September 25, 2025

Last EPS 1.81$

https://s2.q4cdn.com/154085107/files/doc_financials/2025/q2/2Q25-Earnings-Press-Release_vFINAL.pdf

Messaggi

9September 25, 2025

Last EPS 1.81$

https://s2.q4cdn.com/154085107/files/doc_financials/2025/q2/2Q25-Earnings-Press-Release_vFINAL.pdf

14 September 2025 Springfield Shopper

Among other things

Strengthen its portfolio, further "takeovers" are not ruled out.✌️😁

Which company should Homer J Simpson still acquire?

$ICE (-1,75%)

The Intercontinental Exchangefor short ICE! A company behind some of the largest stock exchanges in the world - including the NYSE! But how strong is ICE really? Is an investment worthwhile? And what risks are lurking? I'll find out now

📌 Company profile

💰 Key financial figures - the hard facts!

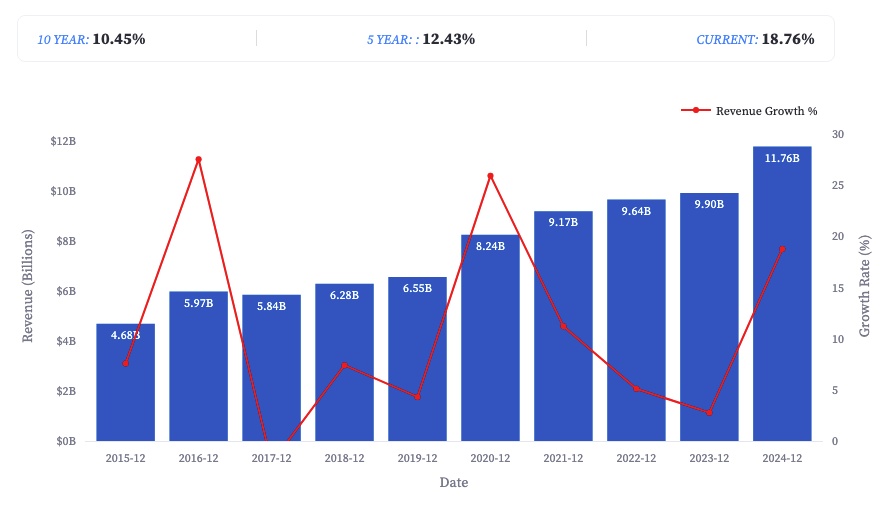

📈 Turnover per share:

📉 Return on invested capital (ROIC):

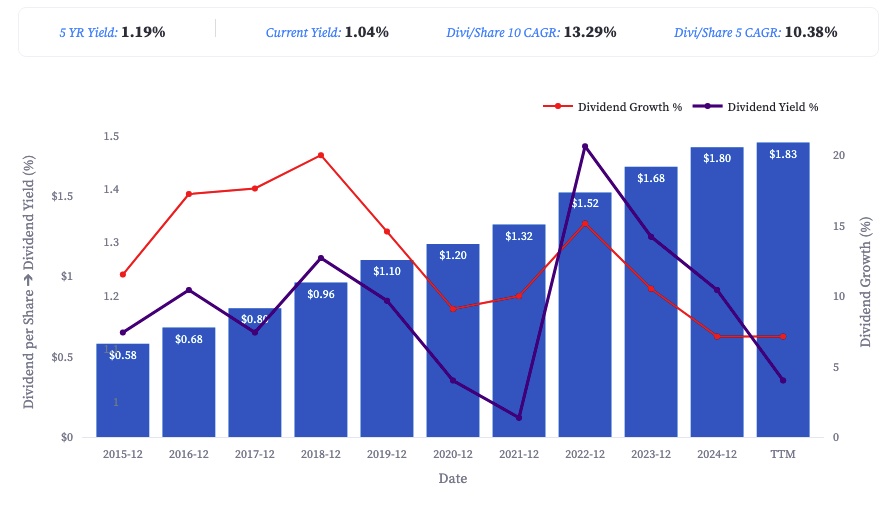

💵 Dividend:

⚠️ Risks - Where are the dangers lurking?

1️⃣ Regulatory hurdles:

2️⃣ Mortgage technology (22% of sales):

📊 Q1 2025 - The results!

🔮 Outlook: Q2 2025 - What's next?

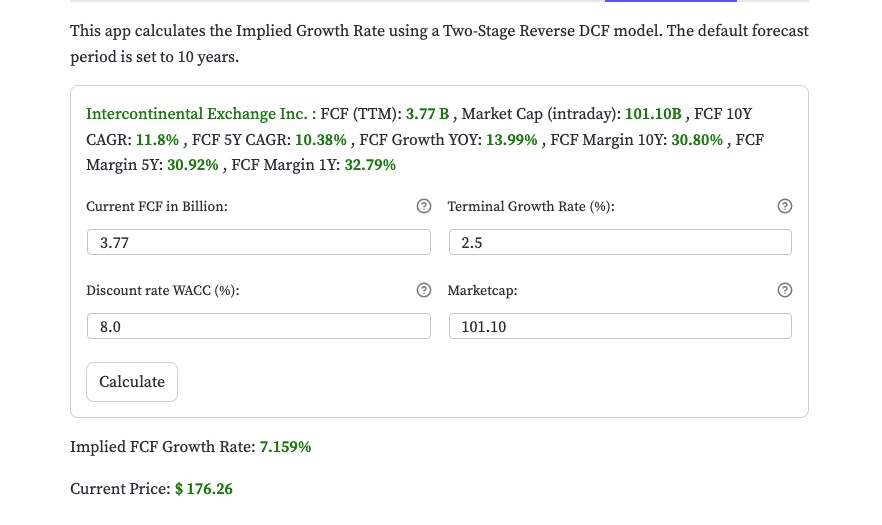

Valuation based on reversed DCF method:

Thus, with the reversed DCF method involves working backwards from the current market price of a share. And the idea behind it is to calculate the growth rates and cash flows that the market implicitly expects for the current price.

This means that in order to justify the current share price, the free cash (FCF) would have to increase by 7,159% over the next 10 years.

And the company has outperformed this 7,159% over the last 5 and 10 years, so it seems to me to be somewhat relatively undervalued.

not investment advice !!!

Conclusion:

ICE is a strong but complex investment - with growth potential, but also risks! Anyone looking for stable dividends and long-term trends could find what they are looking for here. But beware: the regulatory and macroeconomic challenges should not be underestimated!

If you would like to support me and see even more detailed stock analyses, please subscribe to my channel! -> www.youtube.com/@Verstehdieaktie

[1] https://fxnewsgroup.com/forex-news/exchanges/ice-registers-steep-increase-in-revenues-in-q1-2025/

+ 2

The semi-annual rebalancing of the SPDR S&P Developed Quality Aristocrats ETF ($QDEV (-2,77%) ) has just been completed, bringing notable changes to the composition of this quality-focused investment vehicle.

Outgoing Companies:

Incoming Companies:

This rebalancing aligns QDEV with evolving market conditions while maintaining its focus on quality companies with strong financial foundations. For investors seeking exposure to financially robust global corporations, these changes appear strategically sound, particularly with the inclusion of resilient tech giants and hospitality leaders positioned for growth.

Will this prove to be a winning choice? The fundamentals certainly suggest so.

Yesterday and today I once again discovered 2 interesting stocks outside the mainstream. One is $ICE (-1,75%) and the other $HALO (-2,01%) . Of course I bought both with derivatives, as you would expect from me. But I also think that the shares are interesting. Does anyone else have them in their portfolio or on their watchlist?

ICE Q3 2024 $ICE (-1,75%)

Financial performance

Balance sheet overview

Cash flow overview

Key figures and profitability metrics

Segment information

Competitive position

ICE delivered a strong performance across all segments, with significant growth in revenues and operating margins, reflecting a robust competitive position in the market.

Forecasts and management comments

Risks and opportunities

ICE faces risks from regulatory changes and market volatility, but there are opportunities from the expansion of the data services and mortgage technology segments.

Summary of the results

Intercontinental Exchange, Inc. delivered strong financial performance in the third quarter of 2024 with significant revenue and operating income increases across all segments. The company has a solid balance sheet and generates strong cash flow. Management's future focus on cost management and strategic investments indicates good positioning for further growth.

Positive aspects

Negative aspects

All these stocks hit new 52 WEEK HIGHS at some point today

Visa $V (-2,33%)

Robinhood $HOOD (-9,88%)

Delta Airlines $DAL (-3,96%)

Trade Desk $TTD (-5,03%)

DoorDash $DASH (-5,35%)

United Airlines $UAL (-5,1%)

Wells Fargo $WFC (-3,48%)

Booking $BKNG (+0,36%)

Abbvie $ABBV (-1,22%)

Agnico Eagle $AEM (+1%)

Alaska Airlines $ALK (-4,42%)

Apollo $APO (-4,93%)

Applovin $APP (-6,13%)

Ares Capital $ARCC (-1,33%)

Celestica $CLS (-7,11%)

Coupang $CPNG (-4,08%)

Corteva $CTVA (-2,74%)

Carvana $CVNA (-9,59%)

Duolingo $DUOL

Garmin $GRMN (-3,17%)

Hilton $HLT

$ICE (-1,75%)

Incyte $INCY (-1,88%)

Leidos $LDOS (-3,56%)

Live Nation $LYV (-0,32%)

Madison Square Garden $MSGS (-2,11%)

Nasdaq $NDAQ (-2,85%)

Sprouts $SFM (-2,76%)

Nuscale $SMR

Sharkninja $SN

Synchrony $SYF (-5,74%)

Texas Roadhouse $TXRH (-3,15%)

VF Corp $VFC (-6,23%)

WellTower $WELL (-1,28%)

🌐 Stock exchange battle: Deutsche Börse, ICE, Euronext, NASDAQ - who dominates trading? 📊

Company presentation

Deutsche Börse AG

Deutsche Börse is one of the world's leading exchange operators and offers a wide range of services in the areas of trading, clearing and market infrastructure. In addition to the Frankfurt Stock Exchange, the company has particularly distinguished itself through its innovative strength in the field of electronic trading.

Euronext NV

Euronext is a pan-European exchange group that operates markets in Belgium, France, Ireland, Italy, the Netherlands, Norway and Portugal. It is the largest stock exchange in Europe and offers a platform for trading shares, bonds and derivatives.

Nasdaq

As the world's first electronic stock exchange, founded in 1971, Nasdaq has developed into the leading trading center for technology companies. It is known for its high liquidity and the immense trading volume that is handled daily.

Intercontinental Exchange (ICE)

ICE operates global financial and commodity markets and is best known for its acquisition of the New York Stock Exchange (NYSE). The company offers a wide range of services, including trading in energy, commodities and financial derivatives.

Historical development

Business model

Core competencies

Future prospects

Strategic initiatives

Market position and competition

German Stock Exchange

Strong in Europe

Euronext

Euronext

Leading in Europe

German Stock Exchange

Nasdaq

Leading in the USA

NYSE

ICE

Strong global position

CME Group

Total Addressable Market (TAM)

For the development (company figures), better view and more check out the free blog:https://topicswithhead.beehiiv.com/p/b-rsen-battle-deutsche-b-rse-ice-euronext-nasdaq-wer-dominiert-den-handel

Conclusion

Stock market shares are always interesting because they benefit disproportionately from good stock market years due to their relatively fixed costs. In addition, these companies are increasingly developing into data managers, which promises further growth and efficiency gains. There is still plenty of potential for consolidation and growth in the European stock exchanges in particular, especially due to the dynamic market activities.

When looking at capital efficiency, Euronext and Deutsche Börse stand out, either as top performers or as only slightly worse alternatives. Therefore, they are my preferred candidates if I had to make a decision. Despite everything, all the stocks mentioned have performed impressively, which is why I hold all but ICE and regularly buy more.

If you are active on the stock market and want to participate, you can hardly go wrong with these stocks. My three stocks in particular offer excellent diversification, as each of the exchanges has its own advantages and disadvantages.

It should be particularly emphasized that the Nasdaq also includes Scandinavian stock exchange operators, which also contributes to diversification and offers interesting growth opportunities.

If you look at historical performance, Euronext would be the clear outperformer and therefore the best choice over the last 10 years.

I migliori creatori della settimana