Discussione su CARR

Messaggi

28"Star Investor" Homer J Simpson plans several acquisitions with his DepoGlobalHyperMegaInvest "Holding"

14 September 2025 Springfield Shopper

Among other things

- Intuit $INTU (-2%)

UFP Technologies $UFPT (-1,05%)

Group 1 Auto $GPI (-2,18%)

Carrier Global $CARR (-3,05%)

Simpson $SSD (-2,39%)

ICE $ICE (-1,75%)

Strengthen its portfolio, further "takeovers" are not ruled out.✌️😁

Which company should Homer J Simpson still acquire?

Q2 figures - share price slump of almost 11% not justified

Air conditioner maker Carrier Global on Tuesday beat analysts' estimates for second-quarter profit and sales, but a late start to summer led to a drop in orders from residential customers.

The company now expects organic sales in its residential business to rise by a mid-single-digit percentage this year, compared with a previous forecast of high single-digit to double-digit growth.

Shares in the Florida-based company fell by 10 percent.

Quarterly revenue for Carrier's largest segment, Climate Solutions Americas, rose 14 percent year over year, driven by a 45 percent increase in sales to commercial customers.

The rise in global temperatures caused by climate change and increasing air pollution are driving demand for new air conditioning systems and air purifiers as well as for the maintenance and repair of old equipment.

Total sales in the spare parts market rose by 13% in this quarter.

The company is also benefiting from robust demand for its data center cooling products, which are used for artificial intelligence technologies.

However, the late start to the cooling season, i.e. the high-demand summer months, contributed to a 60 percent drop in orders from private customers, compared to a 100 percent increase last year.

"Sales in the private customer segment rose by 11 percent, which was below our expectations due to the lower volume," said CFO Patrick Goris during the quarterly results conference call on Tuesday.

Carrier reiterated its full-year revenue guidance of nearly $23 billion and its adjusted earnings per share guidance of between $3 and $3.10, although it lowered its expectations for consumer revenue.

Total revenue for the quarter ended June 30 rose 3 percent from a year earlier to $6.11 billion, compared with analysts' estimates of $6.09 billion, according to data compiled by LSEG.

The company reported adjusted earnings of 92 cents per share for the second quarter, compared with analysts' estimates of 90 cents per share.

Carrier Global Q2'25 Earnings Highlights

🔹 Revenue: $6.11B (Est. $6.11B) 🟡; UP +3% YoY

🔹 Adj. EPS: $0.92 (Est. $0.91) 🟡; UP +26% YoY

FY25 Guidance (Reaffirmed)

🔹 Revenue: ~$23B (Est. $22.98B) 🟡

🔹 Adj. EPS: $3.00–$3.10 (Est. $3.06) 🟡

🔹 Adj. Oper Margin: 16.5%–17.0%; +100 bps YoY

🔹 Free Cash Flow: $2.4B–$2.6B

Q2 SEGMENTS:

Climate Solutions Americas (CSA)

🔹 Revenue: $3.25B; UP +14% YoY

🔹 Segment Operating Margin: 27.0%; UP +210 bps YoY

Climate Solutions Europe (CSE)

🔹 Revenue: $1.25B; UP +5% YoY

🔹 Segment Operating Margin: 7.9%; UP +10 bps YoY

Climate Solutions Asia, ME & Africa (CSAME)

🔹 Revenue: $882M; DOWN -2% YoY

🔹 Segment Operating Margin: 15.3%; DOWN -210 bps YoY

Climate Solutions Transportation (CST)

🔹 Revenue: $726M; DOWN -25% YoY

🔹 Segment Operating Margin: 17.6%; UP +340 bps YoY

Other Q2 Metrics:

🔹 Adj. Operating Margin: 19.1%; UP +130 bps YoY

🔹 Free Cash Flow: $568M

🔹 Operating Cash Flow: $649M

CEO Commentary

🔸 “We delivered another quarter of strong financial performance.”

🔸 “Organic sales growth of 6% was driven by strong results in Climate Solutions Americas, with Commercial sales up 45%.”

🔸 “Adjusted EPS growth over 25% reflects our margin expansion and productivity.”

🔸 “We remain committed to accelerating growth through differentiated products, aftermarket offerings, and system solutions.” – David Gitlin, Chairman & CEO

1000% profit-taking and two new additions from Scandinavia

$RKLB (-6,93%)

$9984 (-8,87%)

$CADLR (-1,42%)

$MTRS (-0,82%)

Yesterday I was at Rocket Lab $RKLB (-6,93%) and SoftBank $9984 (-8,87%) took profits, with Rocket Lab even over 1000%to further diversify my portfolio.

The strategy remains the same, namely to invest in future-oriented individual stocks with a lot of upside and stable finances, but the Rocket Lab share in the portfolio is growing and growing, so I have decided to reallocate a little.

Two new stocks from Scandinavia have been added.

1) Cadeler

$CADLR (-1,42%)

Cadeler is a world-leading Danish company specializing in the installation of offshore wind turbines. The offshore wind power market is expected to grow to approx. 70-250 billion dollars by 2035 (depending on estimates). Cadeler is ideally positioned to benefit from this trend. They maintain long-term customer relationships with companies such as Ørsted, Equinor or Siemens Gamesa. The barrier to entry is generally regarded as high (moat).

Turnover (2025e)approx. € 500 million (of which 10-20% is usually recurring)

Profit (2025e)approx. 150 mio €

Order backlog (current)approx. 2.5 billion €

Market capitalization (current)1.6 billion €

P/E ratio (current): approx. 17

P/E ratio 2029 (forecast)approx. 3-4

Cadeler will benefit from the global trend towards decarbonization and political initiatives in this area, and many countries are only just getting started. My AI analysis of the company has shown that we will probably 2035 we are likely to have a profit of around €1.4 billion which, with a P/E ratio of 18.6 (Danish average), this implies a market capitalization of around € 26 billion. would mean. With a more conservative P/E ratio of 12 it would be around 17 billion €. In the first scenario, an investment would therefore be around 16x and in the second scenario 11x in the second scenario. The company therefore fits well into my investment strategy, high potential with comparatively low risk.

2) Munters Group $MTRS (-0,82%) (Edit: sold in the meantime)

The Munters Group is a Swedish company that specializes in air treatment and drying solutionsespecially for air conditioning, dehumidification and industrial air technology - with a focus on data centers, pharmaceuticals, food and industrial plants. The data center business in particular is currently booming. The battery factory business has recently experienced problems due to weak demand, which is also reflected in the share price, but this is only a short-term problem.

The company is a technological leader in the field of dehumidification and energy recovery. They are also ahead of the competition when it comes to sustainability. In addition, they always rely on a very local production structurewhich largely frees them from trade policy risks. Competitors such as Daikin Industries $6367 (-3,05%) or Carrier $CARR (-3,05%) are more broadly based and less specialized, which is why they do not pose a major threat either. It is also difficult for customers to switch suppliers.

Turnover (2025e)approx. € 1.3 billion (of which 20-30% is usually recurring)

Profit (2025e)approx. 60 million €

Order backlog (current):

Market capitalization (current)2.2 billion €

P/E ratio (current): approx. 31

P/E ratio 2029 (forecast)approx. 10-11

The Munters Group is benefiting from several trends such as the data center boom, electrification and sustainability. This development is only just beginning. My AI analysis has shown that the profit in 2035 will be around € 300 million. in 2035. With a constant P/E ratio, that would correspond to a valuation of € 9.3 billion would correspond. If one assumes a lower P/E ratio of around 20 it would be 6 billion €. So in the first scenario 4x and in the second 2,7x. The Munters Group therefore represents a rather conservative addition in my growth-oriented portfolio. They will definitely perform well, but for the really big multiples you need other stocks.

What do you think of the two new additions? I think it's particularly nice that there are two European companies are 🇪🇺🇪🇺

Portfolio Update - June 2025

A mixed month with strong individual stocks and weak cryptos. Despite the turbulence, I remain true to my strategy - as announced, I will enter Carrier Global in July $CARR (-3,05%)

✅ Top performers (monthly change in %)

- BVB: +28.73 % 🟢

- Commerzbank: +24.88 %

- Atoss Software: +9.85 %

- ASML: +8.64

- UnitedHealth: +8.12 %

- Artificial Intelligence ETF (L&G): +7.83%

- Video Gaming & eSports ETF: +7.41

- Take-Two: +6.02

📉 Flop performers (monthly change in %)

- Mustang Energy: -29.84 %

- Primary Hydrogen: -30.49 %

- Clearpool: -26.41 %

- RENK Group: -23.26 %

- Pi Network: -22.19

- Cosmos: -21.71 %

- Coupang: -19.43

- Chiliz: -12.41 %

📊 Development by segment

Stable and growing:

- Tech ETFs such as the Digitalization ETF (+5.2%) and the AI ETF posted gains.

- Atoss Software, ASML and Take-Two continue to perform strongly.

- Banking and healthcare stocks (Commerzbank, UnitedHealth) also performed well.

Under pressure:

- Cryptos remain the problem child - especially Chiliz, Cosmos and Bitcoin.

- Some speculative positions such as RENK, Clearpool, Mustang & Hydrogen are showing heavy losses.

📌 Compared to the last update

- Overall impression slightly positive, supported by tech and selected individual stocks.

- Cash holdings slightly increased

- Defensive assets such as gold, physical gold ETC and healthcare ETFs with moderate declines.

- Regional ETFs (Japan, USA, Europe) stable to slightly positive.

- Clean energy and cyber security remain volatile but positive.

🚀 Outlook July 2025

- Entry into Carrier Global (CARR) planned - focus on quality and industries with sustainable demand.

- Crypto holdings will not be expanded further.

- Continuation of ETF savings plans and monitoring of speculative positions.

Germany is sweating - I'm investing.

While everyone is moaning that the killer temperatures are hitting, I think to myself:

Let the south come to us then. 😎

🏖️ Climate change? Tragic.

🧊 But someone has to supply the air conditioning.

👉 That's why I'm looking at companies like:

- Daikin (JP) $6367 (-3,05%) - Asian cooling gods

- Carrier Global (USA) $CARR (-3,05%) - Does not only air conditioning, but also cash

- Trane Technologies $TT (-1,56%) - Less well known, but ice cold efficient

And if I'm not in the mood for individual stocks, there are ETFs with the whole smart city/air conditioning eco-mix $CITY (-2,52%) or $RENW (-3,87%) or $INRG (-4,14%)

Maybe that will be my "summer slump play".

Instead of sweating - just profit.

Invest ice-cold instead of taking an ice-cold shower.

#Getquin

#InvestierenMitHumor

#KlimawandelPortfolio

#DeutschlandSchwitzt

#KlimageräteAktien

#BuyTheHeat

#DividendInsteadOfDeo

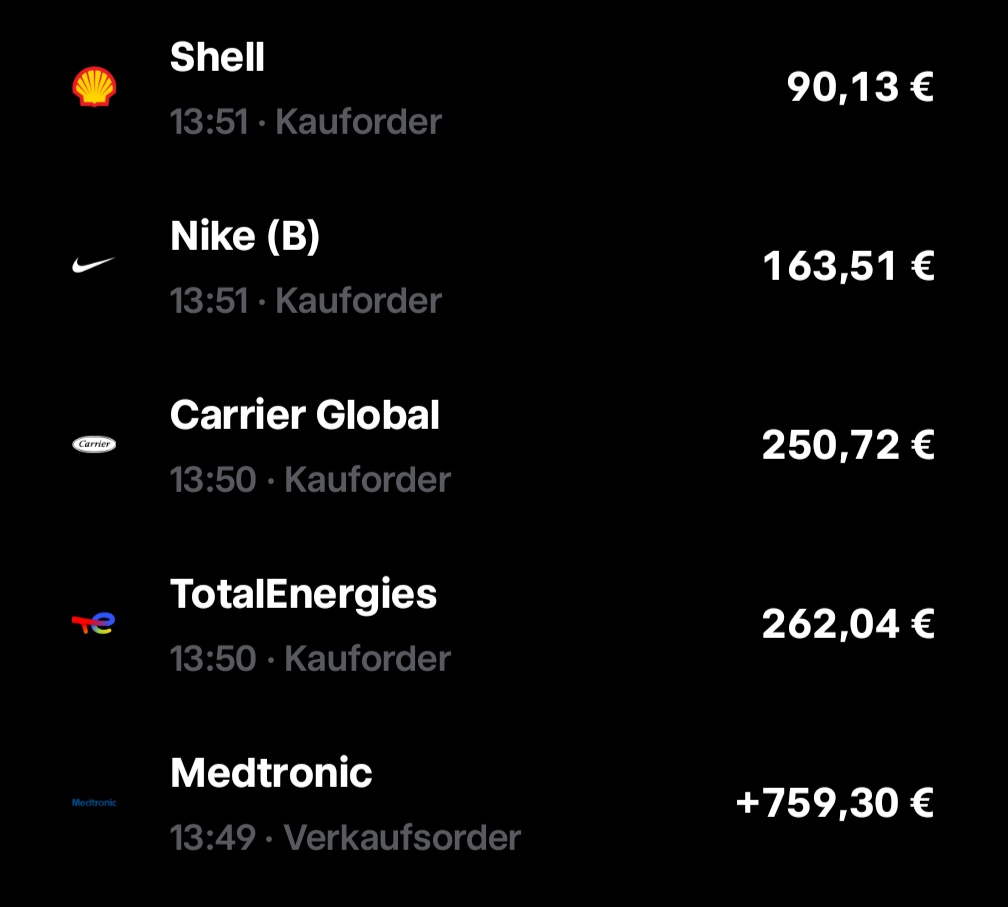

Further conversion

After 4 long years of stagnation and share price decline, I have decided to sell Medtronic and further expand my portfolio in line with my preferences.

To this end, I have reduced my positions

In Shell $SHEL (-3,05%) , Carrier Global $CARR (-3,05%) , Total Energies $TTE (-2,5%) and Nike $NKE (-4,98%) expanded.

With Nike I have now also reached my desired size 😁

There is currently only one single share in the standing order and that is Carrier Global.the standing order on the Vanguard FTSE all-world remains unchanged.

I still intend to $SHEL (-3,05%) , $TTE (-2,5%) , $XYL (-2,22%) , $ECL (-0,68%) and $LIN (-1,49%) to expand.

I am always open to comments and suggestions for improvement 😁

Also really like their business model!

Further regrouping

After many years of holding BP shares, I finally sold them. $BP. (-2,96%) share.

Lack of perspective, hardly any growth despite annual share buybacks and dividend increases.

Deathblow that meanwhile competition like Shell $SHEL (-3,05%) and Total Energies $TTE (-2,5%) want to buy up or take over.

I have taken good dividends over the years and am out with a plus.

In the end, I invested the proceeds in the competitor Shell $SHEL (-3,05%)

and in the refrigeration and air conditioning technology of Carrier Global $CARR (-3,05%) refrigeration and air conditioning technology.

I will miss the high dividend (my personal dividend yield has now reached 8%)

But Carrier and Shell are growing very strongly and if Shell were to take over BP after all, the money would end up back there ☝🏻😜

Titoli di tendenza

I migliori creatori della settimana