Already available in the depot:

Are there any of these that you would still add to now or just hold?

Unfortunately, I sold too early:

On my watchlist:

Messaggi

883Already available in the depot:

Are there any of these that you would still add to now or just hold?

Unfortunately, I sold too early:

On my watchlist:

Hi there!

On the occasion of my milestone, I would like to introduce you to my depot. I would be delighted to receive your feedback :)

First of all about me: 👦

I am 23 years old and currently a law student in my 7th semester. I'm currently in the middle of preparing for my exams (annoying).

I started investing at the beginning of 2022 when I was playing poker with two friends and talking about the potential of shares etc. After briefly reading up (especially here 🤓), I was hooked. 🔥

I have my grandma and my parents to thank for the large sum (approx. 30k). I really appreciate this privilege and am grateful for it every day 🌞

Now to my securities account: 💰

Initially, I was only interested in dividend stocks. An ETF was already to be held as the core. At that time, the proportion was still supposed to be 30%. Now I'm aiming for 50%.🌏

Over the years, the dividend stocks were joined by $NVDA (+2,25%) or $GOOGL (-0,12%) high-growth stocks have also been added to the portfolio. 📈

I have always been fascinated by gold, which is why I have further diversified my portfolio in this area🥇

I also started small projects to motivate myself:

For about a year now, just under 3k at scalable has been used for swing trading. I mainly take advantage of medium-term price fluctuations in large companies. The profits are paid out immediately and spent on nice moments, such as eating out with my girlfriend.

In my opinion, this is a perfect balance to the long-term investment strategy. Last year, we achieved a time-weighted return of just under 33%, which I absolutely did not expect. 🔥

In addition, there is a so-called "punctuality guarantee" for local and long-distance transport in my area - there is a flat rate of €5 for every 20 minutes of delay. I invest this in the $VHYL (+0,27%) and see what happens. In the meantime, after about 2 years, I've saved up almost €250🚈

I haven't had any real income since this month, apart from (grand)parental support for university/rep and my apartment. Before that, I worked as a lifeguard at a swimming pool at the weekend. I also work "voluntarily" as a swimming coach for children aged 4-6. That pays me around €200 a month.

I will therefore have to reduce my daily allowance slightly, but this is the best investment for me. This simply gives me a lot more time to catch up on my work and write exams.

Thank you very much for your attention ♥️

Unfortunately, the recent price increases at Microsoft are causing my strategy to falter, which requires dividends to rise just as quickly as subscription prices.

Game Pass Ultimate now $29.99 per month (increased by 50%)

/ Dividend $MSFT (+0,41%) $0.91 per quarter (last increased by 10%)

= carries itself with 99 shares ~ 44000€

Youtube Premium $13.99 per month (increased by 17% 2 years ago)

/ Dividend $GOOGL (-0,12%) $0.21 per quarter (last increased by 5%)

= supports itself with 200 shares ~ 42000€

That's almost as bad as the Netflix dividend.

(and is not even net)

A question for the swarm knowledge: What exit strategies do you have? How do you secure your profits through a possible bursting of the AI bubble burst?

Maybe it's just me, but somehow I still don't have a real exit strategy to protect my profits in case the AI bubble threatens to burst. My portfolio has been doing quite well recently and with $IREN (+1,87%)

$CIFR (+12,64%)

$NVDA (+2,25%)

$700 (+0,78%)

$GOOGL (-0,12%)

$MSFT (+0,41%)

am quite well in the plus.

Thank you for your input!

Dear community! 🙏

The topic of AI is omnipresent.

Many are shouting loudly that it is now a bubble on the stock market and cannot withstand the high expectations in the short and medium term.

What is certain is that LLMs such as ChatGPT or Gemini have become an integral part of many people's lives.

Still far from "perfect", generative AI nevertheless exudes a surreal magic that we could not have imagined in our wildest dreams just five years ago.

Large companies, such as Accenture recently, are laying off staff on a massive scale as part of a major "AI restructuring".

It seems clear that AI will soon cause massive upheaval in business and society.

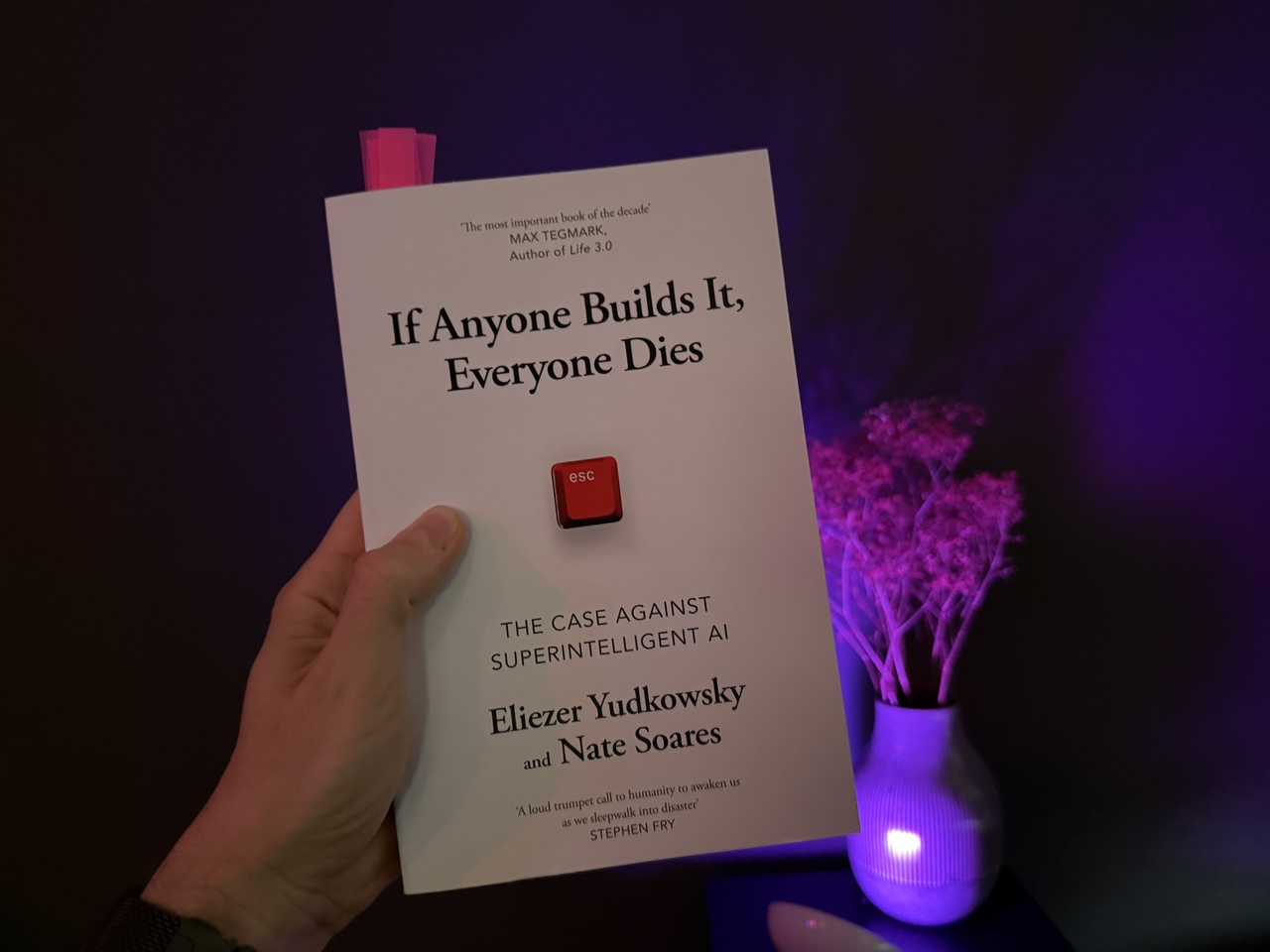

Last week, I received my pre-order of Eliezer Yudkowsky's new book on "superintelligent AI" and devoured it in two days.

Although this post is not directly about stock market investing, I think the topic is important enough to interest you.

Buckle up for a round of existential angst on Monday 😎✨

__________________________

❓What exactly is this about?

Yudkowsky, the author, is co-founder of the "Machine Intelligence Research Institute" in Berkeley and warned of the existential risks of advanced AI systems over 20 years ago.

The title "If Anyone Builds It, Everyone Dies" of his latest book initially sounds like a lurid exaggeration ...

Although I knew the basic thesis on the dangers of AGI (Artificial General Intelligence) in advance, I didn't think too much of it.

With billions and billions flowing into the sector, clever minds will surely think about security (AI alignment) ... right? 🤔

To anticipate the core message of the book:

Yudkowsky and co-author Nate Soares go so far as to say that if we continue to research the capabilities of artificial intelligence and train better and better models, it will undoubtedly lead to the certain demise of humanity.

__________________________

⬛Functionality of LLMs and black box reality:

We know surprisingly little about how LLMs work internally.

"Mechanistic Interpretability" is researching this, but a general, scalable understanding is lacking.

This is fundamentally due to the fact that LLMs are not "programmed", but "grow" analogous to biological evolution.

Here is a rudimentary explanation of how it works, but it is sufficient to illustrate the problem:

A transformer model consists of billions of parameters whose weights are initially set randomly.

During training, it is given tasks in the form of texts and attempts to predict the next word.

Based on the error between the prediction and the correct answer, gradient descent is used to calculate in which direction and to what extent each weight must be changed in order to improve the result.

This process is repeated over an unimaginable number of texts, with the weights constantly adapting.

In this way, the Transformer gradually "learns" language patterns, meaning and context until it can write coherently.

__________________________

😶🌫️Unsichtbare Preferences:

Systems that grow via gradient descent can learn goals that do not correspond to our intentions.

They optimize a training goal and learn internal heuristics or "values" in the process.

This learning dynamic gives rise to instrumental goals (securing resources, avoiding shutdown), which can collide with human goals.

This has already been empirically observed in AI models and supports the fear of hidden desires that only become visible outside of training.

The "alignment" is therefore, as things stand today, unsolvable.

__________________________

🚀Race Condition (States & Big Tech):

In my opinion, this is the most important driver for the known risks simply being ignored.

Who slows down first?

Capital and governments are pushing forward with compute, talent, power and chips.

The AI Index shows record investments, massive government programs and ever faster scaling on the frontier.

Here is a paraphrased passage from the book that illustrates the problem:

Several companies are climbing upward as if on a ladder in the dark.

Each rung brings enormous financial gains (10 billion, 50 billion, 250 billion USD, etc.). But no one knows where the ladder ends - and whoever reaches the top rung causes the ladder to explode and destroys everyone.

Nevertheless, no company wants to be left behind as long as the next rung is seemingly safe.

Some managers even believe that only they themselves can control the "explosion" and turn it into something positive - and therefore feel obliged to keep climbing.

The same dilemma also applies to states: No country wants to weaken its economy through strict AI regulation, while other countries continue their research unabated. Perhaps, so the thinking goes, the next step is even necessary to safeguard national security.

The problem could be solved more easily if science could determine exactly at what performance limit AI becomes truly dangerous. For example: "The fourth rung is deadly" or "Danger looms above 257,000 GPUs". But there is no such clear limit.

A potential, real "Tragedy of the Commons". 🤷♂️

In theory, LLMs could become arbitrarily "intelligent" as long as they have enough parameters, data and computing power.

This follows from the Church-Turing hypothesis: a sufficiently large neural network can approximate (with enough precision) any computable function, including an arbitrarily "intelligent" one.

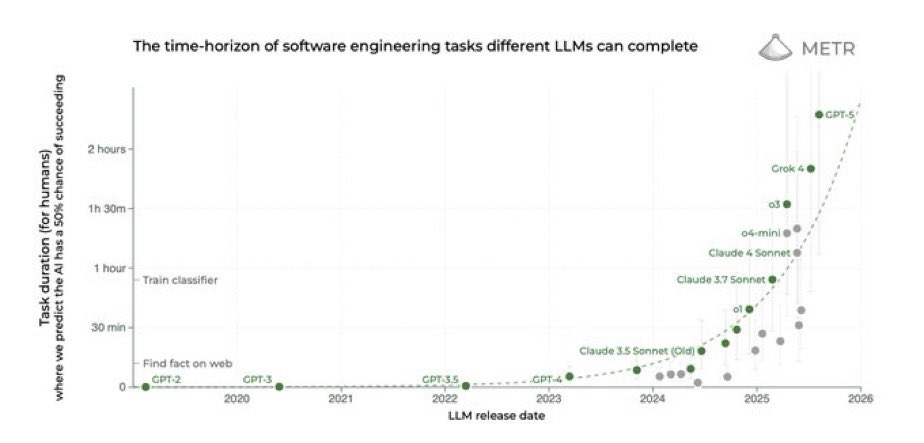

The development of capabilities that we are currently seeing seems to follow an exponential curve.

Nobody knows how much compute we really need to achieve AGI.

We may get to that point in five years, in ten, twenty or thirty years.

__________________________

🔮The most controversial part of the book. The forecast:

The book paints the extinction of humanity in less than 20 years as plausible if we don't stop AI development.

Whether you believe the figure or not, the timelines of many researchers have slipped significantly in recent years.

The AI Impacts Surveys (e.g. 2016, 2022, 2023) have surveyed AI researchers worldwide, especially those who publish at major conferences such as NeurIPS, ICML or AAAI.

The surveys show a clear trend towards shorter AGI timelines and significant p-doom values. (p-doom refers to the risk of humanity being wiped out by artificial intelligence).

⏱️AGI/HLMI timing (50% chance that AI will perform all tasks better and cheaper than humans - "high-level machine intelligence"):

The jump 2022 → 2023 was -13 years. 🫨

💣p(doom) - "extremely poor outcomes"

Not consensus, but far from zero.

We are talking here about the assessment that there is a probability of around 10% that humanity will be wiped out. 🤯

__________________________

Well, hasn't humanity already survived various asymmetric risks?

What about nuclear weapons, for example? 🤔

Nuclear weapons risks are iterative.

Humanity can narrowly escape several times (as in 1962, 1983, 1995).

AGI, on the other hand, is unique:

When a system with uncontrollable power emerges, there is no turning back and no second chance.

"You only get one shot at aligning superintelligence, and you can't debug it afterwards."

- Eliezer Yudkowsky

This means that the expected value is catastrophically high, even if the probability is "small" (~10% according to leading AI scientists).

Nuclear weapons can kill.

A superhuman AI can decide what exists in the future.

__________________________

Closing words 🔚

There is no question that AI will profoundly change our lives in a short space of time.

In many jobs, the economic value that a person contributes already depends on how well they use AI as a tool.

But how long will it be before almost all jobs are performed by AI without human sensitivity or empathy?

For me, the sentence "I want to be operated by a human" is above all a quality requirement and a question of trust.

AI is new and often not yet reliable enough.

But what if talking AI avatars can no longer be distinguished from humans?

Which company, which state will still be able to afford it? not gradually hand over more responsibility to AI?

Regardless of what you think of Yudkowsky's predictions:

He may sound more dramatic than others, but he hits a sore spot.

We have opened Pandora's box with AI and are relying surprisingly heavily on hope when it comes to AI alignment.

Yudkowsky is not alone in this; the shifts in the AI Impacts surveys show a clear trend.

And now the obligatory question for you:

How do you rate the existential threat posed by AI? 😳

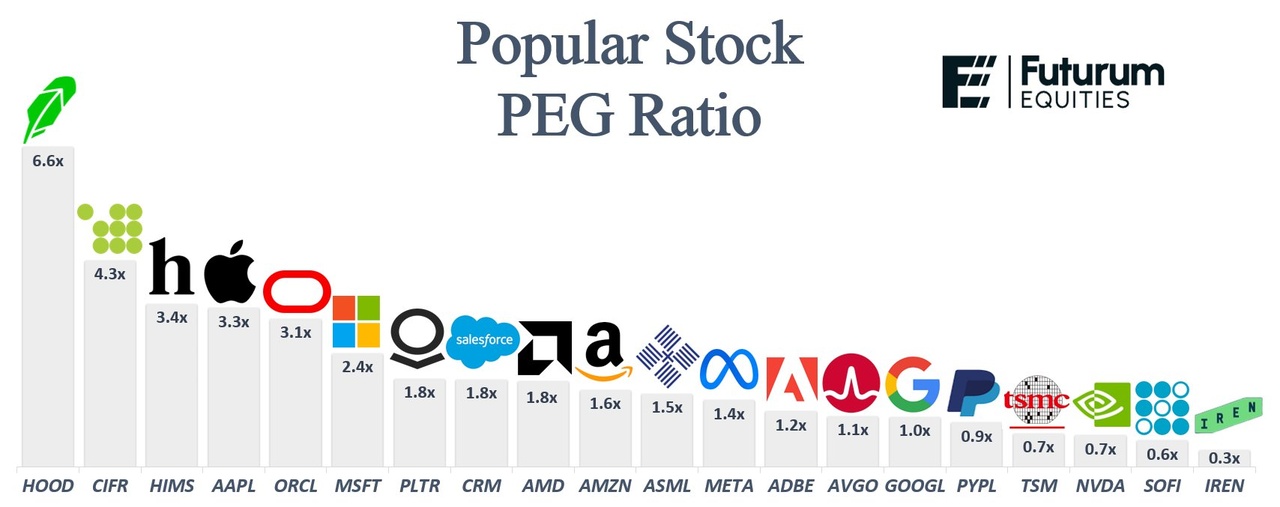

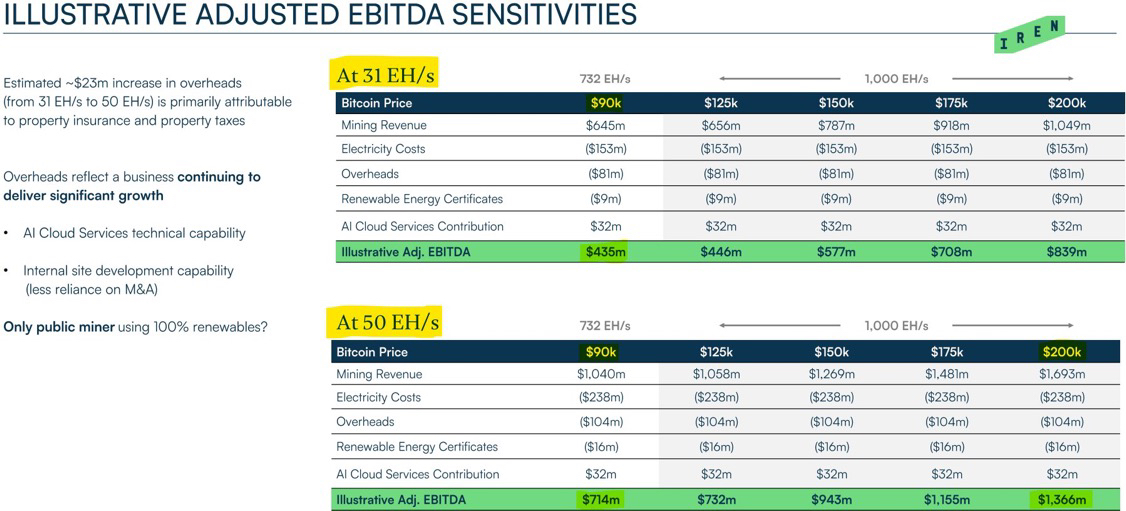

First of all, I have not checked these values exactly and do not know from which date they originate, but could mean even more upside for $IREN (+1,87%) especially if more hype comes in here.

PEG < 1 usually means mispriced growth

PEG > 2 is where you start hitting the danger zone

PEG ratios right now:

- $HOOD (+4,31%) ~6.6x

- $CIFR (+12,64%) ~4.3x

- $HIMS (+0,71%) ~3.4x

- $AAPL (+0,92%) ~3.3x

- $ORCL (+2,01%) ~3.1x

- $MSFT (+0,41%) ~2.4x

- $PLTR (+0,99%) ~1.8x

- $CRM (+0,62%) ~1.8x

- $AMD (+12,69%) ~1.8x

- $AMZN (+1,86%) ~1.6x

-$ASML (-0,66%) ~1.5x

- $META (+0,85%) ~1.4x

- $ADBE (+0,51%) ~1.2x

- $AVGO (+2,58%) ~1.1x

- $GOOGL (-0,12%) ~1.0x

- $PYPL (+2,59%) ~0.9x

- $TSM (+3,67%) ~0.7x

- $NVDA (+2,25%) ~0.7x

- $SOFI (-0,08%) ~0.6x

- $IREN (+1,87%) ~0.3x

https://x.com/stocksavvyshay/status/1974838017815957797?s=46&t=5M46IuHFFx0VtfxNNuG8NA

If we look at the current PEG ratio, this is a very bullish sign for $GOOGL (-0,12%)

$IREN (+1,87%)

$SOFI (-0,08%)

$PYPL (+2,59%)

$2330

PEG Ratio: P/E/expected earnings growth

if this value is <1 the company is undervalued according to Lynch!

I remain invested in both companies.

Google wants to merge Android and ChromeOS. The plan is to start in 2026 in order to broaden the ecosystem - including for AI.

The merger of Android and ChromeOS is set to take place next year: Google's Android boss Sameer Samat said this in the course of Qualcomm's Snapdragon Summit. Among other things, the company wanted to bring its own AI to all form factors.

According to Sameer Samat, Google is aiming to ensure that the devices in its own ecosystem work together seamlessly. "I think the opportunity for us is that we can accelerate all the AI advancements we're making on Android and bring it to the laptop form factor as quickly as possible. This will also allow a laptop and the rest of the Android ecosystem to work together seamlessly," he said on Wednesday.

According to Samat, the familiar ChromeOS user interface will be retained, but the technical foundation will be based on Android. "This combination is something we are very excited about for next year."

ChromeOS interface with Android underpinnings

The Android boss also explained that they are committed to the laptop form factor based on Chrome OS and that the platform has been a success for the company. The company also has Android tablets, which "have successfully evolved into increasingly productive devices". However, Google has currently paused its own development. It is conceivable that the company is currently pausing tablet development in order to provide future products with the Android ChromeOS version.

It is hardly surprising that Samat announced this news during Qualcomm's in-house exhibition. The first Android notebooks are likely to contain one of the new Snapdragon chips that Qualcomm announced there. It is unclear whether Google will use a smartphone SOC (system-on-a-chip) such as the Snapdragon 8 Elite Gen 5 or the new Snapdragon X2 Elite notebook chip for the first computers - or whether a different, more cost-effective model will be used.

As with Android smartphones and Chromebooks, Google is likely to work with various hardware manufacturers such as Acer, Samsung, HP and Lenovo to offer a range of Android notebooks in various designs, versions and price points. The new operating system could make its debut at Google's I/O developer trade fair, which usually takes place in May.

https://www.heise.de/news/Google-Notebooks-mit-Android-kommen-naechstes-Jahr-10675280.html

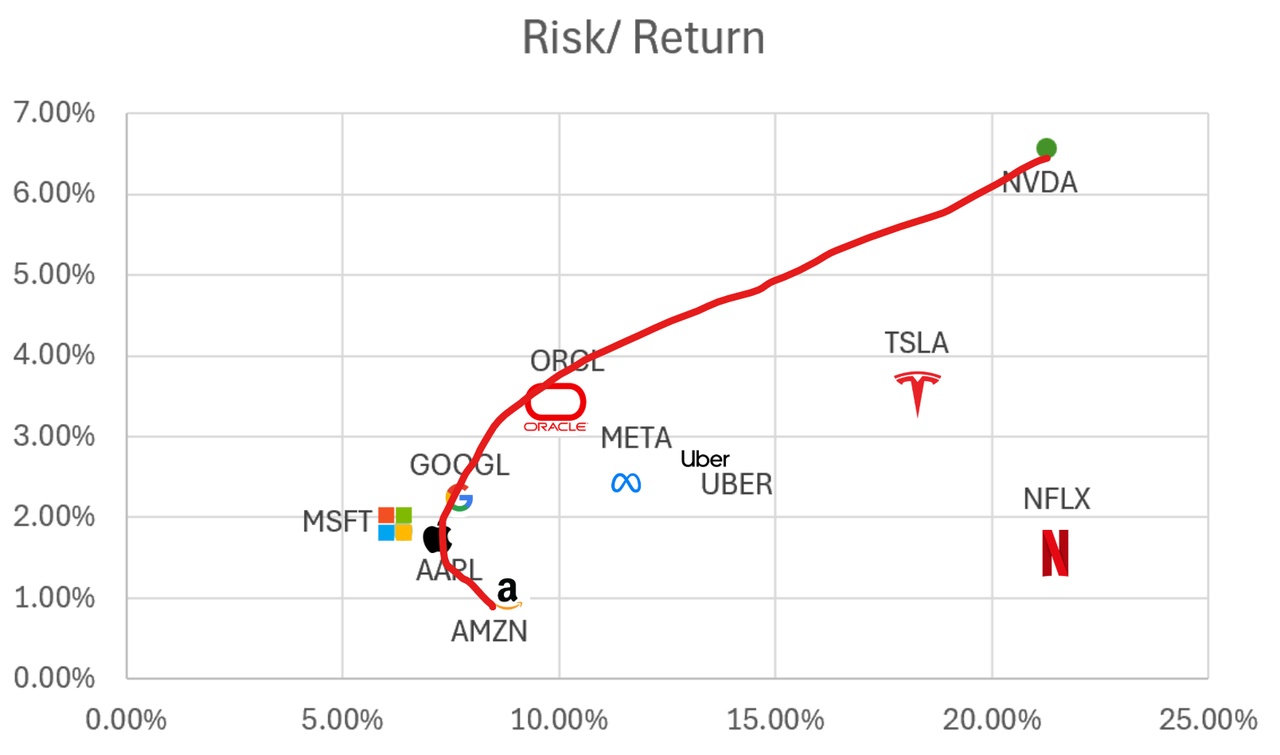

For fun, I took a textbook (risk/return) approach with an efficient frontier analysis. This would make you buy these stocks

$AMZN (+1,86%)

$AAPL (+0,92%)

$MSFT (+0,41%)

$GOOGL (-0,12%)

$ORCL (+2,01%) and $NVDA (+2,25%)

Do not buy the following shares:

$TSLA (+0,88%)

$NFLX (+1,99%)

$UBER (+1,68%) and with $META (+0,85%) you can argue!

I also think conservative approaches are good to strengthen his thesis - I have Amazon, Alphabet and Nvidia in my portfolio :)

$IREN (+1,87%) started earlier than its competitors. The potential is incredible in the truest sense of the word.

"We own the entire stack - land, electricity, substations, data centers and computers. We don't lease anything. This means lower costs, higher performance and long-term reliability. Currently, GPUs consume less than 2% of our total energy portfolio."

CEO & Founder Daniel Roberts

$IREN (+1,87%) Vertical DC integration

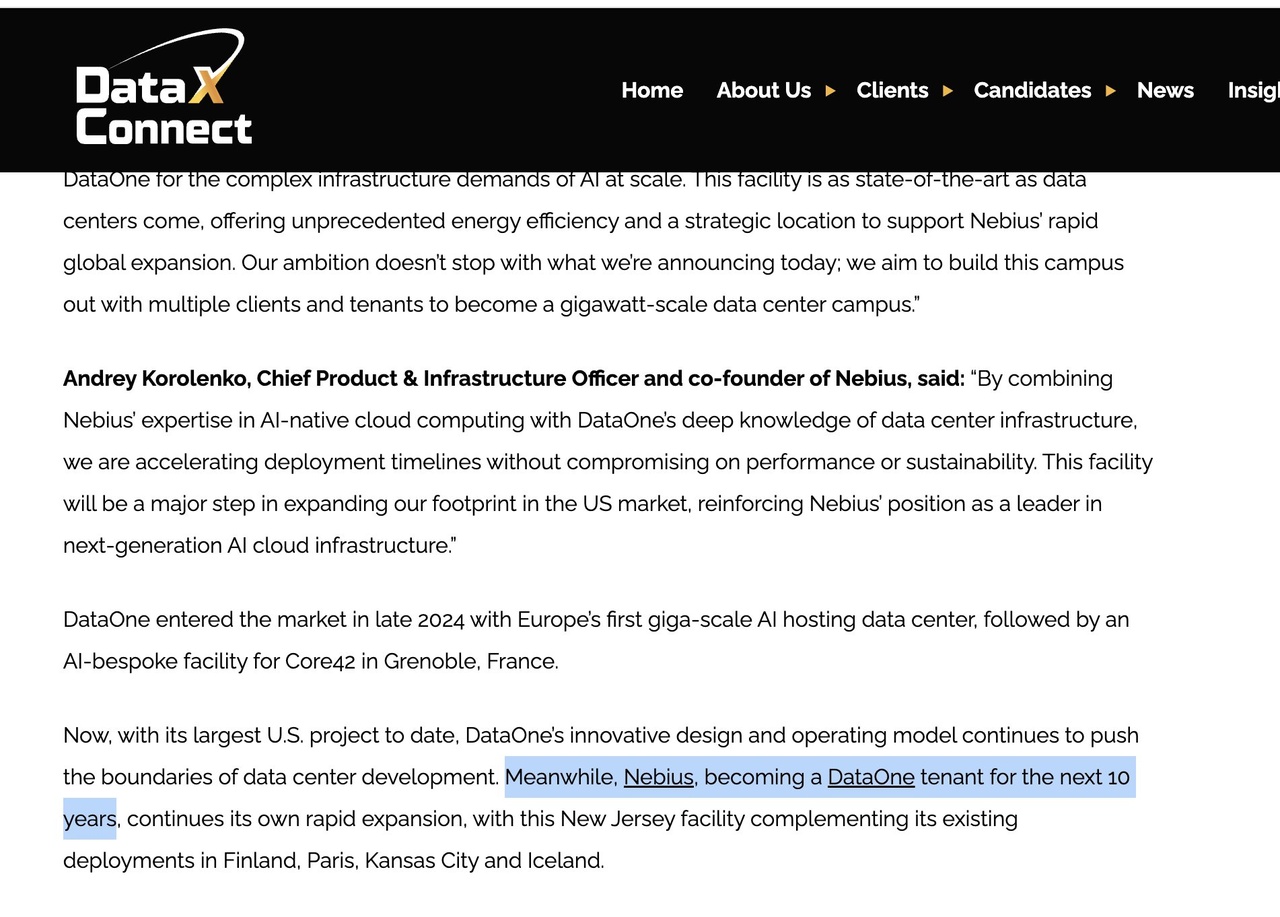

What does the vertical integration of data centers mean for $IREN (+1,87%) ? We take a look at this article from DataXConnect: " $NBIS (+2,94%) will be a DataOne tenant for the next 10 years" (1). $NBIS (+2,94%) provides the designs for the construction by DataOne. DataOne owns power, land, substations, transmission infrastructure, backup power generation and facility operations!

$NBIS (+2,94%) pays colocation to DataOne! The 3.7 billion that Google/Fluidstack $WULF (+1,93%) pays for 200 MW (2)? The 3 billion that Google/Fluidstack pays $CIFR (+12,64%) pays for 168 MW (3)?

$NBIS (+2,94%) DataOne is paying around 5.45 billion for their 300 MW. It is probably more, as DataOne has significantly more influence than $WULF (+1,93%) / $CIFR (+12,64%) as DataOne/BSO operates 240 data centers worldwide; for comparison: $EQIX (+1,81%) (75 billion mcap) has 270 data centers. In addition, DataOne has additional capital expenditures for gas turbines behind the meter and will likely pass at least some of the costs on to $NBIS (+2,94%) pass on. For $IREN (+1,87%) which has already paid most of these costs at lower prices, this is largely pure margin!

From the Neoclouds $ORCL (+2,01%) , $CRWV (+8,56%) , $NBIS (+2,94%) , $IREN (+1,87%) . Is $IREN (+1,87%) the only ones who own their own land, power, data centers and electrical infrastructure! $CRWV (+8,56%) was lucky and signed a contract with $CORZ (+2,73%) when $CORZ (+2,73%) was on the verge of bankruptcy. He also secured $ORCL (+2,01%) Crusoe's electricity when Crusoe failed at Bitcoin mining. $CRWV (+8,56%) at least recognizes the weakness and tries to $CORZ (+2,73%) to buy up.

$CIFR (+12,64%)

$CRWV (+8,56%)

$NBIS (+2,94%)

$GOOGL (-0,12%)

$GOOG (-0,28%)

$MSFT (+0,41%)

$META (+0,85%)

$ORCL (+2,01%)

$NVDA (+2,25%)

$WULF (+1,93%)

IREN Limited, formerly Iris Energy Limited, is an Australian-based company that owns and operates data centers powered by 100% renewable energy. Its facilities are optimized for Bitcoin mining, artificial intelligence (AI) cloud services and other power-intensive computing. The mining data centers are located in Canal Flats, Mackenzie, Prince George and Childress. Bitcoin Mining provides security for the Bitcoin network. Al Cloud Services provides cloud compute for Al customers, 1,896 NVIDIA H100 and H200 GPUs. The Canal Flats facility is located in the Canadian Rocky Mountains, 100 kilometers (km) from Cranbrook Regional Airport and 500 km east of Vancouver. Its facility is located in Prince George, the city in northern British Columbia, 500 km north of Vancouver. The facility is located in Childress County, Texas, more than 250 miles northwest of Dallas and in close proximity to several wind and solar power plants in the region. The company operates 200 MW of data centers in Childress.

I have put together a few interesting graphics here and I would be interested in your opinion of the company.

@stefan_21

@Testo-Investor Have you already dealt with the miners, what do you think of $IREN (+1,87%) ? I would be interested to know ✌️

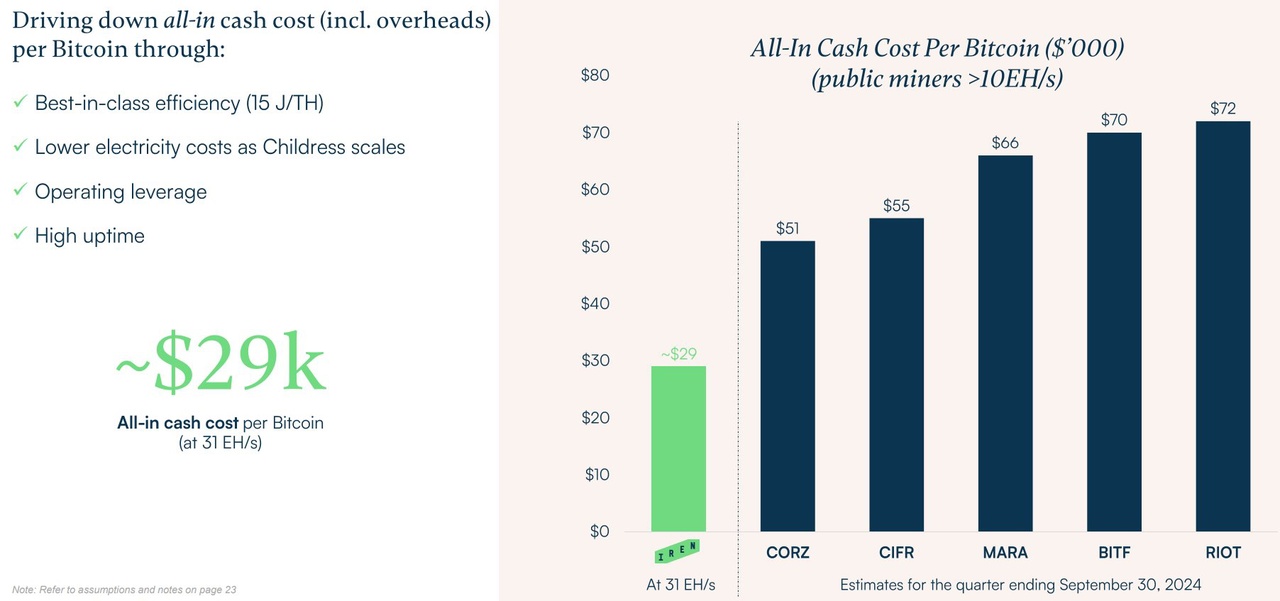

All- In Cash Cost per $BTC (-1,35%) :

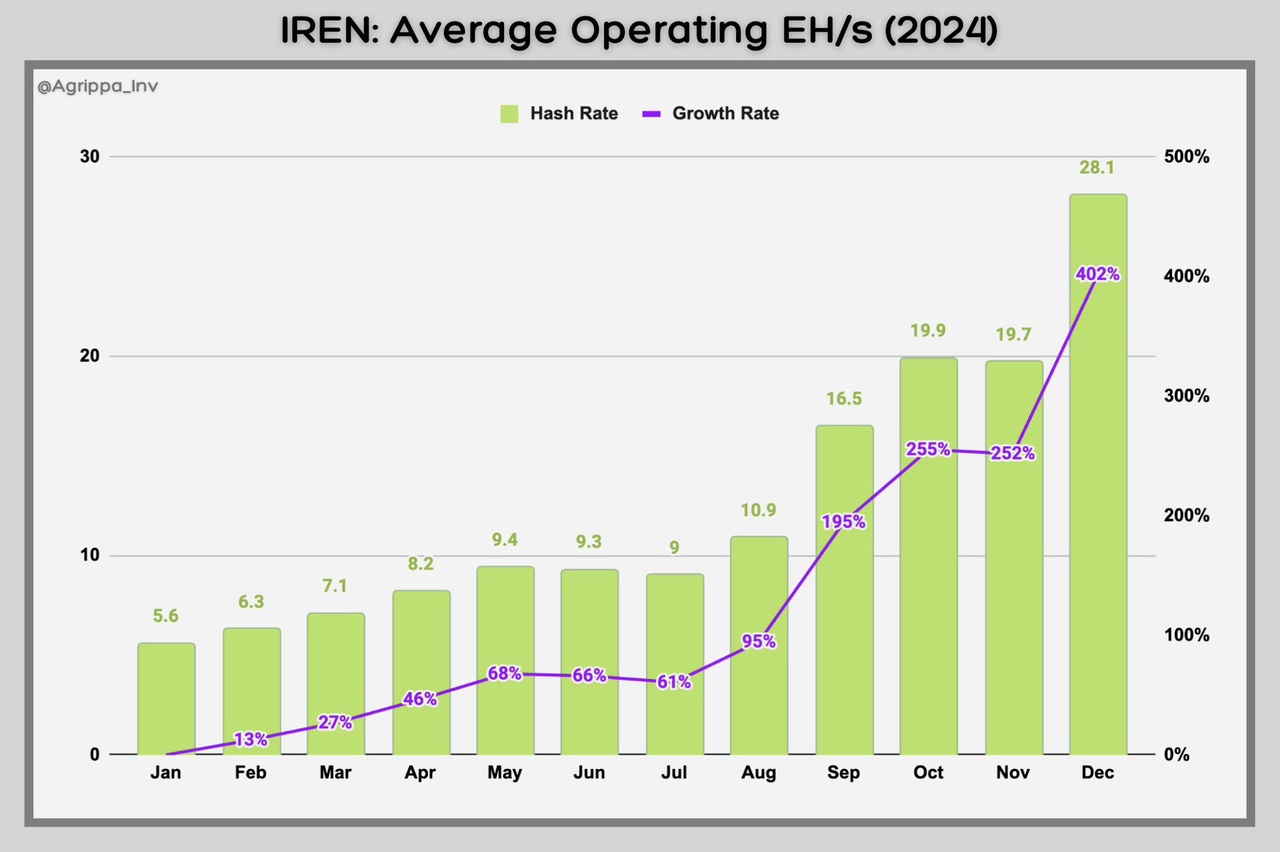

$IREN (+1,87%) Record-breaking growth in hash rate

In the year 2024 $IREN (+1,87%) set a new industry record for the fastest growth in operating hash rate (EH/s) in a single year among the $BTC (-1,35%) -miners, surpassing 400%.

$IREN (+1,87%) also held the previous single-year growth record of 350% in 2023.

Graphic: @Agrippa_Inv from 𝕏

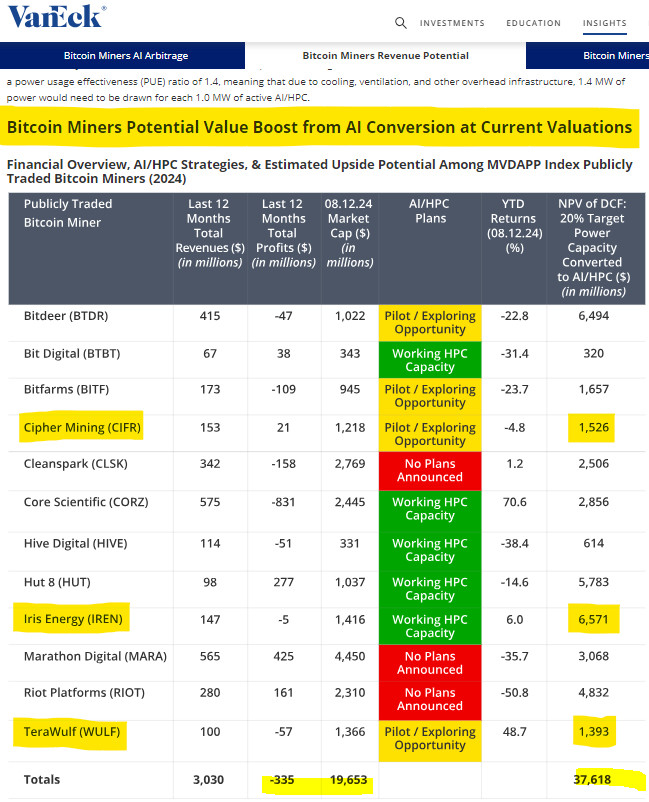

According to VanEck, switching from BTC mining to an AI data center of just 20% for $IREN would be worth a capitalization of $6,571,000,000.

Despite $BTC (-1,35%) halving , $IREN achieved an impressive annual production growth of 55% - the highest growth rate among all public $BTC miners in 2024.

Graphic: @Agrippa_Inv from 𝕏

$CORZ (+2,73%) , $MARA (+0,35%) , $RIOT (+2,55%) , $BITF (+15,82%) , $CIFR (+12,64%) , $CLSK (+5,68%) , $WULF (+1,93%) ,

+ 2

I migliori creatori della settimana