🚜 Deere: From king of the field to prince of construction?

Company presentation and historical development

$DE (+0,85%) John Deere, better known under the John Deere brand, is a leading global manufacturer of agricultural machinery and construction equipment. With an impressive history dating back to 1837, the company was founded by John Deere in Grand Detour, Illinois. Originally revolutionizing agriculture with the development of an innovative, self-cleaning steel plow, Deere laid the foundation for John Deere's rise to a global corporation whose green and yellow machines and iconic leaping deer logo can now be found in fields and construction sites around the world.

Business model and core competencies

Deere operates in three clearly defined business areas:

1. Production & Precision Agriculture: this division focuses on tractors, combine harvesters and loaders developed specifically for medium and large-scale agricultural operations.

2. Small Agriculture & Turf: Here, Deere offers machines and solutions for smaller farms, livestock farming and the maintenance of green spaces.

3. construction & forestry: In this segment, the company manufactures machines for construction and forestry that are used on construction sites as well as in the forestry sector worldwide.

Deere's core competencies lie in the continuous development of high-performance, technologically advanced agricultural machinery. The company invests heavily in research and development, particularly in the areas of precision agriculture and automation. This innovative strength secures Deere a leading position in global agricultural technology and makes it possible to sustainably increase efficiency and productivity in agriculture.

Future prospects and strategic initiatives

Looking to the future, Deere is increasingly focusing on digitalization and automation to meet the growing demands of modern agriculture. The company is developing autonomous tractors and implementing artificial intelligence (AI) to optimize work processes in the fields and maximize crop yields. There is a particular focus on precision agriculture, in which machines and software solutions work closely together to make the use of resources such as water, fertilizers and seeds more efficient.

Deere is also driving forward the development of sustainable solutions, including electrically powered machines for smaller farms and the use of biofuels for larger agricultural machinery. Another important strategic initiative is the expansion of software-based services with the aim of increasing the share of recurring revenue. These services provide farmers with data-driven insights and enable them to manage their fields more efficiently.

Market position and competition

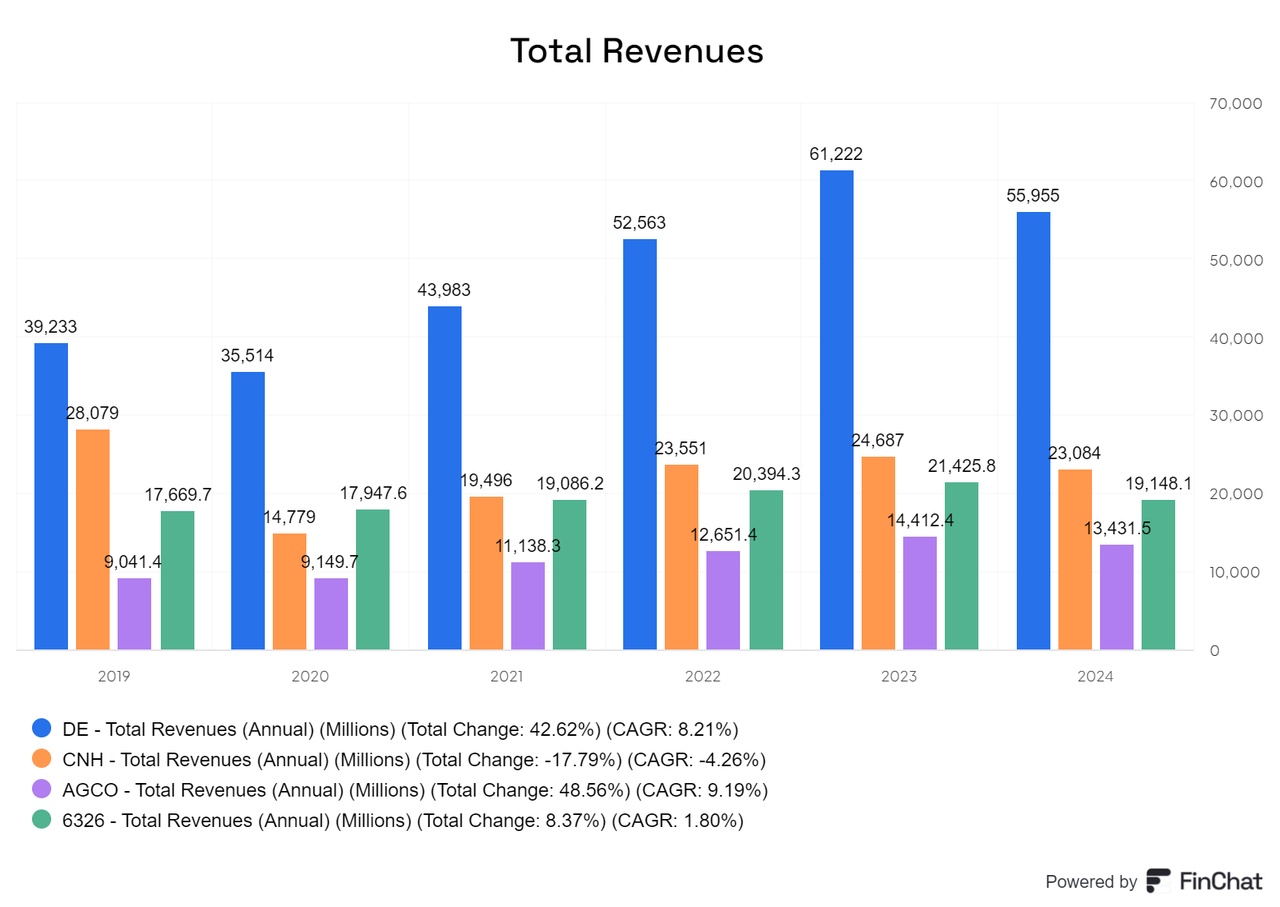

Deere is the undisputed market leader in the agricultural machinery industry and holds a market share of 50-60% in North America. This considerable lead over competitors such as $CNHI (-0,1%) , $AGCO (+1,43%) and $6326 (+1,18%) underscores Deere's dominance in the global market. Not only the company's sales, but also its market capitalization clearly exceeds that of its competitors.

Deere's strong market position is supported by several factors:

- A history of almost 200 years, which consolidates the company as an established premium brand in the agricultural sector.

- Economies of scale in the areas of purchasing, production, marketing and research, which enable Deere to reduce costs and invest in innovation at the same time.

- Targeted expansion into adjacent markets, such as forestry machinery and road construction technology, which open up additional growth opportunities.

Share performance

Deere's share performance has been good in recent years Over the past five years, the company has achieved a total return of 169%. Despite the cyclical nature of its business, which is affected by fluctuations in agricultural markets, Deere remains an attractive investment option for long-term investors due to its innovative strength and robust fundamentals.

Development

Deere is by far the largest manufacturer of agricultural machinery and related equipment in terms of sales. Even if sales are expected to decline in 2024, the company's long-term development remains one of the strongest in the market

When looking at Deere's sales distribution, it quickly becomes clear that the company is much more than just an agricultural company. In addition to the agricultural sector, Deere is also active in the construction and forestry sectors, with the construction and forestry sectors in particular experiencing strong growth recently. Nevertheless, the majority of turnover still comes from agriculture.

In terms of growth, Deere is one of the frontrunners and continues to present impressive figures. If the Japanese companies are not taken into account when the yen is taken into account, Deere even takes first place, despite the considerable size of the company.

In terms of gross profit margin, Deere is in the top class and has been able to increase it continuously. However, this is not happening at too great a distance from Kabuto.

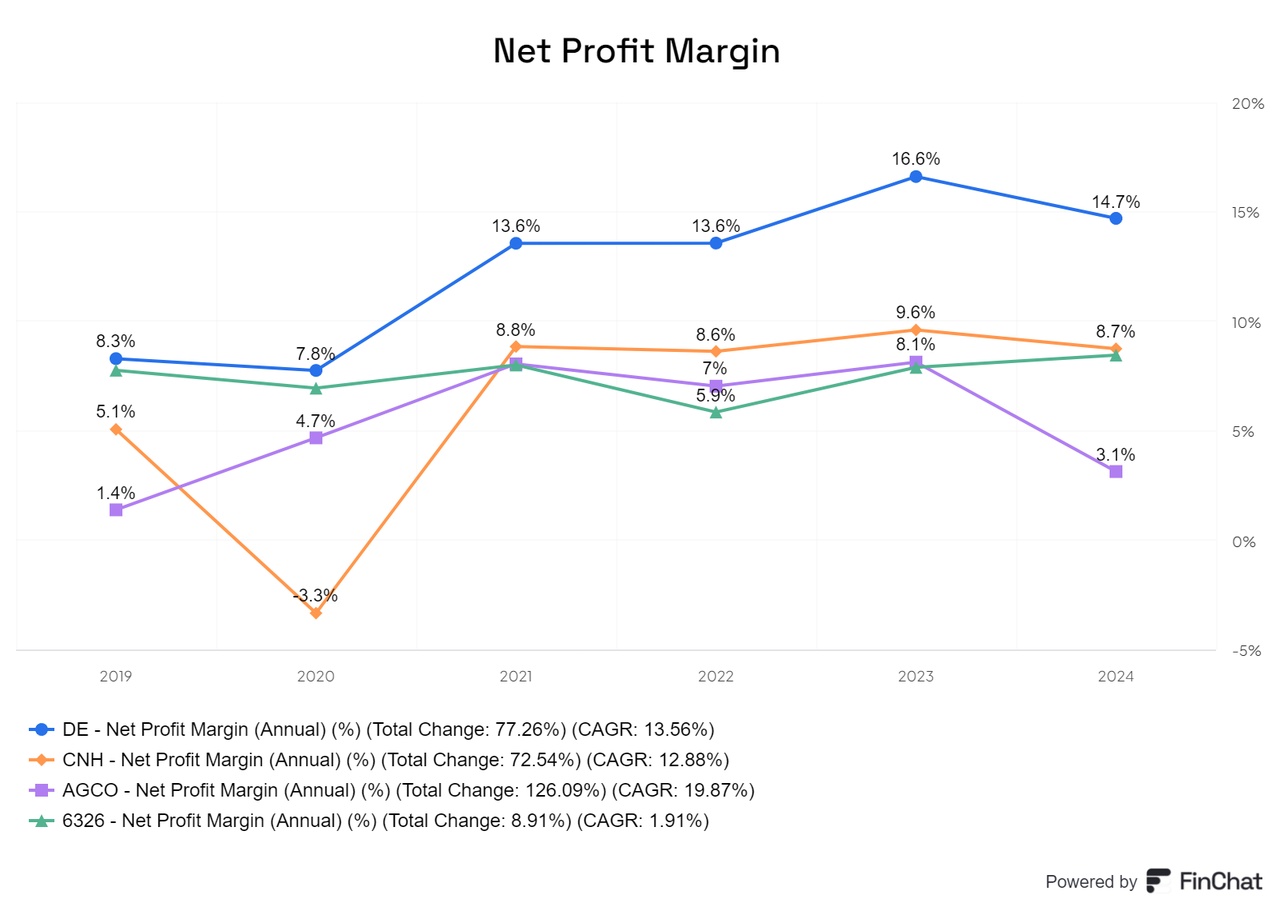

In terms of net profit margin, Deere is twice as strong as the competition and has also significantly improved this key figure in recent years.

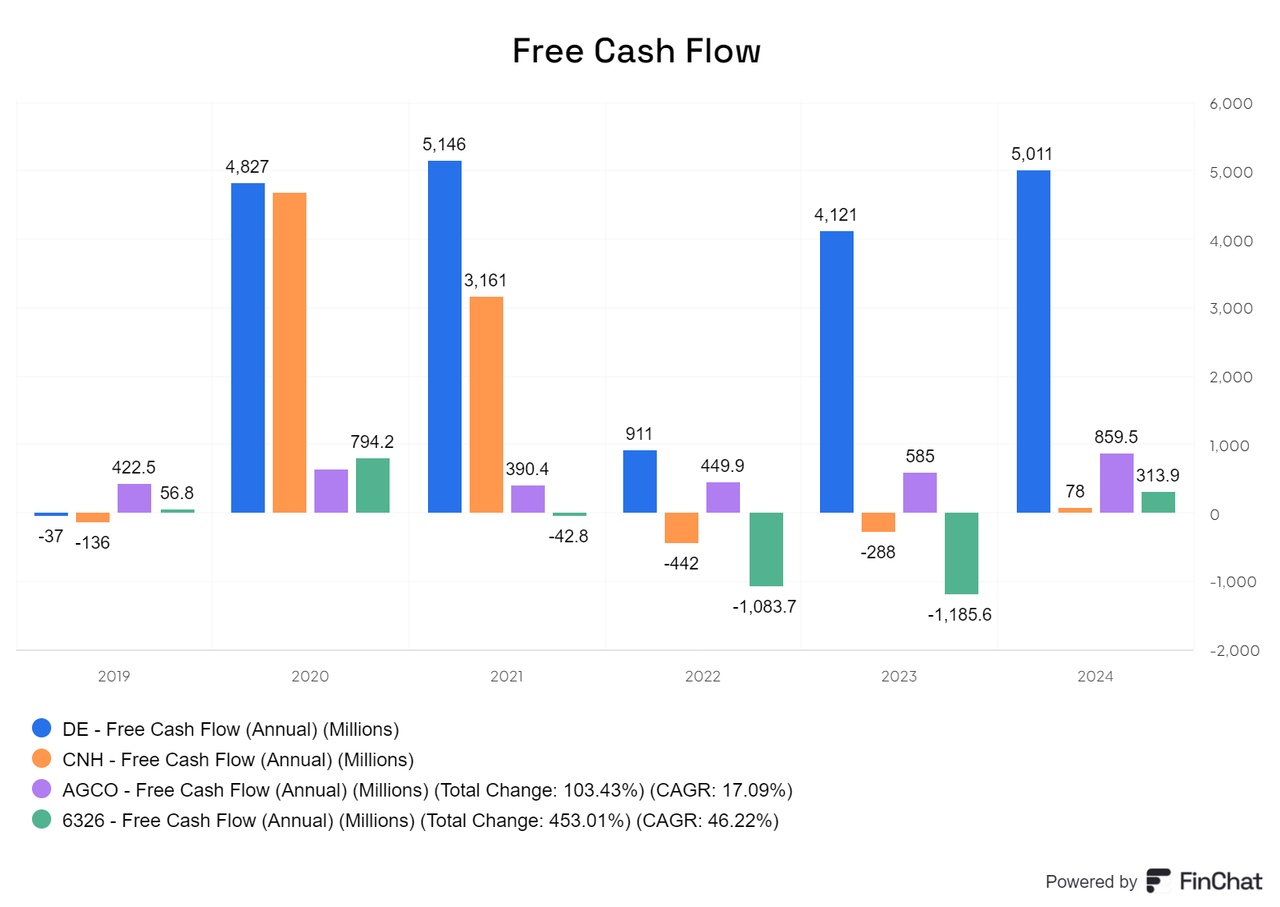

Since 2020, Deere has also recorded positive free cash flow figures that clearly stand out from the competition.

In the area of share-based compensation (SBC), Deere has also recorded considerable growth that significantly exceeds sales increases. However, this development is problematic for shareholders as it indicates dilution of their shares and raises concerns about long-term value creation.

Nevertheless, the company has continuously carried out share buybacks in recent years to support its own share base and increase shareholder value.

While Deere's net leverage ratio is above 3%, only AGCO is better positioned in this regard.

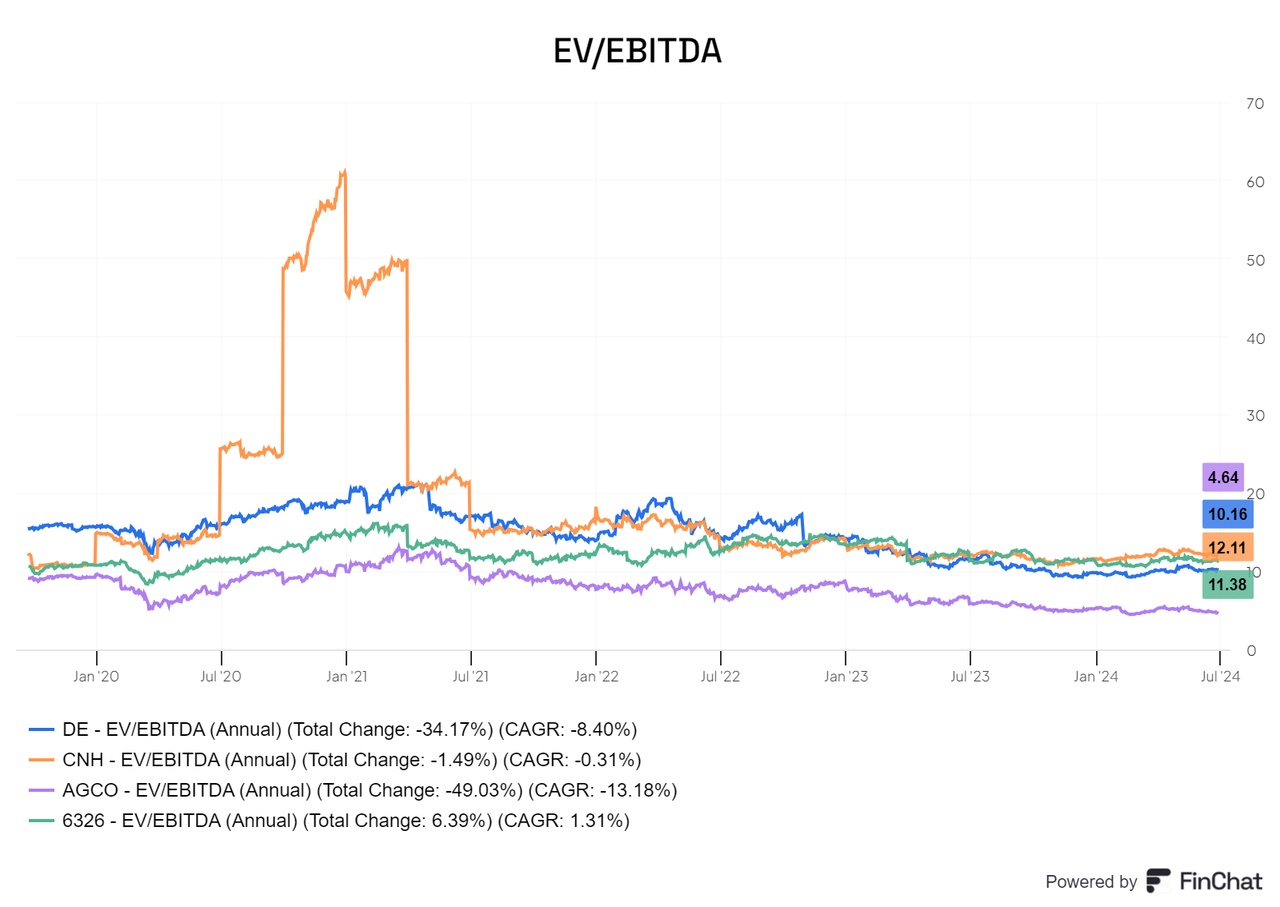

In terms of EV to EBITDA ratio, Deere is among the better valued companies, reflecting the expectations for the company, despite its size, compared to its peers. In contrast, AGCO appears very favorably valued in this area.

Part 2:https://getqu.in/MD8MpF/