Split from AT & T

Discovery Inc Azione Forum

AzioneAzioneDiscussione su DISCA

Messaggi

14Dear Community,

Today I present you my first stock analysis. I would be very pleased if you can give a short feedback to my analysis. Criticism welcome :) The stock in question is the media company Discovery Inc (formerly known as Discovery Communications). Discovery inc. provides content through multiple distribution platforms. Mainly digital distribution agreements, pay TV, free TV and broadcast TV. Enjoy reading ↓ ↓ ↓

- 𝐄𝐢𝐧 𝐩𝐚𝐚𝐫 𝐆𝐫𝐮𝐧𝐝𝐥𝐞𝐠𝐞𝐧𝐝𝐞 𝐈𝐧𝐟𝐨𝐫𝐦𝐚𝐭𝐢𝐨𝐧𝐞𝐧 𝐳𝐮𝐦 𝐔𝐧𝐭𝐞𝐫𝐧𝐞𝐡𝐦𝐞𝐧 ℹ️[1]

Founded: 1985 by John Hendricks

Headquarters: Silver Spring (USA)

Number of employees: approx. 7000

Industry: Media

- 𝐃𝐢𝐞𝐧𝐬𝐭𝐥𝐞𝐢𝐬𝐭𝐮𝐧𝐠 - [2]

Discovery Inc. is a global leader in real-life entertainment, serving fans around the world with content that inspires, informs and entertains. Discovery's services are available in more than 200 countries and offers content with over 50 languages. The company is an innovative platform provider, reaching viewers across all screens and services, from linear, free-to-air and pay TV channels to digital products and streaming services, as well as social and mobile content.

- 𝐖𝐢𝐞 𝐰𝐮𝐫𝐝𝐞 𝐃𝐢𝐬𝐜𝐨𝐯𝐞𝐫𝐲 𝐬𝐨 𝐠𝐫𝐨𝐬𝐬?🚀 [3]

The company was founded in June 1985 by John Hendricks. It started with a documentary film about the icy waters of the North Atlantic. In 1989, the company made its international debut in the United Kingdom and Scandinavia. In 1991, it acquired TLC (The Learning Channel). Launched in 1997 by Discovery Communications, the Discovery Channel Global Education Partnership (now known as the Discovery Learning Alliance) is a nonprofit organization that uses the power of media to transform education and improve lives in underserved schools and communities around the world. Today, Discovery Learning Alliance is opening new doors to education in 16 countries, reaching millions in schools and millions more through television and mass media initiatives in the developing world. Moving on. In March 2000, Discovery was recognized for setting the record for "most-watched documentary." A year later, it became the world's most widely viewed media provider. In 2004, they cracked the first billion subscribers. Two years later, the opening of the well-known channel DMAX took place. DMAX was launched in 27 million German homes at the time and has since expanded throughout Europe and Asia. As a global leader in education, Discovery Education is constantly innovating and launched its first techbook in January 2010. Discovery Education now offers a full range of Techbooks, including K-8 Science, High School Science, Middle School Social Studies, and a new line of Math Techbooks. In March 2014, Discovery launched a new direct-to-consumer product, Dplay, in the Nordic countries (pay TV). In the same year, Discovery announced that it was participating in the acquisition of the channel "Eurosport International." The acquisition strengthened Discovery's position as the world's leading pay-TV provider by expanding into sports programming. In June 2015, the International Olympic Committee announced that all TV and multiplatform broadcasting rights in Europe for the Olympic Games 🏅 2018-2024 had been awarded to Discovery Communications. The new long-term partnership will see Eurosport deliver more coverage than ever before to more than 700 million people across Europe. In January 2021, Discovery will launch a new streaming service. A huge success for Discovery.

- 𝐙𝐮𝐬𝐚𝐦𝐦𝐞𝐧𝐬𝐜𝐡𝐥𝐮𝐬𝐬 𝐦𝐢𝐭 𝐀𝐓&𝐓 📢 [4]

In May 2021, the following was announced. AT&T's WarnerMedia and Discovery Inc. are creating a standalone company by combining operations to form a new global entertainment leader. The name for the new company is still unknown. AT&T will receive $43 billion. In addition, AT&T shareholders will own 71% and Discovery shareholders will own 29% of the new company. For AT&T and its shareholders, this transaction provides an opportunity to increase the value of its media assets and better position its media business. The new company will bring together more than 100 of the world's most recognized, loved and trusted brands into one global portfolio, including: HBO, Warner Bros, Discovery, DC Comics, CNN, Cartoon Network, HGTV, Food Network, the Turner Networks, TNT, TBS, Eurosport, Magnolia, TLC, Animal Planet, ID and many more.

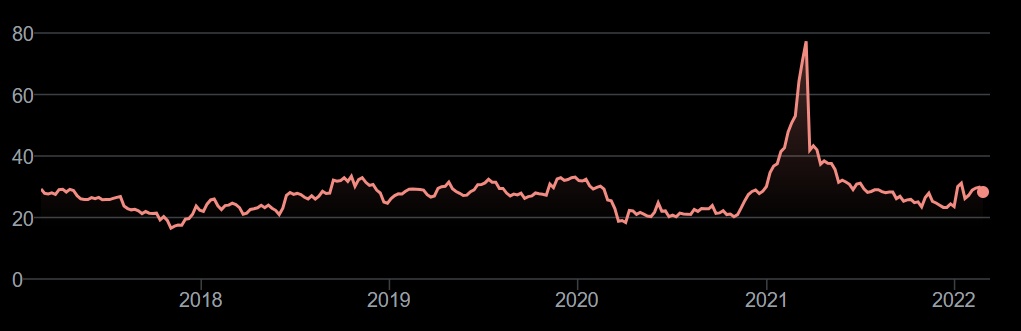

- 𝐊𝐞𝐧𝐧𝐳𝐚𝐡𝐥𝐞𝐧 - [5]

(Figures in USD)

KGV 2021: 15.93

Market cap: 15.09 billion

52-week high: 78.14

52-week low: 21.66

Current share price: 29.62

Dividend: -

-𝐓𝐨𝐩 📈

-Acquisition of AT&T enables even greater diversification.

-All broadcast rights of the Olympic Games until 2024 belong to Discovery

-Strongly growing user numbers

-Involved in a wide variety of sectors such as education, entertainment, knowledge, sports, food, etc.

-𝐅𝐥𝐨𝐩 📉

-strong competition

-tends to have high (long-term) debt [6]

-Sales are rather low compared to the competition.

-𝐊𝐨𝐧𝐤𝐮𝐫𝐫𝐞𝐧𝐳 - [7]

Through Corona, streaming competition has been pushed even bigger than before. The world's largest media conglomerates are feeling the effects of this as well. Here are some media industry competitors: Fox, DISH Network, Walt Disney, Netflix, Charter Communications, and Comcast.

-𝐅𝐚𝐳𝐢𝐭 -

I personally will buy some shares of the company. I find everything behind the company tremendous. Education, entertainment, knowledge, sports and cooking. What more could you want? For me, the big diversification in entertainment is the deciding factor. It seems to me that the collaboration with AT&T is well on its way to becoming a streaming and media powerhouse ready to stake its claim at the top of the streaming world. I'm more sanguine about the debt, as it has been shrinking over the last six months. [6]

[No investment advice]

Sooo, that's actually it. Why don't you write a quick commi? I would be happy to get some feedback.

If you want to see more analysis like this, then give it a thumbs up like Dirk Müllers Premium Fonds and otherwise leave a SOS =)

---

[1] https://de.wikipedia.org/wiki/Discovery_(Unternehmen)

[2] https://corporate.discovery.com/

[3] https://30yearsofdiscovery.com/

[4] https://about.att.com/story/2021/warnermedia_discovery.html

[5]https://www.google.com/finance/quote/DISCA:NASDAQ?sa=X&ved=2ahUKEwj43tbQ74v2AhXpiP0HHR9zCHgQ3ecFegQICxAc

[6] https://www.finanztrends.de/discovery-aktie-uebersicht-ueber-die-schulden/

[7] https://www.capital.de/wirtschaft-politik/das-sind-die-groessten-medienunternehmen-der-welt

---

Images:

2; https://corporate.discovery.com/

3; https://www.barrons.com/articles/discovery-inc-shares-can-rally-40-portfolio-manager-51579038548

The historic zero return convinced me

Maybe it was also @leveragegrinding

Titoli di tendenza

I migliori creatori della settimana