$ING (+0%) x1500 (no, not the ADR, but I can't get it marked properly right now)

... if they're already managing my securities account and collecting commission, they're welcome to give it back to me as a dividend. And lo and behold: I think I'll get more dividends next year than their commission 😉

$GOOGL (+0,79%) x100

... probably one of the div-growth stocks of the coming years. It's simply part of it. Previously it was also in my other portfolio. But since the transfer was too stupid for me there and the position was quite small, I'm just buying more.

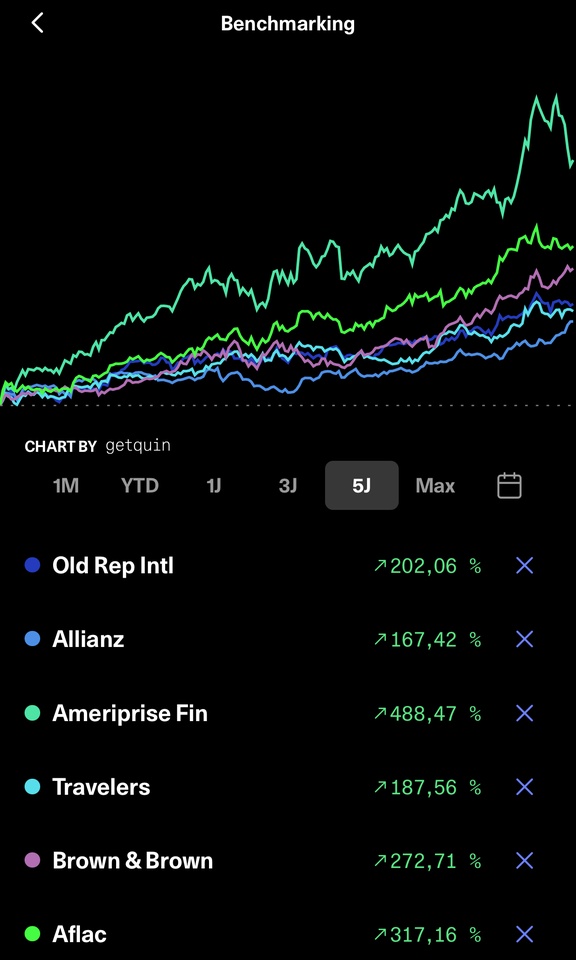

$AFL (+0,18%) x200

...insurance in the broad area of health/retirement/etc. with the current main market in JP and the USA. I don't think you need to say any more about retirement provision in the broader sense in an ageing society. Currently rather low payout ratio for insurance/finance, but offers potential for growth and a higher div yield in the future

$WM (+0,26%) x100

... waste and recycling. Strongly positioned in this area in the USA. I've been annoyed for ages that I didn't get involved. Now I'm just going to get started.

$V (+0,19%) x30

... is part of div growth. Slow build-up, as expensive. Previously also held in my old portfolio.

$LIN (+0,52%) x50

... In my opinion, the market for industrial gases is an oligopoly; Linde is well positioned. Solid growth should be expected.

Out $VST (+2,37%) x250.

... 500 remains. The share has grown unexpectedly well. Take profits

$NEE (-0,05%)

... I didn't buy, but have a small position. In my opinion, a company with future potential, but which could possibly experience some turbulence/uncertainty in the next 4 years (Trump). I am therefore not buying, but I have it on my list to increase my position, probably starting next year. But maybe my 🔮 is wrong 😄