---𝐀𝐤𝐭𝐢𝐞𝐧𝐯𝐨𝐫𝐬𝐭𝐞𝐥𝐥𝐮𝐧𝐠---

Finally I managed to keep my promise. The following stock was voted number 1 in the last poll. So here it is:

Iberdrola S.A.

ES0144590Y14

Iberdrola is one of the largest energy suppliers within Europe. Its core businesses include the generation, transmission, distribution and marketing of electricity and natural gas.

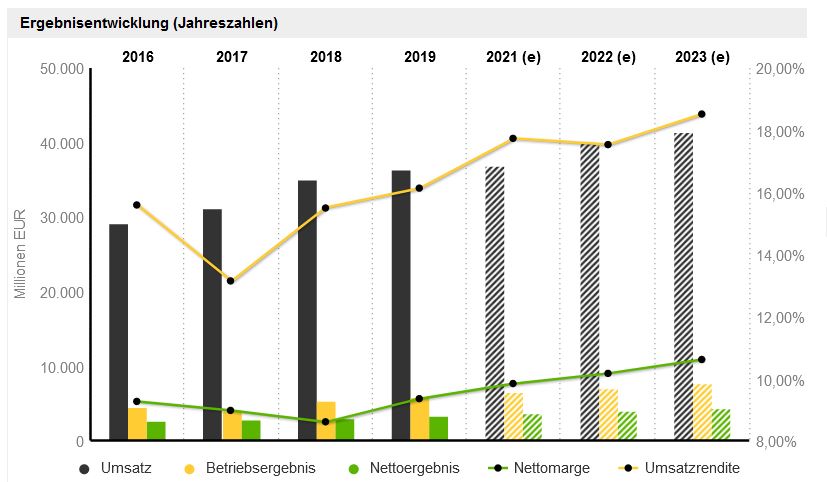

Key Figures [1] [4]:

P/E RATIO 2021: 16.4

P/E ratio 2022e: 14.7

Goodwill/Total Assets: 6.2% (for an understanding of goodwill, see: https://app.getquin.com/activity/ymidZwhlTk)

Debt/EBITDA ratio 2021: 3.66

ROE 2021: 9.26

Gross margin: 48.7%

EBITDA margin: 30.2%

Net margin: 10.89

Dividend yield 2021: 4.64%

What Iberdrola itself says [2]:

"With over 170 years of history behind us, Iberdrola is now a global energy leader, the number one producer of wind power, and one of the world's biggest electricity utilities in terms of market capitalization. We have brought the energy transition forward two decades to combat climate change and provide a clean, reliable and smart business model."

"The IBERDROLA Group continues to pursue its strategy in the different markets where it operates. It has a EUR 75,000 million investment plan until 2025 to continue leading the transition towards climate neutrality, focusing on renewable energies, electricity grids, storage, sustainable mobility and new industrial vectors such as green hydrogen."

Sales are divided into the following segments [1] [5]:

-Generation & Supply: 18,305.2

-Regulated (including power grid concessions/regulated area): 12.899,9

-Renewables: 4,160.8

-Other Businesses (captive supply and gas storage): 106.8

Revenue regions [1]:

-Spain

-UK

-USA

-Portugal

-Mexico

-Brazil

It is the regions that make Iberdrola quite exciting. They have emerging markets in their portfolio as well as established industrialized countries. Since the price of electricity also tends to fluctuate, this is a sensible diversification. If the electricity price is low in one region, it can be absorbed by other regions. Since Iberdola is not only a supplier but also produces electricity (e.g. through wind power plants in the UK or on the coast of Spain, hydropower, PV, gas, etc.), they are one of the beneficiaries of the increased electricity price. This allows them to sell the electricity they produce, which they themselves do not need for supply, at high prices on the electricity exchange. This, of course, drives sales. Utilities that do not have their own production are negatively affected by the rising prices. In Germany, for example, various low-cost electricity providers are going bankrupt as a result. In the network sector, the EMs in particular will be interesting for growth in the future. However, there are also risks at Iberdrola, as power generation is also dependent on the weather. If, for example, the wind does not blow as strongly, there is less electricity to produce or sell.

Iberdrola is currently investing heavily in renewable energies. The investment program should lead to almost double-digit profit growth in the next 5 years. Green hydrogen also plays a role. However, Iberdrola was not as hyped as one or the other "cheap hydrogen joint" in 2020. Currently, the largest complex is being built in Spain to decarbonize the production of ammonia for fertilizer, using hydrogen. [3] This is of course not as fancy as a hydrogen powered truck or similar ;)

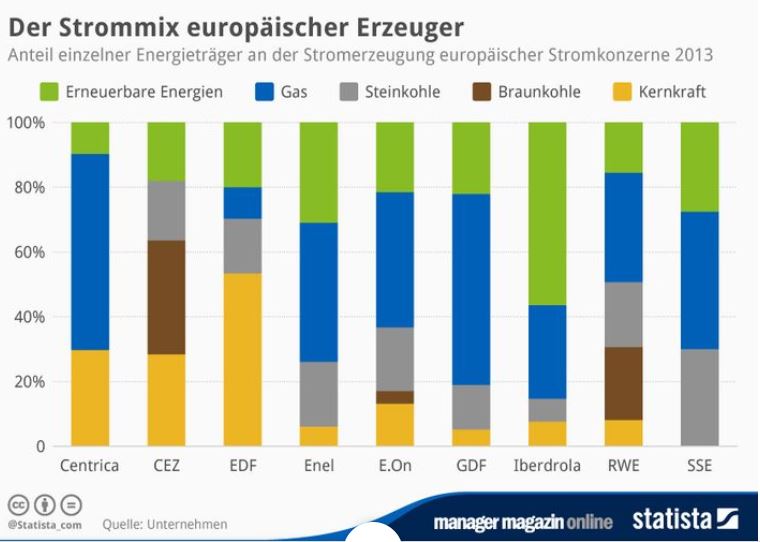

In addition, Iberdrola was already stronger than the competition in the field of renewable energies in their Stommix years ago. This is to their advantage now. See also the picture below about the electricity mix. [6]

Iberdrola has no concrete competitive advantage over other utilities. However, they are one of the market leaders in Spain and are positioned worldwide, which gives them a certain market power.

Competition:

-RWE

-EDF

-Enel

-Endesa

-Naturgy

-etc.

Iberdrola has a rich dividend yield and promises moderate growth to boot. I am therefore bullish for the long term. The price gives a lot of fantasy and the dividend already represents a good basis (very long dividend history). Nevertheless, the energy sector is not an easy market, which, however, will benefit solely due to future demand (climate change, generally increasing energy demand due to digitalization).

I hope you liked it :)

Disclaimer: I am invested myself.

No investment advice!

[2] https://www.iberdrola.com/about-us

[4] https://de.marketscreener.com/kurs/aktie/IBERDROLA-S-A-695457/fundamentals/

[5] https://de.statista.com/statistik/daten/studie/165371/umfrage/umsatz-von-iberdrola-nach-regionen/