$FVRR (-1,02%) Opinions on Fiverr ?

Discussione su FVRR

Messaggi

33Dear GQ friends

After I sold $FVRR (-1,02%) with -40%, I took the remaining amount, plus my monthly amount for individual shares and put it into $FTK (+0,19%) with it.

My decision for $FTK (+0,19%) is based on the fact that I suspect that many small investors will be very active on the stock market in the first quarter of this year. Thanks to shares like $NVDA (+0,5%) , $SMCI , $ARM (-1,5%) etc.- this should also $FTK (+0,19%) should be able to profit from this.

Best regards your He-Man💥🗡️

The second worst investment of my career after Wirecard. Figures were ok, but the outlook gives little hope for growth. From once over 30% to 0.

At the time, I thought corona would pull the future forward, but it was just a one-off effect.

Is there any stock-specific news that I'm missing, or is this simply a case of underpricing in a positive market environment? $FVRR (-1,02%)

Fiverr is now back at €40+.

I thought and still think the crash in the share price after the publication of the quarterly figures was exaggerated. Sales as expected, earnings per share significantly better than expected and only the expectations for 2022 lowered by just 3-4%.

But that's fine with me, I was able to make another cheap additional purchase here.

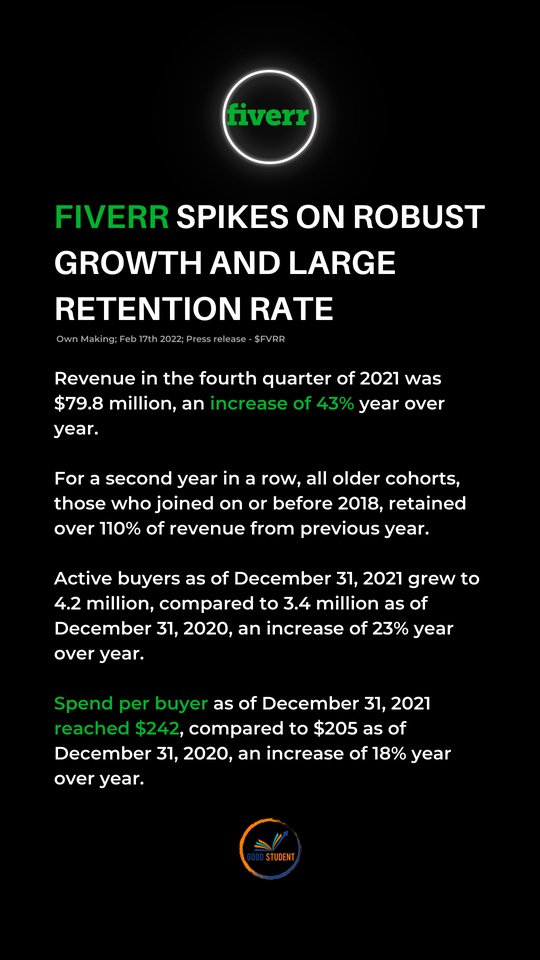

Fiverr Q4 numbers as well as 2021 annual numbers:

👨💻🛒📊

Fiverr announced its quarterly figures on 2022-02-17 and managed to surprise with the following results:

Q4 2021:

Revenue: $79.8 million, up +43% from Q4 2020 ($76.9 million was expected)

Earnings: $0.22/share (non-GAAP), $0.05/share was expected by analysts.

On a full year basis 2021, managed to generate revenue of $297.7m (+57% YoY) and profit of $24.5m.

Those who would like to see a more detailed analysis of the Q4 numbers are welcome to watch the following video:

Titoli di tendenza

I migliori creatori della settimana