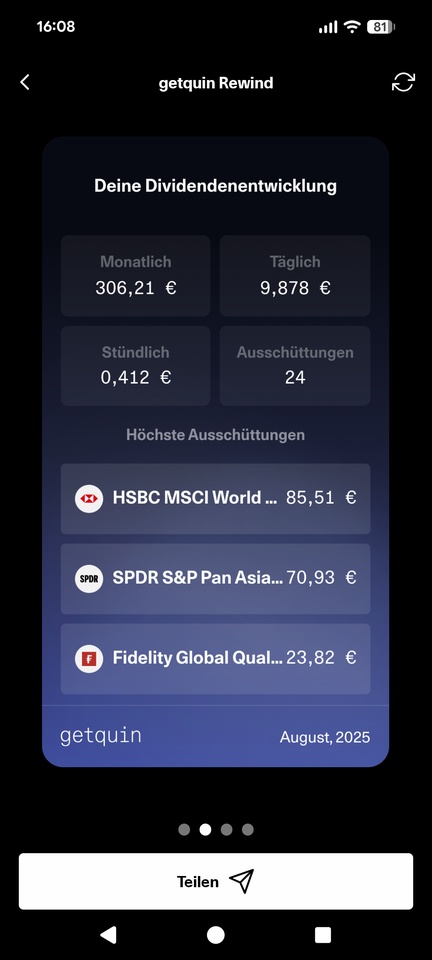

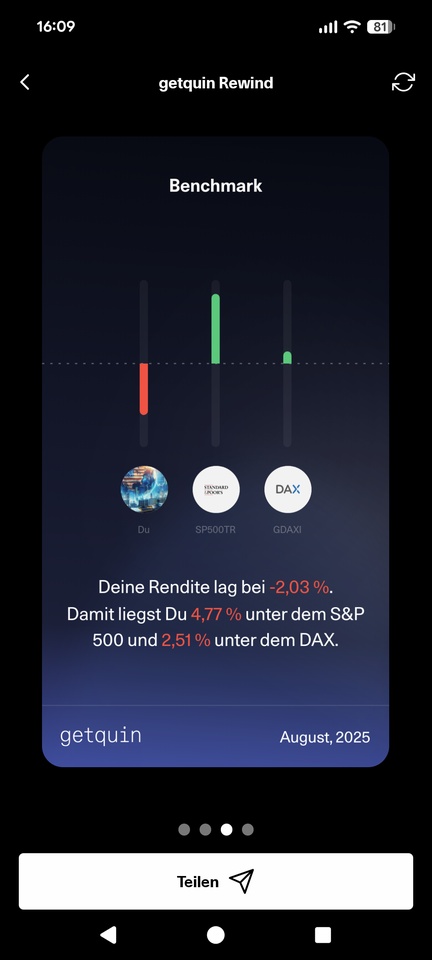

August wasn't so great for me either. But September is looking better so far...:) #rewind

The top 5 performers

$UNH (+1,21%) +20

$NOVO B (+0,13%) +16

$ENPH (+1,79%) +12

$LOW (-0,54%) +10

$8031 (+0,14%) +10

Messaggi

46August wasn't so great for me either. But September is looking better so far...:) #rewind

The top 5 performers

$UNH (+1,21%) +20

$NOVO B (+0,13%) +16

$ENPH (+1,79%) +12

$LOW (-0,54%) +10

$8031 (+0,14%) +10

$ENPH (+1,79%) announces software that lets customers add IQ8 microinverters to existing IQ7 solar systems.

Now available in Australia, India, South Africa & Philippines → boosting upgrade potential worldwide

🔹 Revenue: $363.2M (Est. $361.9M) 🟢; +20% YoY

🔹 Adj. EPS: $0.69 (Est. $0.64) 🟢; +60% YoY

🔹 Net Income: $89.9M (Est. $84.1M) 🟢; +53% YoY

🔹 Gross Margin: 48.6% (incl. IRA); 37.2% ex-IRA

Q3 Guide:

🔹 Revenue: $330M–$370M (Est. $368.4M) 😐

🔹 Non-GAAP Gross Margin: 43%–46% incl. IRA; 33%–36% ex-IRA

🔹 Net IRA Benefit: $34M–$38M (based on ~1.2M U.S. units)

🔹 Non-GAAP OpEx: $78M–$82M

🔹 Battery Shipments Expected: 190–210 MWh

Operational Metrics

🔹 Microinverters Shipped: ~1.53M units / 675.4 MW DC

🔹 Batteries Shipped: 190.9 MWh (record); UP from 170.1 MWh in Q1

🔹 U.S. Manufacturing: 1.41M microinverters; 46.9 MWh batteries

🔹 Installers Certified for IQ Batteries: 11,700+

🔹 Operating Income: $98.6M; UP +61% YoY

🔹 Free Cash Flow: $18.4M

🔹 Cash & Equivalents: $1.53B

CEO Commentary & Strategic Updates

🔸 “We are pleased with our second quarter results and customer response to our new Enphase Energy System.” — CEO Badri Kothandaraman

🔸 IQ Battery 10C launched: 30% more energy-dense, 62% less wall space

🔸 IQ Meter Collar now approved by 29 U.S. utilities

🔸 Ramp-up of IQ Battery 5P with FlexPhase in Europe; supports both single- and three-phase homes

🔸 IQ EV Charger 2 shipping to 18 countries; IQ Balcony Solar Kits launched in Germany & Belgium

After careful consideration and despite a painful -65% price performance, I decided to sell Enphase and took out the last €500. It was once the star of my portfolio in 2021 and 22, but has fallen sharply since then. For me, it is currently valued like a growth company, only without growth in the figures for three years. And I doubt that anything will change under Trump in a trade war. If Trump then overturns the Inflation Reduction Act, I think Enphase will be on fire. The last earnings call, which I listened to in part and from which I was unable to draw any inspiration at all, then gave me the rest. So, finish the chapter, wipe my mouth and move on.

🔹 Adj. EPS: $0.68 (Est: $0.70) 🔴

🔹 Revenue: $356.1M (Est: $357.75M) 🔴

🔸 Q2 guidance includes ~2% margin drag from new tariffs; total FY gross margin outlook reflects IRA/tariff dynamics.

Q2 Guidance

🔹 Revenue: $340M–$380M (Est: $377.74M) 🟡

🔹 Non-GAAP Gross Margin:

• 44.0%–47.0% with IRA benefit

• 35.0%–38.0% ex-IRA benefit (incl. ~200bps tariff headwind)

🔹 Battery Shipments: 160–180 MWh

🔹 Non-GAAP Operating Expenses: $78M–$82M

🔹 Net IRA Benefit: $30M–$33M

Shipments & Segment Metrics

🔹 Microinverters Shipped: ~1.53M units (~688.5 MW DC); U.S. Shipments: ~1.21M units

🔹 IQ Battery Shipments: 170.1 MWh (▲ from 152.4 MWh QoQ)

🔹 Certified Battery Installers: >10,900 globally

Strategic / Capital Updates

🔹 Paid off $102.2M in convertible senior notes

🔹 Repurchased 1.59M shares for ~$100M

🔹 Continued rollout of IQ Battery 5P with FlexPhase in EU

🔹 Expanded EV charger availability to 14 European markets

🔹 Upcoming launches: IQ Battery 10C, IQ Meter Collar, IQ Balcony Solar Kit in Germany/Belgium

Other Key Metrics:

🔹 Non-GAAP Gross Margin: 48.9% (vs. Est: ~49.5%)

• Ex-IRA Benefit: 38.3%

🔹 Non-GAAP Operating Income: $94.6M (▼ from $120.4M QoQ)

🔹 Non-GAAP Net Income: $89.2M

🔹 Free Cash Flow: $33.8M

🔹 Ending Cash & Investments: $1.53B

CEO Commentary

🔸 “We reported solid shipments and continued growth in Europe, while U.S. demand remains soft due to seasonality. Our new products are positioned to drive better customer outcomes and enable grid services.” – Badri Kothandaraman, CEO

Hello my investors,

Today I would like to share my analysis of $ENPH (+1,79%) with you. I would be delighted to hear your opinions on the share. The body text is only my summary of the analysis. You can download the full analysis as a Word file via the following link: https://www.mediafire.com/file/qzne5338hn7z7qz/Analyse_Enphase_Energy.docx/file

Conclusion:

The chart analysis shows us that we are already in a long-term downtrend and that there may now be a possible trend reversal. The OB on the monthly chart represents a strong support zone, which gives us hope for an upward trend. However, apart from this bullish structure, there are only a few weak bullish signals (RSI, MACD). However, a break of structure on the weekly chart could confirm a trend reversal, which is why the chart should be kept an eye on.

The fundamental analysis shows that Enphase Energy has already achieved a huge leap in growth in the past, which only slowed down in 2023 and turned into a slump in sales and profits in 2024. This was triggered by supply chain bottlenecks for semiconductors and interest rate hikes in the US. The latest quarterly figures (Q4 2024) were convincing again with a doubling of profits compared to the previous year and therefore point to a more positive future. Furthermore, the company can score with very high net profit margins compared to the industry as a whole. Enphase Energy's debt is high, but is kept in check by a high level of cash, which is why net debt is actually negative (cash > debt). The figures for the future again promise strong growth and good opportunities for expansion. In the short term, Trump's climate policy could lead to major difficulties for the company. The planned removal of subsidies for solar energy and subsidies for fossil fuels could drastically reduce demand for PV systems in the USA and thus limit the company's sales.

Enphase Energy's valuation is currently very high and even the forward P/E ratio for the coming years is above the industry average. However, in view of the strong growth figures and margins, a forward P/E ratio of 21x for 2026 is acceptable. The historical multiples are all at approximately 3-year lows and do not provide any long-term and meaningful trend reversal signals.

From the perspective of seasonal trends, there are many opportunities during the year. Mid-February to early March tends to be a bullish phase for Enphase Energy, which promises high returns. This part of the analysis is only of minor importance for long-term investments.

$NKE (-0,74%) I'll wait until 52 - maybe I'll miss it, but it's okay

$ENPH (+1,79%) from now until 47 on a bullish impulse

$VNA (-0,02%) - already have a position but add here at Retraces.

$BABA (+1,49%) - I already have a position, but I'll add at Retraces.

$PYPL (+0,12%) - DCA from now on , 72, 63, 54

🔹 EPS: $0.94 (Est. $0.75) 🟢; DOWN -30% YoY

🔹 Revenue: $382.7M (Est. $378.37M) 🟢; UP +26% YoY

🔹 GAAP Gross Margin: 51.8% (Prev. 48.5%) 🟢

🔹 Non-GAAP Gross Margin: 53.2% (Prev. 50.3%) 🟢

🔹 GAAP Operating Income: $54.8M (Prev. -$10.2M) 🟢

🔹 Non-GAAP Operating Income: $120.4M (Prev. $65.6M) 🟢

🔹 GAAP Net Income: $62.2M (Prev. $20.9M) 🟢

🔹 Free Cash Flow: $159.2M

Segment & Regional Breakdown:

🔹 Microinverter Shipments: 2.01M units (878 MW DC)

🔹 IQ Battery Shipments: 152.4 MWh

🔹 U.S. Revenue: UP +6% QoQ, driven by higher microinverter sales 🟢

🔹 Europe Revenue: DOWN -25% QoQ, due to softening demand 🔴

🔹 U.S. Manufacturing: 1.69M microinverters shipped

Q1'25 Guidance:

🔹 Revenue: $340M-$380M (Est. $341M) 🟡

🔹 GAAP Gross Margin: 46.0%-49.0%

🔹 Non-GAAP Gross Margin: 48.0%-51.0% (Ex-IRA Benefit: 38.0%-41.0%)

🔹 Net IRA Benefit: $36M-$39M (1.2M U.S. manufactured microinverter units)

🔹 GAAP Operating Expenses: $143M-$147M

🔹 Non-GAAP Operating Expenses: $81M-$85M

Business & Product Updates:

🔸 Launched IQ® PowerPack 1500, a portable energy system

🔸 Expanded IQ Battery 5P™ shipments to Germany, Austria, Switzerland

🔸 Expanded IQ8P™ Microinverters to Vietnam, Malaysia, and Latin America

🔸 Collaborated with Octopus Energy (UK) for smart tariff integrations

🔸 Entered radioactive waste solar project (Belgium) with 2.2 MW solar installation

Stock Buyback & Capital Updates:

🔹 Stock Repurchase: 2.88M shares at $69.25/share ($199.7M total)

🔹 Cash & Marketable Securities: $1.72B

CEO Badri Kothandaraman's Commentary:

🔸 “We saw continued strength in the U.S. market but softness in Europe. We remain focused on innovation, launching advanced battery and microinverter products while expanding global market presence.”

$ENPH (+1,79%) I'm curious to know what you guys think. Does Emdphase Energy have a foundation of success? Can its technology provide further value in the future? And stay ahead of the competition?

The loss at $ENPH (+1,79%) hurts, but better an end with horror than horror without end!

The solar industry will have a tough time for a while yet, especially with the new US energy policy. I have therefore now reduced my positions in $AMZN (+1,56%) and $ABBV (-0,1%) have been expanded.

I migliori creatori della settimana