Today there were fresh figures from Siemens $SIE (-1,03%) for the second quarter of 2025 and, as always, I'll try to make them as understandable as possible for you 📈

In this article you will find everything you need to know about the current status.

The information is based entirely on the Q2 report [1], the media presentation [2] and the earnings call [3].

Hier to the article from the last quarterly report.

📅 First of all, the context: Why Q2 at Siemens?

Siemens' fiscal year begins in October. That means:

- Q2 2025 covers the period from January to March 2025

- The figures were published on May 15, 2025

Overall overview: Robust performance with a special effect

Siemens delivered a strong operating performance. Sales grew by 6 %, incoming orders by 9 %. An important driver was a special gain from the sale of a company in the Smart Infrastructure division, more on this later.

Key figures

- Turnover+6% to € 19.8 billion

- Incoming orders: +9% to € 21.6 billion

- Book-to-bill ratio: 1.10 -> more orders than sales

- Order backlog: € 117 billion -> still at a record level 🔥

- Profit after tax (continuing operations): € 2.44 billion

- EPS (before PPA): € 3.00 -> incl. € 0.32 profit from the sale of the company

👉 The profit includes a special effect from the sale of the Wiring Accessories business in the Smart Infrastructure division. This contributed around € 0.32 to EPS and 550 basis points to the margin.

("EPS before PPA" shows the operating earnings per share, excluding distortions due to acquisition-related special effects, which analysts consider to be the more realistic benchmark for measuring earnings)

- Free cash flow (Industrial division): € 2.1 billion

(Why only the Industrial Sector is stated: Because the focus is on the Industrial Sector without Healthineers & Financial Services as the core business. This shows Siemens' true operating financial strength, without dividends from investments or financial transactions)

The Siemens Groups at a glance

Share of total sales:

- Digital Industries: 21,7%

- Smart Infrastructure: 28,8%

- Mobility: 16,2%

- Siemens Healthineers: ~28%

- Siemens Financial Services: 0,5%

*Difference to 100%: "Reconciliation to consolidated figures, see end of article

📊 Digital Industries (DI):

Siemens is global leader in industrial automation and software for factories. This involves robot control systems, production software and automation solutions for the automotive, pharmaceutical and electronics industries, for example.

Our productsSIMATIC, NX, Teamcenter, TIA Portal

📉 figures:

- Turnover: -5 % to € 4.3 billion

- Profit: -9 % to € 512 million

- Incoming orders: stable at € 4.3 billion

- Book-to-bill: 1,00

🔎 Regional trends:

- China: Incoming orders -16%, sales -10%

- Germany: Sales -22 %

- USA: stable sales

What's going on at Digital Industries...

Digital Industries is Siemens' central division for industrial automation and software, i.e. actually the area that should offer the greatest leverage in AI, efficiency and scalability in the future, which makes the current decline of Sales: -5% & profit: -9%.

- Particularly affected: discrete automation (e.g. mechanical engineering, automotive, electronics)

3 main reasons identified:

Destocking: destocking is dragging on

The problem was already visible in Q1, as in my article: customers (especially mechanical engineering & electronics manufacturers) ordered massively during the corona period, but now they don't need any new components for the time being because their warehouses are still full.

The consequenceLess call-offs, less sales at Siemens, although the demand remains in the medium term.

CFO Ralf Thomas:

"Distributor inventories in China are still above levels, even if declining."

Regional weaknesses, especially Europe & China

- In China, FDI sales fell by -10% in Q2, incoming orders by as much as -16%

- In Germany, sales even fell by -22%

- Reasons: hesitant investments, uncertain economy, geopolitical tensions

CEO Roland Busch:

"We need clarity on trade policy. Customers are holding back investments in key regions."

EDA software weakens, despite strong PLM

The software share is split in two:

- PLM (Product Lifecycle Management): +9% growth (positive)

- EDA (Electronic Design Automation): -34 % in orders (a heavy burden on earnings)

EDA tools are primarily used by chip manufacturers, where investment restraint is currently particularly high following the boom of recent years.

What's next...

✅ The book-to-bill ratio is back at 1.0 - a first signal of stabilization

✅ Siemens expects improvement from H2 if inventories continue to fall and the economy stabilizes

✅ Software business remains profitable in the long term, also due to the integration of Altair

CFO Ralf Thomas:

"We see green shoots in PLM and some signs of stabilization in short-cycle factory automation."

Interim conclusion Digital Industries:

The decline in DI is not a structural problem, but a cyclical weakness combined with geopolitical uncertainty. Siemens itself is continuing to invest in AI & software and believes that the downturn will bottom out this year.

For investors this means: Be patient, DI remains the key to the future in my opinion, even if it is currently bumpy.

🏡 Smart Infrastructure (SI): The star in the quarta

This is about energy supply, building automation and infrastructure. Siemens helps companies to work more efficiently and sustainably, from smart buildings to energy grid feed-in

Known products/services:

- Charging stations for electric cars

- Building management systems for smart office buildings

- Switchgear for power grids

figures:

- Turnover: +10 % to € 5.7 billion

- Profit: +27% to € 979 million (incl. special effect)

- Incoming orders: -3 % (strong comparative quarter)

Drivers:

- Data centers, power grids and industrial orders

- Services +6 %, broad margin expansion (18.5 % operating EBIT margin)

- USA & China strong growth in sales

🏷️ Wiring Accessories sales:

Sale of switches, sockets etc. -> no longer a strategic focus.

CFO Ralf Thomas:

"Concentrate on high-margin, digital and scalable solutions"

🚆 Mobility (MO): New orders, top margin

Siemens builds and maintains trains, rail infrastructure and signaling technology. The focus here is on fast, efficient and sustainable mobility systems.

Well-known products/services:

- ICE trains for Deutsche Bahn

- Metro systems for major cities

- Digital interlockings for railroad lines

numbers:

- Turnover: +12 % to € 3.2 billion

- Profit: +70% to € 331 million (margin 9.4%)

- Incoming orders: +22% to € 3.9 billion

- Book-to-bill: 1,22

Drivers:

- New major orders in Rolling Stock & Rail Infrastructure

- Services continues with high margin, order backlog at €49 billion

CEO Roland Busch:

"Train business remains resistant to economic cycles and can be planned for the long term."

🧬 Siemens Healthineers $SHL (-0,56%) (SHS): Strong performance despite trading risks

Siemens is a leader in medical and diagnostic technology. The company supplies imaging systems, laboratory diagnostics and digital healthcare solutions.

Known products/services:

- MRI & CT devices for hospitals

- Laboratory diagnostics for blood tests & cancer research

- AI-supported diagnostic software

Numbers

- Double-digit increase in orders

- Sales growth in the mid single-digit range

- US trade tariffs (anti-dumping) have a negative impact, but no direct drop in profits

💰 Siemens Financial Services (SFS)

Siemens offers leasing and financing services, e.g. for companies that want to modernize their infrastructure.

Known products/services:

- Leasing for medical technology

- Project financing for renewable energies

- Industrial investments

Earnings before taxes: € +210 million (previous year: € 184 million)

- Main driver201 million profit from the sale of shareholdings

- Return on equity at 12.8%

Strategic highlights: AI, Altair & Innovation

📌 Altair takeover completed

Siemens strengthens its portfolio for industrial AI & simulation with the acquisition of Altair.

GoalComprehensive, AI-supported software offering across all industries.

CEO Roland Busch On the Altair deal:

"After a very stringent regulatory approval process, we closed the Altair acquisition earlier than planned. Customer feedback for the most complete AI-powered design and simulation portfolio has been excellent.

➡ Early closing of the Altair deal, integration and synergies start immediately Siemens is thus massively expanding its software portfolio.

📌 New acquisition: Dotmatics

- Specialist for AI-supported life science software (laboratory data, drug development)

- 95% subscription revenue, >40% EBITDA margin

- Complements Healthineers + PLM division

📌 Xcelerator & Industrial Copilot: Siemens drives industrial AI forward

Together with partners such as Microsoft $MSFT (+0,01%) , NVIDIA

$NVDA (-0,59%) and Accenture

$ACN (+0,18%) are building an AI ecosystem for industry with the aim of revolutionizing manufacturing and development processes through artificial intelligence and digital twins.

Xcelerator is the open Siemens platform for industrial software, hardware and digital services.

Industrial Copilot is a new tool based on Foundation Models (comparable to GPT, but for industrial applications):

- It can generate control code by voice input

- Accelerates processes in development, production and maintenance

- First practical application, e.g. at Audi in production

Siemens was honored with the Hermes Award 2025 for real business impact.

GoalIncrease efficiency, avoid errors and cushion the shortage of skilled workers with intelligent assistance systems.

Roland Busch:

About the Industrial Copilot & Xcelerator

"Our Siemens Industrial Copilot received the prestigious Hermes Award for business impact - it's the first real generative AI for the factory floor.

➡ Siemens emphasizes the lead in AI in industry with real customer impact, e.g. Audi .

Regions at a glance

- Americas region: 42% share of sales, driven by strong demand in the USA - particularly in Smart Infrastructure and Mobility.

- China: Still weak, but first signs of recovery in DI

- Europe (EMEA): Mixed, Germany with weaknesses in the automation business

Siemens & Siemens Energy $ENR (-5,19%): only a side note

Even though Siemens Energy has been an independent company since 2020, Siemens AG still holds a minority stake of less than 15% (as of Q2 2025).

The stake has been gradually reduced in recent years, with a large proportion going to the Siemens Pension Trust, for example.

In Q1 2024, this step resulted in a one-off gain of €500 million; this effect will be absent in 2025.

CFO Ralf Thomas (Q2 Call):

"We continue the divestment of the Siemens Energy stake - now below 15%."

Is this still relevant for investors?

No, Siemens Energy no longer plays an operational role for Siemens AG.

What remains, however, are risks at Siemens Energy (e.g. Gamesa, wind power problems, anti-dumping duties), which investors may still associate with Siemens. Even if at least emotionally.

However, Siemens itself emphasizes that Energy is no longer part of the strategic core.

In accounting terms, the investment is listed under "financial assets" and is to be further reduced.

Trade tariffs & geopolitics

USA imposes tariffs on products from Europe & China

Siemens Healthineers particularly affected: -€200-300 million profit risk

CEO Roland Busch:

"Tariff uncertainty is already having an impact on investment decisions."

Siemens is increasingly localizing production & supply chains ("local for local")

CFO Ralf Thomas on macroeconomic risks

"Looking ahead, further recovery of economic activity will depend heavily on clarity about the future tariff environment and on timely resolution of trade conflicts.

➡ Siemens identifies risks from trade conflicts, but remains optimistic

🔮 Outlook for 2025

- Total sales growth: 3-7% confirmed

- EPS (before PPA, without Innomotics): € 10.40-11.00

Segment targets:

- DI: -6% to +1%, margin: 15-19

- SI: +6-9%, margin: 17-18

- MO: +8-10%, margin: 8-10

👉 Siemens expects continued volatility (trade tariffs, economy, China), but believes it is strategically well positioned.

Further insights from the call:

CEO Roland Busch:

On the current global situation and Siemens' role in it:

"The last few months demonstrated to all of us how fundamentally and how fast the world is transforming... In an environment of accelerating technological progress driven by data and AI, we have to fundamentally rebuild our products, processes, and the way we operate."

➡ ContextSiemens sees the current upheaval as an opportunity for fundamental transformation and wants to be a leader in AI & digitalization.

About the strategic vision "One Tech Company":

"Through our leadership in industrial AI, we enable our customers to combine the real and the digital worlds to improve competitiveness, resilience and sustainability and to achieve real impact."

➡ Siemens is positioning itself as a central enabler of industrial digitalization

CFO Ralf Thomas: On the financial strength in Q2:

"Our excellent profit of €3.2 billion in the Industrial Business clearly topped market expectations even without the divestment gain from Wiring Accessories."

➡ Siemens shows strong operating performance - the special effect was not decisive for the success .

On the strategic importance of China:

"When I was in China... we noted some encouraging signals for more cooperation and openness to drive high-tech and high-quality growth."

Siemens relies on localized development and production; 16 new products were launched locally.

Current share price movement:

Looks like a slight price correction, probably a technical reaction.

- Profit taking

- Macroeconomic uncertainties

- Or or or

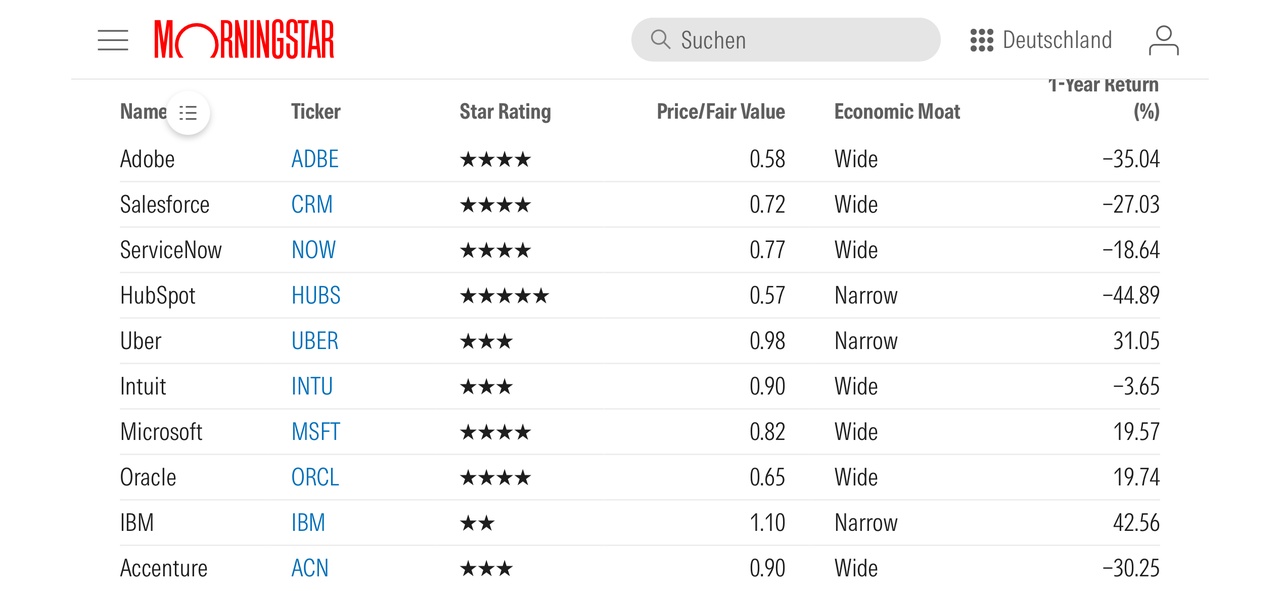

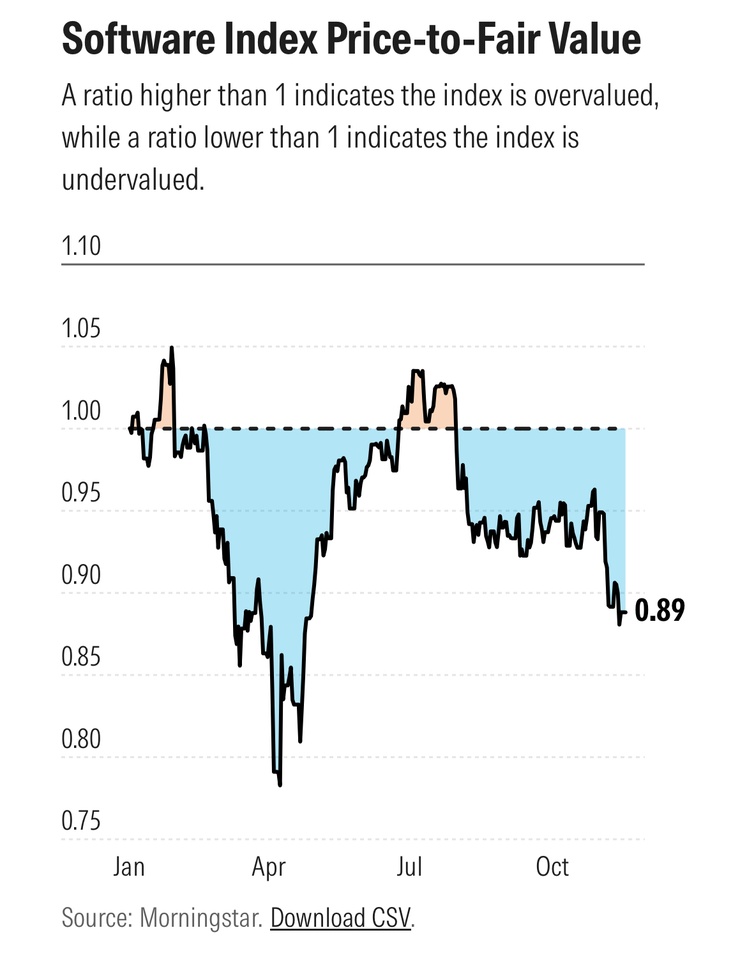

Valuation (no investment advice)

With a P/E RATIO of around 18 for a global industrial group with stable margins with stable margins, a growing share of software and high free cash flow is rather moderately valued in my opinion.

Especially compared to many highly valued growth or tech stocks, the valuation may even look rather attractive in the long term, especially when you consider that Siemens now generates around a third of its business with digital, software-based solutions and the trend is rising.

In combination with the strong Q2 figures, the confirmed outlook and a solid order backlog of 117 bn., Siemens is currently delivering a convincing mix of operational stability and structural growth potential.

For me, the share is therefore neither overvalued nor speculative, but appears fundamentally sound, strategically well positioned and interesting in the long term thanks to clear megatrends such as:

- Artificial intelligence & automation

- Decarbonization & electrification

- Digitalization of the industry

Conclusion

- In my view, Siemens has once again delivered a strong performance, both operationally and strategically.

- Smart Infrastructure & Mobility are the strong segments

- Digital Industries (recovery expected from H2) remains challenging

- The focus on software with AI & sustainability is clearly being implemented

The order backlog of 117 bn € is simply insane and, together with the cash flow, provides a certain degree of security

CEO Roland Busch:

"Our backlog is high-quality, high-margin and provides planning security."

I see Siemens as future-proof in the long term, top position in Industry 4.0, electrification & health tech

Strong balance sheet & dividend

Short-term headwinds from the economy & tariffs don't bother me.

I am holding my position and will double the current value within the next few months, Siemens remains a stable core stock with tech ambitions for me!

______

Thanks for reading! 🤝

______

Sources:

[1] https://assets.new.siemens.com/siemens/assets/api/uuid:1d09b7cc-50a4-48c5-b632-8b26971ba722/2025-q2-earnings-release-de.pdf

[2] https://assets.new.siemens.com/siemens/assets/api/uuid:2adbcbb2-f53b-4bb3-ba78-37ed1cb3948b/2025-q2-presentation-en.pdf

[3] https://web.quartr.com/link/companies/3485/events/257252/transcript?targetTime=0.0

______

*Difference in sales shares:

The ~5% difference is explained by:

Reconciliation consolidated financial statements

- Internal allocations, currency adjustments, cross-segment effects

Consolidation & other

- e.g. eliminated sales between the segments

These items are shown in the balance sheet under "Reconciliation to consolidated figures" in the balance sheet. In Q2, this reconciliation figure amounted to € 1.055 billion

The missing % of revenue is attributable to consolidation-related reconciliations and non-operationally allocated revenue, a completely normal figure for a diversified group such as Siemens.