Dear community,

I have been a member of getquin for almost 2 months now and I am thrilled with how lively the discussions and contributions are. Thanks to everyone who takes the time to research certain topics and share their knowledge.

I would like to take the opportunity to briefly introduce my portfolio and share my thoughts for 2025.

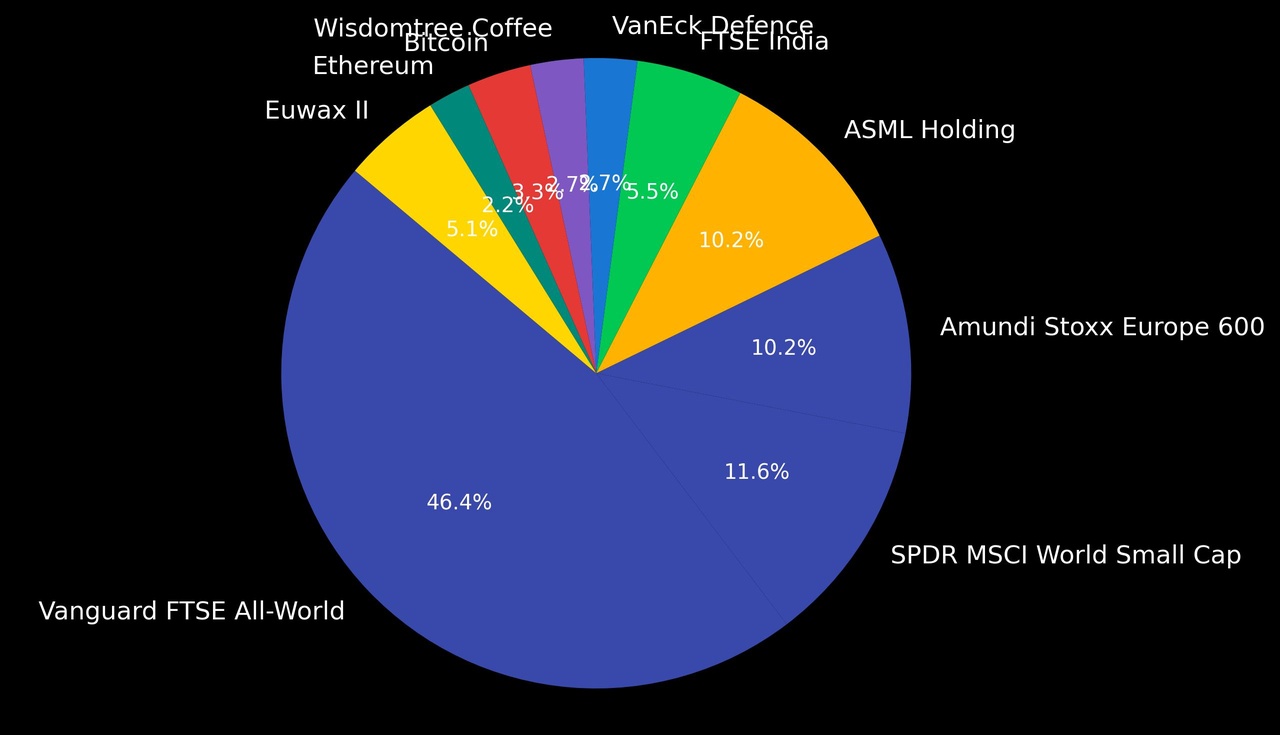

I have been managing my own investments for 10 years now. I started with ETFs and got into cryptos in 2017 (and got out again after the FTX bankruptcy and the Terra Luna crash). And for a few years now I've also been trading shares and now also real assets (I'm currently testing Timeless). Over the years, I have been able to expand my portfolio.

Due to my family responsibilities, my monthly fixed savings rate is currently €500. I also park monthly surpluses in my call money account and invest them when I see an opportunity. I need a certain amount of cash as we are still renovating and therefore simply need some cash...

My goal is to have at least €500,000 in 10 years so that I can pay off the existing loans on our house. So I would need to generate an annual return of 15%...

Over time, I've built up quite a mix of shares. My credo so far has been not to invest more than €1000 per share (although there have been exceptions) and a stop-loss at 20% below the purchase price. I haven't decided when the best time to sell is and I still don't know which strategy is best for me. I would therefore describe myself more as a hodler...

Now to my plans for 2025.

- I will change the fixed value per share of €1000 and increase it to €5000.

- The stop loss remains in place.

- Keep savings rates at €500 for the time being.

- Reduce the number of shares

- Focus on growth

What could a savings plan look like that I would continue for the next few years?

One point that bothers me is the high proportion of US equities in the global ETFs (cluster risk) - even though this is where most returns have been made historically...

Hence my consideration:

- Save in an ETF with a lower or no USA share (I currently have the following in my portfolio $GERD (-0,24 %) where the USA share is only 50% - unfortunately quite expensive with TER 0.5%; or a new start with a $EXUS (-0,26 %) ) (share: 40%)

- Saving $MEUD (-0,46 %) (20 %), $FLXI (-0,69 %) (20%), $WSML (-0,32 %) (20%)

- S&P500 or MSCI USA via the 2xSPYTIPS of @Epi (via single payments)

- In addition $BTC (-2,04 %) Savings plan of 40€ / week from existing USDC holdings (LTC sales from December) Note: Crypto portfolio cannot be fully mapped in Getquin as the EARN Binance Wallet is not displayed.

What do you think? Does that make sense?

As a next step, am I considering divesting from stocks?

From $OBDC (-0,7 %) I would probably divest myself, possibly also $CSCO (-0,65 %) . Can you think of any other shares or ETFs that would make sense to sell due to low growth prospects? I would then invest the free money in 3xGtaaa and shares like $ASML (-0,92 %) , $NVDA (+0,36 %) ...

Overall, I'm still not sure whether my strategy is quite right. Do you have any ideas, suggestions or comments? I would be grateful for any advice.

Thank you and best regards