Northland Power Inc.

$NPI (-0,46 %)

CA6665111002

Or also..."Gone with the wind" 💨🥸

Description of the company:

Northland Power Inc. is a Canadian electric utility headquartered in Toronto. Northland operates power plants in Europe and Canada, with a focus on natural gas and renewable energy. [1]

Business segments [4]:

Offshore Wind

Onshore Renewables

Utilities

Natural Gas

New Technologies

Sales (in thousands of CAD) [7]:

Offshore Wind (DE / NED): 1,259,247

Onshore Renewable Facilities (CA / ESP): 485,857

Natural Gas (CA): 425,572

Utilities (COL): 269,692

Other: 8,447

More than 70% of revenue is attributable to the Offshore/Onshore Wind division, i.e. the operation of wind turbines on water, and Onshore Renewables, which includes solar installations and wind energy generation on land.

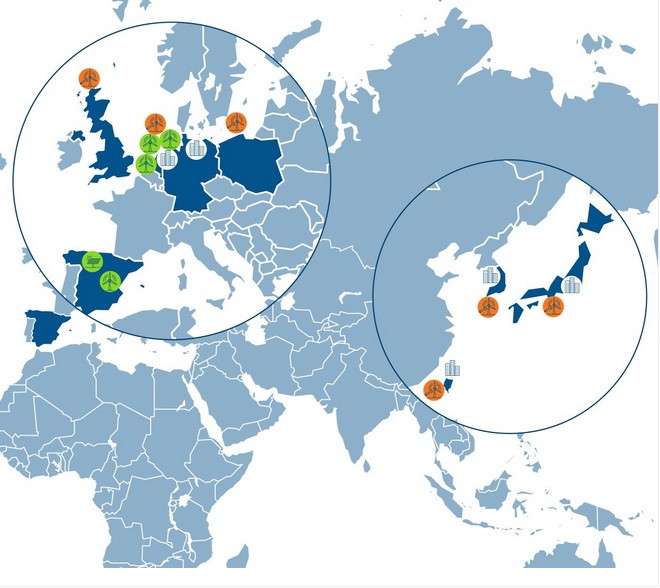

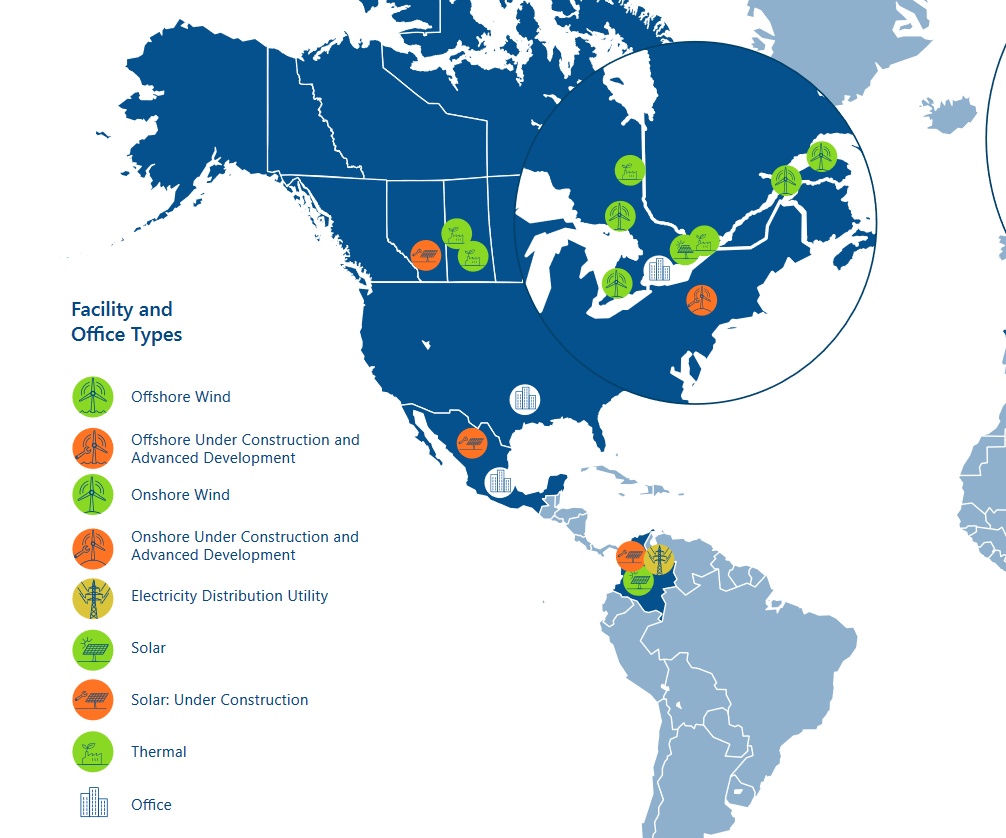

The attached chart shows the existing onshore and offshore wind farms and solar plants.

In future, the company would also like to invest in South Korea, Japan, Scotland and Taiwan and finance offshore wind and solar projects. Some of these are already in the early/mid-stage.

About us according to the homepage:

"Northland Power is a power producer dedicated to developing, building, owning and operating clean and green global power infrastructure assets in Asia, Europe, Latin America and North America. Our facilities produce electricity from clean-burning natural gas and renewable resources such as wind, and solar. We have a long track record of 35 years in business." [2]

Strategy according to company homepage:

"Northland aims to continually increase shareholder value by creating high-quality projects underpinned by revenue contracts that deliver predictable cash flows. We strive for excellence in managing our projects and operating facilities, always seeking opportunities to enhance performance and value. We focus on sustainability with the goal of improving the impact of resource usage in our environment." [3]

"We actively seek to invest in technologies and jurisdictions where we can apply an early mover advantage and establish a meaningful presence. We inspire our people to achieve excellence in everything, embracing and living Northland's values on a daily basis." [3]

We will certainly find out in this analysis whether Northland is also putting its strategy into action. So what do we want to see from the facts and figures?

A. Secure and predictable cash flows.

B. Shareholder value.

C. Good/sensible strategic alignment.

D. Sustainability in the projects.

Key figures Northland Power [6]*:

-P/E 2022: 10.7

-P/E 2023e: 24.6

-P/E 2024e: 18.6

-P/E 2025e: 25.4

-PEG 2023e (P/E ratio/growth rate*): = 6.15 (rule of thumb: < 1 = very favorable)

-PEG 2024e: = 4.65

-Price to book 2023e: 2.25

-Price to book 2024e: 2.13

-FCF margin 2023e: 15.6%

-FCF margin 2024e: 16.1%

-Enterprise value to FCF 2023e: 34.5

-Sales growth: 2023e: -10.2%; 2024e: 4.7%; 2025e: -1.4%

-EBIT growth: 2023e: -20.6%; 2024e: 4.3%; 2025e: -1.7%

-Dividend yield 2022: 4.97% (payout ratio of the last 3 years at 83%)

Country key figures for Australia, NZ and Canada [9]:

-Total P/E ratio (excluding banking sector/financials): 11.64

-Growth (without banking sector/financials): 11.99%

-P/E Power (power generation): 18.72

-PEG Power (power generation): 1.18 (growth next 5 years 9.6%)

-Inflation Canada (forecast for 2023): 3.9% [10]

-Prime rate: 5% [11]

-Government debt: 66.4% of GDP [12]

-->Growth rate Northland*:

Based on Northland Power's general and sector-specific data and sales and EBIT forecasts, I assume average growth of 4% p.a. Northland is growing slower than the market! 4% is even too high from a short-term perspective.

Side note: Based on the valuation ratios, we could have an attractively valued market (Australia, NZ and Canada)!

Given the growth prospects, I don't see Northland as cheaply valued. I would rather put it in the "moderately valued" range.

Traderfox Scores [16]:

Quality Check: 13 out of 15 points

Dividend Check: 9 out of 15 points

Growth Check: 5 out of 15 points

Category - What would Buffet say (Data from the Annual Report 2022 [7]):

Criteria to read in detail:

https://app.getquin.com/activity/XcuRrJwmyP

Income Statement:

-Net margin: 2022: 39%, 2021: 12.89%*, 2020: 23.54% -->positive! (Buffet's target: >20%)

*In 2021 operating costs and depreciation and amortization quite high in relation to comparative periods.

-Gross margin: 2022: 88.9%, --> positive! (Buffets target: at least 40%)

-Selling/administrative and other overheads: 3.4% of sales --> positive! (Buffet's target: max. 30-40%)

-Interest expense: 30.78% of operating profit -->negative! (Buffet's target: <15%) Per HJA 2023 leicht rückläufig.

Key Note Income Statement: Gute Margen und geringe operative Kosten. Zinsaufwand etwas zu hoch!

Balance Sheet:

-Eigene Aktien (Treasury Shares): Nein! -->negative (no shareholder value through buybacks)!

Debt < 4xEBIT: Ja! →positiv!

-Verhältnis kurzfr. Fremdkapital zu kurzfr. Vermögen: 0,81 -->positive! Ideally <1 -->The cash position alone covers 68%. This means that 68% of current liabilities could be paid off immediately!

-Equity ratio: 33.2% (2022)->in order. But the target should be at least 40%.

-Yield on equity: 18.84% →positive (>15%)!

-Goodwill: 5% of total assets and 15% of equity -->reassuring and therefore no cause for concern! For further details on goodwill:

https://app.getquin.com/activity/ymidZwhlTk

Key note balance sheet: Solid debt situation with sufficient cash and therefore flexibility.

Cash flow statement:

2021 (previous year) in brackets, figures in CAD (in thousands):

Operating cash flow 1,832,983 (1,609,295)

-Cash flow from investing activities -629,683 (-1,030,863)

=Free cash flow 1,203,300 (578,432)

-Cash flow from financing activities -604,837 (-225,679) -->Main components are debt repayments and dividends paid.

Investments: 76% of net profit (Buffet's target: <50%) -->negative! However, this is understandable given the investment-intensive nature of the business. I therefore do not see this quite so critically.

Company classification according to Peter Lynch [12]:

-->Slow Grower (2-3%) or Stalwart (5%, max. 12%)

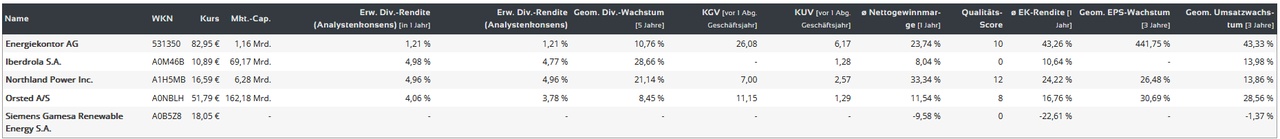

Peer group/competition [5]:

Here I have taken the liberty of using the Traderfox Peer Group Check. Attached is a picture with a few relevant comparative figures of selected companies. Northland performs quite well (good net margin, fair P/E ratio):

Crescent Point Energy Corp (CA) P/E 4.37 -->but focus on oil+gas

Iberdrola (ESP): P/E ratio 16.52

Orsted (DK): P/E ratio 11.49

Energiekontor (DE): P/E 16.52 -->Whereby Energiekontor does not exclusively operate wind farms itself but resells them to producers and is therefore a potential business partner of Northland.

Siemens Gamesa (ESP): P/E ratio negative!

RWE (DE): P/E RATIO 9.32

EnBW (DE): P/E ratio 13.11

You can find my own analyses of Iberdrola and Energiekontor here:

https://app.getquin.com/activity/vXGiuLuFAK

https://app.getquin.com/activity/vrtMBgZQJu

Competitive Advantage/Burggraben:

-Over 30 years of experience in the renewable energy sector. +

-Focus on business partners with good creditworthiness. +

-Good margins, especially for an investment-intensive company. ++

Risks/Weaknesses:

-Impairment risk -

Similar to Orsted, there is a short-term risk of impairment. See the following article:

Due to the low goodwill, however, I am reasonably reassured, even if wind farms are of course recognized as the main item in fixed assets. There is still a risk here.

-Dependence on wind conditions

This is accompanied by sales/profit fluctuations, which can also be seen from the last half-year figures:

https://www.ecoreporter.de/artikel/nortland-power-wenig-wind-l%C3%A4sst-umsatz-und-gewinn-sinken/

--Low growth, compared to the industry. --

Chart:

Northland has been in a steady downward trend for over a year. This looks anything but pretty and is also reflected in a low P/E ratio. It could well be that impairment risks and low growth compared to the market as a whole are playing a major role and that short-term confidence has been lost somewhat as a result.

Analyst estimates [15]:

Buy: 6

Add: 9

Hold: 0

Reduce: 0

Sell: 0

Conclusion:

Nortland Power is a well-positioned company with a good margin. The low growth is particularly disturbing, which is why I do not expect a favorable valuation. Nevertheless, there is still a good dividend yield (therefore possibly something for @Simpson or @GoDividend 😁). An initial entry could soon become interesting, although you should first invest with a smaller tranche in order to be able to buy more if the price falls.

Let's come back to Northland's strategic goals. Will these be achieved?

A. Secure and predictable cash flows: As an electricity supplier, solid and predictable cash flows will certainly be generated. Especially as a slow grower (Peter Lynch), these should also be predictable! However, due to the rather one-sided focus on wind power, the company is also somewhat one-sidedly diversified and dependent on wind. There is certainly still some potential here if you want to position yourself even more broadly for the future.

B. Shareholder value: Certainly given by the dividend. Share buybacks could certainly be considered in order to bring about some price stability. The share price performance is currently anything but good for shareholders. I also see the problem here in the lack of diversification in the business areas and the poor news situation.

C. Good/sensible strategic orientation: See point A. I still see potential for improvement! The good margins could be used more sensibly and aggressively! Investments in Asia are already in the early stages. So a first step has been taken.

D. Sustainability in the projects: Certainly given. Investments are made primarily in Asian and European countries with sustainable projects (wind power / PV). However, I believe that a little more could be done. As an electricity supplier with a green focus, the company is still too dependent on the gas business, even if the main revenue driver is wind farms. A "NetZero" target for climate neutrality has been announced. However, my subjective perception is that this could progress faster than communicated, as there is already a strong focus on wind.

Net Zero Target - Scope 1, 2 and 3

"As part of the Company's purpose to help build a carbon free world, it is establishing a net zero initiative that aims to achieve zero emissions across its operations by 2040. Efforts will focus on reducing GHG emissions intensity from Scope 1 & 2 by 65% by 2030 (from a 2019 baseline) while targeting a science-aligned net zero over all emissions scopes by 2040. "

Perhaps the strategy is also somewhat reflected in the Canadian government's climate policy. CO2 emissions per capita in Canada are 14.3 (Germany: 8.1). Greenhouse gases from oil and gas account for 28.2% of total emissions, which is quite high [14]. So there is still potential!

As always, no investment advice!

At the request of @Malte123

@RealMrKrabs

I hope you enjoyed it 😊

For further analysis take a look here:

Sources:

[1]

https://www.northlandpower.com/en/investor-centre/investor-fact-sheet.aspx

[2]

https://www.northlandpower.com/en/about-northland/about-northland.aspx

[3]

https://www.northlandpower.com/en/about-northland/corporate-strategy.aspx

[4]

[5]

[6]

https://de.marketscreener.com/kurs/aktie/NORTHLAND-POWER-INC-1411045/fundamentals/

[7]

https://www.northlandpower.com/en/resources/Corporate%20Reports/NPI-2022-Annual-Report-FINAL.pdf

[8]

[9]

https://pages.stern.nyu.edu/~adamodar/New_Home_Page/datacurrent.html

[10]

https://de.statista.com/statistik/daten/studie/170383/umfrage/inflationsrate-in-kanada/

[11] https://www.ceicdata.com/de/indicator/canada/policy-rate

[12]

https://www.ceicdata.com/de/indicator/canada/government-debt--of-nominal-gdp

[13]

https://strategyinvest.de/6-typen-von-aktien-nach-peter-lynch/

[14]

https://www.gtai.de/de/trade/kanada/specials/kanada-volle-kraft-fuer-den-klimaschutz-795782

[15] https://de.marketscreener.com/kurs/aktie/NORTHLAND-POWER-INC-15914416/analystenerwartungen/

[16]

https://aktie.traderfox.com/visualizations/CA6665111002/EI/northland-power-inc

Graphics:

Facility and Office types:

https://www.northlandpower.com/en/resources/Corporate%20Reports/NPI-2022-Annual-Report-FINAL.pdf

Company homepage:

https://www.northlandpower.com/en/index.aspx