$MMM (-0,18%)

$NFLX (-0,14%)

$JNJ (-0,09%)

$HAL (-0,31%)

$UAL (-0,83%)

$EQT (+0,56%)

$PG (+0,45%)

$ISRG (-0,12%)

$INTC (+0,97%)

$AA (+0,39%)

$COF (+0%)

$ERIC A (-0,05%)

Ericsson

Price

Discussione su ERIC A

Messaggi

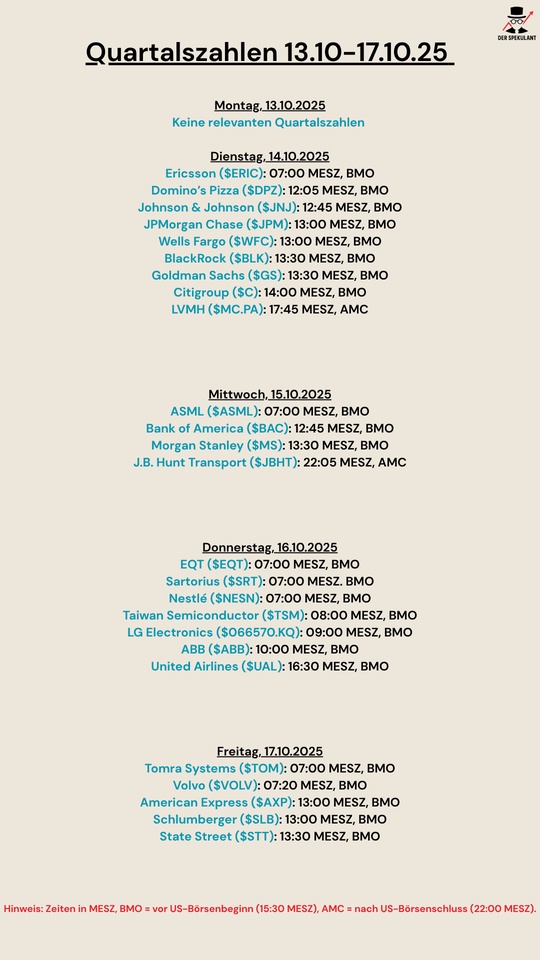

8Quartalsberichte 13.10-17.10.25

$ERIC A (-0,05%)

$DPZ (-0,07%)

$JNJ (-0,09%)

$JPM (+0,1%)

$WFC (-0,66%)

$BLK (-0,08%)

$GS (-0,13%)

$C (-0,15%)

$MC (-1,37%)

$ASML (+0,92%)

$BAC (-0,23%)

$MS (-0,07%)

$JBHT (-0,09%)

$EQT (+0,56%)

$SRT (-0,67%)

$NESNE

$TSM (+1,07%)

$ABBN (-0,63%)

$UAL (-0,83%)

$TOM (-0,54%)

$VOLV B (+1,01%)

$AXP (-0,03%)

$SLBG34

$STT (+0,01%)

24.01.2025

TEXAS INSTRUMENTS with 21 consecutive years of higher dividends + Thyssenkrupp now at the top of the MDax + Givaudan posts significantly higher sales and record profits + Ericsson's adjusted results worse than expected + Purchasing Managers' Index FR, DE, UK and US today

TEXAS INSTRUMENTS $TXN (-0,06%)with 21 consecutive years of higher dividends

- Texas Instruments generated sales of USD 4.01 billion in the fourth quarter of 2024, exceeding market expectations of USD 3.87 billion.

- However, sales fell by 2% compared to the previous year. Earnings per share of USD 1.30 were also above the consensus estimate of USD 1.20, but were 13% lower than in the previous year.

- Operating profit amounted to USD 1.38 billion, down 10% on the same period last year.

- What's next for the chip giant with a long history?

- https://stock3.com/news/texas-instruments-21-jahre-in-folge-mehr-dividende-16075310

Thyssenkrupp $TKA (-1,77%)now at the top of the MDax

- Thyssenkrupp shares significantly extended their gains on Thursday afternoon.

- They rose to their highest level since June 2024 and recently gained 7.2 percent as the best MDax stock.

- Market observers pointed to plans by Turkish steel manufacturer Tosyali, which had caused some movement.

- The company is looking for a steel producer in Europe to expand its green steel business.

Givaudan $GIVN (-1,18%)achieves significantly higher sales and record profit

- The flavor and fragrance manufacturer Givaudan achieved significantly higher sales in 2024 thanks to higher sales volumes. Growth at the Symrise competitor was particularly strong in the emerging markets.

- Profit exceeded one billion Swiss francs for the first time.

- Sales increased by 7.2 percent to 7.41 billion Swiss francs, as the supplier of flavors and fragrances for food, perfumes, household and personal care products announced on Friday.

- Negative currency effects dampened growth somewhat.

- In organic terms, i.e. adjusted for acquisitions and disposals as well as currency effects, Givaudan grew by as much as 12.3 percent.

- The Geneva-based group benefited from higher sales in all regions and segments.

- https://de.marketscreener.com/kurs/aktie/GIVAUDAN-SA-2956033/news/Givaudan-setzt-deutlich-mehr-um-und-erzielt-Rekordgewinn-48857955/

Ericsson's $ERIC A (-0,05%)adjusted results worse than expected

- Telecommunications equipment supplier Ericsson reports sales in line with expectations for the fourth quarter.

- The Executive Board is proposing an increased ordinary dividend.

- Adjusted earnings were significantly lower than expected.

- Sales increased by 1.4 percent to SEK 72.9 billion (71.9), above the Factset analysts' consensus of 72.9.

- Organic sales growth amounted to 2 percent (-17). The adjusted gross margin was 46.3 percent (41.1).

- The expectation was 45.4 percent. Ebita profit amounted to SEK 8.6 billion (6.7), with an Ebita margin of 11.8 percent (9.3).

- Adjusted EBITA amounted to SEK 10.2 billion (8.2), compared with an expected figure of 10.8, with an adjusted EBITA margin of 14.0 percent (11.4).

- Operating profit amounted to SEK 8 billion (5.8), with an operating margin of 11.0 percent (8.1).

- Adjusted operating profit amounted to SEK 9.6 billion (7.4), compared with an expected SEK 10.5 billion, with an adjusted operating margin of 13.2 percent (10.3).

- Profit after tax amounted to SEK 4.9 billion (3.4).

- Earnings per share amounted to SEK 1.44 (1.02).

- The proposed ordinary dividend amounts to SEK 2.85 per share (2.70).

- 2.82 was expected.

Friday: Stock market dates, economic data, quarterly figures

- ex-dividend of individual stocks

- Pfizer USD 0.43

- Quarterly figures / company dates USA / Asia

- 13:00 American Express | Verizon Quarterly figures

- Quarterly figures / company dates Europe

- 07:00 Givaudan annual results | Ericsson quarterly figures

- 10:00 Vonovia ao AGM on the domination and profit and loss transfer agreement with Deutsche Wohnen

- Economic data

09:15 FR: Purchasing Managers' Index/PMI non-manufacturing (1st release) January Forecast: 49.5 Previous: 49.3 Total Purchasing Managers' Index (1st release) Forecast: 47.7 Previous: 47.5

09:15 FR: Purchasing Managers' Index/PMI Manufacturing (1st release) January FORECAST: 42.2 PREVIOUS: 41.9

09:30 DE: Purchasing Managers' Index/PMI non-manufacturing (1st release) January PROGNOSE: 51.0 PREVIOUS: 51.2 Total Purchasing Managers' Index (1st release) PROGNOSE: 48.3 PREVIOUS: 48.0

09:30 DE: Purchasing Managers' Index/PMI Manufacturing (1st release) January FORECAST: 42.5 PREVIOUS: 42.5

10:00 EU: Purchasing Managers' Index/PMI non-manufacturing Eurozone (1st release) January FORECAST: 51.5 PREVIOUS: 51.6

10:00 EU: Purchasing Managers' Index/PMI Manufacturing Eurozone (1st release) January PROGNOSE: 45.4 PREV: 45.1 Total Purchasing Managers' Index (1st release) PROGNOSE: 49.8 PREV: 49.6

10:30 UK: Purchasing Managers' Index/PMI non-manufacturing (1st release) January FORECAST: 50.9 PREVIOUS: 51.1

10:30 UK: Purchasing Managers' Index/PMI Manufacturing (1st release) January FORECAST: 47.0 PREVIOUS: 47.0

15:45 US: Purchasing Managers' Index/PMI Services (1st release) January FORECAST: 56.5 PREVIOUS: 56.8

15:45 US: Purchasing Managers' Index/PMI Manufacturing (1st release) January FORECAST: 49.7 PREVIOUS: 49.4

16:00 US: Consumer Sentiment Index Uni Michigan (2nd survey) January FORECAST: 73.2 PREVIOUS: 74.0

16:00 US: NAR, Existing Home Sales December FORECAST: +1.2% yoy previous: +4.8% yoy

The market overview for 🇺🇸 & 🇪🇺:

US MARKET🇺🇸

Monday

- PACS Group ($PACS) and UL Solutions ($ULS) have potential IPOs.

- Neel KashkariPresident of the Minneapolis Fed, delivers remarks.

Tuesday

- Release of the NFIB Small Business Optimism Index (March).

- Quarterly reports from WD-40 ($WDFC (+0,48%) ) and Tilray Brands ($TLRY (-0,47%) ).

Wednesday

- Publication of the consumer price index (March).

- Publication of the wholesale stocks (March).

- Publication of the minutes of the March meeting of the Federal Open Market Committee (FOMC).

- Publication of the monthly federal budget of the USA (March).

- Speeches by Austan GoolsbeePresident of the Chicago Fed.

- Quarterly reports from Delta Air Lines ($DAL (-0,07%) ) and Applied Digital ($APLD (+2%) ).

Thursday

- Publication of the initial applications for unemployment benefits (April 5).

- Publication of the producer price index (March).

- Speeches by John C. WilliamsPresident of the New York Fed, and Raphael BosticPresident of the Atlanta Fed.

- Quarterly reports from Constellation Brands ($STZ (-0,39%) ), Fastenal ($FAST (-0,29%) ) and CarMax ($KMX (-0,51%) ).

Friday

- Publication of the preliminary Michigan Consumer Sentiment Index (April).

- Speeches by Raphael Bostic, President of the Atlanta Fed, and Mary C. DalyPresident of the San Francisco Fed.

- Quarterly reports from JPMorgan Chase ($JPM (+0,1%) ), Wells Fargo ($WFC (-0,66%) ), BlackRock ($BLK ), Citigroup ($C (-0,15%) ), State Street ($STT (+0,01%) ) and Progressive ($PGR (-0,19%) ).

EUROPEAN MARKET🇪🇺

Monday

- Publication of Industrial Production Index🇪🇺

Tuesday

- ZEW Economic Sentiment🇩🇪 will be published

- Quarterly reports from Ericsson ($ERIC A (-0,05%) )🇸🇪, Beiersdorf AG ($BEI (-1,05%) )🇩🇪, Sika ($SIKA (-2,22%) )🇨🇭, Rio Tinto PLC ($RIO (+1,3%) )🇬🇧

Wednesday

- Release of CPI data🇪🇺

- Quarterly reports from Hays ($HAS (-1,3%) )🇬🇧, Petershill Partners ($PHLL )🇬🇧, Just Eat Takeaway ($TKWY )🇬🇧, Entain ($ENT (+1,01%) )🇬🇧, La Francaise ($FDJ (-0,81%) )🇫🇷, Legal & General ($LGEN (-0,99%) ), Tryg ($TRYG (-0,44%) )🇩🇰, BHP Group Ltd ($BHP (+1,21%) )🇬🇧, ASML Holding ($ASML (+0,92%) )🇳🇱Volvo B ($VOLV B (+1,01%) )🇸🇪, Severstal ($CHMF )🇷🇺

thursday

- Publication of Construction Output🇪🇺

- Quarterly reports from Danone ($BN (+2,72%) )🇫🇷, Nokia Oyj ($NOKIA (-1,47%) )🇫🇮, Tele2 AB ($TEL2 B (+1,22%) )🇸🇪

Nvidia ($NVDA (+0,63%) ) is planning to set up a new unitunit that will focus on developing customized chips for cloud computing companies and others, including "advanced AI processors".

The company is in talks with major cloud computing companies as well as with Ericsson ($ERIC A (-0,05%) ) to design "customized chips" for "wireless infrastructures". Nvidia's new unit is expected to find use in the automotive, video games and telecommunications find.

As every Sunday, the most important dates of the coming week and the news of the last week:

https://youtube.com/shorts/pfzYa1llP08?feature=share

Monday:

Signs of #deflation in China 🇨🇳mehren. In June, there was 0% inflation. Deflation is as damaging to the economy as inflation that is too high. With deflation, consumption is stifled. Since it pays more not to spend money and just leave it lying around, people spend less money on consumption. As a result, domestic demand falls and the economy grows more slowly.

Already on Friday, the major bank $UBSG (-2,03%) (UBS) from Switzerland left its assessment for $BOSS (-3,94%) (Hugo Boss) unchanged at "Buy" after a roadshow in which CFO Yves Müller participated, among others. The price target was set at 87 euros. According to analyst Susy Tibaldi, who commented in an available report on Friday, relaxed tones were struck during the roadshow. There were no signs of a slowdown in broad-based sales growth. Then on Saturday, Societe General still raised the price target from EUR 75 to EUR 78. The rating is still left at 'Hold'. Finally, this morning JPMorgan raised the price target from EUR 76 to EUR 82. The rating remains at 'Overweight'.

https://goldesel.de/Artikel/mehrere-aufstufungen-bei-dieser-aktie

Tuesday:

Harmonized #consumer prices (comparable across the EU) increase to 6.8% year-on-year in Germany. Main reason are the effects of the EUR 9 ticket and the fuel price discount, which were introduced in June 2022.

dpa-AFX ProFeed

Corporate profits in Germany have increased at an above-average rate in recent years. While unit profits have increased by 24% since 2019, unit labor costs have increased by only 13%. The #OECD stresses the high difference between unit labor costs and unit profits allows further wage increases to spread the cost of inflation more evenly.

Wednesday:

The share of $YOU (About You) gains significantly. The reason is that About You surprisingly quickly reached profitability.

dpa-AFX ProFeed

$$F3C (+0,42%) (SFC Energy) has received a follow-up order from the Netherlands. The company will supply EFOY Pro fuel cells worth approximately EUR 2.5 million to BauWatch, a leading service provider for temporary monitoring applications in Central Europe. Approximately €2 million of the order value will be recognized in sales in the current fiscal year, while the remaining amount will be recognized in 2024. The fuel cells supplied by SFC Energy will be deployed by BauWatch in camera towers mainly used for monitoring construction sites. The camera systems enable real-time tracking of construction progress remotely while increasing protection against criminal activity. BauWatch's security applications are also used in wind farms, solar farms and infrastructure projects. Each camera tower is equipped with batteries and solar panels for power supply. As an intelligent power generator, the EFOY Pro fuel cell monitors the battery's state of charge and automatically switches on to continuously recharge the battery if the voltage drops due to weather-related influences. The fuel cell then switches back to standby mode.

https://goldesel.de/Artikel/sfc-energy-mit-folgeauftraegen

Markets rise noticeably after inflation data from the USA turns out lower than expected. The inflation rate falls to 3.0% (forecast: 3.1%). Core rate also falls to 4.8% (forecast: 5.0%)

dpa-AFX ProFeed

Thursday:

After Lanxess, Evonik and Clariant, must also. $BAS (-0,5%) (BASF) lower its forecast. The main reason is that the recovery in China fails to materialize for the time being and Germany has already slipped into a technical recession. However, this has probably already been priced in, and the share is hardly losing any ground.

The chemical sector is considered a leading indicator for economic development. There have been forecast adjustments, but BASF is expected to remain profitable this year.

No special statements in the minutes of the #ECB meeting. The assumption is that the current interest rate level may not yet be sufficient to curb inflation.

https://www.xtb.com/de/Marktanalysen/Trading-News/eur-steigt-nach-aggressivem-ezb-protokoll

Friday:

Telecom equipment maker $ERIC A (-0,05%) (Ericsson) continues to struggle with a weak phase in its network business. In addition, the tightened austerity measures are weighing heavily on results. In the second quarter, the Swedish company posted a net loss of around 600 million Swedish kronor (52 million euros), it announced in Stockholm on Friday. That compares with a profit of just under 4.7 billion kronor a year earlier. Analysts, however, had expected an even worse result. Group CEO Börje Ekholm does not expect an improvement until the end of the year. Ericsson is suffering mainly from the reluctance of large mobile network operators to invest early in new technologies related to the 5G mobile standard and are now reducing their inventories. In the last quarter, sales in the network division fell by 13 percent, excluding acquisitions, disposals and currency effects. Performance was particularly weak in the United States. Successful business in India, where Ericsson has now become the market leader, could not compensate for this. Total Group revenue increased slightly by 3 percent to 64.4 billion kronor due to an acquisition.

https://goldesel.de/Artikel/ericsson-mit-schlechten-zahlen

Good figures from US banks 🇺🇸, JP Morgan earns 67% more than in the same quarter last year. Wells Fargo also increased its net income by more than 60%. Only Citigroup saw a decline of 31%, the reason being a weak trading business.

Key dates for the coming week:

Monday: 4:00 GDP figures (China)

Tuesday: 14:30 Retail Sales (USA)

Wednesday: 11:00 Inflation data (EU)

Thursday: 3:15 Interest rate decision (China)

Friday: 1:30 Inflation data (Japan)

Happy start of the week dear 𝐆𝐞𝐭𝐪𝐮𝐢𝐧 𝐂𝐨𝐦𝐦𝐮𝐧𝐢𝐭𝐲. I'm still on vacation, but look forward to bringing you content again soon, which Sören is currently taking over. Last week, the renowned IAM magazine (leader in technology/licensing and patents) published a tech-report about 𝐒𝐦𝐚𝐫𝐭 𝐄𝐧𝐞𝐫𝐠𝐲 written by me, which already made it to the Most Reads list. Here is a small excerpt for you - 𝐋𝐢𝐧𝐤 𝐮𝐧𝐭𝐞𝐫𝐦 𝐓𝐞𝐱𝐭. The article is written in English - here is a short translation.

The demand for electricity and for energy in general has increased rapidly in the last century, and so has the price. Therefore, efficient use of electricity is essential. One solution to meet the rising demand is smart energy technologies, i.e., so-called "smart technologies" that improve efficiency in the areas of energy conversion, generation, storage, transmission and consumption. Innovations in this area typically focus on sustainable and renewable energy sources while reducing costs.

[...]

The success and adoption of smart energy depends on the technology leaders listed in the report developing devices, chips, networks, applications, services, sensors, and connectivity standards to realize the initial use cases of smart energy. As electricity supply and consumption become more expensive, advances in smart energy must be made. These achievements can not only reduce costs, but also lead to a reduction in CO2 emissions and make an important contribution to combating climate change.

𝐋𝐢𝐧𝐤 𝐳𝐮𝐦 𝐀𝐫𝐭𝐢𝐤𝐞𝐥:

Best regards from France,

your Magnus from @rainbow_stocks

𝐄𝐮𝐫𝐨𝐩𝐚 𝐭𝐞𝐜𝐡𝐧𝐨𝐥𝐨𝐠𝐢𝐬𝐜𝐡 𝐚𝐛𝐠𝐞𝐡ä𝐧𝐠𝐭? 🐢🐢🐢 𝐖𝐚𝐬 𝐦ü𝐬𝐬𝐞𝐧 𝐰𝐢𝐫 ä𝐧𝐝𝐞𝐫𝐧 - 𝐡𝐚𝐮𝐭 𝐞𝐬 𝐢𝐧 𝐝𝐢𝐞 𝐊𝐨𝐦𝐦𝐞𝐧𝐭𝐚𝐫𝐞! Due to work, I had calls with customers in Japan, Korea, China and the US again this week. Somehow I can't get over how little is happening in Europe and Germany at the moment. Everything seems much too slow and sluggish and the bureaucracy does not provide the framework, but much too rigid specifications. The Handelsblatt headlined correctly: "If Germany and Europe do not want to become technologically dependent, we must now significantly intensify our efforts with regard to these standardization processes," demands Fraunhofer President Reimund Neugebauer. Germany has not been in an optimal position in this area for some time. Politicians have underestimated the importance so far, and companies have also acted too hesitantly."

It remains to be seen whether Germany will awaken from its digital torpor and be able to generate momentum with new initiatives, or whether we will soon just be buying in technologies instead of developing them.

Best regards, Magnus from Rainbow Stocks

Titoli di tendenza

I migliori creatori della settimana