$CVX (-0,65%)

$SIE (+1,06%)

$SHOP (+3,64%)

$LDO (-0,99%)

$SHEL (-0,11%)

$AMZN (+1,56%)

$IRM (+0,2%)

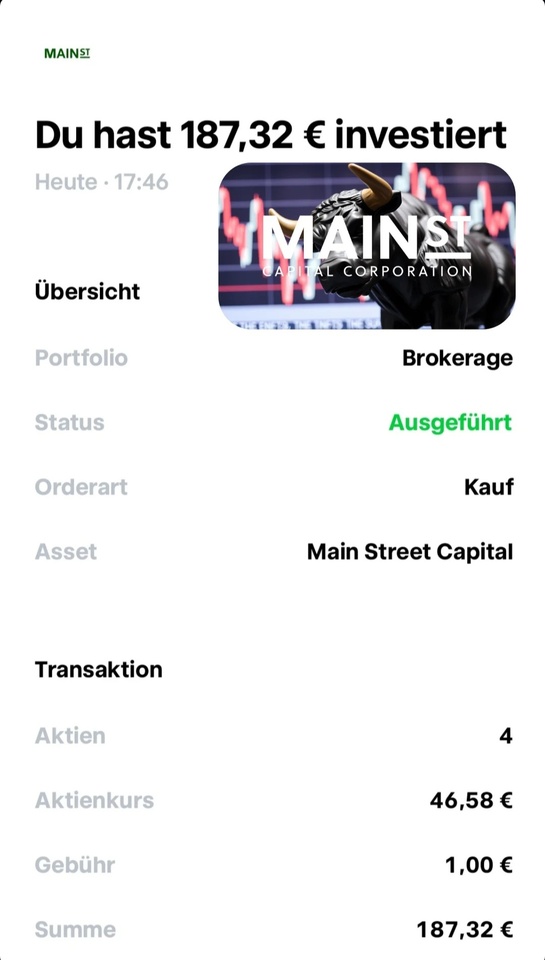

$MAIN (-0,58%)

$LBW (-6,28%)

Discussione su IRM

Messaggi

29Watchlist for turbulent times

In uncertain times, it is important to keep a watchlist so that you can pick up stable shares at bargain prices. I hope we go down a few more levels, another -20% would be nice, even if the short to medium-term price losses hurt.

I currently have almost 30 stocks on my watchlist, some of which are attractive in terms of price, while others are still far too high for me. I have not listed stocks that are already in my portfolio and that I would like to buy (in order of dividend amount):

Hercules Capital $HTGC (+0%) or Main Street Capital $MAIN (-0,58%)

Chevron $CVX (-0,65%)

Vinci SA $DG (-4,15%)

United Parcel Service $UPS (+0,01%)

3i Infrastructure $3IN (-1,48%)

Iron Mountain $IRM (+0,2%)

Micro Star International $MSS

Nextera Energy $NEE (+0,96%)

Partners Group $PGHN (+1,53%)

Itochu Shoji $8001 (+0,54%)

Canadian National Railway $CNR (-0,73%)

Svenska Cellulosa $SCA B (+1,93%)

VAT $VAT

Investor AB $IVSB

Assa Abloy $ASSA B (-0,42%)

Linde $LIN (-0,16%)

John Deere $DE (+0,55%)

Landstar Systems $LSTR (+0%)

Dover Corporation $DOV (-2,15%)

Alimentation Couche-Tard $ATD (+2,03%)

ASML $ASML (-0,02%)

Infineon Technologies $IFX (-0,02%)

Sherwin-Williams $SHW (+0,6%)

Tencent $700 (+0,67%)

Microsoft $MSFT (+0,63%)

S&P Global Inc. $SPGI (+1,54%) or Moody's Corp. $MCO (+2,02%)

Visa $V (+0,08%) or Mastercard $MA (-0,34%)

Ferrari $RACE (+1,37%)

Which stocks do you have on your watchlist?

Watchlist for the 2KW 2025

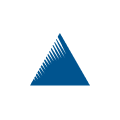

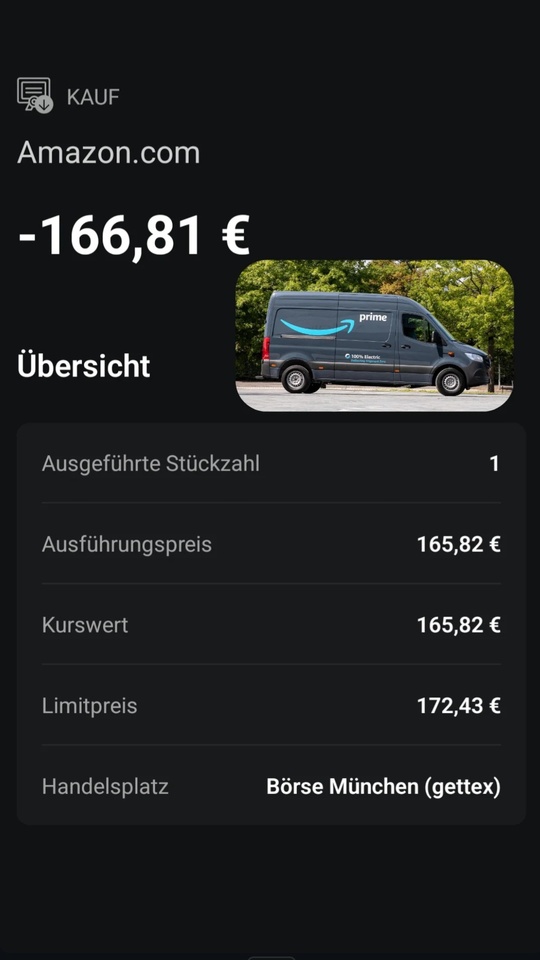

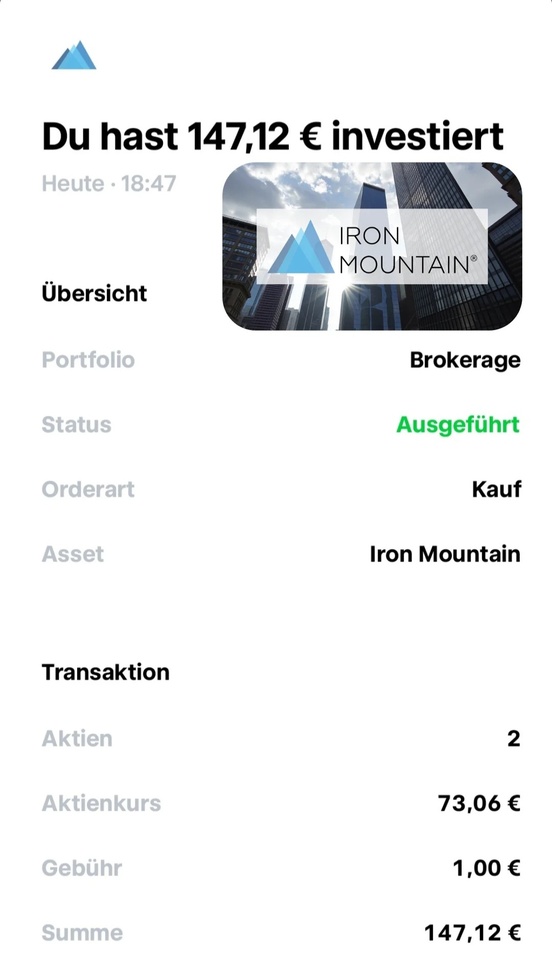

A quick overview of the stocks I am trying to get into the portfolio for the coming week. The limit orders can be adjusted to the market. However, I will start with this on Monday morning

Fastenal - limit EUR 69.50 $FAST (+0,41%)

Coca Cola limit 58.50 EUR $KO (-0,37%)

Watsco limit 451,50 EUR $WSO (+0,81%)

Waste Management Limit 195.00 EUR $WM (-0,38%)

UnitedHealth Limit 490 EUR $UNH (+1,21%)

Philip Morris limit EUR 117 $PM (+0,09%)

Lockheed Martin Limit 460.00 EUR $LMT (-0,76%)

Iron Mountain Limit 100 EUR $IRM (+0,2%)

Have a nice rest of Sunday .

IRM is similar to ETF, important for loss equalization.

$IRM (+0,2%) Attention!

When selling at a profit with loss compensation, the profit ends up

NOT in the share loss pot, but in the general loss pot.

Reason: Classification similar to ETF.

Thank you #Consors for NOTHING!

You should be able to see something like this beforehand.

$IRM (+0,2%) Who sells a 3.7 excavator in the depot?

Every percent plus is an increase of 3.7% of the initial value.

A doubling is almost all that is needed for 10 times.

And now? This calculation should not be a reason for anything.

Sale of $IRM (+0,2%)

and increase of $NESN (-0,97%)

As I mentioned yesterday, I have decided to sell my position in Iron Mountain.

The share has shown strong price growth recently, with one all-time high chasing the next. Even if this sounds tempting, the pace of the rise was too high for me personally, which is why I realized 100% of my profits.

I took advantage of the current lower share price to increase my holdings. For me, Nestlé offers more stability and security, especially in more turbulent times.

At the end of the day, as always, good or bad, who knows😁

What could be better than buying shares on vacation 😀

The portfolio was restructured. $IRM (+0,2%) Sold with almost 250%.

The profit was reallocated directly to Nestle. I am thus further expanding my base with crisis-proof, boring companies.

The absolute return was also increased somewhat by the reallocation.

$NESN (-0,97%) is currently perfect as an entry point in my opinion.

Just wanted to share a little test I'm using as benchmark:

I selected by screener the biggest 10 companies by Market Cap with these parameters:

- ROIC > 15%

- Net debt / EBITDA LTM <3x

- Total return 5Y >100% (20% CAGR)

- PE NTM <40x

- Analysts Estimated EPS Forwards 5Y CAGR >12%

Equal weighted buying in January 2nd 2024

Results:

$UNH (+1,21%) (I removed this because the PE LTM was too close to 40)

$BKNG (+0,72%) (I removed this one total return 5Y was too close to 100%)

$KLAC (+1,14%) (added the next one to replace the removed one)

$HCA (+1,52%) (same)

I know that in January the screener results maybe wouldn't be these, and that most companies are the easy ones, but... 30% returns YTD, without using the 10 best performance of the SP500 YTD ($NVDA (+2,31%) , $VST (+5,19%) , $SMCI , $HWM (-0,86%) , $CEG , $TRGP (-2,02%) , $LLY (+0,54%) , $IRM (+0,2%) , $NRG (+3,79%) , $GDDY (-0,88%) and no crypto,)

If I reached half of it every year, I will be very proud of myself.

Hope it helps

Hello everyone,

I have a question. I started with around 53 dividends, which is of course far too much.

Now I want to start building up assets.

Does it make sense to already include dividend stocks like $MAIN (-0,58%) or $IRM (+0,2%) or first save in the existing ETFs and start with e.g. 50k dividends.

By the way, I am 34 years old and my savings plan amounts to 750eur divided between the ETFs and 50eur Nvidia

Thanks to everyone :-)

Here is your Etf list:

94% USA

4% EU

2% Asia

Top 10 in %:

Apple 11.84

Microsoft 11.03

NVIDIA Corp 8.58

Broadcom 2.62

Amazon.com Inc 1.99

Salesforce Inc 1.35

Meta Platforms Inc Class A 1.35

Advanced Micro Devices 1.34

Adobe Inc 1.19

Accenture PLC Class A 1.11

Economy on 24.02.2023...

Next week professionally in Egypt, more dazu⤵️

Yesterday, I really hardly noticed anything from the market. Next week it goes for me professionally to Egypt. Many of you know that I work as a purchasing manager in the shipbuilding industry. For almost 2 years now, I have ships built there and now I would like to have a look at it myself. We also have a few meetings on site, because it is about some more ships in the next few years. So it's an exciting trip for me. So yesterday I first got myself a few things. A tropical overall, helmet with ventilation and so on. In the evening I had some calls with people from Instagram. That's why I really did not notice yesterday, and the numbers that I now post, I see even for the first time (except for MüRück, there I have already luschert). Next week I will not post here either. Maybe if I'm bored, I'll look for a nice picture out, which I could make there, and take you times a piece with. But maybe I end up in the evening in some bar... who knows :D. I am curious about Egypt Air. But now back to the stock market:

$MAIN (-0,58%)

Main Street Capital:

Missed analyst estimates of $0.89 in the fourth quarter with earnings per share of $0.13. Revenue of $113.88 million beat expectations of $104 million.

$BYND (-27,05%)

Beyond Meat:

Beats fourth-quarter analyst estimates of -$1.20 with earnings per share of -$1.05. Revenue of $79.94 million beats expectations of $75.8 million (shares up 17%)

$SQ (+1,23%)

Block:

Missed analyst estimates of $0.30 in the fourth quarter with earnings per share of $0.22. Revenue of $4.65 billion exceeded expectations of $4.62 billion (stock still up 6%!!!)

$WBD (-0,55%)

Warner Bros Discovery:

Missed analyst estimates of -$0.29 in the fourth quarter with earnings per share of -$0.86. Revenue of $11.01 billion below expectations of $11.23 billion (sold it all this week)

$ADSK (+0,82%)

Autodesk:

Beat analyst estimates of $1.81 in the fourth quarter with earnings per share of $1.86. Revenue of $1.32 billion above expectations of $1.31 billion (Also a WEB3 favorite for me)

$INTU (+1,64%)

Intuit:

Second-quarter earnings per share of $2.20 beat analyst estimates of $1.47. Revenue of $3 billion beat expectations of $2.91 billion.

$BKNG (+0,72%)

Booking Holdings:

Beats fourth-quarter analyst estimates of $22.00 with earnings per share of $24.74. Revenue of $4 billion beats expectations of $3.9 billion.

$AMT (+0,49%)

American Tower Corp:

Missed analyst estimates of $1.04 in the fourth quarter with earnings per share of -$1.47. Revenue of $2.71 billion exceeded expectations of $2.68 billion.

$MRNA (+1,86%)

Moderna Inc:

Missed analyst estimates of $4.70 in the fourth quarter with earnings per share of $3.61. Revenue of $5.1 billion exceeded expectations of $5.05 billion.

$IRM (+0,2%)

Iron Mountain Inc:

Hits fourth-quarter analyst estimates with earnings per share of $0.43. Revenue of $1.28 billion below expectations of $1.31 billion (The LUNE really tops my list!!!).

$HOT (+1,97%)

HOCHTIEF:

Will pay dividend of €4 per share for 2022 (PY: €1.91, analyst forecast: €4.06); 2022 sales at €26.2 billion (PY: €21.38 billion (forecast: €24.9). For 2023, Hochtief targets net profit (adjusted) of €510 million to €550 million (forecast: €490 million).

$MUV2 (+0,31%)

Munich Re:

Will achieve gross premiums of €67.13 billion in 2022 (PY: €59.56 billion, forecast: €67.3 billion), an operating result of €3.582 billion (PY: €3.517 billion, forecast: €3.035 billion), an investment result of €4.903 billion (PY: €7.156 billion), and a net profit after minorities of €3.432 billion (PY: €2.933 billion). In the outlook for 2023, the company expects a net profit of around €4.0 billion (analyst forecast: €4.022 billion). (I have 30% of my shares still sold at € 237.90, to take some profit and pressure out. The share was in the portfolio, by the high performance in recent times, the largest position with me. Therefore somewhat reduced!)

$AG1 (+1,43%)

Auto1:

Reaches 2022 revenues of €6.5 billion according to preliminary figures (PY: +36.8%, analyst forecast: €6.6 billion), sales of 649,709 vehicles (forecast: around 660,000) and Ebitda (adjusted) of -€165.6 million (forecast: -€174 million).

$DTE (-1,36%)

Deutsche Telekom:

Reports Q4 revenue of €29.8 billion (PY: €28.65 billion, analyst forecast: €30.00 billion), Ebitda AL (adjusted) of €40.2 billion (PY: €37.3 billion, forecast: €40.1 billion) and net profit (adjusted) of €1.99 billion (PY: €1.23 billion, forecast: €1.18 billion). In the outlook for 2023, the company expects Ebitda AL (adjusted) of +4% to around €40.8 billion (PY: €39.3 billion).

That's enough now, otherwise it will be too much. I'd like to get some feedback on this, because otherwise I always end up with the values that interest me. Maybe they are not the same ones that interest you. But otherwise the post will be too big and then no one reads it anymore. Still briefly to the economic dates. DAX changes, I have already announced in yesterday's post. Here again to look:

https://app.getquin.com/activity/VpjwppEQfv?lang=de&utm_source=sharing

Economic data (shortened version)

08:00

- DE: GDP (2nd release) 4Q calendar and seasonally adjusted yoy PROGNOSIS: -0.2% yoy 1st release: -0.2% yoy 3rd quarter: +0.5% yoy calendar-adjusted PROGNOSIS: +1.1% yoy 1st release: +1.1% yoy 3rd quarter: +1.4% yoy

- DE: GfK Consumer Climate Indicator March PROGNOSIS: -30.2 points previous: -33.9 points

08:45

- FR: Consumer confidence February PROGNOSIS: 81 previously: 80

14:30

- US: Personal Spending and Income January Personal Spending PROGNOSE: +1.4% yoy previously: -0.2% yoy Personal Income PROGNOSE: +1.2% yoy previous: +0.2% yoy PCE price index / core rate PROGNOSE: +0.5% yoy/+4.4% yoy previous: +0.3% yoy/+4.4% yoy

16:00

- US: Consumer Sentiment Index Uni Michigan (2nd survey) February PROGNOSIS: 66.4 1st survey: 66.4 previously: 64.9

- US: New home sales January PROGNOSIS: +0.6% yoy previous: +2.3% yoy

Untimed:

- EU: rating review for Netherlands (Fitch); North Rhine-Westphalia (S&P); Austria (Moody's); Austria (S&P); Sweden (Moody's);

Quarterly figures / corporate dates Europe

07:00 BASF | Holcim annual results

08:00 International Consolidated Airlines

10:00 Metro AGM (virtual)

No time stated: VW: Detmold Regional Court, ruling in proceedings against Volkswagen on end of production of vehicles with internal combustion engines by 2030

#quartalszahlen

#boerse

#börse

#aktien

#news

#newsroom

#community

#communityfeedback

#nachrichten

#täglich

#investieren

#wirtschaft

#politik

#inflation

#fed

#rezession

#mitverstandzumkapital

#krypto

#kryptowährung

#kryptos

#cryptos

#nvidia

#etsy

#ebay

#münchnerrück

#deutschetelekom

#bookingcom

#bookingholdings

#beyondmeat

#moderna

#ironmountain

Titoli di tendenza

I migliori creatori della settimana