Global markets open the week with a strong bullish tone, capitalizing on optimism from US inflation data which has fueled bets on Fed rate cuts and pushed indices to historical highs last week. Focus remains on earnings and monetary policy prospects.

🇺🇸 US Equities (Pre-market)

$SPX500 — Futures indicate a solid rise, extending gains recorded after the inflation data.

$DJ30 — Up, positive sentiment is widespread, including blue-chip stocks.

$NSDQ100 — Strong rally, the Tech sector is the main beneficiary of lower rate expectations.

💻 Tech & Growth Snapshot

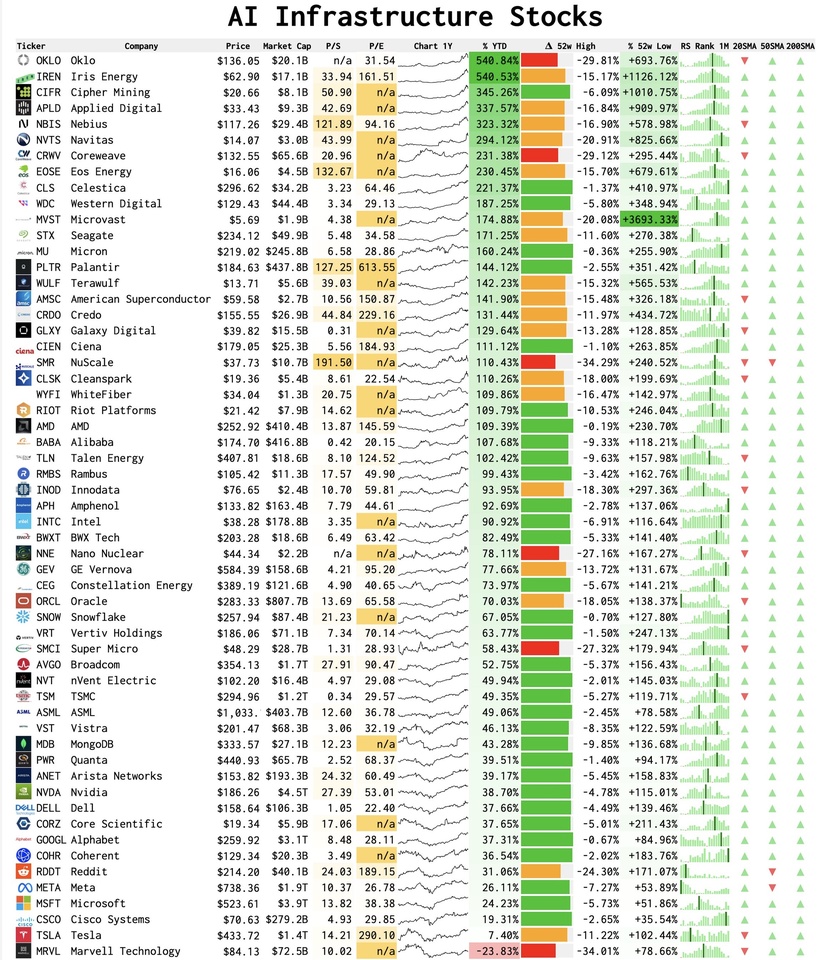

$NVDA (+1,71%) — Strongly up, AI stocks continue to ride the wave of optimism.

$GOOGL (+3,06%) — Up, in line with the sector's performance.

$AVGO (+1,68%) — Solid rise, the semiconductor complex remains a key driver.

$META (+1,42%) — Up, the Communication Services sector is well-positioned.

$MSFT (+1,43%) — Up, the stock benefits from Tech enthusiasm.

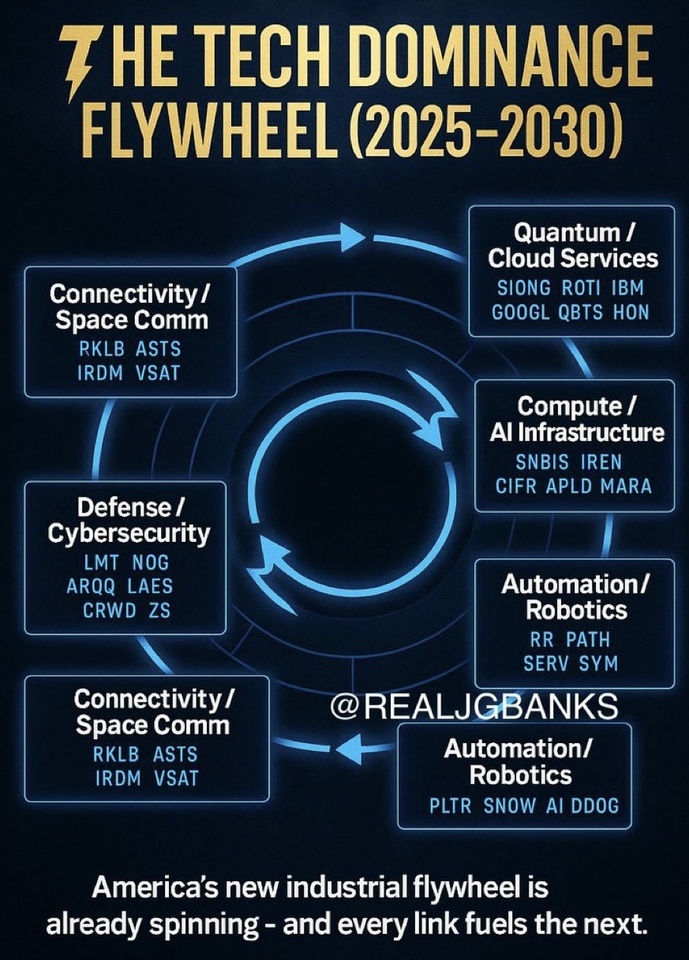

$QBTS (+7,34%) — Up, new techstocks attempt to recover after correction.

$RGTI (+5,96%) — Up, following the recovery in speculative sentiment.

$TSM (+0,39%) — Solidly up, chip optimism is consolidated.

$$RR. (-0,08%) — Up, the Industrial/Aerospace sector shows strength.

🛍️ Retail & Commerce

$AMZN (+0,93%) — Strong rise, driven by *risk-onand consumer confidence.

$BABA (+2,66%) — Up, positive global sentiment supports Asian stocks.

$CVNA (+0,92%) — Up, the stock follows the trend.

$SHOP (+1,11%) — Solid rise, retail tech is fully recovering.

⚕️ Health & Pharmaceutical

$LLY (-0,49%) — Down slightly, the Pharma sector is experiencing mild profit-taking, penalized by the shift towards growth.

$HIMS (-1,1%) — Up, in line with the general mood.

$INSM (+2,18%) — Up, the biotech sector participates in the rally.

🇪🇺 Europe & Industrials

STOXX 600 — Decidedly positive*open, tracking the US sentiment.

GER40 — Solid rise, the German market is driven by optimism about rates.

$LDO (+0,39%) — Up, the defense sector is mixed/positive.

$IBE (+0,01%) — Down slightly, utilities are being sold off as defensive sectors in a risk-onenvironment.

$OKLO — Up, nuclear *new techfollows the rally.

🏦 Banking & Finance

$UCG (+2,36%) , $ISP (+1,85%) — Up, banks look to capitalize on positive sentiment.

$BAMI (+1,79%)

$CE (+0,68%) , $BPE (+2,83%) — Up, financial stocks are positive.

$BBVA (+1,15%) — Up, the financial sector participates in the rally.

$AXP (+0,94%) , $V (+0,19%) — Up, payment services benefit from consumer confidence.

💱 Forex

$DXY — The Dollar Index is moving in a slight decline, given rate cut expectations.

$EURUSD — Up, the Euro gains ground against the weaker Dollar.

$USDJPY — Stable, the Yen moves sideways.

💎 Commodities & Precious Metals

$GLD (-2,57%) — Down, gold is under pressure due to *risk-onand diminished haven demand.

$CDE (-5,28%) — Down, following the gold correction.

$BRENT / $WTI — Stable/Mixed, oil is cautious.

💰 Crypto

$BTC (+0,72%) / $ETH (+1,15%) — Up, cryptocurrencies benefit from *risk-onand liquidity expectations.

$TRX (-0,45%) , $CRO (-1,51%) — Up, the altcoin sector is positive.

🔎 Deep Dive: Optimism Returns (Rates & Earnings)

The week opens with widespread optimism, primarily fueled by the prospect of rate cuts*from the Federal Reserve and ongoing resilient corporate earnings. The weakness of the Dollar ($DXY) and the decline in Gold ($GLD) are the clearest signals of this prevailing *risk-onmood. The sector rotation is evident: defensive assets ($LLY, $IBE.MC) are giving way to Tech ($NVDA, $GOOGL) which has resumed leadership. Financial stocks ($AXP, $V) are capitalizing on consumer confidence, while *new technames ($QBTS, $RGTI) are recovering from recent lows.

For daily real-time market insights, deep dives, and trading discussions, follow me on X: https://x.com/ThomasVioli

To copy my portfolio, strategies, and complete trade insights, you can follow me on eToro: https://www.etoro.com/people/farlys

⚠️ Disclaimer: Past performance is not indicative of future results. Investing involves risks, including the loss of capital.