$ERIC A (+13,36%)

$DPZ (-0,17%)

$JNJ (+0,15%)

$JPM (+0,09%)

$WFC (+0,07%)

$BLK (-0,8%)

$GS (-0,78%)

$C (-0,04%)

$MC (-1,14%)

$ASML (-2,1%)

$BAC (-0,04%)

$MS (-0,31%)

$JBHT (-0,88%)

$EQT (-0,66%)

$SRT (-1,67%)

$NESNE

$TSM (-2,57%)

$ABBN (-1,59%)

$UAL (-1,05%)

$TOM (-1,4%)

$VOLV B (-0,87%)

$AXP (-0,43%)

$SLBG34

$STT (-0,79%)

Discussione su JNJ

Messaggi

356Quartalsberichte 13.10-17.10.25

Building Portfolio

You have $5,000 to build a portfolio, how are you building it based on these prices:

$1,000 each - $AAPL (-0,81%)

$TSLA (-2,39%)

$NVDA (-1,39%)

$MSFT (-0,38%)

$META (-0,89%)

$750 each - $HD (-0,47%)

$SBUX (-0,3%)

$LOW (-0,32%)

$AVGO (-1,91%)

$COST (+0,04%)

$500 each - $JNJ (+0,15%)

$ABBV (+0,25%)

$CSCO (-0,09%)

$UNH (-0,68%)

$KO (+0,41%)

Today I increased my position at Johnson & Johnson

🔹 Dividend King

Over 60 consecutive years increasing the annual dividend, a track record that few companies in the world can match.

🔹 Controlled payout

Even with consistent dividends, the company maintains a relatively low payout, ensuring room to reinvest and continue to grow dividend payments in the future (~57%).

🔹 Diversified business

Pharmaceuticals, medical devices and consumer goods: three areas that reduce risk and bring resilience in different phases of the economic cycle.

🔹 Global consumer brands

Tylenol, Band-Aid, Listerine, Neutrogena, Aveeno... a portfolio of strong brands, present in the daily lives of millions of people.

👉 I see JNJ as a pillar of stability in my dividend strategy.

Here we go again

Hello everyone,

Almost 3 years have now passed since my last portfolio presentation.

A lot has happened in that time.

About me: I follow a core-satelite strategy and focus on dividends/dividend growth. My current savings rate is around €1000 per month and I am 27 years old.

I want to continue saving in the portfolio until I retire and use it as additional income.

I am well aware that I would be better off with an accumulating ETF due to my still long savings period, but the regular distributions help me to stay "on the ball".

The aim over the next few years is to increase the proportion of ETFs as core to 70-80%. Monthly savings will be made in the $VWCE (-0,65%) and the $TDIV (-0,48%) . The second is currently being built up. The second FTSE All World is saved separately at €20 per month.

I'm currently wondering whether I should invest in stocks like $KO (+0,41%) / $NEE (+0,14%) / $JNJ (+0,15%) into the $TDIV (-0,48%) to keep the portfolio simpler.

Feel free to leave your opinion - I'm curious 🫡

These are all stocks, you can buy them and then leave them. Wait and see.

An investor who put Johnson & Johnson in his portfolio 30 years ago has seen his share package increase in value by 850 percent to date. However, if he consistently reinvested the dividend, the total return is now 1,850 percent. 61% : per year!

These companies have outperformed the index for decades.

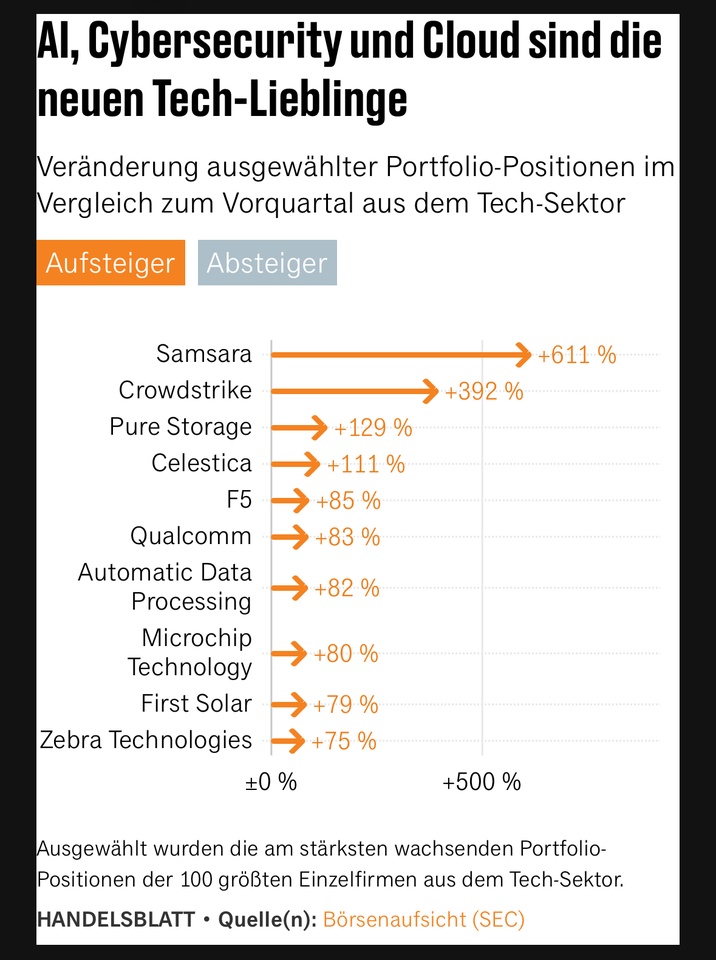

The current stock favorites of the professionals

Handelsblatt evaluated the portfolios of the 1,000 investors with the highest investment amounts who had reported fewer than 250 positions to the SEC as of June 30, 2025. This is intended to exclude providers of particularly broadly diversified ETF funds.

The tech sector continues to dominate the portfolios as the most important industry. At 21.8%, the share rose again to its highest level since the end of 2024. The financial sector follows in second place with 14.5%. The healthcare sector and real estate shares have lost much of their importance. Both were represented in the portfolios at the end of July with just under 5% less weighting.

Many professional investors took shares in Microsoft $MSFT (-0,38%) Amazon $AMZN (-0,71%) , Alphabet $GOOGL (-0,95%) and Nvidia $NVDA (-1,39%) into their portfolios or increased their weighting. Tesla $TSLA (-2,39%) also made strong gains. A quarter of institutional investors had Elon Musk's company in their portfolios at the end of July.

Of the major tech stocks, only Apple $AAPL (-0,81%) clearly shows weaknesses. The average share of the iPhone manufacturer in the professional portfolios fell by almost 20 percent to 5.3 percent.

Smaller software companies have also moved the portfolios. Handelsblatt has calculated the fastest-growing portfolio positions among the 100 largest tech companies.

According to the report, the most hotly traded tech climber at the moment is Samsara $IOT which produces networked solutions for industrial means of production, including networking and tracking trucks. The number of shares in the Californian company in the portfolios increased sevenfold in the second quarter. The cybersecurity provider Crowdstrike $CRWD (-1,27%) from Texas also made strong gains.

The most important investments outside of tech companies

Alongside the tech giants, the list of the most important companies is headed by Visa $V (-0,24%) and Broadcom $AVGO (-1,91%) followed by Johnson & Johnson $JNJ (+0,15%) and Mastercard $MA (-0,96%) and Eli Lilly $LLY (-0,64%)

New among the 20 most important investments after the Mag Seven is the accounting software provider Intuit $INTU (+0,14%).

Source: Text (excerpt) and graphics: Handelsblatt, 25.08.2025

Likewise, no players in infrastructure.

Energy plays no role here.

What about

Raw materials and rare earths.

Growth shares

Everything is at an all-time high. While growth stocks are starting to fall, my dividend stocks are benefiting from the rise. I am quietly waiting for growth stocks to fall further to buy back in until then I continue to expand my dividend positions.

$VWRL (-0,74%)

$ASML (-2,1%)

$GOOGL (-0,95%)

$MSFT (-0,38%)

$JNJ (+0,15%)

$O (+0,01%)

$BTC (-3,32%)

New 52-week highs for these stocks

These shares reached a new 52-week high today:

Johnson & Johnson $JNJ (+0,15%)

Unity $U (-3,19%)

Reddit $RDDT

Celsius $CELH

Altria $MO (+0,36%)

Do you hold any of the shares?

@thewolfofallstreetz

The $5K Portfolio Challenge: Pick Your Winners From This Price List

You have $5,000 to build a portfolio, how are you building it based on these prices:

$1,000 each - $AAPL (-0,81%)

$TSLA (-2,39%)

$NVDA (-1,39%)

$750 each - $HD (-0,47%)

$SBUX (-0,3%)

$LOW (-0,32%)

$AVGO (-1,91%)

$500 each - $JNJ (+0,15%)

$ABBV (+0,25%)

$CSCO (-0,09%)

$UNH (-0,68%)

Any improvements?

This investment portfolio is for long term, focussing on buy and hold forever stocks.

I also put some growth stocks in for 5/10 years.

24 years old and i invest €1000 per month and i want to keep it under 15 positions.

I also think about putting it all in 1 etf, but it has to give me some nice dividend, maybe some suggestions or do you guys have some tips for improving my portfolio?

Some stocks that are now catching my eye:

$ALV (-0,11%)

$AD (+0,18%)

$VZ (+0,25%)

$JNJ (+0,15%)

$SHEL (-0,59%)

$DTE (+1,04%)

$KPN (+1,64%)

$NN (-0,38%)

$KO (+0,41%)

$MCD (+0,08%)

$NESN (+0,77%)

Let's go into the next round, will the 300 🇩🇰 crowns hold up as support today? 😁

$NOVO B (-1,89%)

$NVO (-1,61%)

$UNH (-0,68%)

$MRK (-0,41%)

$JNJ (+0,15%)

$XDWH (-0,24%)

$PFE (-0,56%)

$LLY (-0,64%)

I am curious to see how the European stock markets will react today, but with the RSI extremely oversold and I could well imagine a bounce at 300 Danish kroner.

Is anyone here trying their luck as a trader and is so tired of life with leverage? 😂

@Multibagger put another one on top ? Do you have a good certificate for that ?

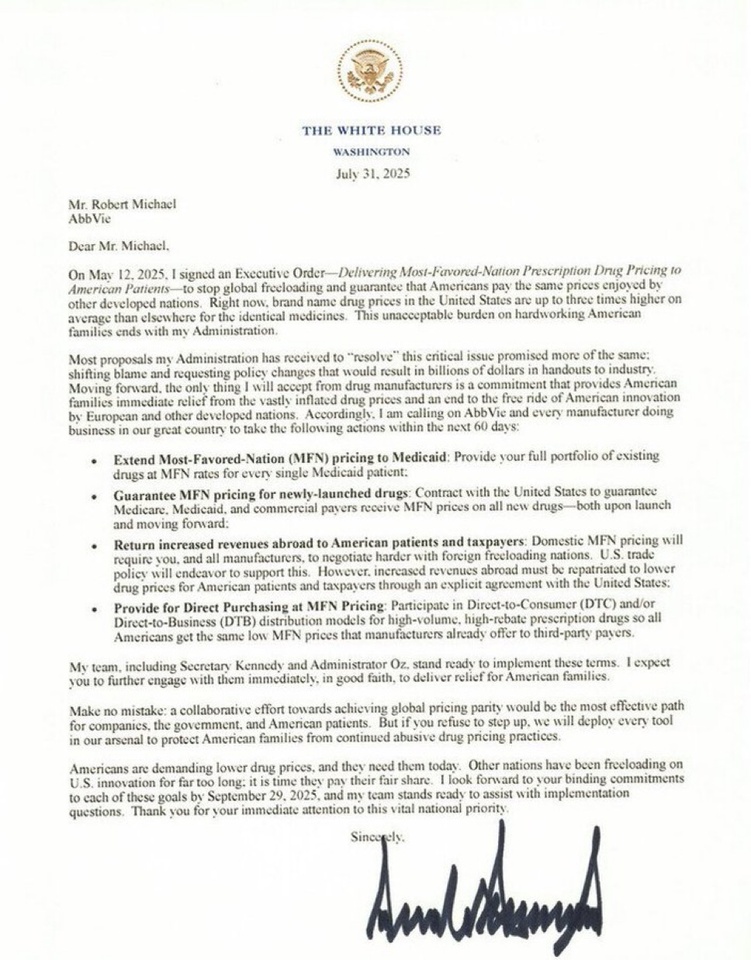

BREAKING: TRUMP HAS TAKEN ACTION AGAINST THE PHARMACEUTICAL INDUSTRY

$NOVO B (-1,89%)

$LLY (-0,64%)

$HIMS (-3,08%)

$NVO (-1,61%)

$PFE (-0,56%)

$JNJ (+0,15%)

$MRK (-0,41%)

He has sent letters to 17 companies, including Eli Lilly, asking them to lower their prices within 60 days.

Said if they refuse, he will use a "federal tool" to protect Americans

Getting more and more exciting 😂

Titoli di tendenza

I migliori creatori della settimana