$MNDY (-3,86%)

$PGY

$APO (-0,34%)

$ON (-1,15%)

$AMKR (-1,58%)

$MEDP (-0,74%)

$UPWK (-0,74%)

$ACGL (-0,32%)

$ACM (-0,9%)

$KO (-0,04%)

$SPOT (-0,63%)

$CVS (-0,64%)

$DDOG (-1,37%)

$FI (-0,59%)

$SPGI (+0,08%)

$RACE (-1,06%)

$AZN (-0,22%)

$MAR (-0,59%)

$OSCR (-1,33%)

$HOOD (-2,11%)

$ALAB (-2,27%)

$F (-0,19%)

$LYFT (-0,78%)

$UPST (-2,02%)

$NET (-1,14%)

$GILD (-1,29%)

$EW (-0,8%)

$SHOP (-2%)

$VRT (-0,99%)

$HUM (-0,56%)

$KHC (+0,16%)

$MCD (-0,13%)

$9ZX1

$TMUS (+0,02%)

$APP (-3,01%)

$CSCO (-0,83%)

$ALB (-0,58%)

$HUBS (-2,37%)

$TYL (+0,78%)

$NBIS (-1,21%)

$BN (-0,51%)

$CROX (-0,58%)

$ZTS (-1,28%)

$BIRK (-0,6%)

$COIN (-2,29%)

$ANET (-0,91%)

$RIVN (-1%)

$TOST (-0,54%)

$AMAT (-0,49%)

$DKNG (-1,14%)

$WEN (-0,82%)

$CCO (-0,69%)

$ENB (+0,59%)

Enbridge

Price

Discussione su ENB

Messaggi

19Will the sell-off continue next week?

Navigating the Tech Correction: Strategic Entry Points in a Volatile AI-Driven Market

The AI-driven technology sector has experienced a dramatic selloff in late 2025, driven by concerns over overvaluation and macroeconomic uncertainty. This correction, however, has created a unique opportunity for contrarian investors to identify undervalued assets in a market that has historically rewarded patience and strategic entry timing. By analyzing recent financial metrics, competitive advantages, and catalysts for recovery, we can pinpoint Al stocks and alternative investments that may outperform in the coming year.

Undervalued AI Stocks:

- C3.ai ($AI (-1,26%)) has emerged as a compelling contrarian play. Strategic partnerships with Microsoft, AWS, and McKinsey & Company have expanded its enterprise AI adoption, while federal contracts with the U.S. Department of Defense and the Air Force underscore its operational resilience. Key catalysts include its consumption-based billing model and the integration of generative AI solutions, which could drive scalable growth.

- Quantum Computing Inc. ($QUBT) collaboration with NASA position it as a leader in niche quantum applications. With $1.5 billion in liquidity and a gross margin of 33%, QUBT's financial health contrasts with its volatile stock price, which is currently shorted at of the float. Analysts project a 96.4% upside potential, though execution risks remain.

Risks and Considerations

While the opportunities are compelling, investors must remain cautious. C3.ai's cash-burning operations and leadership transitions pose execution risks, while QUBT's reliance on quantum commercialization remains unproven. Broader macroeconomic factors, including interest rate uncertainty, could also delay sector recovery.

Conclusion

The 2025 tech selloff has created a rare window for contrarian investors to acquire undervalued AI assets at discounted prices. Companies like $AI (-1,26%), $QUBT, and $PLTR (-1,91%), supported by strong revenue growth and strategic partnerships, offer long-term upside.

Meanwhile, energy stocks ($ENB (+0,59%) and $FTS (+0,3%)) and CEFs ($SPXX and $BDJ) provide diversification in a volatile market. As the sector navigates its correction, disciplined investors who prioritize fundamentals over short-term noise may be rewarded handsomely in 2026.

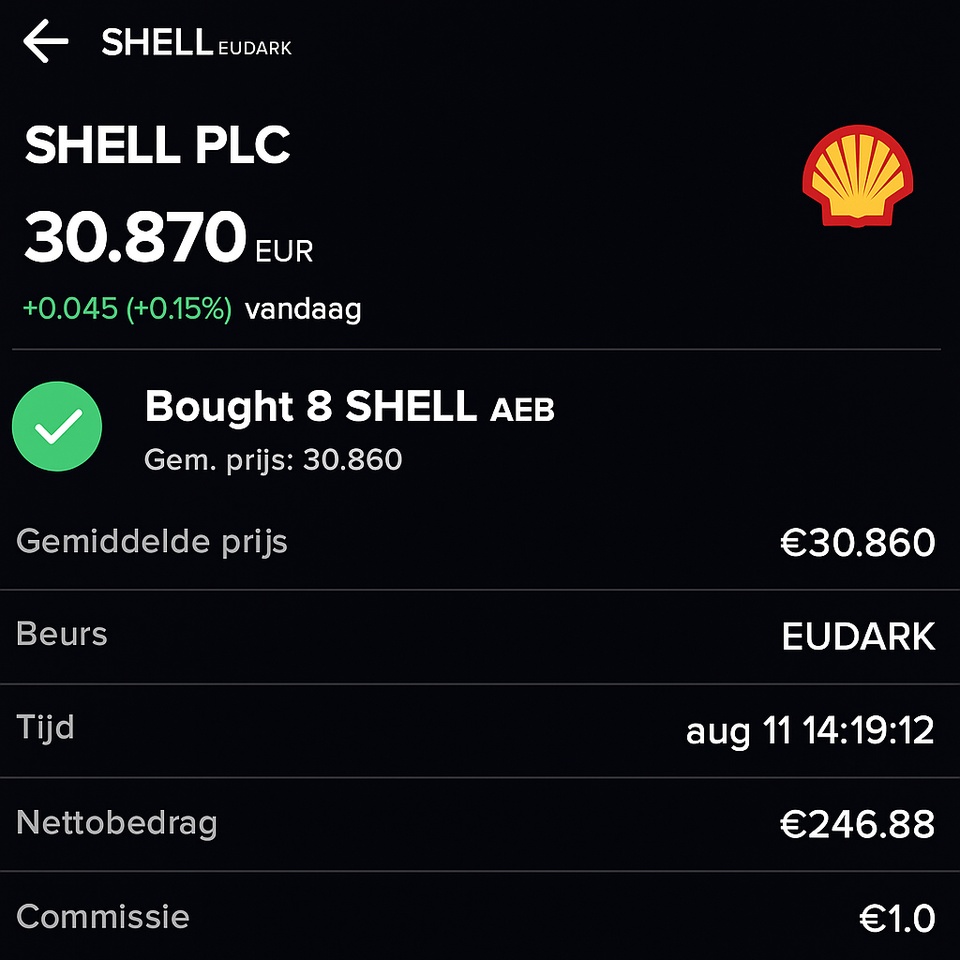

Today i invested in Shell

Today I invested in $SHEL (+0,21%) .

Bought 8 shares at an average price of €30,66 per share including transaction costs.

In total I now own 157 shares, this gives me +- €200 per year in dividend.

#dividend

#dividends

#dividende

#invest

#investing

#etf

#etfs

$SHEL (+0,21%)

$XOM (+0,03%)

$CVX (-0,03%)

$ENB (+0,59%)

$BP. (+0,5%)

$TTE (+0,08%)

Today I invested in Shell

Today I invested in $SHEL (+0,21%) .

Bought 8 shares at an average price of €30,985 per share including transaction costs.

In total I now own 149 shares, this gives me +- €190 per year in dividend.

#dividend

#dividends

#dividende

#invest

#investing

#etf

#etfs

$SHEL (+0,21%)

$XOM (+0,03%)

$CVX (-0,03%)

$ENB (+0,59%)

$BP. (+0,5%)

$TTE (+0,08%)

Today I invested in Shell

Today I invested in $SHEL (+0,21%) .

Bought 8 shares at an average price of €29,95 per share including transaction costs.

In total I now own 141 shares, this gives me +- €180 per year in dividend.

#dividend

#dividends

#dividende

#invest

#investing

#etf

#etfs

$CVX (-0,03%)

$XOM (+0,03%)

$BP. (+0,5%)

$SHEL (+0,21%)

$TTE (+0,08%)

$ENB (+0,59%)

Parents receive inheritance

Hello everyone!

My parents are in the process of selling my grandparents' house. It will probably fetch around €275,000. My parents will soon both be 60 years old.

They had initially considered buying another property nearby. But they have moved away again. The lack of flexibility and the time and risk involved with tenants put them off.

I also told them more about investing in the stock market. They were very open and interested, even though they said they had an unfounded fear of shares etc.

Now my question to you. What is the best way to invest the money? I think dividends would be very nice as my parents like the passive income like from a property. But it should also be very well diversified across countries and sectors.

I personally have developed 2 solutions. You can give your opinion as to whether you think the solutions are good or, of course, if you have completely different ideas.

1. the ETF solution

15% $XEOD (+0,01%) Call money ETF. Div. 1.9%

15% $TDIV (-0,19%) VanEck Divi Leaders. Div 3.5%

10% $TRET (+0,1%) Global Real Estate. Div. 3.7%

7,5% $VHYL (-0,07%) Allworld High Div Yi. Div 3.1%

7,5% $PEH (+0,09%) FTSE RAFI EM. Div 3.9%

5% $EWG2 (+1,57%) Gold

5% $SEDY (+0,83%) iShares EM Dividend. Div 8.0%

5% $JEGP (+0,15%) JPM Global Equity Inc Div 7.1%

5% $EEI (+0,43%) WisTree Europ Equity Inc Div 6.3%

5% $IHYG (+0,09%) High Yield Bond. Div 6.1%

5% $EXXW (+0,03%) AsiaPac Select Div50 Div 5.5%

15% Rest German Divi Shares approx. div 2.5%

=100% with 3.7% dividend.

275k ×3,7% = 10.175€

With full taxation 27.99% = 7327€

On average per month: 610€ dividend

With 2k tax-free allowance: 657€ dividend per month

I find it very well diversified, you have overnight money, you have the USA and Europe well represented, but also 12.5% emerging markets ETF. In terms of sectors, finance will be at the forefront. Followed by real estate and energy. I think that's fine.

2. the equity solution

I have selected 34 strong dividend stocks. In the list they are roughly divided into GICS sectors.

15% $XEOD (+0,01%) Overnight ETF. Div 1.9%

12% $EQQQ (-0,58%) Nasdaq100 ETF. Div 0.4%

5% $EWG2 (+1,57%) Gold

2% $O (-0,19%) Realty Income 6.0%

2% $VICI (+0,2%) Vici Properties 5.6%

2% $OHI (-0,89%) Omega Healthcare 7.2%

2% $PLD (-0,36%) Prologis 4.1%

2% $ALV (+0,49%) Allianz 4.35%

2% $HNR1 (+0,32%) Hannover Re 3.4%

2% $D05 (-0,35%) DBS Group 5.5%

2% $ARCC (-0,49%) Ares Capital 9.3

2% $6301 (-0,65%) Komatsu. 4,2%

2% $1 (+1,41%) CK Hutchison 4.6%

2% $AENA (+1,63%) AENA. 4,2%

2% $LOG (+0,18%) Logista 7.3%

1,5% $AIR (-1,7%) Airbus 1.8%

1,5% $DHL (-0,28%) DHL Group 4.8%

1,5% $8001 (+0,27%) Itochu 2.8%

2% $RIO (-0,18%) RioTinto plc 6.4%

2% $LIN (-1,46%) Linde 1.3%

2% $ADN (+0,48%) Acadian Timber 6.7%

3,5% $BATS (-0,47%) BAT 7.0%

2% $KO (-0,04%) Coca Cola 2.9

2% $HEN (+0,66%) Henkel 3.0%

2% $KVUE (-0,18%) Kenvue 4.1%

2% $ITX (-0,42%) Inditex 3.6%

2% $MCD (-0,13%) McDonalds 2.6%

2% $690D (+0,18%) Haier Smart Home 5.6

3,5% $IBE (-0,06%) Iberdrola. 4,1%

1,5% $AWK (-0,46%) American Water Works 4.4%

1,5% $SHEL (+0,21%) Shell 4.1%

1,5% $ENB (+0,59%) Enbridge 6.5%

2% $DTE (+0,95%) Deutsche Telekom 2.8%

2% $VZ (-0,2%) Verizon 6.8%

2% $GSK (-0,22%) GlaxoSmithKline 4.2

2% $AMGN (-0,24%) Amgen 3.5%

2% $JNJ (-1,47%) Johnson&Johnson 3.5%

= 100% with 3.5% dividend

275k ×3,5% = 9625€

With full taxation 27.99% = 6930€

On average per month: 577€ dividend

With 2k tax-free allowance: 624€ dividend per month

I also think this solution is cool because you can select the largest companies or strong dividend payers in the individual sectors or countries yourself. And of course you can also select shares with which you have a connection. However, I have focused on shares from the USA, England and Germany because of the withholding tax. Spain is also well represented because of my parents' ties to this country. It's also cool that the NasdaqETF also includes the Microsoft, Amazon, etc. compounders.

What do you think?

Titoli di tendenza

I migliori creatori della settimana