In August 2024, I became aware of $SGMO (-0,88 %) came to my attention. At the time, it was more of a coincidence than a plan - a short article about gene regulation, zinc finger technology and the idea of not just treating diseases, but tackling their genetic cause. I thought: "Sounds too good to be true." 🤩

I started small - a learning position, a bit of play money. But the more I got involved with the company, the stronger my conviction became. Sangamo took me on a rollercoaster ride - with all its ups and downs: from the shock of Pfizer's Pfizer's withdrawalwithdrawal, the share dilution,

to the recent positive news from the pipeline.

At the time, this was one of my first stock position ever - I had only started investing a few months earlier. In the beginning, it was pure learning: understanding price movements, reducing buy-ins, trying out trading apps and chart tools such as Investing.com and TradingView - and, to be honest, feeling real emotions on the stock market for the first time. And things went really well: in the late summer of 2024, the share price soared - at times I was up over 80% at times. 🤑

I took profits, bought more, sold again, almost traded. It was exciting, instructive and motivating at the same time.

But then came the damper: Pfizer's withdrawal. The share price plummeted 📉 - and with it my portfolio. I did more research, delved deeper into the company and began to understand why I was invested in the first place: not because of short-term profits, but because of the technology behind it.

Nevertheless, it wasn't easy 🫣 This year there was another setback - I was down I was down around 40 % in the meantime. I sold part of it during the free fall to reduce the risk and bought more at the bottom. Looking back today, this may not have been necessary as the price has largely recovered again - depending on the day, I'm back at around 0 or slightly up, depending on the day.

A bruise remains, but I got out in one piece. Despite all the setbacks, I never gave up. I learned to distinguish between price movements and the substance of the company. And that was precisely the turning point: I realized that Sangamo is more than just a "penny stock in a fight for survival". It is a biotech company with over 25 years of researchwith patents, strong partners and a pipeline that - despite all the setbacks - could set technological standards.

🔶 The pipeline - six programs, one common goal

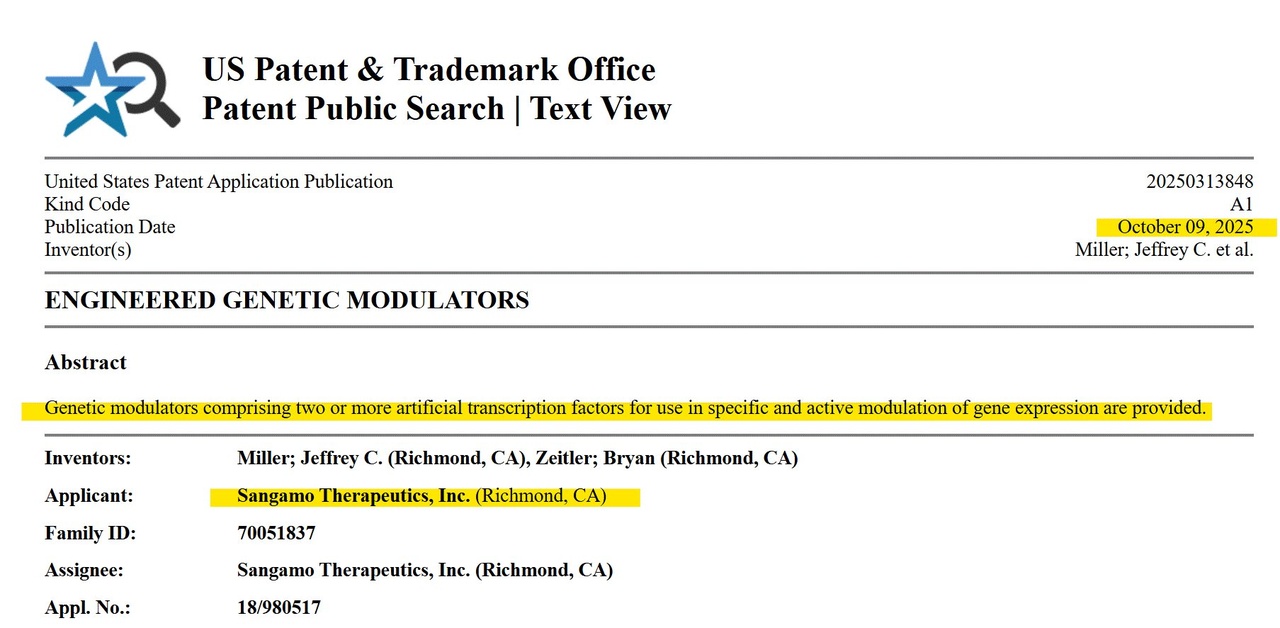

What many underestimate: $SGMO (-0,88 %) is not a pure "gene therapy player". They are pioneers of zinc finger technology (ZFN) - a highly precise form of gene control that has made enormous progress in recent years. And this technology runs like a common thread through their entire pipeline.

(Sangamo's program, as of October 2025, Sangamo website)

1️⃣ Fabry disease (ST-920 / Isaralgagene civaparvovec)

Brief characterization:

ST-920 is an AAV-based gene therapythat targets the missing enzyme α-galactosidase A permanently in the liver - with the aim of enabling Fabry patients to lead a normal life without lifelong enzyme infusions.

Disease & market potential:

Fabry is a rare lysosomal storage disease in which a defect in the GLA gene prevents certain fatty substances from being broken down. These are deposited in blood vessels and organs - sometimes with life-threatening consequences. The global market for Fabry therapies is currently worth over 2 billion USD annually, dominated by expensive enzyme replacement preparations that have to be administered intravenously every two weeks.

Mechanism of action:

ST-920 utilizes an AAV2/6 vectorwhich turns the body itself into a production site for the missing enzyme. After a single infusion, the liver takes over the permanent expression of the GLA gene - patients therefore produce their own enzyme.

Current status:

The program is currently in phase 1/2 ("STAAR") - with excellent interim results.

- All treated patients show stable α-Gal-A levels over 24 months +

- Several were able to discontinue enzyme replacement therapy completely

- No serious side effects

- Improved quality of life and kidney values

Approval & timeline:

Sangamo is planning the marketing authorization applications (BLA/MAA) in the course of end of 2025 / beginning of 2026. FDA feedback has been positive and discussions with potential partners are already underway.

Outlook:

For me, Fabry is the crown jewel in Sangamo's pipeline. A first-in-class approach that could turn a lifelong ERT into a potentially once-in-a-lifetime cure. If approved, it would not only be a medical milestone - but a strategic turning point for Sangamo. strategic turning point for Sangamo.

2️⃣ Neuropathic pain therapy (ST-503 - zinc finger gene regulation)

Brief characterization:

A preclinical pain programthat $SGMO (-0,88 %) first made public in early 2024. The aim: to permanently block chronic, neuropathic pain at its source - without without opioids.

Disease & market potential:

In the USA alone, over 20 million people suffer from chronic neuropathic pain. Current medications are symptomatic and risky - keyword opioid crisis . A one-time intervention with a lasting effect would be revolutionary.

Mechanism of action:

ST-503 utilizes Sangamo's zinc finger gene regulators (ZFP-TFRs)to specifically dampen pain receptors in the spinal cord - in particular the expression of the SCN9A genewhich is responsible for the transmission of pain impulses. Unlike CRISPR, ZFP does not cut, but regulates - reversibly and controllably! reversible and controllable!

Current status:

- Preclinical studies in animal models show over 80 % pain reduction with stable motor function.

- No neurotoxic effects.

- IND submission to the FDA: Completed - approval for clinical phase 1/2 granted (2025).

- The Phase 1/2 study ("STAND") was started in summer 2025 - the first study center has been initiated, the first patient dosing is expected in autumn 2025.

Outlook:

The program has enormous potential - not only medically, but also economically. If it is clinically successful, ST-503 could become a billion-dollar game changer. I see the program as a second wave of growth after Fabry.

3️⃣ Hemophilia A (SB-525 / Giroctocogene fitelparvovec)

Brief characterization:

A gene therapy program that compensates for the absence of factor VIII - the defect that causes hemophilia A - with the aim of: Drastically reduce bleeding and replace prophylaxis.

Disease & market potential:

Hemophilia A is a rare blood clotting disorder caused by mutations in the F8 gene, resulting in a deficiency of clotting factor VIII (FVIII), a protein required for normal blood clotting. The disease affects an average of 1 in 7,500 male newborns. Patients must receive expensive factor infusions for the rest of their lives (annual therapy costs: up to 500,000 USD per person).

Mechanism of action:

A functional copy of the FVIII gene is delivered to the liver via the AAV vector. The body then continuously produces factor VIII - a potentially permanent solution.

Current status:

Following very positive phase 3 results from the AFFINE study (2024) - with stable factor VIII levels and greatly reduced bleeding rates - Pfizer ended the Pfizer surprisingly ended the partnership and handed back all rights to Sangamo. The official statement was: "strategic realignment". Unofficially, cost and portfolio decisions are likely to have played a role.

Approval & Timeline:

Sangamo is currently evaluating the best path for its own BLA submission or a new partnership. The data is clinically strong - it was not a scientific failure, but a strategic break.

Outlook:

For me, the program is emblematic of Sangamo's resilience. Despite setbacks, they remain owners of a therapy that works clinically - and with the right partner, haemophilia A could come back into the limelight.

4️⃣ ST-506 - Prion diseases (e.g. Creutzfeldt-Jakob)

Brief characterization:

A preclinical ZFN programthat targets the silenced expression of the prion protein (PRNP) is targeted.

Disease & market potential:

Prion diseases are fatal neurodegenerative diseases without any therapy. Here, too, there is a potential market worth billions - should an active substance ever be approved.

Mechanism of action:

ST-506 suppresses the formation of pathogenic prion proteins through targeted "gene silencing mechanisms" - a kind of molecular "off button".

Current status:

- Preclinical data show > 70 % reduction of PrP expression in animal models.

- No neurological side effects observed.

- IND submission planned for early 2026.

Outlook:

Still early, but promising. Should ST-506 enter the clinic, it would be $SGMO (-0,88 %) be one of the first companies worldwide to develop a preventive gene therapy against prion diseases. against prion diseases.

5️⃣ Genentech programs - Tauopathies (+ 1 undisclosed target)

Brief characterization:

One of the most important partnerships of $SGMO (-0,88 %): together with Genentech (Roche) the company develops zinc finger-based gene regulatorswhich are designed to specifically downregulate pathological tau proteins in the brain - an innovative approach to combat neurodegenerative diseases such as Alzheimer's and frontotemporal dementia (FTD).

Disease & market potential:

Tauopathies are among the greatest medical challenges of our time. Alzheimer's alone affects more than 50 million people - and the trend is rising. By 2030, the market for new Alzheimer's therapies could be worth a three-digit billion euro volume by 2030. A mechanism of action that permanently reduces the pathological tau protein would be a real breakthrough.

Mechanism of action:

The ZFP repressors developed by Sangamo ZFP repressors target the MAPT genegene, which is responsible for the tau protein. Precise gene repression permanently reduces tau production in the brain. The following serve as transport vehicles new STAC-BBB capsidsthat cross the blood-brain barrier efficiently - a key advantage over previous gene therapies.

Current status:

- The program is currently in the preclinical preclinical development phase at Genentech.

- In animal and NHP models a a deep, sustained reduction of the tau protein has been demonstrated.

- Both partners are preparing the candidate nomination and IND submission. submission.

- All clinical decisions (e.g. start date) are made by Genentech.

Outlook:

For me, this is a real blue chip validation. As soon as Genentech has clinical initiation (IND) it would be a strong external confidence signal for Sangamo's technology platform - and a potential trigger for a re-rating of the company. trigger for a revaluation of the company.

6️⃣ Capsid partnerships - Astellas & Eli Lilly

Brief Characterization:

In addition to Genentech has $SGMO (-0,88 %) also with Astellas Gene Therapies and Eli Lilly strategic agreements. Both utilize Sangamo's STAC-BBB capsid technologyto develop proprietary gene therapy programs for diseases of the central nervous system (CNS).

Disease & market potential:

The range of potential applications is enormous - from rare neurodegenerative diseases to common CNS indications such as Parkinson's, ALS or multiple sclerosis. The market for CNS gene therapies alone is expected to reach over 20 billion USD by 2032.

Mechanism of action:

The STAC-BBB capsules from Sangamo are specially designed to genes efficiently across the blood-brain barrier. barrier. This technology could make gene therapies possible for the first time, reach broad areas of the brain evenly for the first time - a key innovation for many neurological diseases.

Current status:

- Both partnerships are currently in the discovery discovery or preclinical phase.

- Each partner can develop up to five CNS targets licensed.

- First target nominations have been made, clinical INDs are still pending.

- For Sangamo, these contracts mean upfront payments, milestone potential and future royaltieswithout having to bear its own development costs.

Outlook:

For me, these collaborations are silent but powerful value drivers. They bring validation by global pharmaceutical companies and at the same time non-dilutive financing opportunities. With each advance at Astellas or Lilly, the value of value of Sangamo's platform - without any additional burn rate.

🔶 Previous / paused programs (brief overview):

TX200 - CAR-Tregs for transplants:

A world-first CAR-Treg programprogram, which was launched after kidney transplants rejection reactions after kidney transplants - through specifically "reprogrammed" regulatory T cells that tolerate the new organ tolerate the new organ instead of fighting it. The program has been started clinically, but is currently deprioritizedto concentrate resources on priority projects. Re-activation would be dependent on capital or partnersbut remains scientifically highly relevant.

BIVV-003 - sickle cell anemia (ex vivo ZFN editing):

An early approach to reactivation of the fetal hemoglobin (HbF) through precise zinc finger gene editing in stem cells - comparable to the approved CRISPR therapy Exa-celbut with potentially greater controllability and safety. The program is currently on hold due to strategic priorities, but could be restarted with a new new partner or fresh capital revived - especially as the approach has been regulatory validated and remains clinically promising.

🔶 Competition & differentiation - why Sangamo is more than "just another biotech" for me

Of course: Sangamo is not alone in the field. The field of gene and cell therapy is highly competitive - with heavyweights such as CRISPR Therapeutics, Intellia Therapeutics, Editas Medicine, Beam Therapeutics, BioMarin, 4D Molecular Therapeutics, uniQure and Spark Therapeutics (Roche). These names are big, they have full coffers, media attention and, in some cases, market-ready products. But size does not automatically mean superiority - especially not in science.

While many of these companies rely on CRISPR-based systems - i.e. the well-known "gene scissors" that permanently modify DNA $SGMO (-0,88 %) takes a different, more elegant approach with its Zinc Finger Platform (ZFP): instead of cutting, they regulate genes - precisely, reversibly and controllably.

Especially in the nervous system, where any risk can be too much, this is a decisive advantage for me. No irreversible intervention, but fine, controllable gene control.

It's quieter, but scientifically much smarter.

Yes, companies like CRISPR Tx or Intellia are currently more financially strong and clinically faster. But Sangamo has done something in the last two years that many large companies avoid: Focus! They have shed ballast, paused projects such as Sickle Cell and TX200 - and instead invested their capital and energy in programs that are scientifically the most advanced and have realistic chances of approval: Fabry, ST-503 (neuropathic pain) and the CNS collaborations with Genentech, Astellas and Lilly.

In the area of Fabry gene therapy, I see $SGMO (-0,88 %) even ahead of the competition. While competitors such as 4D Molecular Therapeutics or uniQure had to struggle with safety issues and unclear efficacy signals, Sangamo delivers stable data, good tolerability and the clear potential to make patients permanently ERT-free.

This is not about hype - this is about data.

And then there is the delivery side, i.e. the question of how to get gene therapies into the brain in the first place.

This is exactly where Sangamo shines. Their STAC-BBB capsid platform manages to transport genetic vectors across the blood-brain barrier - something that many others have failed to do for years.

For me, the fact that Astellas and Eli Lilly have licensed this technology is not a PR message, but a real seal of quality.

When two big pharma companies with budgets in the billions integrate your technology into their own development, that is the clearest form of recognition.

To summarize:

While others seem bigger, louder and faster, to me Sangamo is more precise, focused and scientifically deep.

This is not a classic race for market share, but an example of how an "underdog" can survive in the long term with genuine innovation and perseverance.

In an industry where many promise loudly, Sangamo delivers quietly but solidly - and that's exactly what I like. and that's exactly what I like. 😎

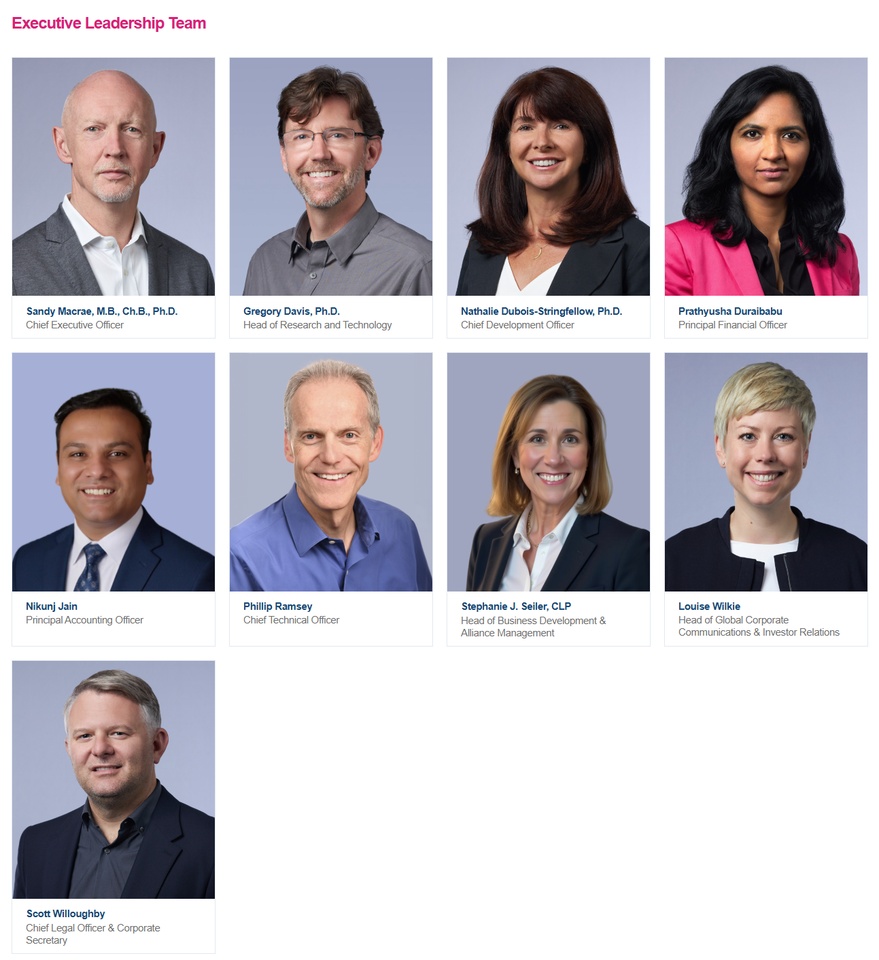

🔶 Leadership - the people behind the strategy

(Leadership team, photos: Sangamo)

Dr. Sandy Macrae (M.B., Ch.B., Ph.D.) - Chief Executive Officer

Physician and molecular biologist, previously with Takeda and GSK. Macrae is considered visionary but detail-oriented. He has $SGMO (-0,88 %) through difficult years, focused the portfolio and established new partnerships (Genentech, Astellas, Lilly) - a CEO who understands research but thinks commercially.

Dr. Gregory Davis - Head of Research and Technology

An experimental molecular biologist specializing in zinc finger technology and AAV vectors. Davis is recognized internally as the engine of the scientific platform - one of those who have $SGMO (-0,88 %) translated research from theory into applicable programs.

Dr. Nathalie Dubois-Stringfellow - Chief Development Officer

Leads preclinical and clinical development. Brings over 20 years of experience from large biopharma companies. Her focus: study quality, regulatory excellence and clinical impact - critical for Fabry, ST-503 and upcoming INDs.

Prathyusha Duraibabu - Principal Financial Officer (until 2025 CFO)

Part of the company since 2017, she has $SGMO (-0,88 %) through one of the most financially challenging phases - calm, disciplined and with a clear focus on stability. On September 9, 2025, she officially announced that she would be stepping down from her CFO position on October 1 to take on a leadership role at a private AI company. Important for me: Her resignation was not due to disagreements or conflicts, but for career reasons. She will remain with Sangamo on a part-time basis and will continue in the role of Principal Financial Officer on an interim basis until a successor is appointed. I see the fact that she has not sold all of her shares as a sign of confidence.

Nikunj Jain - Principal Accounting Officer

Financial expert with a focus on governance, compliance and reporting. His role has become increasingly important as Sangamo focuses more on capital discipline and transparency. In response to the resignation of Prathyusha Duraibabu, the company appointed Nikunj Jain as Principal Accounting Officer with effect from the same date.

Phillip Ramsey - Chief Technical Officer (CTO)

Technology strategist with decades of experience in vector production and manufacturing processes. He is responsible for the technical implementation of the STAC-BBB capsid platform and production scalability - crucial for later commercialization.

Stephanie J. Seiler, CLP - Head of Business Development & Alliance Management

Lawyer specializing in biotech contracts. She coordinates the collaboration with partners such as Genentech, Astellas and Lilly - and ensures that $SGMO (-0,88 %) delivers scientifically and benefits contractually.

Louise Wilkie - Head of Global Corporate Communications & Investor Relations

Communications professional with a clear focus on trust and transparency. She has been noticeably more present in recent months - which I take as a sign that $SGMO (-0,88 %) that the company is once again entering into a stronger dialog with investors.

Scott Willoughby - Chief Legal Officer & Corporate Secretary

Experienced lawyer in the biotech sector, responsible for legal compliance and IP protection. Especially in a company with a high patent value, his role is central - particularly with regard to future partnerships and potential M&A scenarios.

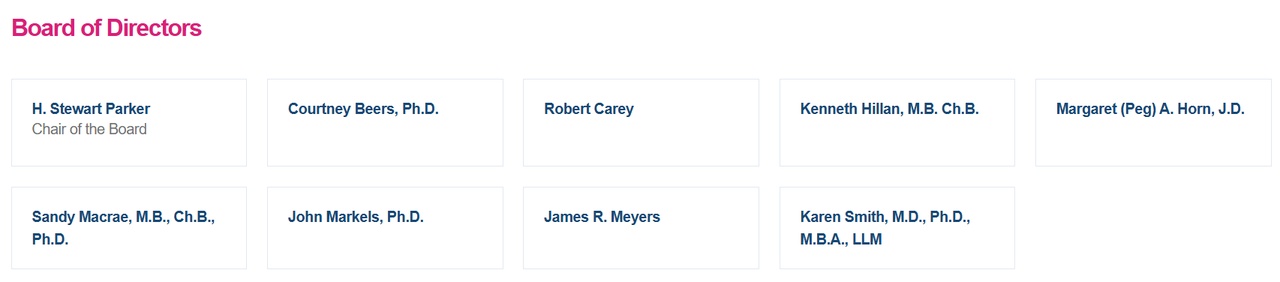

🔶 Board of Directors - experience, focus and backing

(Board of Directors, Sangamo)

The Board of $SGMO (-0,88 %) is not a decorative body, but an experienced group of scientists scientists, entrepreneurs and industry "veterans"who provide strategic support to the company.

H. Stewart ParkerChair of the Board, brings decades of experience in biotech commercialization - she was CEO of Targeted Genetics and is deeply networked in the US biopharma ecosystem. At her side are proven experts such as Courtney Beers, Ph.D.with a background in molecular genetics and translational research, and Robert Careywho, as former CFO of Horizon Therapeutics, bridges the gap between finance and biotechnology.

With Dr. Kenneth Hillanformer CEO of Achaogen and Chief Clinical Officer at Genentech, the Board has a strong medical voice - someone who has first-hand knowledge of regulatory processes and clinical risks. Margaret (Peg) Horn, J.D.adds legal and strategic expertise to the Board; among other things, she was an executive at Eli Lilly and specializes in corporate governance.

Also part of the Board are Dr. John Markelsformer President of Merck Vaccines, and James R. Meyersformer COO of Gilead Sciences - both individuals who know how to translate biotech innovations into marketable products. Karen Smith, M.D., Ph.D., M.B.A., LLMrounds out the Board with over 25 years of experience in global drug development - she has held leadership roles at Jazz Pharma, Allergan and Novo Nordisk.

And finally, of course Dr. Sandy Macraewho is also represented on the Board as CEO - a clear signal that the scientific line and strategic management are closely interlinked.

For me, this Board is not just a supervisory board, but a strategic backbone. strategic backbone. The mixture of clinical experience, operational management history and financial expertise shows: There are no theorists sitting here, but people who have written biotech success stories before. For me, the fact that this very board supports the CEO is a sign of confidence rather than an alarm signal.

🔶 Opportunities and risks - my sober view (as at October 2025)

➕ Strengths

- Fabry with consistently strong data (ERT-free, kidney/lyso-Gb3), good safety profile.

- ZFP platform: regulates instead of cutting - reversible/fine dosage.

- Pipeline breadth + partner breadth (Genentech/Astellas/Lilly).

- External validation through Big Pharma deals.

Weaknesses

- Financing: Runway rough until mid '26; without deals, dilution threatens.

- Dependence on partner timelines (e.g. Tau/Genentech).

- Pfizer withdrawal (2024) weighed on confidence - despite strong data.

- Negative EPS (typical for the sector, but psychologically difficult).

🤑 Opportunities

- Fabry-BLA/MAA at the end of '25/beginning of '26; ideally with partner.

- ST-503 provides initial efficacy → platform re-rating.

- ST-506 as CNS proof of concept (large lever).

- New/allocated partner deals (incl. hemophilia A).

☠️ Risks

- Financing / dilution if non-dilutive cash fails to materialize.

- Regulatory requirements/delays (esp. CNS).

- Sector volatility (small/micro caps).

- Competition (CRISPR Tx/Vertex, BioMarin, Freeline etc.).

📈 Analyst targets

- H.C. Wainwright: Buy, $10 (05.09.2025)

- Barclays: Overweight, $5 (08.08.2025)

- RBC: Sector Perform, $2 (13.05.2025)

- Truist: Buy (19.03.2025, target removed)

🔶 My conclusion

I remain invested 🫡 - not out of stubbornness, but out of conviction. For me $SGMO (-0,88 %) not a game of chance, but a bet on science, on innovation - and on the people who work there every day on the future of medicine.

Of course, I keep a close eye on the crucial points:

▶️ the potential Fabry partnership and the BLA submission,

▶️ the first clinical signals from ST-503,

▶️ the progress with ST-506 (prion) and new impetus from the partnerships with Genentech, Astellas and Lilly.

▶️ Equally important for me is how the financing is handled - whether new deals can be secured without burdening the share portfolio and thus the share price through further dilution.

Perhaps this story will one day be just a footnote in biotech history. Or an example of how patience was rewarded in the end. Whatever the outcome, I was there from the beginning. And that alone is an experience that no course in the world can take away from me. 🌱

🔶 Note:

This article is not investment advice, just my personal view as a private investor. I may be wrong - the market is the better teacher. But anyone who deals with genetics knows: It takes courage, and it takes time. The share is showing the first signs of recovery, but the big breakthrough is yet to come. If you are already invested, like me, you should be patient; if you want to get in, you should do it in stages - bit by bit rather than all at once.