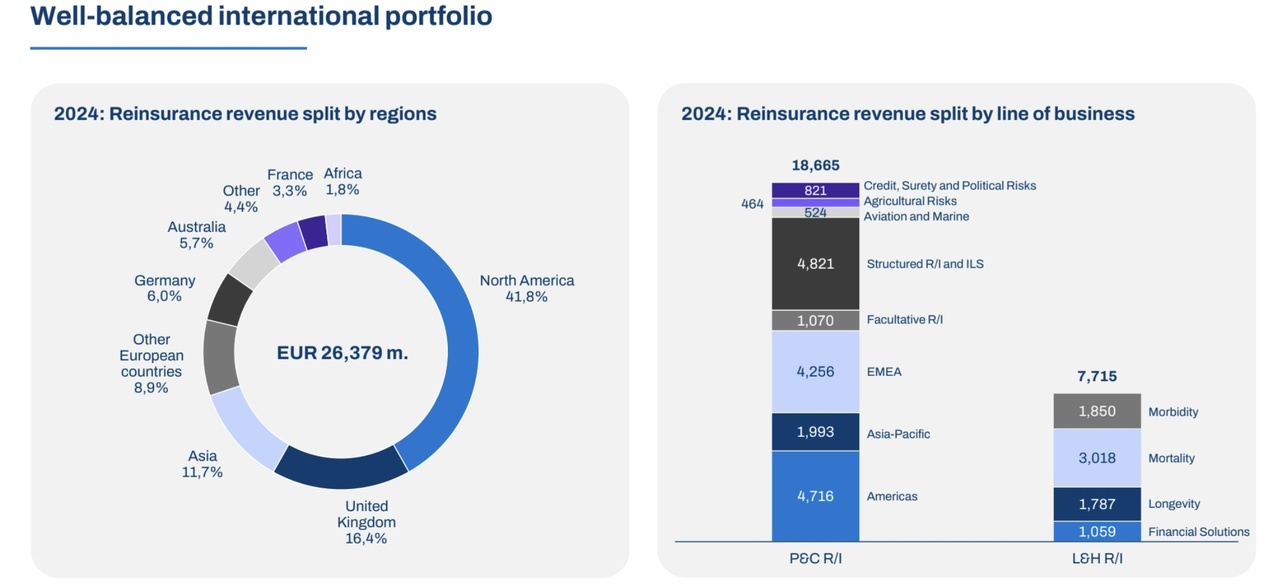

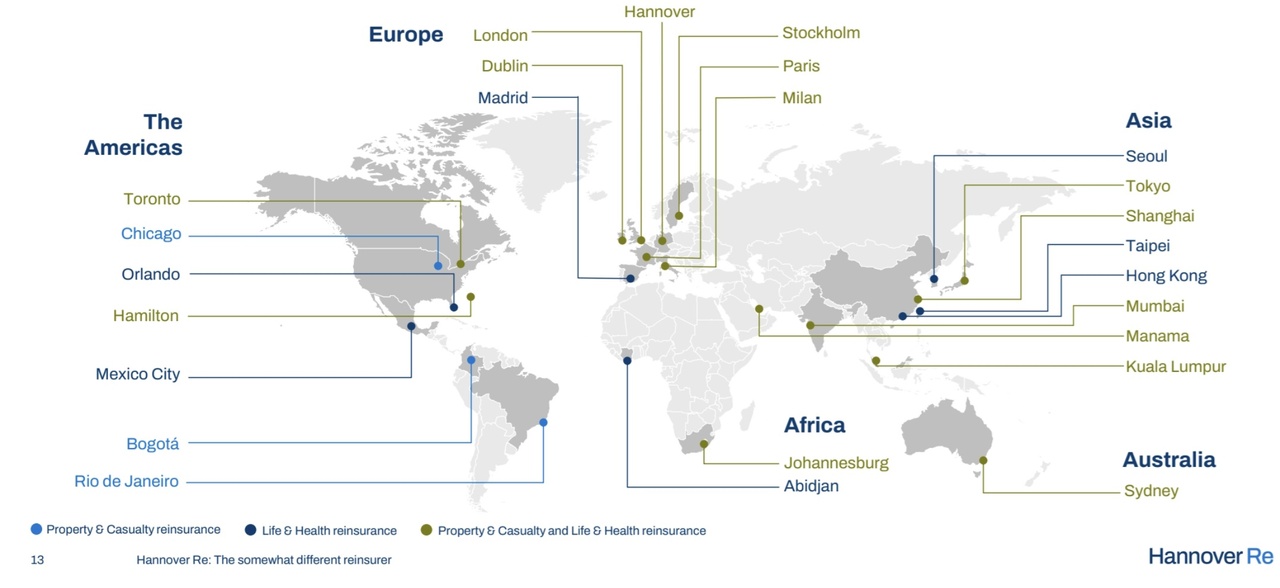

With reinsurance capital of over 29 billion euros, Hannover Re is the second largest reinsurer in the world - only Munich Re $MUV2 is larger. Headquartered in Hannover and with branches on almost every continent, the company insures risks that traditional insurers cannot bear alone: Natural disasters, industrial plants, life and health risks. $HNR1 (+1,13 %)

●Market position at a glance:

2nd place worldwide: behind Munich Re $MUV2 (+0,8 %) ahead of Swiss Re. $SREN (+1,28 %)

Munich Re: approx. 13 %

Hannover Re: approx. 9%

Swiss Re: approx. 8%

●Financial figures 2024

Gross premiums written: €26.4 billion (+7.9%)

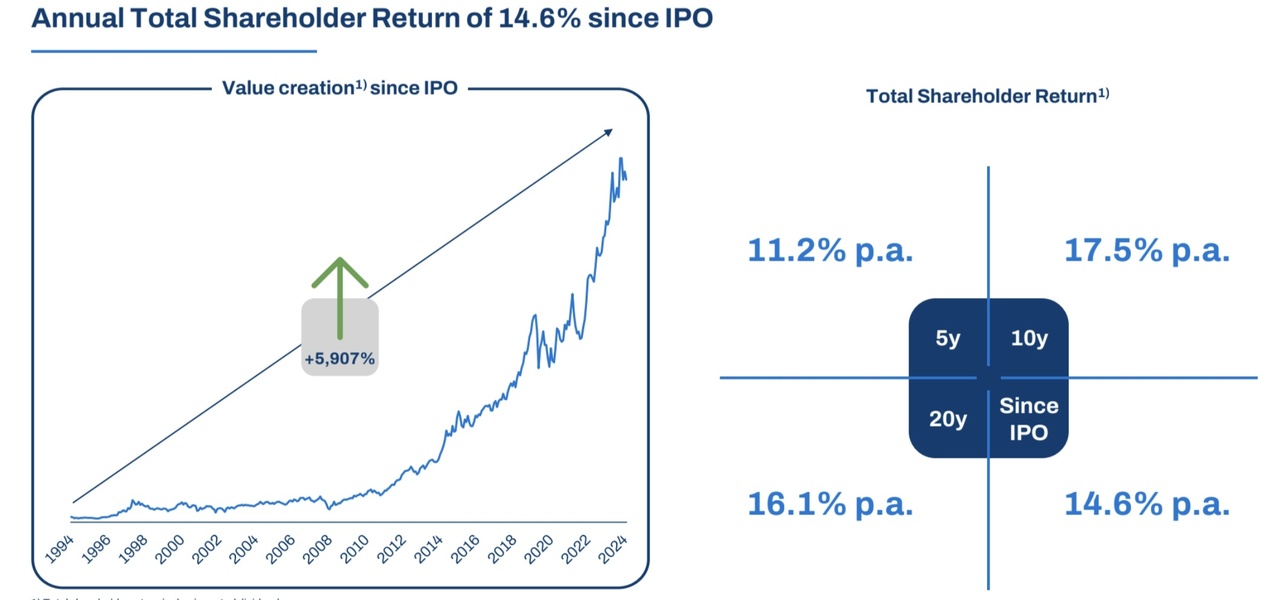

Group result: € 2.3 billion (+27.6%)

Return on equity: 21.2% (target was >14%)

Combined ratio: 86.6% (anything below 95% is considered very profitable)

Dividend: € 9.00 per share (basis € 7, special dividend € 2)

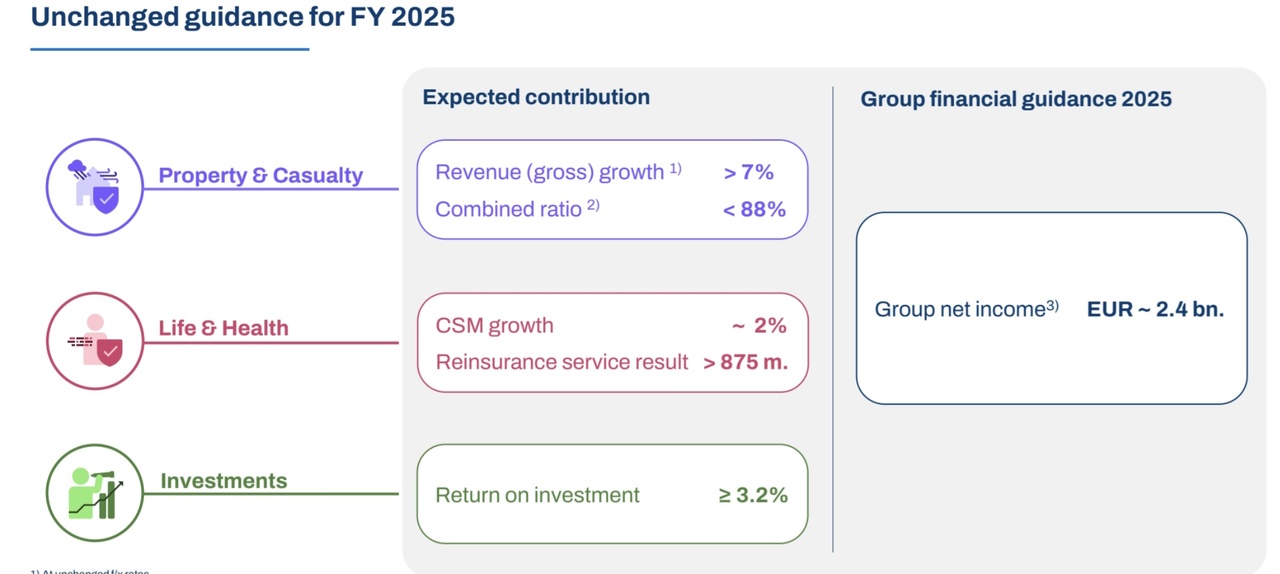

●Outlook for the future

-The demand for reinsurance is growing:

-Climate change leads to more extreme weather → more need for cover.

-Social inflation (rising claims, especially in the USA) increases risk awareness.

-Digitalization & AI improve risk modelling and claims management.

-Regulation such as Solvency II forces insurers to cede more risk → advantage for reinsurers.

●Risks

-Natural catastrophes: Can weigh heavily on profits (storm, flood, earthquake).

-Capital markets: Falling interest rates reduce investment income.

-Regulation: New EU regulations (e.g. supply chain laws, sustainability guidelines) increase costs.

-Competition: Price war in phases when there is a lot of reinsurance capital on the market.

■Conclusion

Hannover Re is a silent dividend compounder: not spectacular, but steadily growing, with solid payouts and a strong global market position. For long-term investors who are looking for security, stability and rising dividends.

Do you have insurers in your portfolio? If not, why?

That was my last share purchase for the time being, now I'm saving for my future self-employment. 🌳