$ERIC A (+0%)

$DPZ (+0,06%)

$JNJ (-0,5%)

$JPM (-2,22%)

$WFC (-3,48%)

$BLK (-3,34%)

$GS (-2,43%)

$C (-3,2%)

$MC (-2,5%)

$ASML (-5,06%)

$BAC (-3,39%)

$MS (-3,39%)

$JBHT (-4,18%)

$EQT (-4,05%)

$SRT (-2,16%)

$NESNE

$TSM (-6,55%)

$ABBN (-0,59%)

$UAL (-5,1%)

$TOM (-2,03%)

$VOLV B (-1,01%)

$AXP (-3,64%)

$SLBG34

$STT (-5,57%)

Discussione su AXP

Messaggi

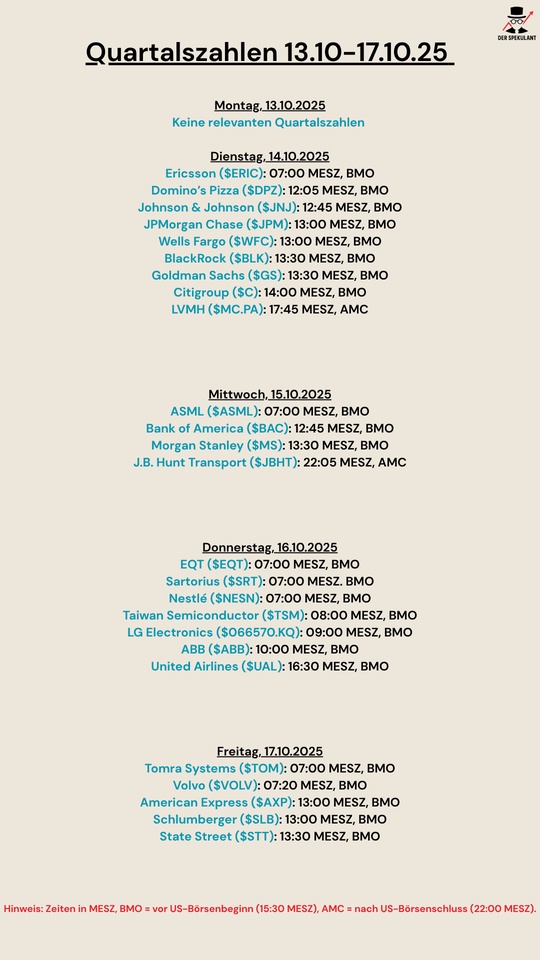

63Quartalsberichte 13.10-17.10.25

A nearly one year review

Hi everyone!

I’ve been building this portfolio for almost a year now, following a long-term growth approach rather than chasing short-term explosive gains. So far, it’s up +5.30%. I’ve focused more on the italian and american markets with stoks such as $ISP (-1,98%)

$KO (+0,18%)

$BRK.B (-2,44%) that make more than half my portfolio. What do you think about my strategy and approach?

$VOW3 (-2,24%)

$PLTR (-7,09%)

$FCT (-3,29%)

$LDO (-5,28%)

$RHM (-2,26%)

$INTC (-5,15%)

$CPR (-2,8%)

$AXP (-3,64%)

$BMPS (-1,43%)

$FBK (-1,72%)

$G (-0,96%)

$GS (-2,43%)

$MCD (+0,18%)

$SL (+0,8%)

$ENI (-2,74%)

$BBAI (-4,05%)

$PRY (-1,79%)

At +140% I had to realize profits!

But with a little extra cash, there were a few $CRM (-2,41%) pieces

I will definitely get back in at $AXP (-3,64%) if the share is valued somewhat more attractively again.

Very solid company

American Express $AXP (-3,64%) is a solid, low-risk company with good long-term growth. Due to a change in strategy, I have now sold my $AXP (-3,64%) sold my shares.

Points that prompted me to sell:

Although the company is the undisputed market leader in its premium credit card segment and has higher profitability than its competitors, it is growing more slowly than them.

How is the company supposed to gain market share from Visa/Mastercard? I think it is more likely that $AXP (-3,64%) more likely to lose market share.

High geographical concentration

High economic dependency: industry forecasts weak 2nd half of the year

The business model has become too boring for me, stronger growth is extremely difficult to achieve through product innovations.

American Express: 2nd quarter figures

(AXP) reported a profit of 2.89 billion US dollars for the second quarter on Friday.

- The New York-based company generated earnings per share of 4.08 US dollars.

- The results exceeded Wall Street's expectations. The average of 14 analysts polled by Zacks Investment Research were surveyed was an expected profit of 3.86 US dollars per share.

- The credit card issuer and global payment services provider generated revenue of 17.86 billion US dollarsalso above analysts' forecasts. 13 analysts polled by Zacks had predicted 17.69 billion US dollars expected.

- American Express expects full-year earnings of 15 to 15.50 US dollars per share.

- Youtube channel for stock analysis: www.youtube.com/@Verstehdieaktie

American Express Q2'25 Earnings Highlights

🔹 Revenue: $17.86B (Est. $17.70B) 🟢; +9% YoY

🔹 Adj EPS: $4.08 (Est. $3.87) 🟢; +17% YoY*

🔹 Card Member Spending: $416.3B; +7% YoY – All-time quarterly high

FY25 Guidance (Reaffirmed)

🔹 EPS: $15.00 – $15.50 (Est. $15.22) 🟢

🔹 Revenue Growth: 8–10%

Segment & Operating Highlights

🔹 Billed Business (FX-adjusted): $390.7B; UP +7% YoY

🔹 Consolidated Provisions for Credit Losses: $1.4B (vs. $1.3B YoY); net write-off rate: 2.0%

🔹 Operating Expenses: $12.9B; UP +14% YoY

🔹 Effective Tax Rate: 18.7% (DOWN from 20.4% YoY)

🔹 Average Diluted Shares: 699M (DOWN -3% YoY)

🔹 Net Income: $2.89B; DOWN -4% YoY

Strategic & Product Updates

🔸 Card Member spending at all-time high; demand for premium products remains strong

🔸 U.S. Consumer & Business Platinum Card refresh set for Fall 2025

🔸 Announced launch of Coinbase One Card on AXP network

🔸 Ranked #1 in J.D. Power for both Mobile App & Website Customer Satisfaction

🔸 Ranked #4 on 2025 “Best Companies to Work For” in the U.S.

CEO Commentary

🔸 “We delivered record revenue and strong EPS, supported by high Card Member engagement and premium demand.”

🔸 “Our differentiated Membership model and proven product refresh strategy give us confidence in long-term growth.”

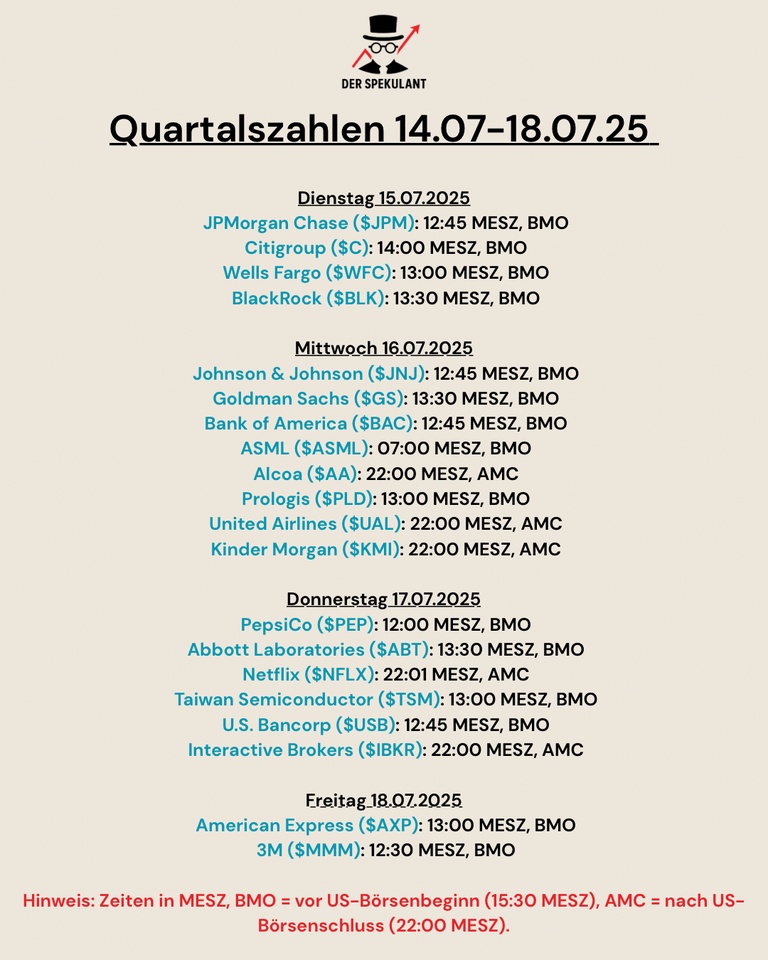

The earnings season begins again!

As the earnings season starts again, here is a summary of the most important figures next week.

$JPM (-2,22%)

$C (-3,2%)

$WFC (-0,55%)

$BLK (-3,34%)

$JNJ (-0,5%)

$GS (-2,43%)

$BAC (-3,39%)

$AA (-5,11%)

$ASML (-5,06%)

$PLD (-3,76%)

$UAL (-5,1%)

$KMI (-1,26%)

$PEP (+3,06%)

$ABT (-1,35%)

$Netflix

$TSM (-6,55%)

$USB (-5,18%)

$IBKR (-5,42%)

$AXP (-3,64%)

$MMM (-2,96%)

American Express Q1'25 Earnings Highlights:

🔹 EPS: $3.64 (Est. $3.48) 🟢; UP +9% YoY

🔹 Revenue: $17.00B (Est. $17.00B) 🟡; UP +7% YoY

🔹 Billed Business: $387.4B; UP +6% YoY

🔹 Net Write-off Rate: 2.1% (Flat YoY)

FY Guidance (Maintained, subject to macro environment):

🔹 Revenue Growth: 8% to 10%

🔹 EPS: $15.00 to $15.50

Key Operational Highlights:

🔸 Strong Card Member spending growth at 6% YoY (+7% excl. leap year impact)

🔸 Revenue increase driven by higher net interest income, growth in revolving loan balances, increased spending, and robust card fee growth

🔸 Modest net reserve release (vs. prior-year reserve build), partially offset by higher net write-offs

🔹 Provisions for Credit Losses: $1.2B (DOWN from $1.3B YoY)

🔸 Operating expenses rose moderately; marketing expenses flat YoY

🔹 Net Income: $2.58B; UP +6% YoY

🔹 Consolidated Expenses: $12.5B; UP +10% YoY (driven by higher variable customer engagement and travel-related benefit costs)

🔹 Effective Tax Rate: 22.4% (Prev. 22.5% YoY)

CEO Stephen J. Squeri’s Commentary:

🔸 "Strong Q1 performance reflects robust Card Member spending and premium customer base strength. Given steady spend and credit trends amid the current economic outlook, maintaining FY guidance, subject to macroeconomic conditions."

🔸 "Committed to disciplined expense management and strategic business investment."

Titoli di tendenza

I migliori creatori della settimana