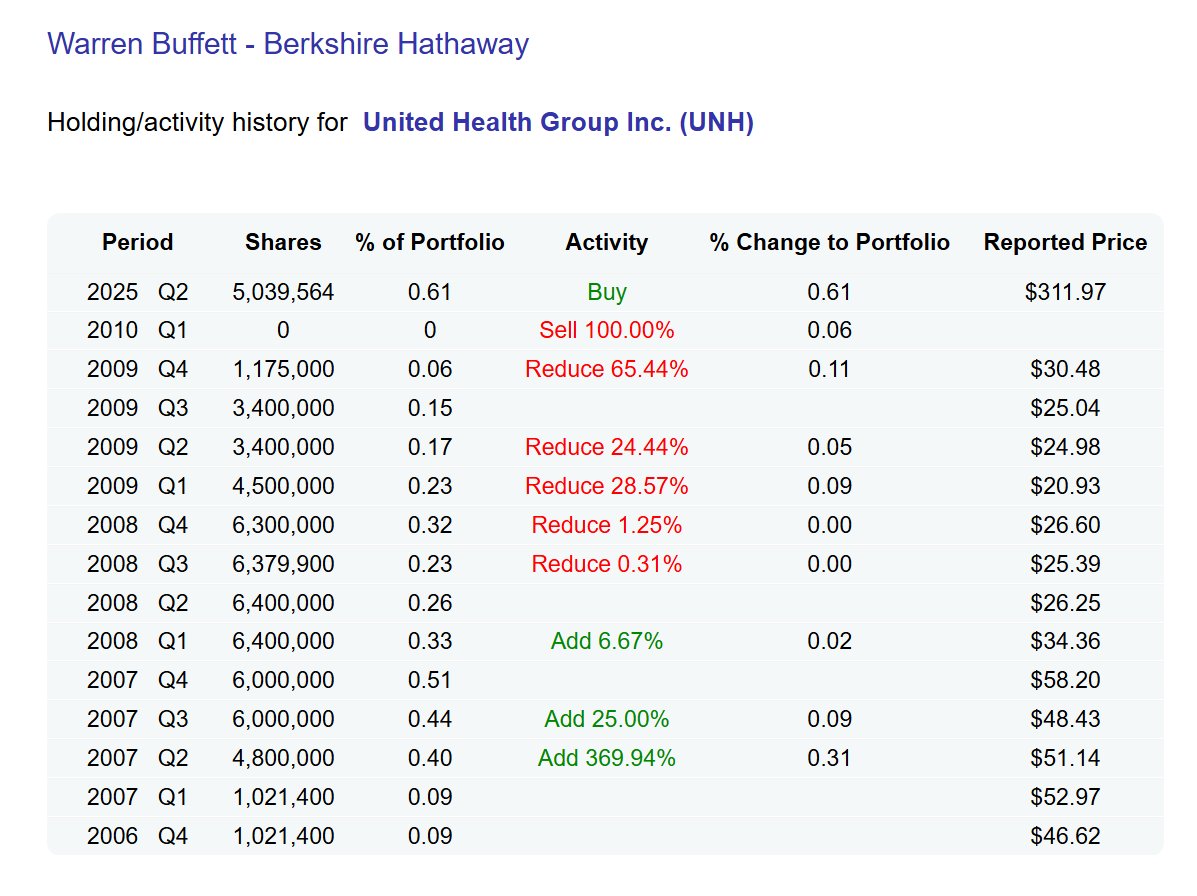

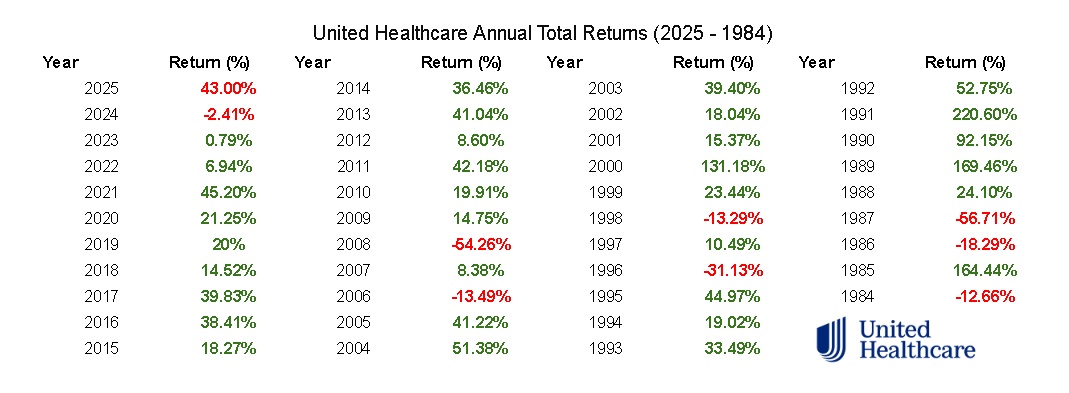

$UNH (-5,78%)

Supplementary information/further research:

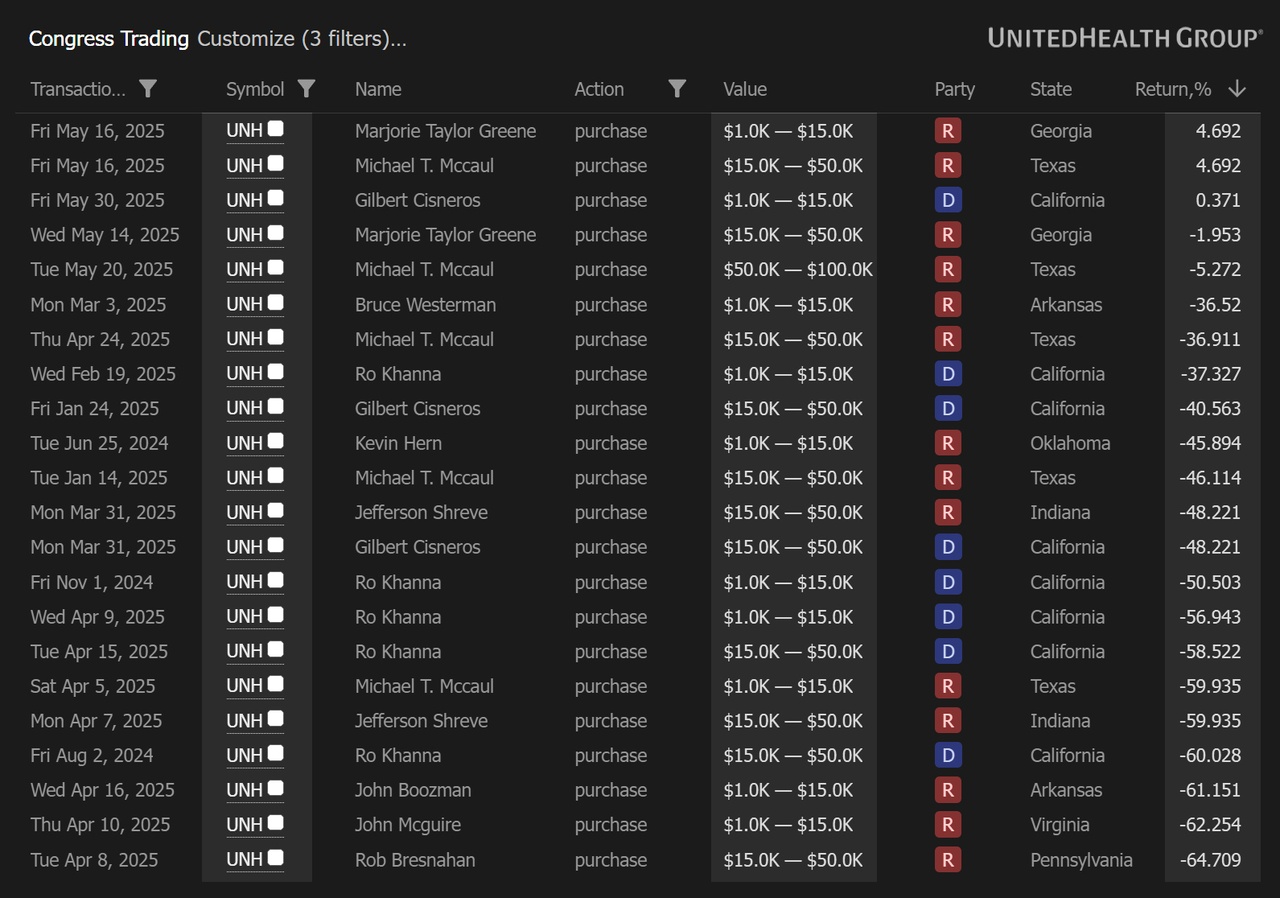

ESPP programs have a contribution limit of $25,000 per year per employee under IRS 423c. You cannot buy unlimited shares. This buying pressure is negligible for price movements (especially long term).

In addition, the buying power is split between two purchase dates.

The participation rate of $UNH (-5,78%) employees in the ESPP is unlikely to be anywhere near 100% and some employees will often sell their shares on the same day they buy them as there is no holding period.

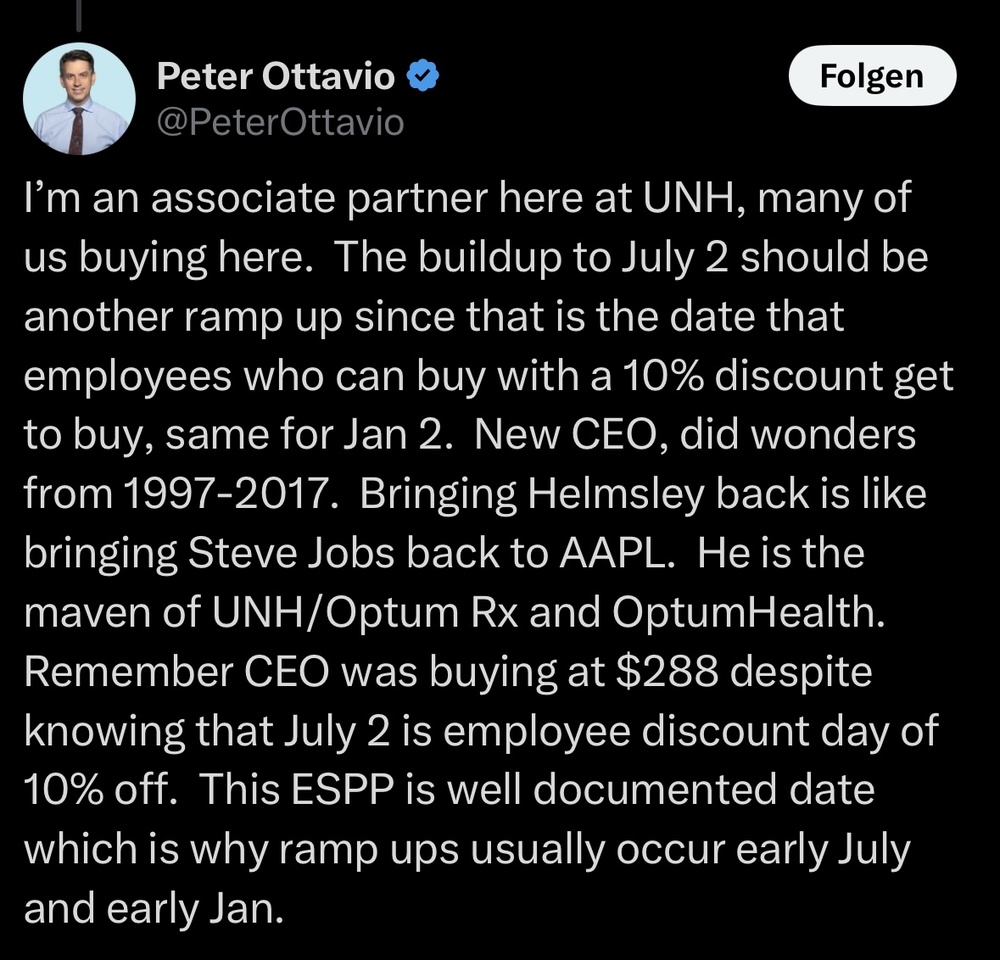

Here are more insights from Mr. Peter Ottavio on UNH/Optum Rx and Optum Health:

(For those who are interested)

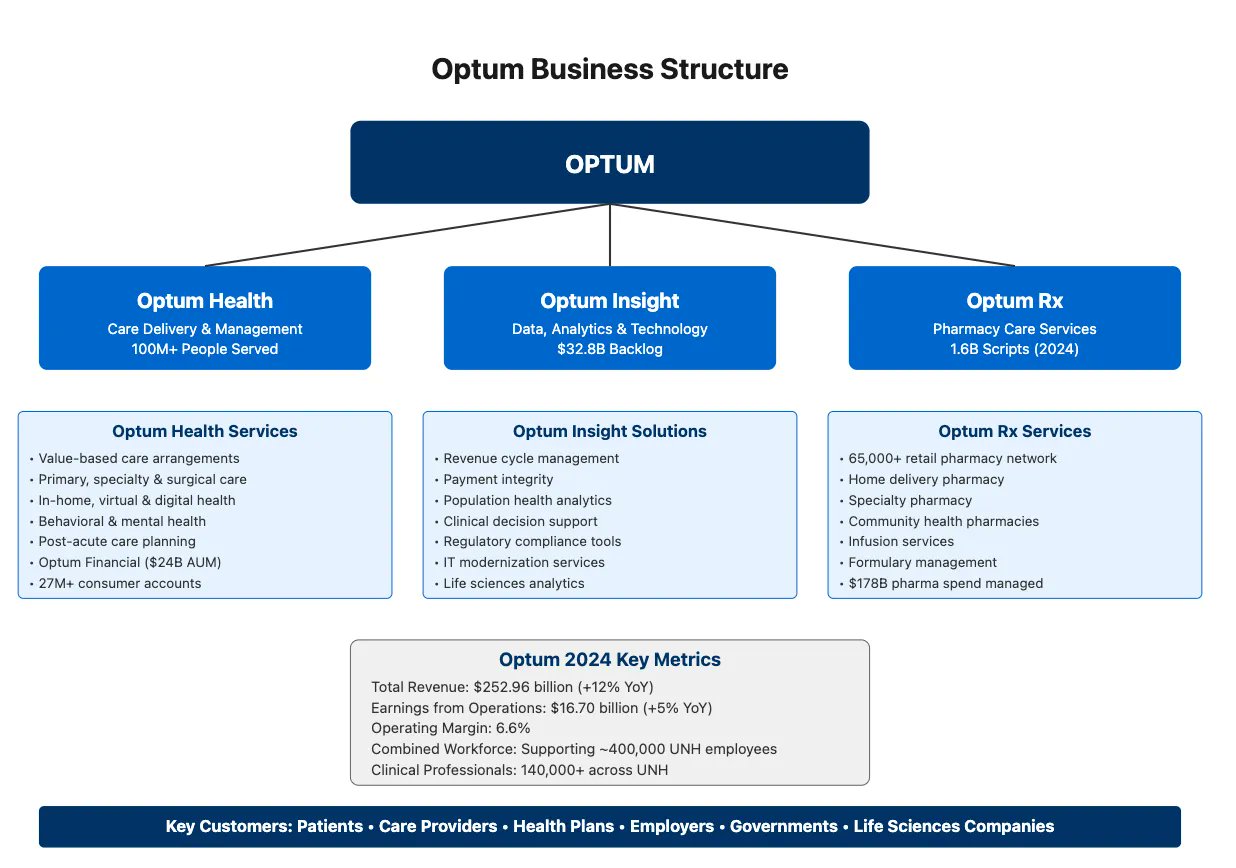

These are just a few of the many reasons why I love working at this company as a partner/physician of OptumHealth/UHG. UNH functions more like three efficient companies in one.

OptumHealth is a subsidiary of UnitedHealth Group and focuses on healthcare delivery, population health management and technology-enabled services. With approximately 90,000 physicians and 40,000 healthcare providers, it is the largest provider network in the country. This size provides providers with the resources they need to care for patients efficiently and effectively. Of all the health systems I've worked for, I've never had the resources to care for a sick patient so effectively. In addition, I have never experienced such tremendous growth of a provider network during my three years here.

If a patient comes to me with a cough, I can immediately have x-rays and blood work done in the same building without authorization or delay. The patient then comes back into the hallway to review the images and discuss the next steps in treatment. In the unlikely event that a lung tumor is detected, I can have a CT scan of the chest performed immediately on campus (or off campus if the patient wishes) on the same day and come back the same day to discuss the next steps. If a PET scan is then required, I can have this done as soon as possible. I can honestly say that I have never been refused a CT or PET scan for valid reasons.

OptumRx is the pharmacy benefit management and pharmacy supply arm of UnitedHealth Group and is one of the largest mail-order pharmacies in the country. OptumRx often provides necessary medications affordably and efficiently. The choice is up to the patient, but for long-term therapy, many choose this route.

The sad news about Brian Thompson has hit us hard. While I have heard many good things about him, the role of the insurance arm of the company is not one of my responsibilities.

I have watched countless hours of interviews and presentations by Hemsley and would liken him to Steve Jobs as the true expert on these companies and would definitely welcome him back.

Regarding ESPP.

UnitedHealth Group's Employee Stock Purchase Plan (ESPP) allows eligible employees of UnitedHealth Group (UHG), including its subsidiaries such as UnitedHealthcare, to purchase UHG common stock (traded under the symbol UNH) at a discounted price through payroll deductions. Employees who elect to do so will receive six months of regular payroll deductions from January 2 through July 1 and from July 2 through January 1. These payroll deductions are accumulated in an escrow account and purchased on July 1 at a discounted rate at the same time. Our portfolio books the purchase on the following day.

None of this is financial advice, but for those of you who have requested information on the role of UHG companies and their ESPP, this is the well-documented and non-confidential information provided.

$OSCR (-4,92%)

$CVS (-0,22%)

$CI (-2,28%)