$IREN (-9,15%)

The tariff on Chinese imports has no material impact on the core business of $IREN (-9,15%)

$IREN (-9,15%) operates data centers in the US and Canada, uses domestically sourced GPUs (from Nvidia/AMD) and sells computing services directly to US companies.

Take profits if you want, stay true to your strategy, but don't make emotional decisions.

You must be able to sleep well with your investment or weight it in your portfolio in such a way that it lets you sleep well.

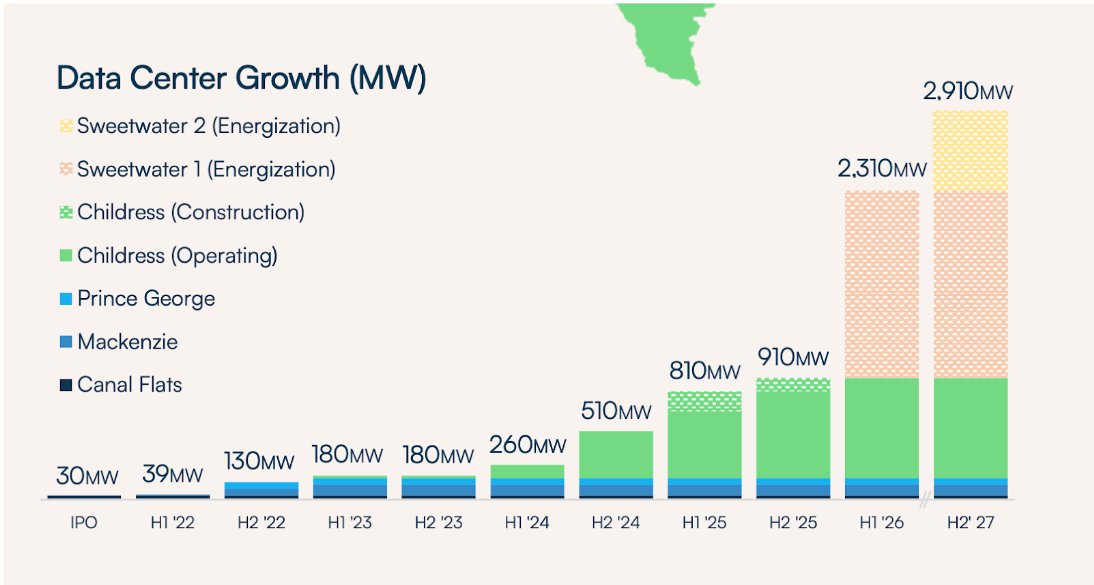

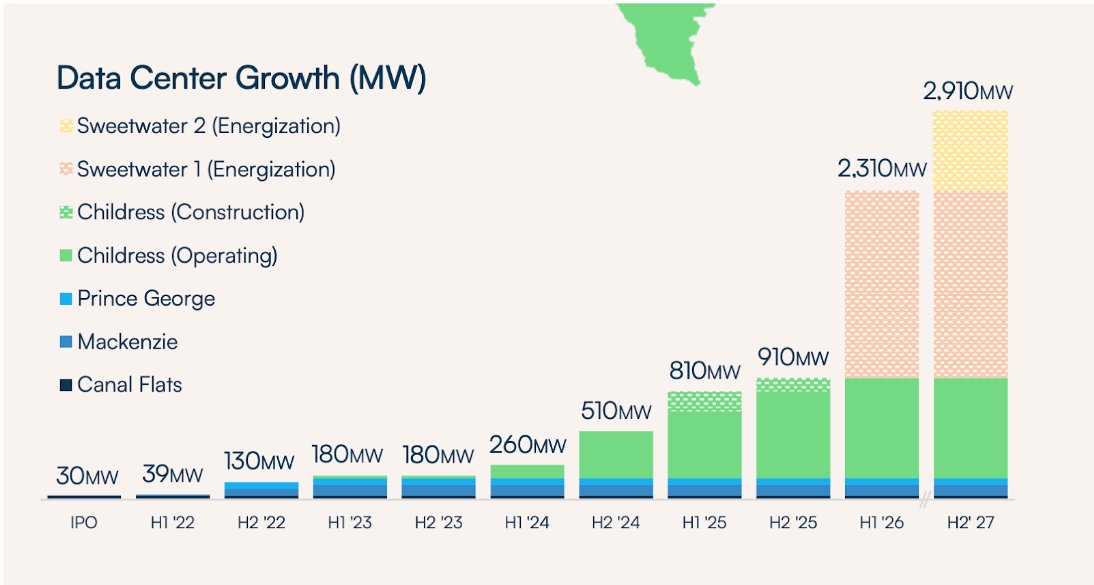

2026 will also be a very exciting year for Irish as significant capacities are being expanded and added.

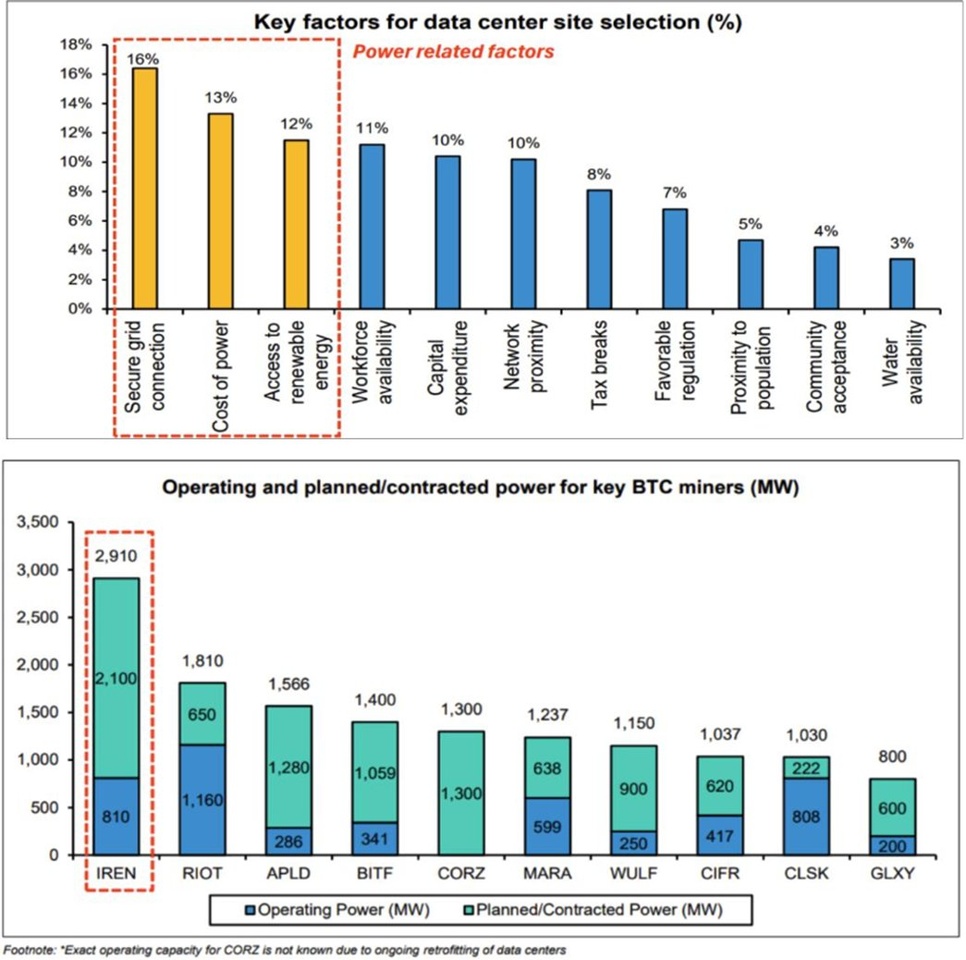

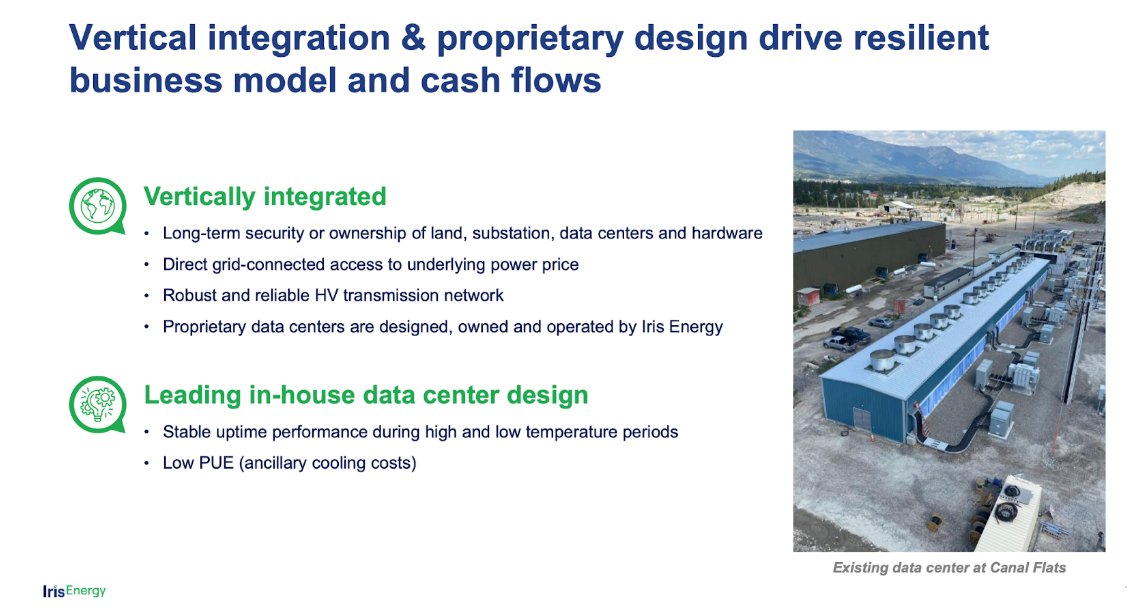

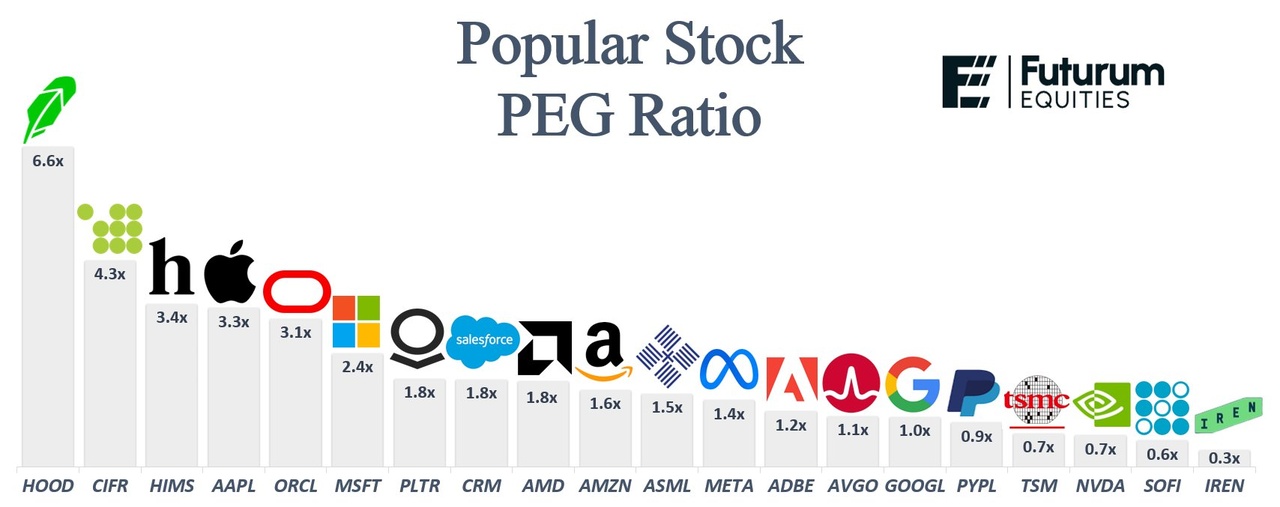

$IREN (-9,15%) methodical strategy - building a low-cost, high-density infrastructure initially through bitcoin mining and then expanding into AI computing - positions $IREN (-9,15%) as a more resilient, vertically integrated player. Its strong asset base, low operating costs and limited reliance on external funding lend $IREN (-9,15%) a structurally more profitable, lower risk business model compared to the highly leveraged, asset-light models of many newer cloud providers.

In general, Bitcoin mining typically requires much lower capital expenditure (capex) than AI or HPC data centers. However, Iren's existing data centers (e.g. over 150 MW in Canada) are configured for both Bitcoin mining and high-density AI workloads, with rack densities of around 80 kW. Despite this, Iren achieved construction costs of around $650,000 per megawatt, well below the $6-15 million per megawatt typical of specialized AI facilities. Iren's designs are not only extremely fast to build, but also easy to retrofit (e.g. rack density should be scalable to 300 kW and beyond), giving Iren a significant advantage in terms of flexibility and time to market (e.g. in relation to the B200s).

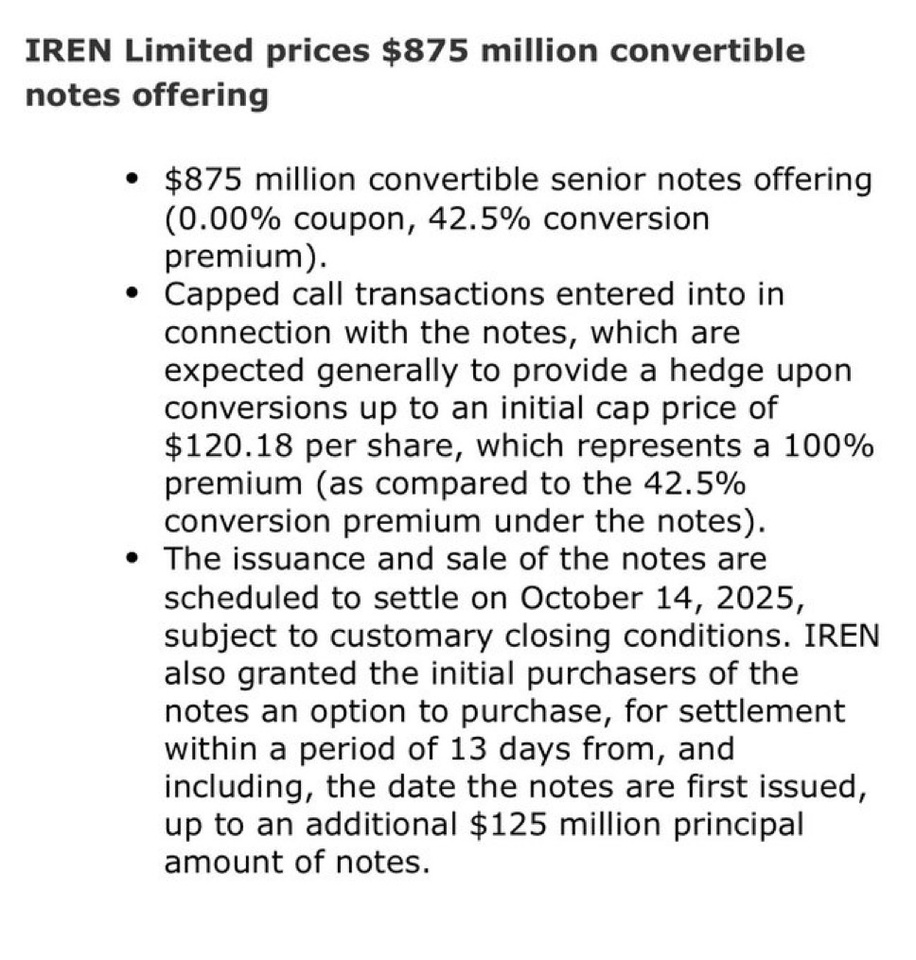

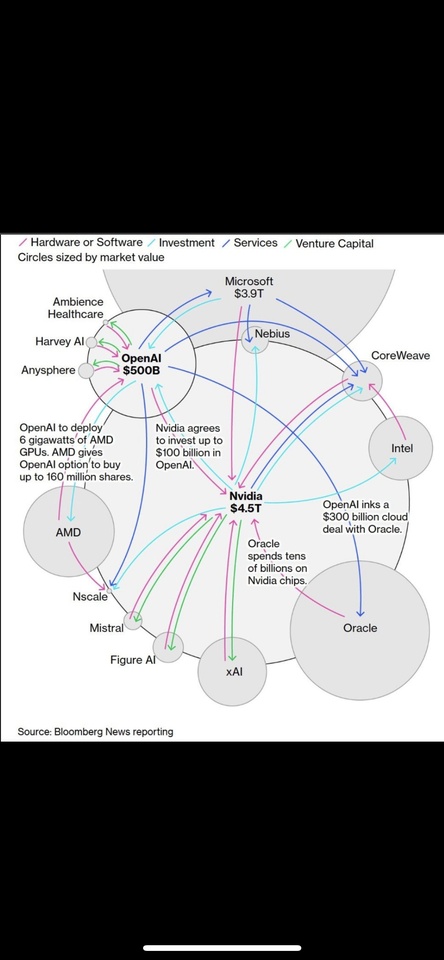

This efficient, infrastructure-oriented approach has $IREN (-9,15%) enabled it to grow without taking on significant debt. In contrast, most of Neocloud's competitors, such as $CRWV (-5,69%) have financed their rapid expansion by eliminating large amounts of debt. Unlike Irish, most neoclouds typically own little land or physical infrastructure, which can hinder future growth.

$CIFR (-8,23%)

$CRWV (-5,69%)

$BTBT

$BITF (-0,84%)

$BTC (+0,5%)

$NVDA (-6,14%)

$AMD (-10,01%)