Thanks to our Donald 🍊, I took a look at which European stocks could follow the current hot American stocks. While tech giants in the USA are often valued at the limit, the European "backyard" offers massive catch-up potential - driven by the need for technological sovereignty.

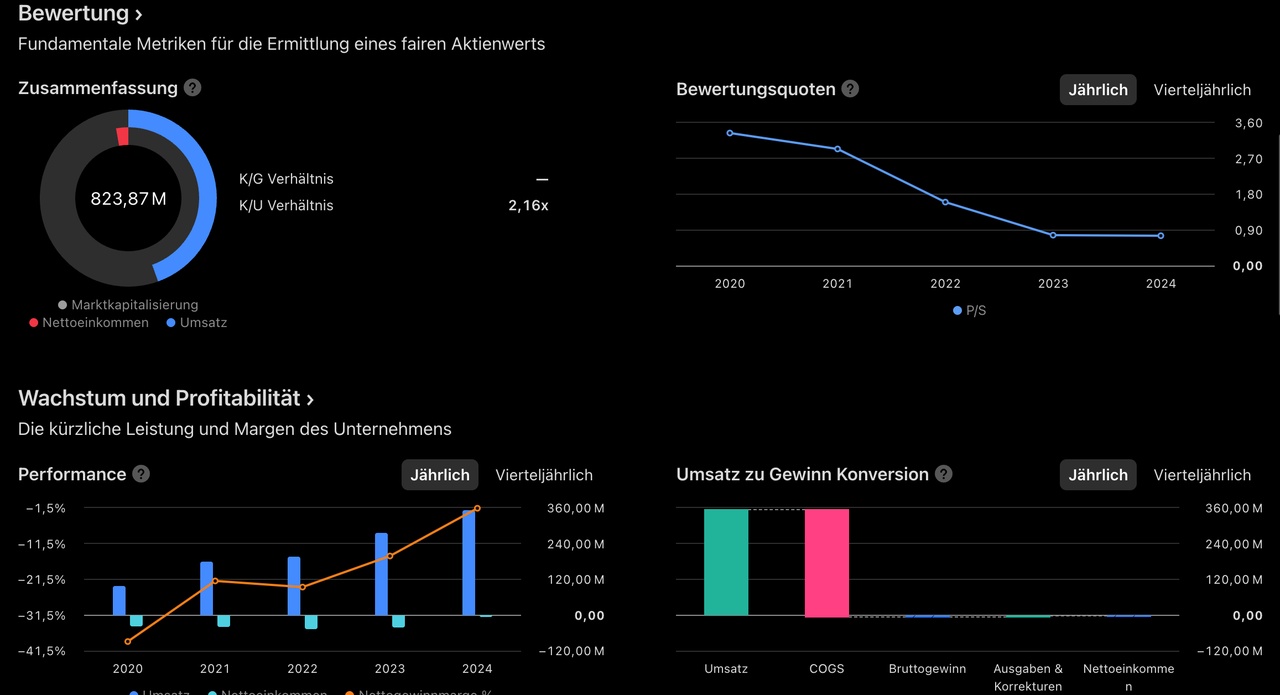

Two stocks in particular caught my eye: $AAC (-5,39%)

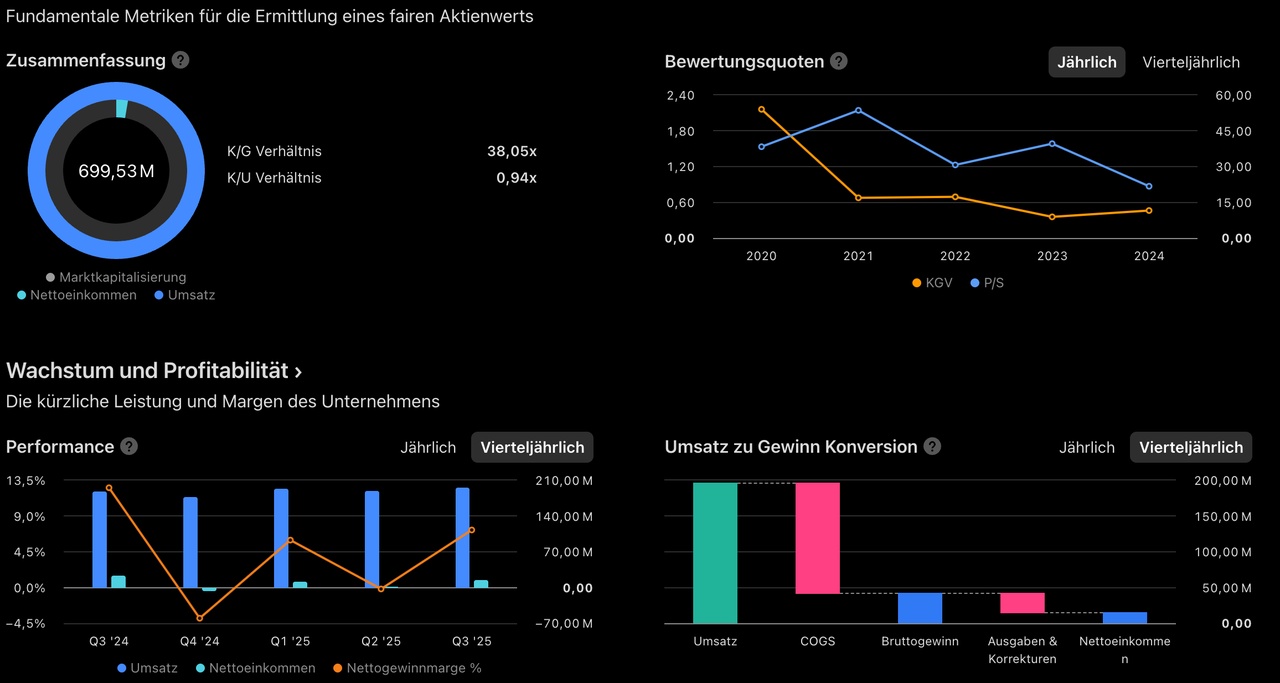

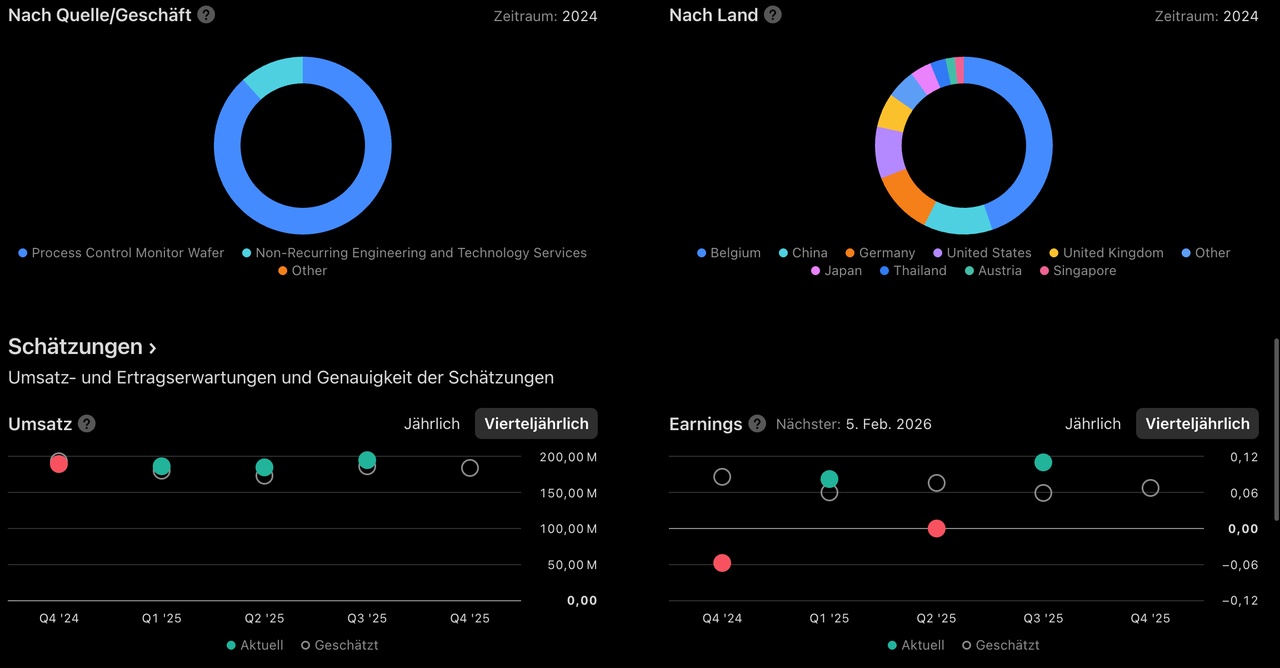

(AAC Clyde Space) and $XFAB (-1,03%)

(X-FAB Silicon Foundries). Both are still quite small compared to their US peers, but they set a decisive course in January 2026.

- AAC Clyde Space (AAC): Just a few days ago (12.01.2026), the green light was given for the 60 million euro "EPS-Sterna" project. With the new anchor shareholder Bonnier Capital the financing is finally in the bag until the 2026 break-even point. 🚀

https://finance.yahoo.com/quote/MKC0.F/

- X-FAB (XFAB): While Trump is ramping up tariffs on chips in the USA, X-FAB has just (January 2026) received massive EU subsidies for the plant in Erfurt. The valuation is attractive with a P/E ratio of approx. 11-13 (2026e) is almost laughably cheap compared to the US competition.

https://finance.yahoo.com/quote/XFAB.PA/

My conclusion:

We will see a massive rotation if Trump continues to push through his policies so aggressively.

Forecast: 🔮The money is flowing out of the overheated US markets back into European small caps, which provide real hardware for the "sovereignty agenda."

- AAC Clyde Space is the speculative bet on the European "new space" boom. Those who invest here are betting that Europe will build its own satellite infrastructure independently of SpaceX & Co.

- X-FAB is the solid basis. If you want to manufacture chips for the automotive revolution and quantum sensor technology in Europe, there is no way around this foundry.

The verdict: If the US tariffs put further pressure on supply chains in 2026, local champions like AAC and X-FAB will be among the big beneficiaries.

@Klein-Anleger

@Multibagger

@Tenbagger2024

@All-in-or-nothing

@Aktienfox

@TomTurboInvest and, of course, every other active member.