🧾 Balance sheet analysis Goodwill 🧾

Tonight I decided without further ado to start a series on balance sheet analysis. Every now and then, I will therefore point out facts that are very important in balance sheet analysis and thus in the fundamental valuation of a company. I would like to start with the following balance sheet item:

GOODWILL

Goodwill is defined as follows:

"Goodwill is the amount that a buyer is willing to pay to acquire a business as a whole, taking into account future earnings expectations (enterprise value, capitalized earnings value), over and above the value of the individual assets after deducting liabilities (net asset value) (enterprise surplus value)." [1]

In short, the value I am willing to pay extra because I think the company will be worth more in the future than what is on the books. This "premium" must be accounted for. The counterpart is the so-called badwill. Goodwill can be found under intangible assets in the balance sheet.

But why is goodwill so important for balance sheet analysis?

Companies that make an extremely large number of acquisitions inevitably have a lot of goodwill on their books. When valuing acquisitions, one logically assumes that they will generate "value" and thus increase the company's value in the long term. But this is not always the case. There are two points to bear in mind when goodwill is high:

1) Companies that make a lot of acquisitions could also be maliciously assumed to no longer grow organically. They are therefore dependent on acquisitions.

2) If the acquisition does not work out and yields less than expected, there is a risk that the goodwill will also be written off. In the end, you have paid too much for the purchase. An annual impairment test determines the recoverability of the goodwill. A high proportion of goodwill in the balance sheet therefore always carries the risk of high write-downs, which has a direct impact on the company's profit. In the worst case, this could even result in corporate losses. Particularly in corona times, there is a great danger of goodwill write-offs. Auditors are paying particular attention to this (believe me).

Do I therefore want companies with high goodwill? Definitely no! There must be very good reasons why a high goodwill share is justified. Otherwise, it also carries a high risk.

The latest example could be the takeover of Activision Blizzard by Microsoft. The takeover will take some time, but there will be goodwill there as well. Fortunately, Microsoft has so many assets that goodwill won't be a huge portion. Not to mention that I think the acquisition is strategically sound.

But don't just look at the "quick wins" like P/E, CUV, KCV, PEG, etc. in your analysis. Really look at the balance sheet and take the company apart from top to bottom. I would like to give you a first clue with the goodwill.

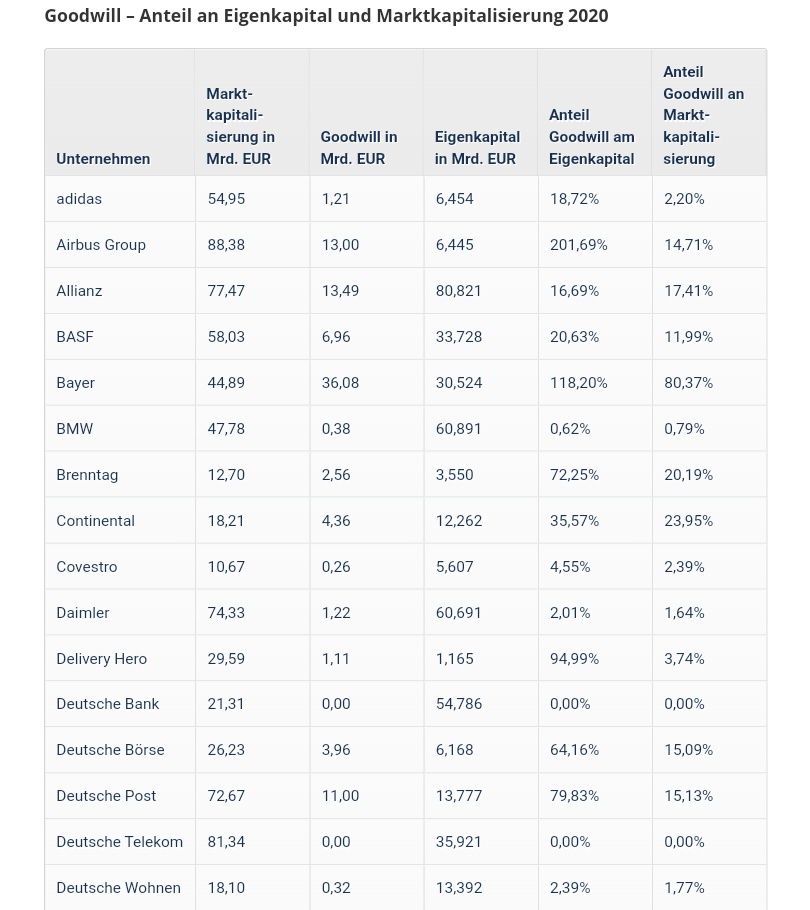

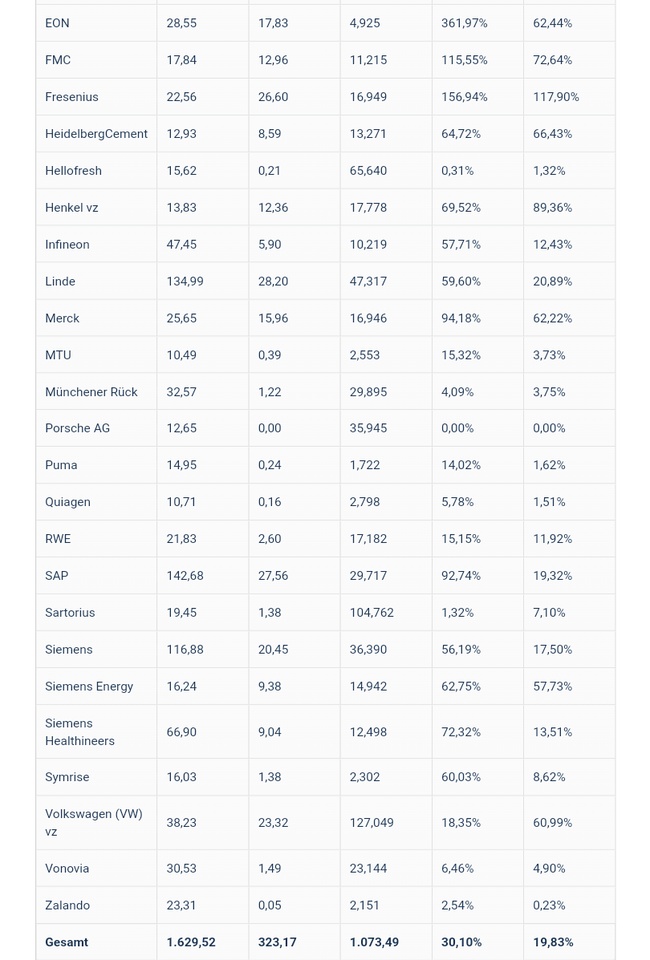

The picture [2] below shows an overview of the DAX 40 companies and their respective goodwill share. I find the goodwill share of Bayer or Fresenius really gruesome 🙈

Finally, I would like to briefly explain the motivation for this "excursus": The excursus is aimed at all those who have little or no idea how to read balance sheets correctly. I would therefore like to give you short, important tools that I have used in my job and previously learned in my studies. I hope you like it! 😊 Except for the quote and picture own thoughts/experience.

Sources:

[1] https://wirtschaftslexikon.gabler.de/definition/firmenwert-36857

[2] https://www.brokervergleich.de/wissen/expertisen/goodwill-bei-dax-unternehmen/