The idea of further diversifying my portfolio had solidified somewhat in recent weeks. $IREN (+11,25%) I left it at my self-imposed partial sell target of EUR 55 and started to build up the first positions on Friday. I am sticking to my target of investing around EUR 5k in each position. $IREN (+11,25%) remains in the portfolio with 500 shares and will (probably) not be touched in the near future. $DEFI (-0,57%) Now also full with 5,500 shares.

19k liquidity left and will still be invested in top-ups + new shares.

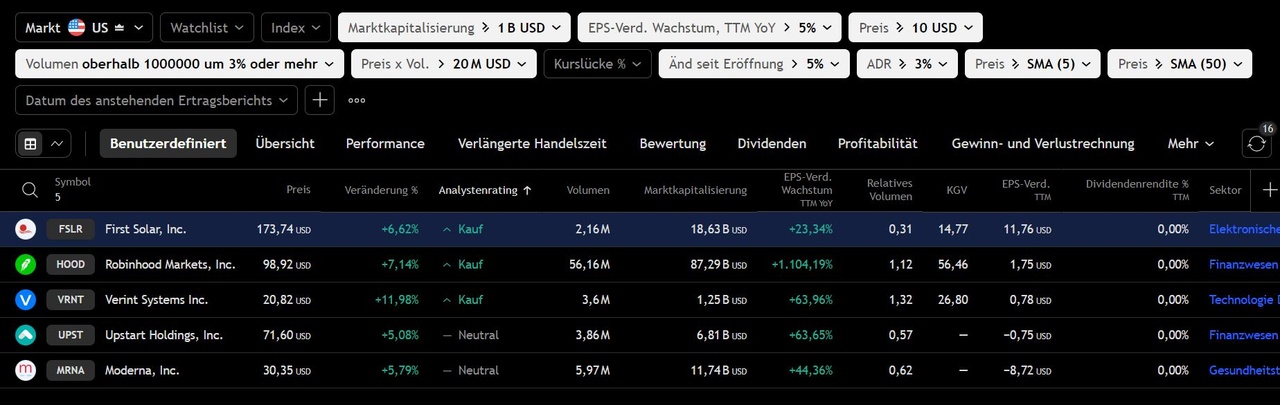

Individual shares are now:

$DSFIR (+0,56%) possibly increase

$MUM (-0,29%) possibly increase

$FSLR (+4,46%) Increase if necessary

$NICE Increase if necessary

Does anyone else have an idea for a share, possibly also from the German-speaking region? The Asian region would also be very interesting, although I am looking a little at $1810 (-2,49%) look at.

vg and have a nice WE

Micha