15 September 2025

Last EPS at 10,73$

That's it for today ✌️😁

Messaggi

3If Warren Buffett's Berkshire is already making a lot of money with insurance, it can't hurt me either 😁

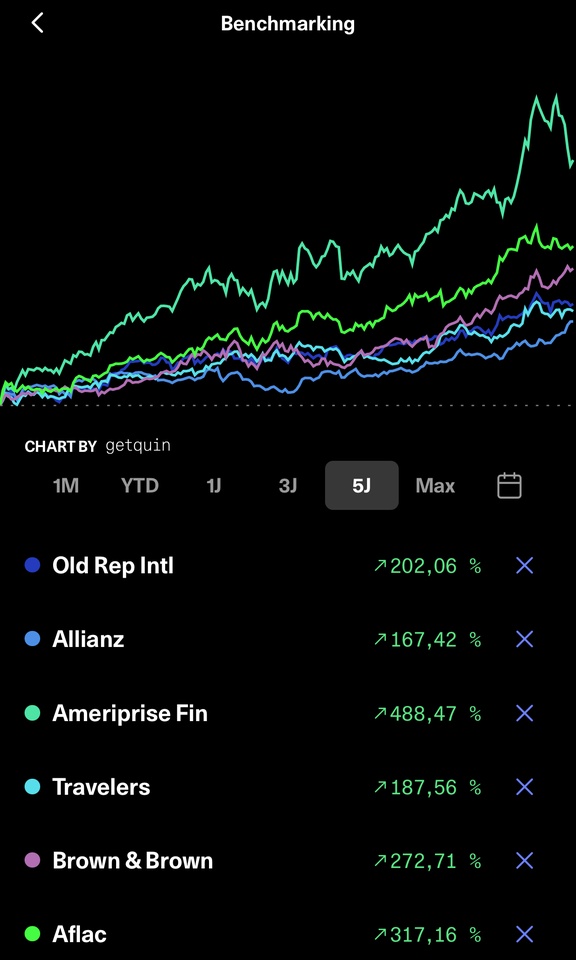

My $ORI (-0,21%) I started building up my position in September 2021, until then I had only $ALV (-0,68%) and $AFL (-0,73%) in the portfolio. In the meantime $TRV (-2,09%) and recently also $AMP (-2,86%)

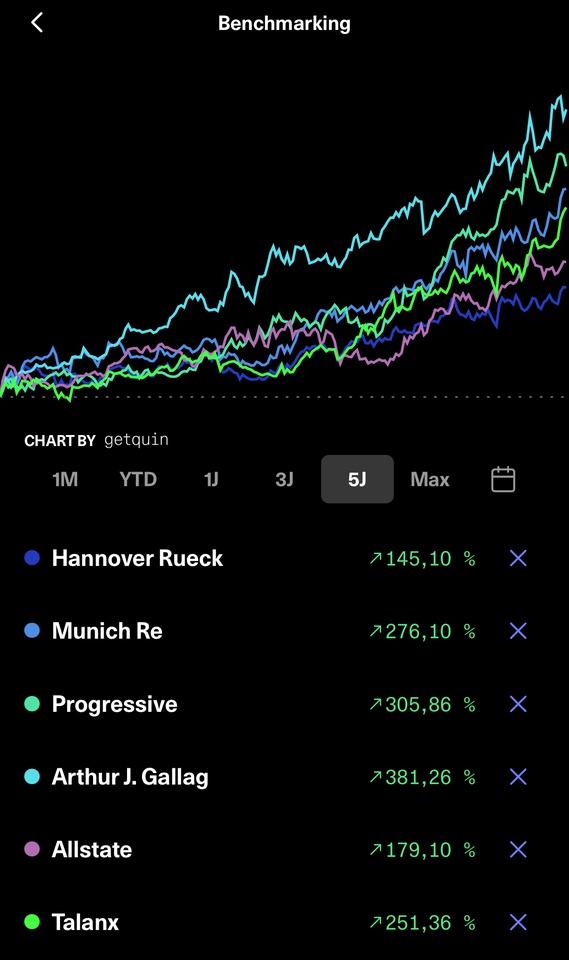

$BRO (-0,04%) have landed in the Scalable portfolio, in which I also invest in the "Ultimate Homer ETF" Trade Republic Depot via a savings plan, as well as $MUV2 (-0,74%)

$HNR1 (-1,02%)

$PGR (-1,61%)

$ALL (-2,09%)

$AJG (-0,65%)

$TLX (-2,04%)

$8766 (-3,31%) 😁

Which insurance companies are you with?

Old Republic balance sheet

Benchmark

Amazing that with a dividend aristocrat you could keep up well with the ETFs over the last 5 years 💪😁

Benchmark vs competition

I migliori creatori della settimana