Kazakhstan, Romania and Morocco dominate regionally, while Africa offers diversification through broadly diversified indices.

The largest listed players

$KSPI (+0,47%) Kaspi.kz (Kazakhstan, Fintech & E-Commerce)

$SNP OMV Petrom (Romania, energy)

$VHM Vinhomes (Vietnam, real estate)

$ATW Attijariwafa Bank (Morocco, banking)

$TLV Banca Transilvania (Romania, Banking)

$KAP (-1,46%) Kazatomprom (Kazakhstan, uranium production)

$KRKG (+0,97%) KRKA (Slovenia, pharmaceuticals)

$HPG Hoa Phat Group (Vietnam, steel/industry)

$NLB Nova Ljubljanska Banka - NLB (Slovenia, banking)

+ High-growth mid caps from Vietnam and Africa

Top 5 frontier ETFs

$XFVT (+0,08%) Xtrackers FTSE Vietnam Swap ETF (WKN: DBX1AG)

$DX2Z (+0,86%) Xtrackers S&P Select Frontier Swap ETF (WKN: DBX1A9)

$XMKA (-0,5%) MSCI EFM Africa Top 50 Capped Swap ETF (WKN: DBX0HX)

$FM iShares MSCI Frontier and Select EM ETF (Ticker: FM, US)

$EMFM Global X MSCI Next Emerging & Frontier ETF (Ticker: EMFM, US)

Takeaway

Frontier markets are volatile, but their combination of growth, diversification and high margins makes them a strategic building block for any forward-looking portfolio. However, many shares and ETFs are difficult to access in Germany. The key question: who will recognize the potential of these markets early enough and position themselves before they are discovered by the mainstream?

Source: MSCI Frontier Markets Index Factsheet, company reports, podcast All on equities (13.08.), image material: Bondguide.de

But a little more and correct background would have been good. Frontiers are not a "bridge" between EM and industrialized nations. They are the stage BEFORE emerging markets, i.e. the markets you can just invest in. Wild West, so to speak. Compared to Kazakhstan, Brazil is an established market.

The frontier markets are highly non-transparent and inefficient. Corruption and arbitrary expropriations are the order of the day. You get paid for the risk, but you should know it well.

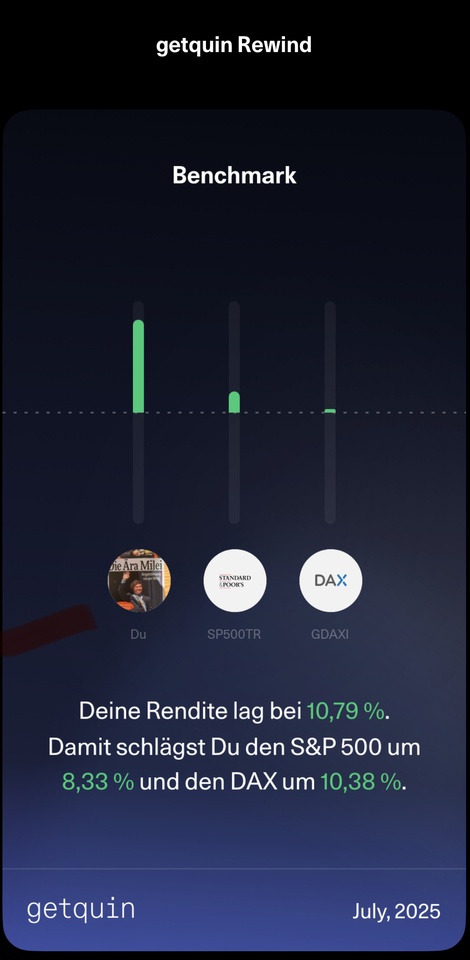

July very good again :)

July was also very good again, but the year is still long. Key investments for the future with overweighting $IREN (+11,25%)

let's see what happens :) I wish you all continued success with your investments.

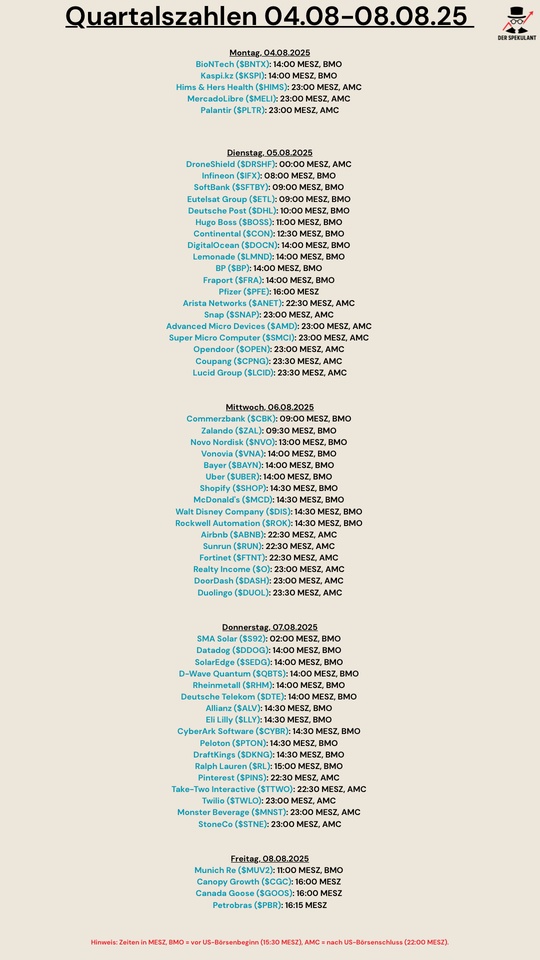

Quartalszahlen 04.08-08.08.2025

$BNTX (+0,44%)

$KSPI (+0,47%)

$HIMS (+1,27%)

$MELI (+0,32%)

$PLTR (+2,29%)

$DRO (-2,77%)

$IFX (-0,02%)

$9434 (-1,41%)

$FR0010108928

$DHL (-0,13%)

$BOSS (-0,1%)

$CONTININS

$DOCN (-0,79%)

$LMND (+1,4%)

$BP. (-0,9%)

$FRA (-1,03%)

$PFIZER

$SNAP (+0,59%)

$AMD (+6,32%)

$SMCI (-0,4%)

$OPEN (+13,34%)

$CPNG (+0,21%)

$LCID (-1,24%)

$CBK (+1,29%)

$ZAL (-0,55%)

$NOVO B (+0,13%)

$VNA (-0,02%)

$BAYN (+0,56%)

$UBER (-0,67%)

$SHOP (+3,64%)

$MCD (-0,54%)

$DIS (-1,22%)

$ROK (-0,26%)

$ABNB (+0,39%)

$RUN (+5,99%)

$FTNT (+0,84%)

$O (-0,39%)

$DASH (+1,08%)

$DUOL

$S92 (+4,04%)

$DDOG (-0,63%)

$SEDG (+5%)

$QBTS (+3,39%)

$RHM (-0,79%)

$DTE (-1,36%)

$ALV (+0,33%)

$LLY (+0,54%)

$CYBR (+0,7%)

$PTON (+3,09%)

$DKNG (-4,92%)

$RL (-0,66%)

$PINS

$TTWO (+0,66%)

$TWLO (+1,38%)

$MNST (+0,52%)

$STNE (+1,37%)

$MUV2 (+0,31%)

$WEED (+1,75%)

$GOOS (+0,69%)

$PETR3T

$ANET (-0,02%)

Depot Check

My goal is to beat the market, I'm still relatively young and want to see if I can do it, if not I'll put everything in an etf in 5 years.

Regarding my portfolio, I currently have a cash ratio of 23-25% depending on the fluctuations in the last month.

Purchases of existing stocks:

I plan to increase the financial stocks by 50%, $CG (+1,01%)

$KKR (+0,97%)

$APO (+1,53%)

$TPG (+1,04%) .

In addition, a little $DMP (+1,15%) by 25%.

Sales:

I made the mistake of wanting to $EVO (-0,23%) and $CPRX (+1,12%) trade, but then I was too greedy.

I am convinced of both positions in the long term but not in this size in the portfolio, which is why I will reduce both stocks by 33%.

Potential purchases:

$HALO (-0,73%)

$CUV (+2,88%) - Will invest a little extra, otherwise just the 33% from sale of $CPRX. Both around 50 - 50

$SL (+0,8%) - the same as $TISG (+0%)

$KSPI (+0,47%) - about as high as $MUM (-0,29%)

$FIH.U (-0,33%) - about as high as $MUM (-0,29%)

$2GB (+1,63%) - about as high as $MUM (-0,29%)

$M12 (-2,76%) - about as high as $MUM (-0,29%)

$CPR (-0,62%)

$DGE (-0,71%)

$RI (-0,16%) - I'll wait and see, but I can imagine that they will develop in a similar way to the tobacco shares. Since I don't want to decide, I'll just buy three for the sum of one. And divide the amount between these 3.

In general:

I'm generally a fan of putting together baskets like with alcohol or the yacht builders.

What would you change because you see a high risk? I am relatively poorly positioned in the tech sector, do you have any other titles that I could take a closer look at in this area?

However, I would be interested to know how you came up with the companies mentioned in your article.

Kaspi.kz

Company overview

Kaspi.kz (Joint Stock Company Kaspi.kz), formerly known as "Aktsionernoe obshchestvo kaspi", is a Kazakhstan-based fintech company offering a wide range of services from online payments to e-commerce and digital banking. As the parent company of Kaspi Group AO and Kaspi Magazine TOO, the company has positioned itself at the intersection of finance and technology, serving millions of customers in Kazakhstan. Its offering is divided into two main segments: mass retail, which offers a wide range of financial products to private customers via branches, offices and ATMs, and financial services for companies of all sizes, including deposits, overdrafts, loans and currency exchange.

The transformation of Kaspi.kz reflects a profound transformation of Kazakhstan's financial landscape. Starting from a traditional banking operation, Kaspi Bank gained over 9 million users by pioneering the integration of information and communication technologies into banking. The company experienced impressive growth, particularly during the COVID-19 pandemic, with revenues increasing by 32% in the first half of 2020 and the monthly number of users of the mobile app reaching 7.8 million. Since then, however, things have continued...

Mission and vision

The mission of Kaspi.kz is based on creating added value through innovation, convenience and high-quality service. The company pursues a consistently customer-oriented approach, which is reflected in the extensive digital platform that already serves over 10 million active users. This impressive development underlines how successfully Kaspi.kz is implementing its mission. The consistently high satisfaction ratings, such as a Net Promoter Score (NPS) of 78, are proof of the strong customer loyalty and high level of trust in the services offered.

The vision of Kaspi.kz aims to achieve a leading market position in the entire Central Asian region and secure long-term growth through technological innovation and strategic partnerships. By 2024, the company already controlled around 60-65% of the Kazakh fintech sector, consolidating its dominance.

Historical development

The IPO on the London Stock Exchange marked a historic milestone: the share price rose by 32% on the very first day of trading, resulting in a market capitalization of Kaspi.kz became the most valuable listed company in Kazakhstan with a market capitalization of USD 6.5 billion. This success catapulted founders Vyacheslav Kim and Mikhail Lomtadze into the ranks of billionaires - their fortunes were valued at around 1.9 and 1.8 billion dollars respectively.

In January 2025 Kaspi.kz took a significant step towards international expansion with the acquisition of a 65.41% stake in Hepsiburada. The initial payment amounted to 600 million dollars, with a further 526.9 million dollars due within six months. This acquisition underlines the company's ambition to take its successful strategy beyond Kazakhstan and into new markets. The company is now also listed on the Nasdaq and no longer in London.

Business model and core competencies

Business model

Kaspi.kz pursues a super app approach that integrates three closely linked platforms: Payments, Marketplace and Fintech. This multi-faceted strategy creates a comprehensive ecosystem that supports both consumers and merchants in their daily financial and commercial activities. While the payments platform enables online and cashless transactions, the marketplace platform offers e-commerce and retail solutions, and the fintech platform provides banking and financial services for individuals and businesses.

The change in the composition of earnings is remarkable: while traditional banking services dominated in previous years, the high-margin marketplace and payment segments now contribute 69% of net profit in the 2024 financial year - an increase from 66% in the previous year. The e-commerce business in particular developed as a driving force with impressive annual GMV growth of 85%.

Core competencies

Kaspi.kz has developed several significant competitive advantages that sustainably strengthen its market position. The integrated ecosystem generates strong network effects and high switching barriers for users and retailers, which intensifies customer loyalty. The broad acceptance of the digital solutions is reflected, for example, in the mobile app, which has been downloaded more than 8 million times and has become an indispensable companion in the everyday lives of the Kazakh population.

Proprietary systems such as the Kaspi POS Register, which was adopted by 35% of retailers within the first year, illustrate the ability to address market-specific technology needs with precision.

The company's strength is also evident in the area of infrastructure development: the Kaspi Postomat network now handles over 50% of e-commerce deliveries, contributing to a seamless omnichannel experience. This success manifests itself in an impressive 128% growth in delivery orders in the 2024 financial year, underlining the increased importance of physical logistics in the digital age.

Future prospects and strategic initiatives

Growth initiatives

Kaspi.kz is pursuing several strategic initiatives for expansion. Especially the e-commerce sector. Supported by investments in infrastructure, such as the Kaspi Postomat network, which now plays a central role in the delivery system, as well as the rapid growth in Kaspi Delivery, which increased by 128% to 99 million orders in the 2024 financial year, the success of this strategy is clear to see.

The company also recorded significant growth in the e-grocery segment: GMV increased by 97%, underlining the diversification of the marketplace offering. An improved e-commerce take rate of 11.3% also contributes to profitability.

In the financial services sector Kaspi.kz is specifically expanding its offerings for merchants and micro-enterprises. Specialized services such as business deposits and flexible financing options create additional touchpoints that not only generate direct sales but also increase transaction volumes across the entire ecosystem.

Medium-term corporate goals

For the coming years Kaspi.kz has defined ambitious but realistic targets for the coming years. Consolidated net profit growth of around 20% is forecast for 2025 - excluding the Turkish business as a result of the Hepsiburada acquisition.

In terms of market share, the company is also aiming to increase its share from 60% to 70% and thus further expand its leading position in the Kazakh fintech sector.

International expansion is increasingly playing a central role in the strategy. The acquisition of Hepsiburada signals the decision to establish the successful business model in new markets, particularly in Turkey. This geographical diversification offers enormous growth potential and also reduces dependence on a single market.

Market position and competition

Market position

With a market share of around 60% in the national fintech sector, the company has firmly established itself. This dominant position is based on continuous innovation and a strong customer focus, which has enabled it to Kaspi.kz has enabled it to leave traditional financial institutions far behind.

In addition, the company has Kaspi.kz has also positioned itself as an indispensable player in e-commerce and payment transactions beyond the area of financial services. The company's offerings are an integral part of everyday economic activity and play a key role in reducing cash transactions and driving the shift towards digital payments.

With a user base of 9 to 10 million people - in a country with a population of around 19 million - the company reaches Kaspi.kz over half of the population. This widespread distribution creates network effects that not only strengthen the company's own offering, but also deter potential competitors. At the same time, this solid customer base offers an excellent starting position for the introduction of new services.

Competitive advantages

The strength of Kaspi.kz lies above all in the seamless integration of financial services, e-commerce and payment transactions within a single ecosystem - a combination that is difficult to imitate. These synergies ensure that activities in one area trigger positive effects in other segments.

Another key competitive advantage is the pronounced network effects: The more users and retailers are part of the Kaspi ecosystem, the more attractive the platform becomes - a cycle that consolidates the market position in the long term. The innovative delivery structures, above all the Kaspi Postomat network, also give the company a noticeable competitive advantage in e-commerce by continuously increasing customer satisfaction and brand presence.

The exceptional customer loyalty, evidenced by an NPS of 78, speaks for the high level of satisfaction with the services offered and at the same time reduces acquisition costs - a decisive factor for sustainable growth.

Market potential

In addition to further consolidating our domestic presence, international expansion and the development of new service areas in particular open up enormous opportunities.

The acquisition of a majority stake in Hepsiburada, a leading e-commerce company in Turkey, opens up access to a significantly larger market with a population of over 84 million. This geographical diversification offers promising opportunities to continue the success story of the integrated business model in a new environment.

The e-commerce sector itself, which boasts GMV growth of 85%, also indicates that digital commerce is still in its infancy in the target markets and holds considerable potential for expansion. Similar positive momentum can be seen in the e-grocery sector and in specialized financial services for retailers and micro-enterprises.

Click here for the company figures and the conclusion.

https://topicswithhead.beehiiv.com/p/kaspi-kz-die-app-die-alles-kann-aber-wie-sieht-die-aktie-aus

After the short sell report sent the share of $KSPI (+0,47%) last week, I bought the first tranche (5 shares) yesterday and added more today.

The company's counterstatement is more convincing than the report. Kaspi is opening up more towards Uzbekistan and Azerbaijan. With a deposit rate of 2.9% for non-residents (the report mentions 29%), I can't see the huge exposure to Russia either.

The share has been on the watchlist for some time and the entry is now attractive.

Titoli di tendenza

I migliori creatori della settimana