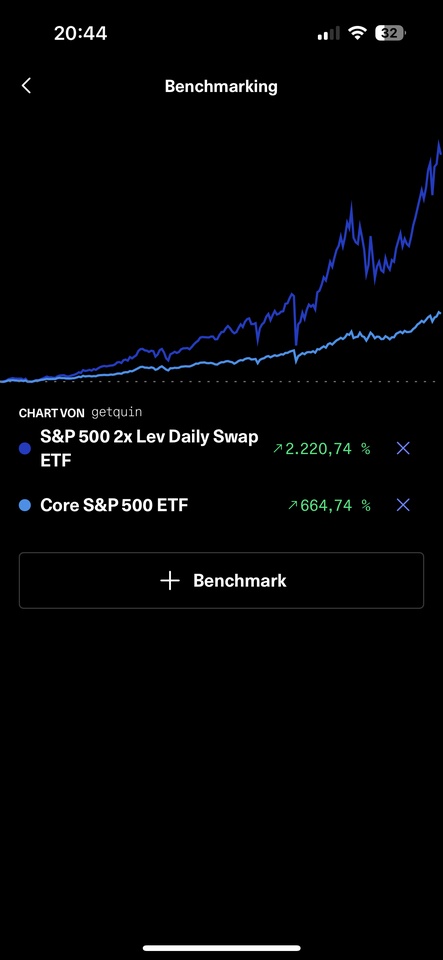

Hi guys I have a question regarding an ETF. Please no unnecessary comments but factual information and criticism. I am still learning and of course have to question some things and there are some people here with experience and good knowledge :). So I invest monthly in the $CSPX (+1,03 %) and I recently heard about this one $DBPG (+1,36 %) . Double the return for the same risk? I mean I'm betting on the S&P going up in the long run anyway so what's the catch? Why not switch from the normal S&P? There is also a clear difference in the benchmark.

Xtrackers S&P 500 2x Lev Daily Swap ETF

Price

Discussion sur DBPG

Postes

10Children's custody account - ETF 2x products as a return booster? Your opinion

The normal savings plan for the child runs with classic Ishares MSCI World & EM with 75%/25% allocation.

Next year there will be a grandiose 5€ more child benefit so I'll take out 25€.

I'm now thinking about adding a small yield booster (of course with higher risk + I realize that it is calculated daily and tends to go down a little more with minus movement than with plus).

25€ additional p.m. on : (so pi times thumb 300€ p.a. times ~15 years= 4.500€)

$CL2 (+2,42 %) Amumbi 2X MSCI USA Daily (0.5% TER)

$LQQ (+1,39 %) Amumbi 2X Nasdaq Daily (0.6% TER)

$DBPG (+1,36 %) Xtracker S&P 500 2x Daily (0.6% TER)

or rather boring momentum

$XDEM (+0,99 %) MSCI World Momentum (0.25% TER)

SOS incoming

Example: 1. when investing in the 2xQQQ in 2000, it only caught up with the 1xQQQ in 2020. Before that it underperformed. 2. the psychological pressure of a 90% drawdown should not be underestimated! If there is only 1k left of 10k savings for the children, even mom gets nervous. Not selling then puts a strain on you and your relationship.

That's why leveraged ETFs should normally be flanked by a volume-reducing strategy. Otherwise it will backfire. The best way to do this is to read research.

Good morning everyone! Wanted to ask your opinion on this particular investment plan, which consists of two leveraged ETFs ($LQQ (+1,39 %) and $DBPG (+1,36 %) ).

Is there anyone who already owns them or any other leveraged ETF? What do you think?

My plan is to buy a small amount every month, 15 USD in total for both, so it's not the end of the world if it doesn't work. I already invest in 5 other ETFs so my portfolio is already very steady.

Anybody who wants to share his/her experience with leveraged 2x Sp500 etf ? $SSO or $DBPG (+1,36 %) ? Is it worth it? Thanksl

Has the S&P 500 increased over the last 12 months? NO 0

Will a new U.S. president be elected this year or next? YES +1

Was there no interest rate inversion at the same time last year? YES +1

Are we in the period 01.November-01.May? YES +1

--------------------------------------------------------------------------

Action: Sell gold ETC, buy leveraged S&P 500 ETF at the open in the USA: 16:30

ALPHA INDICATOR = 3

I may not outperform the market, but I can leverage it. Millionaire or new start at 30 - let's go!

Titres populaires

Meilleurs créateurs cette semaine