Let's see how strong the tobacco lobby is in European politics 😂

Discussion sur PM

Postes

97Ban on filter cigarettes

Philip Morris increases dividend

$PM (+0,24 %) Philip Morris International will increase its quarterly dividend by around 8.9 % from US$ 1.35 to US$ 1.47. This was decided by the Board of Directors on September 19, 2025. The increased dividend will be paid for the first time on October 20. Philip Morris' next quarterly report will probably be published on October 21.

I love BIG TOBACCO

$BATS (+0,06 %) is my biggest position and I am over the moon. $PM (+0,24 %) It's still going great. Big dividends are trickling into my portfolio for reinvestment.

Cheers to big tobacco and many, many years of shareholder value.

Long live Joe Camel

❌ Why investing in companies like British American Tobacco is ethically unacceptable

British American Tobacco (BAT) is one of the largest tobacco companies in the world - and is emblematic of an industry whose business model is based on addiction, disease and environmental destruction.

Investing in companies like BAT supports a business model based on addiction, disease and environmental destruction. It is high time that ethical criteria were given more weight in the financial world. Capital should not flow where it causes damage - but where it shapes the future.

Philip Morris Q2 2025 Earnings Review

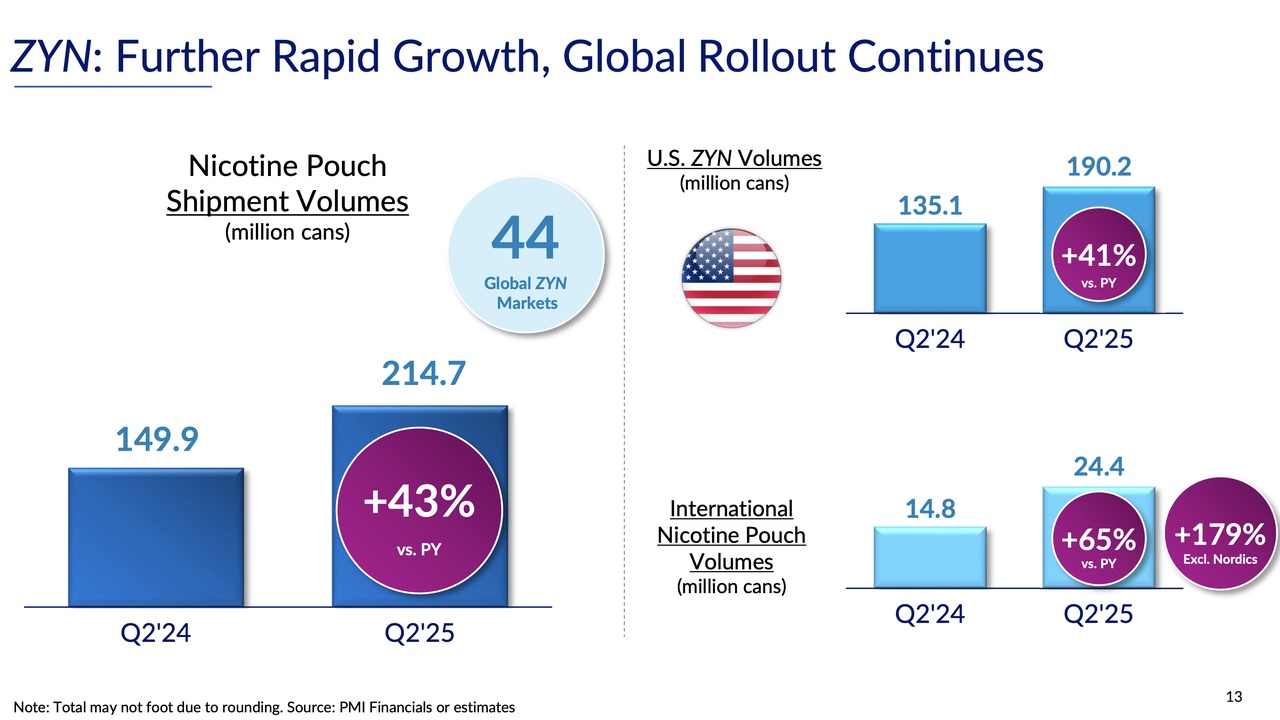

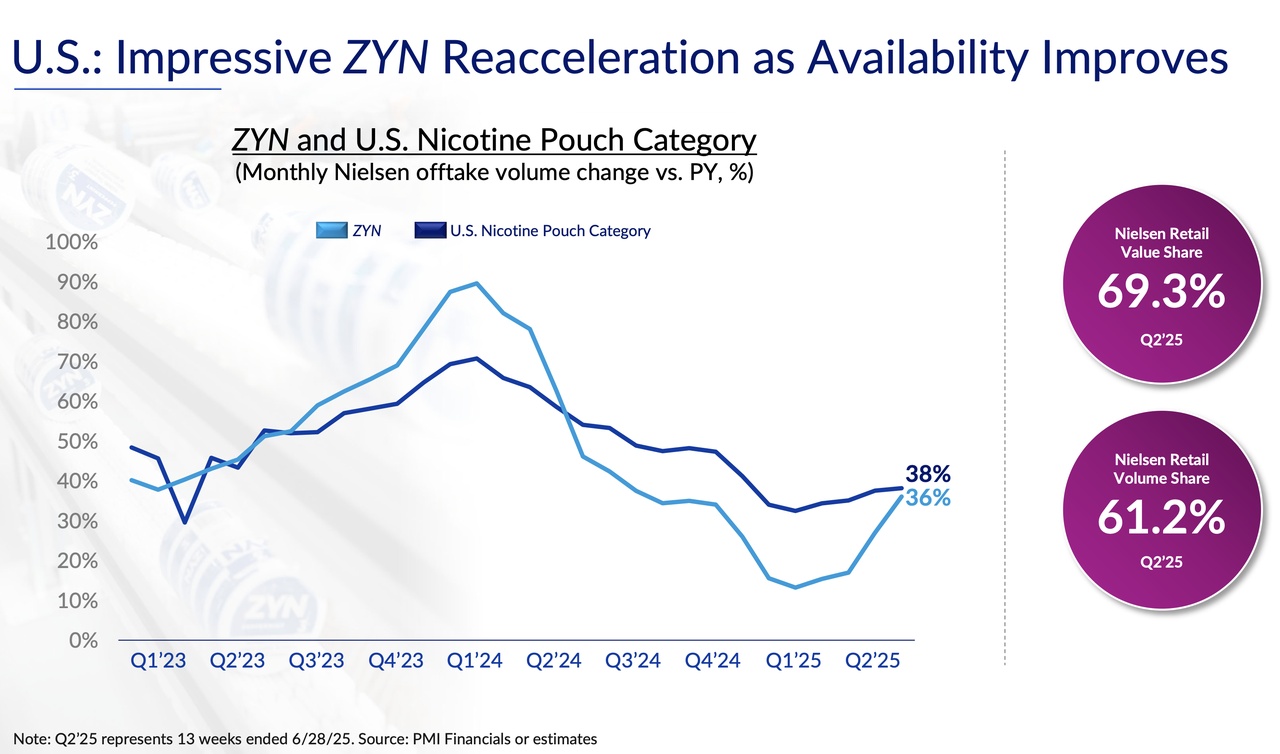

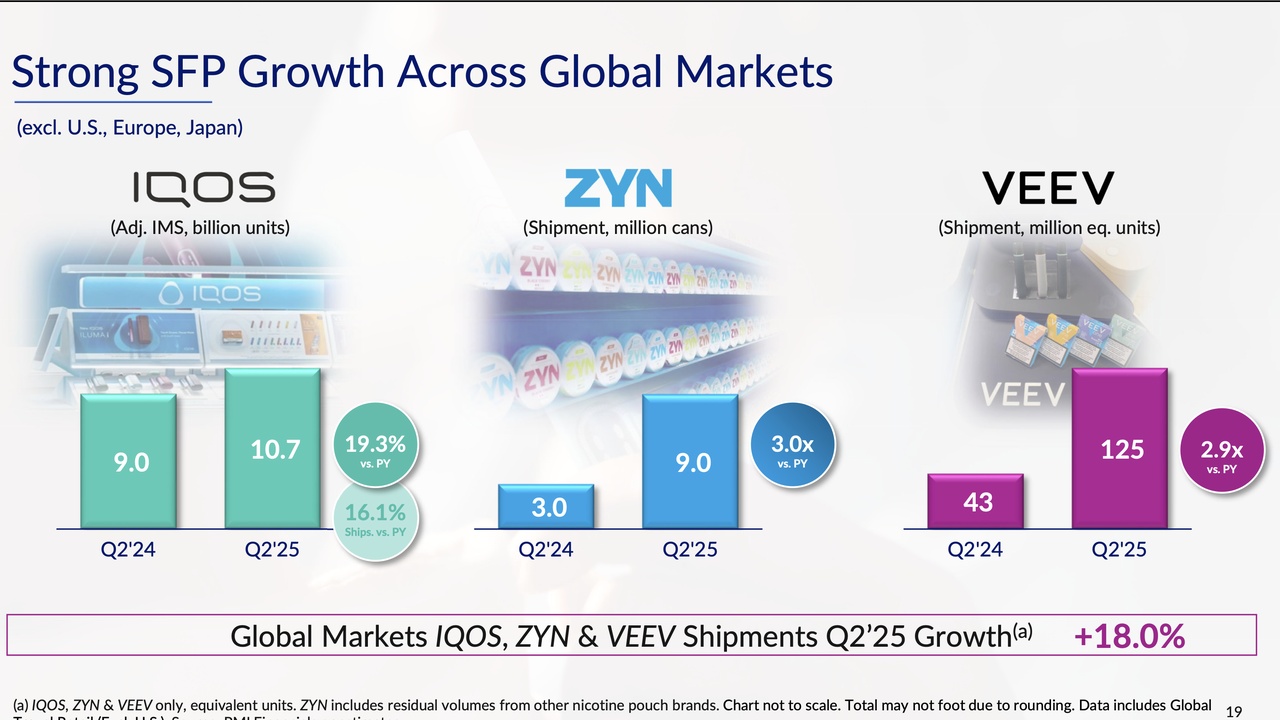

Philip Morris International (PMI) $PM (+0,24 %) published its financial results for the second quarter (Q2) and first six months (YTD) of 2025 on July 22, 2025. $PM (+0,24 %) misses the top line for the first time since Q4 2023. IQOS misses the double digit mark in volume growth. Zyn volume growth is also weaker than in Q1, indicating a decline in volume share.

Pictures will be added later

1. total overview

Volume development

- Q2 2025:

- Total shipment volume200.1 billion units (+1.2%)

- Smoke-free products (SFP)44.8 billion units (+11.8%)

- Heated Tobacco Units (HTU)38.8 billion units (+9.2%), driven by IQOS with adjusted in-market sales (IMS) growth of 11.4%. Strong growth in Japan, Europe and key markets such as Indonesia, Mexico and Saudi Arabia.

- Nicotine pouches (Oral SFP)308.4 million doses (+26.5%), mainly driven by ZYN in the US (+41.6% to 191.3 million doses) and strong international growth (+100% outside the US and Nordics in markets such as Pakistan, South Africa and Poland).

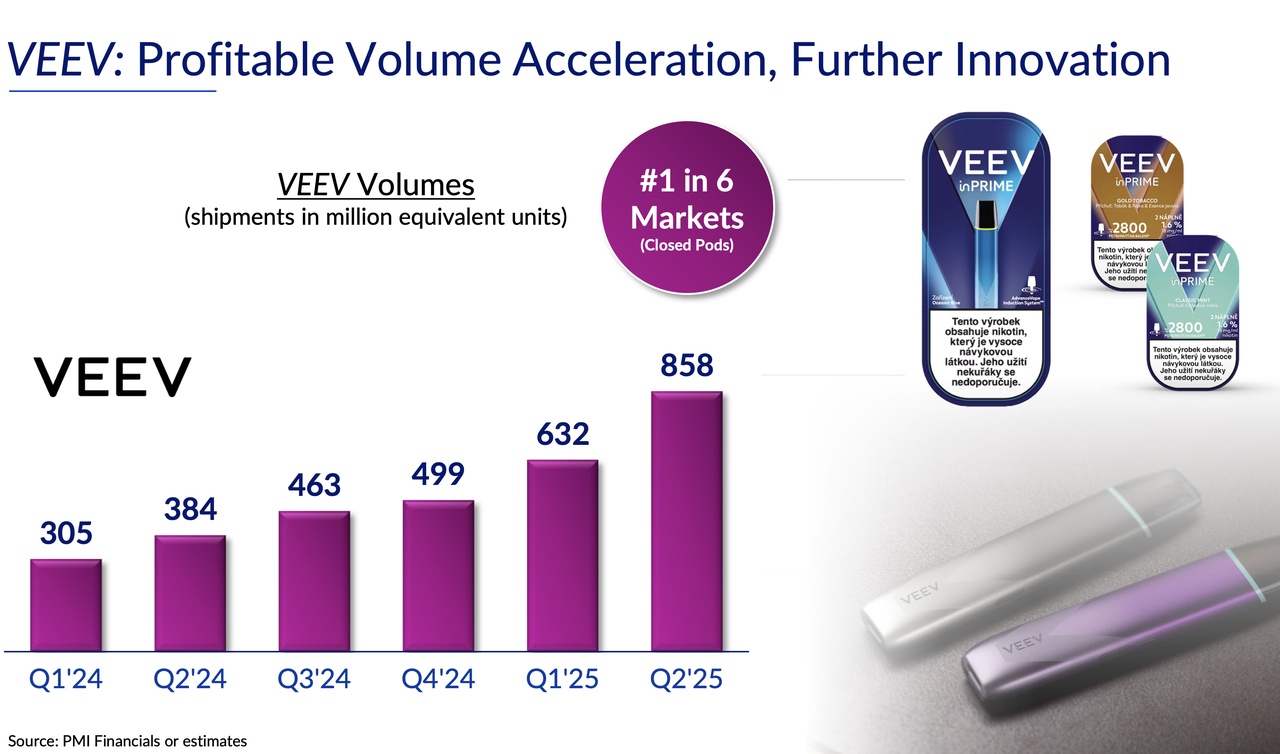

- E-Vapor (VEEV)0.9 billion units (>100%), driven by expansion in 42 markets, with a leading position in six European markets (e.g. Greece, Italy).

- Cigarettes155.2 billion units (-1.5%), declines in Turkey (-8.0%, due to supply chain issues) and Indonesia (-3.7%), partially offset by growth in India (+41.9%) and the Philippines (+8.0%).

- YTD 2025:

- Total volume: 387.9 billion units (+2.5%)

- SFP: 87.9 billion units (+13.1%), HTU: 75.9 billion (+10.5%), nicotine pouches: 626.3 million cans (+28.8%), cigarettes: 300.0 billion (-0.3%).

Sales development

- Q2 2025:

- Net sales10,140 million USD (+7.1%, organic +6.8%)

- Smoke-free products: USD 4,200 million (+15.2%, organically +14.5%), share of total sales: 41% (+2.9 percentage points). IQOS alone generated over USD 3 billion in sales.

- CigarettesUSD 6,000 million (+2.1%, organically +2.0%), driven by price increases (USD +420 million), despite volume decline and unfavorable mix (USD -225 million).

- DriversHigher prices for cigarettes, strong volume growth for SFP, positive currency effects (+71m USD), partially offset by negative effects from acquisitions/divestitures (-39m USD).

- YTD 2025:

- Net sales: USD 19,441m (+6.5%, organically +8.4%)

- SFP: USD 8,100 million (+15.1%, organically +17.3%), Cigarettes: USD 11,400 million (+1.1%, organically +2.9%).

Profit development

- Q2 2025:

- Gross profitUSD 6,900 million (+12.1%, organically +11.2%)

- SFP: USD 2,900 million (+23.3%, organically +21.5%), share of gross profit: 42% (+3.8 percentage points).

- Cigarettes: USD 4,000 million (+5.0%, organically +4.8%).

- Operating income (OI)USD 3,712 million (+7.8%, organically +6.2%)

- Adjusted operating incomeUSD 4,246 million (+16.1%, organically +14.9%).

- Adjusted OI margin41.9% (+3.3 percentage points, organically +3.0 percentage points).

- DriversHigher prices (USD +420 million), volume growth in SFP (USD +301 million), partially offset by higher marketing, administration and research costs (USD -429 million) and restructuring costs (USD -243 million, mainly for the optimization of the production structure in Germany).

- YTD 2025:

- Gross profit: USD 13,100 million (+12.0%, organically +13.5%).

- Operating income: USD 7,256 million (+11.8%, organically +12.1%).

- Adjusted operating profit: USD 8,036 million (+14.5%, organically +15.4%), margin: 41.3% (+2.9 percentage points).

EPS and dividend

- Q2 2025:

- Diluted EPS: USD 1.95 (+26.6%).

- Adjusted diluted EPS: USD 1.91 (+20.1%, excluding currency effects +18.9%).

- Dividend: USD 1.35 per share (USD 5.40 annually).

- YTD 2025:

- Adjusted EPS: USD 3.60 (+16.1%, without currency effects +17.7%).

2. segment analysis

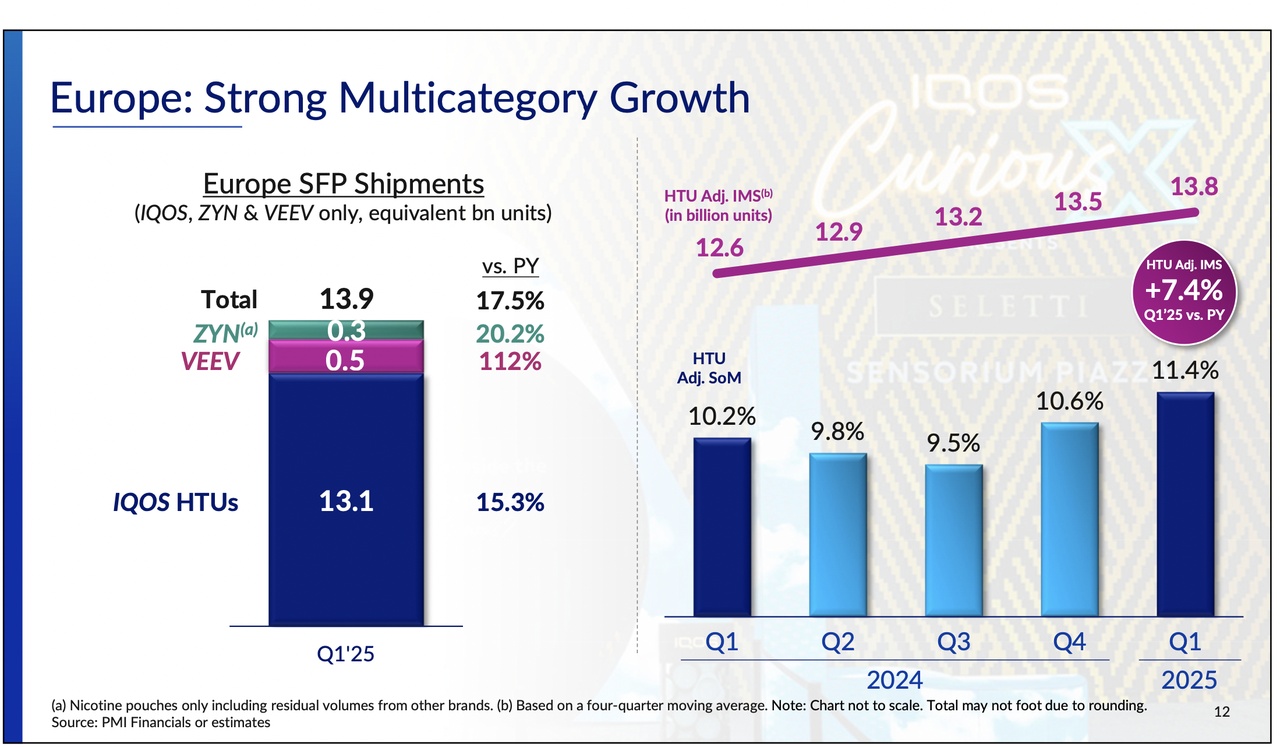

Europe

Volume development

- Q2 2025:

- Total shipment volume55.1 billion units (-2.4%)

- HTU14.3 billion units (+10.5%), adjusted IMS growth +9.1%, driven by Italy (+22.2% to 3.1 billion units), Germany (+16.5%), Greece, Romania, Bulgaria and Spain (+35.3%). Supported by the launch of ILUMA i and new consumables such as DELIA and tobacco-free LEVIA.

- Cigarettes40.8 billion units (-6.2%), declines in France (-17.5%) and Italy (-12.5%) due to unfavorable stock movements.

- Nicotine pouches: 70.8 million cans (stable), decline in snus (-5.9%), growth in ZYN (+31.0% to 15.5 million cans).

- YTD 2025: 103.5 billion units (-1.3%), HTU +12.7%, cigarettes -5.5%, nicotine pouches -1.3% (ZYN +26.9%).

Sales development

- Q2 2025Net sales: USD 4,234 million (+8.7%, organically +7.3%)

- Driven by price increases for cigarettes (USD +211 million) and volume growth for SFP (USD +75 million), despite unfavorable cigarette mix Positive currency effects: USD +92 million.

- YTD 2025USD 7,794 million (+6.0%, organic +7.9%).

Profit development

- Q2 2025:

- Operating profitUSD 1,668 million (+3.2%, organically +13.8%).

- Adjusted operating resultUSD 2,000 million (+19.6%, organically +13.8%).

- Adjusted OI margin47.2% (+4.3 percentage points, organically +2.6 percentage points).

- Drivers: Higher prices, SFP volume growth, partially offset by higher marketing, administration and research costs (USD -308m).

- YTD 2025Adjusted operating income: USD 3,480 million (+10.0%, organically +9.6%), margin: 44.6% (+1.5 percentage points).

Market shares

- HTU market share: +1.2 percentage points to 10.9% (e.g. Italy +1.0 percentage point to 17.7%, Germany +0.8 percentage points to 6.8%, Poland +0.7 percentage points to 9.9%).

- Cigarette market share: Declines in France (-1.0 percentage point to 40.5%) and Germany (-1.1 percentage points to 37.9%), stable in Italy (-0.2 percentage points to 53.4%).

SSEA, CIS & MEA

Volume development

- Q2 2025:

- Total shipment volume95.3 billion units (+1.1%)

- HTU7.9 billion units (+13.3%), adjusted IMS growth +19.8%, driven by broad growth in the region (e.g. Russia +13.9%, Indonesia +50.2%).

- Cigarettes87.5 billion units (+0.1%), growth in India (+41.9%) and the Philippines (+8.0%), declines in Turkey (-8.0%, due to supply chain issues following regulatory changes) and Indonesia (-3.7%).

- Nicotine pouches: 6.0 million cans (+100%), expansion in markets such as Pakistan, South Africa and Poland.

- YTD 2025: 185.6 billion units (+2.8%), HTU +10.4%, cigarettes +2.2%, nicotine pouches +100%.

Sales development

- Q2 2025Net sales: USD 2,926 million (+5.6%, organic +4.9%)

- Driven by price increases for cigarettes (USD +174m), partially offset by unfavorable cigarette mix (USD -34m, mainly Indonesia due to change in business model for lower price segment in Q4 2024)

- YTD 2025USD 5,669 million (+4.4%, organically +5.7%).

Profit development

- Q2 2025:

- Operating profitUSD 1,000 million (+12.2%, organically +17.2%).

- Adjusted operating resultUSD 1,004 million (+12.1%, organically +17.2%).

- Adjusted OI margin34.3% (+2.0 percentage points, organically +3.8 percentage points).

- DriversHigher prices, volume growth in cigarettes and HTU (USD +57m), partially offset by higher marketing, administrative and research costs as well as manufacturing costs (e.g. tobacco leaf, USD -76m).

- YTD 2025Adjusted operating result: USD 1,928 million (+15.2%, organically +15.7%), margin: 34.0% (+3.2 percentage points).

Market shares

- HTU market share: growth in Russia (+0.8 percentage points to 9.0%), Indonesia (+0.3 percentage points to 0.7%), Philippines (+0.3 percentage points to 0.9%).

- Cigarette market share: Decline in Turkey (-5.9 percentage points to 45.8%), stable in the Philippines (-0.2 percentage points to 46.0%), growth in Indonesia (+1.1 percentage points to 31.3%).

East Asia, Australia & PMI Global Travel Retail (EA, AU & PMI GTR)

Volume development

- Q2 2025:

- Total shipment volume28.3 billion units (+3.6%)

- HTU16.5 billion units (+6.3%), adjusted IMS growth +9.6%, driven by Japan (+2.9% to 13.9 billion units) and Global Travel Retail (+23.0%).

- Cigarettes11.9 billion units (+0.1%), decline in Australia (-83.4%, due to delivery phases).

- Nicotine pouches: 6.3 million cans (+100%), expansion in new markets such as the UK and Mexico.

- YTD 2025: 57.1 billion units (+4.7%), HTU +8.8%, cigarettes -0.7%, nicotine pouches +100%.

Sales development

- Q2 2025Net sales: USD 1,708 million (+2.1%, organically +1.6%)

- Driven by volume growth at SFP (+15 million USD), supported by positive currency effects (+9 million USD)

- YTD 2025USD 3,439 million (+2.4%, organically +4.0%).

Profit development

- Q2 2025:

- Operating profitUSD 853 million (+13.3%, organically +9.4%).

- Adjusted operating resultUSD 853 million (+13.3%, organically +9.4%).

- Adjusted OI margin49.9% (+4.9 percentage points, organically +3.5 percentage points).

- DriversHigher SFP volume (USD +49 million), lower cost increases (USD +11 million).

- YTD 2025Adjusted operating result: USD 1,767 million (+16.5%, organically +16.2%), margin: 51.4% (+6.2 percentage points).

Market shares

- HTU market share: Japan +2.3 percentage points to 31.7% (TEREA and SENTIA as #1 and #3), South Korea +1.2 percentage points to 8.9%.

- Cigarette market share: decline in Australia (-8.0 percentage points to 24.8%), growth in Japan (+1.8 percentage points to 42.8%).

Americas

Volume development

- Q2 2025:

- Total shipment volume15.3 billion units (+1.6%)

- HTU: 0.2 billion units (+3.0%), growth in Mexico (+38.8%).

- Cigarettes15.1 billion units (+1.6%), growth in Argentina (+12.3%) and Mexico (+2.3%), declines in Brazil (-2.7%) and Colombia (-7.9%).

- Nicotine pouches225.3 million cans (+32.5%), mainly ZYN in the USA (+41.6% to 191.3 million cans, sales growth +26% in Q2).

- YTD 2025: 29.8 billion units (+0.7%), HTU +12.7%, cigarettes +0.6%, nicotine pouches +37.3% (ZYN +47.8%).

Sales development

- Q2 2025Net sales: USD 1,272 million (+12.7%, organically +17.0%)

- Driven by volume growth in nicotine pouches (USD +169 million) and price increases (USD +24 million), despite negative currency effects (USD -49 million)

- YTD 2025USD 2,539 million (+19.5%, organically +24.0%).

Profit development

- Q2 2025:

- Operating profitUSD 191 million (+4.4%, organically +26.9%).

- Adjusted operating resultUSD 389 million (+16.1%, organically +26.9%).

- Adjusted OI margin30.6% (+0.9 percentage points, organically +2.5 percentage points).

- Drivers: Volume growth in ZYN (USD +154m), partially offset by higher marketing, administration and research costs (USD -134m, especially in the US).

- YTD 2025: Adjusted operating income: USD 861 million (+30.3%, organically +41.5%), margin: 33.9% (+2.8 percentage points).

Market shares

- Cigarette market share: Growth in Argentina (+2.2 percentage points to 63.8%), decline in Mexico (-0.8 percentage points to 57.8%).

- HTU market share: slight growth in Mexico (+0.2 percentage points to 1.0%).

3 Strategic highlights and market trends

- Smoke-free products (SFP):

- SFP are the main growth driver, accounting for 41% of sales and 42% of gross profit. IQOS is the second largest nicotine brand in the markets where it is present, with a market share of 9.2% (+1.0 percentage point). PMI holds ~76% of the global heat-not-burn market.

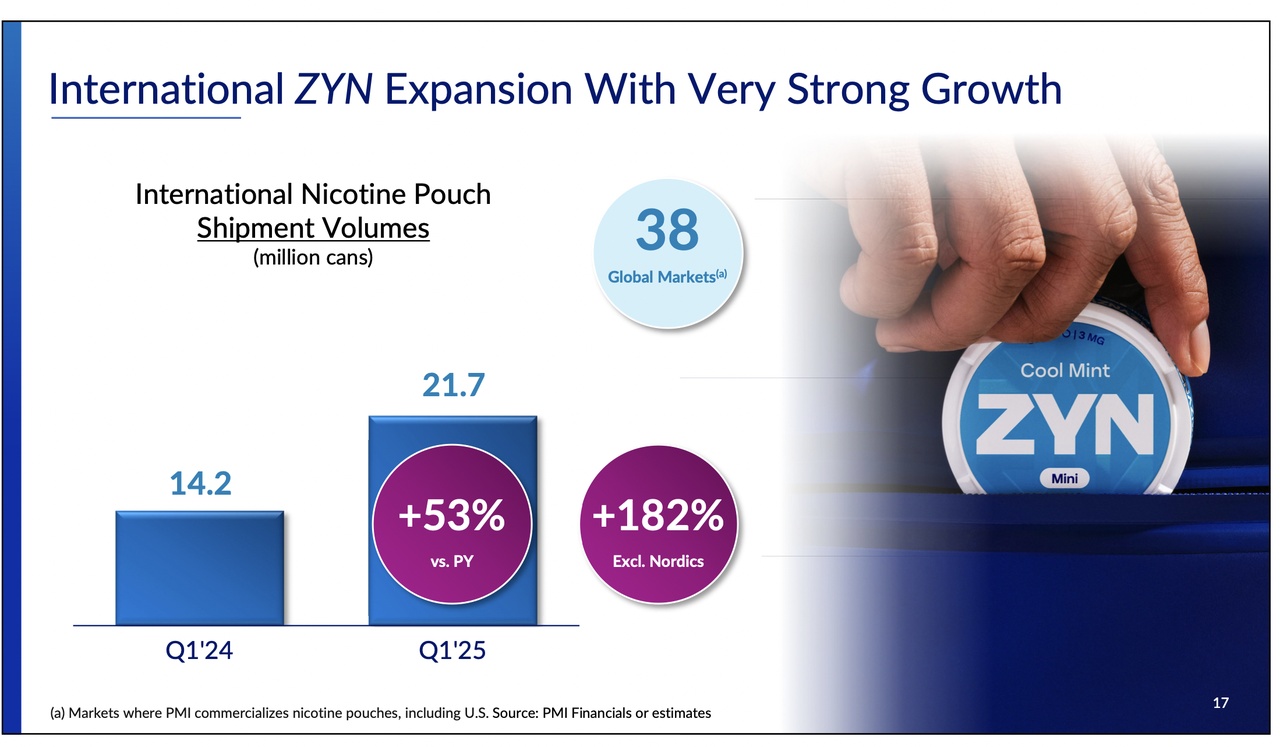

- ZYN is experiencing strong growth in the US (+26% sales growth in Q2, +36% in June) following improved availability. Internationally, ZYN is growing in 44 markets, with strong performances in Global Travel Retail, the UK and South Africa.

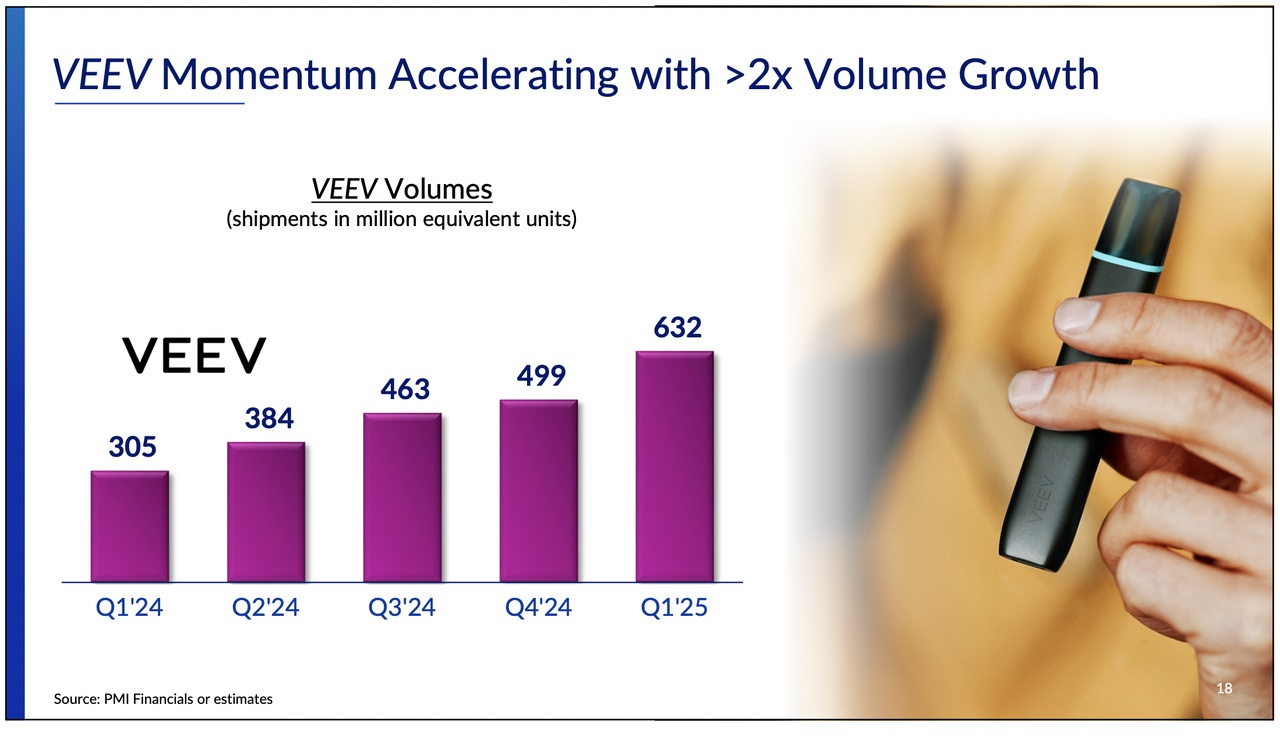

- VEEV is growing profitably in 42 markets, with a leading position in six European markets. New innovations such as VEEV inPrime optimize the consumer experience.

- Cigarettes:

- Despite a decline in volume (-1.5% in Q2), PMI achieves sales growth (+2.1%) through price increases. Marlboro achieves the highest market share since the spin-off in 2008. The overall market share remains stable (29.2% in Q2, +0.4 percentage points).

- Market share and geographical expansion:

- IQOS reaches over 41 million adult users worldwide, including over 10 million in Japan. SFP available in 97 markets, all three main brands (IQOS, ZYN, VEEV) in 20 markets.

- Strong market share gains in Japan (HTU +2.3 percentage points to 31.7%), Europe (HTU +1.2 percentage points to 10.9%) and key markets such as Indonesia, Mexico and Russia.

- Investments and innovation:

- PMI has invested over USD 14 billion in smokeless products since 2008, with a focus on scientific validation and commercialization. Investments of USD 1.6 billion are planned for 2025, almost exclusively for SFP.

- New products such as ILUMA i, DELIA, LEVIA and VEEV inPrime are driving growth.

4. annual forecast and strategic direction

PMI raises its annual forecast for 2025, based on the strong performance in the first half of the year:

- Adjusted EPS: USD 7.43-7.56 (+13-15% vs. 2024), excluding currency effects +11.5-13.5%.

- Organic sales growth: 6-8%.

- Organic operating profit growth: 11-12,5%.

- SFP volume growth12-14%, cigarette volume decline: ~2%.

- Operating cash flow~11.5 billion USD.

- Capital expenditureUSD 1.6 bn, mainly for SFP.

- Q3 guidanceAdjusted EPS of USD 2.08-2.13 (+5 cents currency effect).

PMI remains committed to its goal of creating a smoke-free future, with a long-term goal of expanding the business into wellness and health products. The FDA has authorized versions of IQOS, ZYN and General Snus as Modified Risk Tobacco Products, underscoring the scientific basis of the products.

6 Conclusion

PMI shows strong financial performance in Q2 2025, driven by smokeless products, which account for 41% of sales and 42% of gross profit. IQOS and ZYN are the main drivers of growth, with strong market share gains in Japan, Europe and the US. Despite a slight volume decline in cigarettes, PMI secures sales growth through price increases, while Marlboro gains market share. Regional development shows strengths in Europe (SFP growth), SSEA, CIS & MEA (HTU expansion), EA, AU & PMI GTR (Japan) and the Americas (ZYN). Challenges such as supply chain issues in Turkey and unfavorable inventory movements in Europe are offset by the robust SFP performance. The raised full-year guidance and strategic investments in innovation and sustainability underline PMI's confidence in continuing its growth trajectory and transformation towards a smoke-free portfolio.

Philip Morris Q2 Earnings

Tomorrow are the Q2 earnings of $PM (+0,24 %) what do you expect?

I will then write a detailed review.

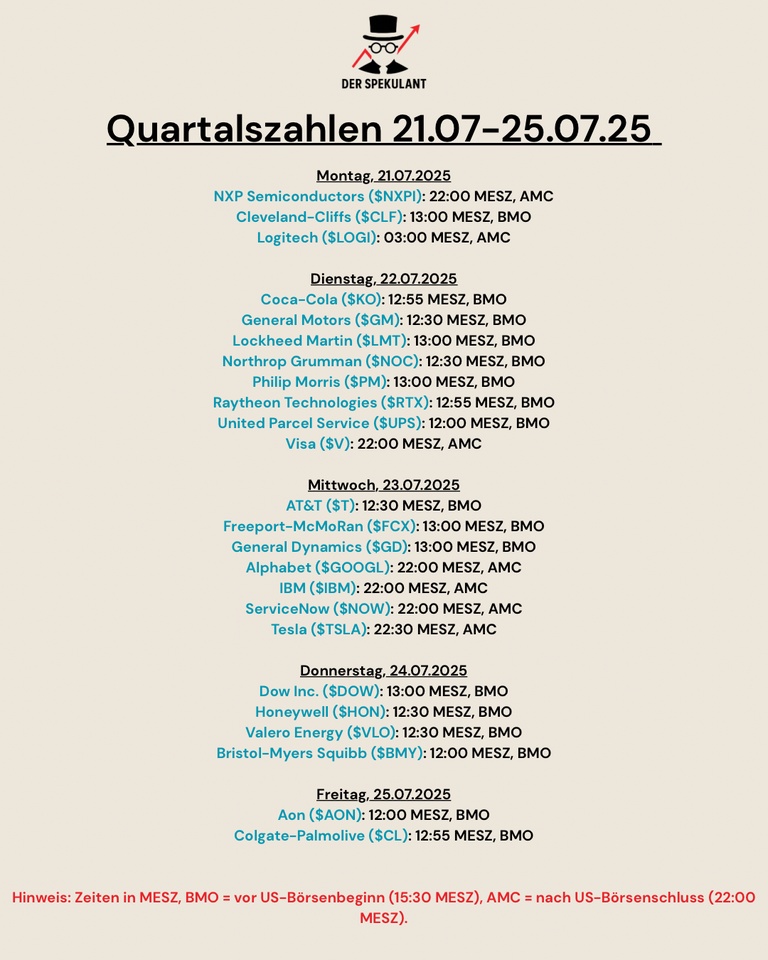

Quarterly figures 21.07-25.07.25

Here is a clear overview of the quarterly figures due next week.

$NXPI (+0 %)

$CLF (+2,47 %)

$LOGN (-0,17 %)

$KO (-0,09 %)

$GM (-0,19 %)

$LMT (+1,38 %)

$NOC (+0,14 %)

$PM (+0,24 %)

$RYTT34

$UPS (+0,24 %)

$V (+0,09 %)

$T (-0,22 %)

$FCX (+1,33 %)

$GD (+0,11 %)

$GOOGL (+0,01 %)

$IBM (-0,07 %)

$NOW (+0,12 %)

$TSLA (+0,99 %)

$DOW (+0,4 %)

$HON (-0,42 %)

$VLO (+0,2 %)

$BMY (+0,19 %)

$AON (+0,17 %)

$CL (+0,37 %)

Philip Morris: More than just hot air... 🚬

Philip Morris International $PM (+0,24 %) is reinventing itself, combining the stability of its core business with the incredible potential of new markets. The solid cash flow from traditional tobacco sales is financing a forward-looking transformation.

With three innovative product categories $PM (+0,24 %) new markets:

● Tobacco heaters (Heat-not-Burn) (IQOS)

● E-cigarettes (Vapes) (VEEV)

● Tobacco-free nicotine pouches (ZYN)

These products are in tune with the times and already account for over 40 % of total sales responsible. With forecast growth rates of approx. 20 % per year in these segments and a leading market position stands $PM (+0,24 %) faces a promising future. Particularly noteworthy is the first approval for the sale of nicotine pouches in the USA. (PMTA approval from the FDA) With this approval, Philip Morris can can legally sell nicotine pouches and, unlike its competitors, has the security of being able to put all its eggs in one basket.

Opportunities:

● Strong diversification in growing markets.

● Leading market shares in future-oriented products.

● Stable financial foundation.

Risks:

● Dependence on the shrinking cigarette market.

● Strict government regulations and potential penalties.

Through intensive research of almost all comparable tobacco companies, is $PM (+0,24 %)

by far the best positionedhas the least dependence on the cigarette business and offers the greatest growth. I therefore see a positive risk/reward ratio and have bought a few shares. 🚬

PS: Such an investment is morally very reprehensible. Tobacco consumption in the form of cigarettes kills millions of people every year.

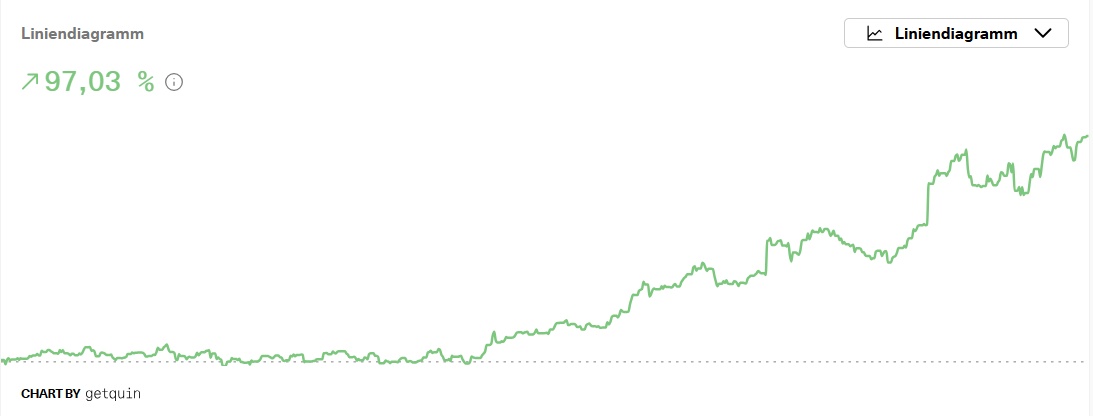

Savings plan day: Anniversary

In June 2023, I started a savings plan on Philip Morris $PM (+0,24 %) and have been adding to it weekly via a savings plan ever since. Today, the savings plan on Philip Morris is being used for the 100th time executed.

Especially at the beginning, when the amounts were very small in relation to the rest of the portfolio, I could never have imagined that the small weekly amounts would grow into such a large position in my portfolio over a period of almost 2 years.

Just in time for the anniversary of the savings plan, I created the following chart:

The yellow dots mark the day the savings plan was executed and the price at which it was executed. Especially at the beginning, I was able to collect shares at comparatively low prices. Even after the share price only went in one direction (upwards), I remained loyal to the savings plan and continued to invest stubbornly on a weekly basis.

The result:

- average buy in103.05 USD

- Return through price gains: ~64%

- Total return (with dividends): ~71%

- TTWOR yield: ~97%

So just keep at it and invest regularly. Especially for people who want to keep things simple and uncomplicated, a savings plan in a broadly diversified ETF is the best way to turn small amounts into a substantial sum over time.

Stay tuned,

Yours Nico Uhlig

DCA is often underestimated. You simply buy regularly with small amounts, don't worry about the price, trade less emotionally and simply get the average price over a longer period of time.

The stock market is not everything

Analyzing stocks and writing articles is a lot of fun for me and is more than just a hobby. Nevertheless, I'm happy to switch off and get away from dreary Germany. I also fly the Getquin flag when it's a nice 37 degrees outside Germany:

Nevertheless, asset accumulation continues in the background: quite simply via my current savings plans. So I'm pleased that Philip Morris $PM (+0,24 %) presented excellent figures today, including a forecast increase. Thank you @TaxesAreTheft for the nice summary of the figures.

Also just under 32 degrees 🤭

Philip Morris Q1 2025 Earnings Review

$PM (+0,24 %) convinces with first-class constant growth. I am more than satisfied with the results. Double-digit growth in top and bottom line and the RRP are becoming more and more profitable. There really isn't much to say here. I assume that $PM (+0,24 %) will have reduced its debt well in about 2 years and will then put the FCF totally into shareholder value. I say by then the profit of RRP will have more than doubled.

Volume (bn units)

HTU: 37.1 +12%

Oral: 5.3 +27.2%

Vapor: 0.6 +100%

Total RRP: 43 +14.4%

Combustibles: 144.8 +1.1%

Total: 187.8 +3.8%

Rep share: 23%

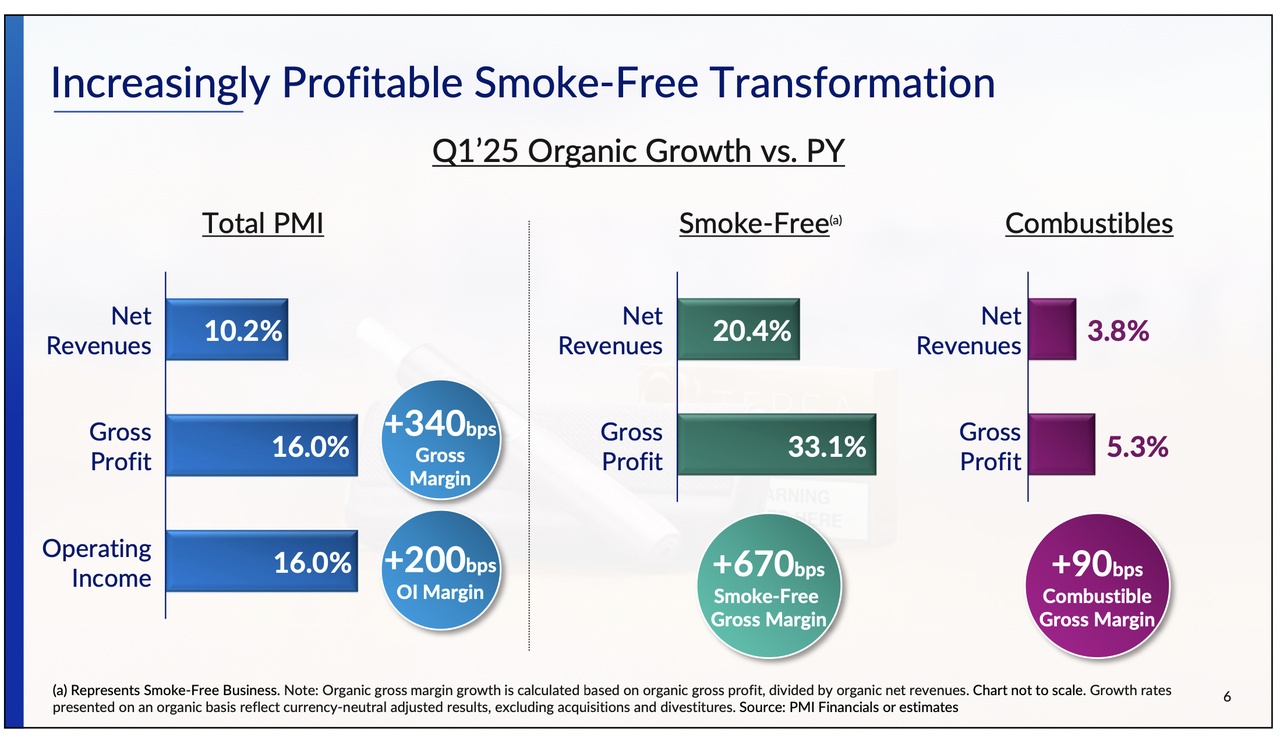

Revenue (bn $) reported I organic

RRP: 3.9 +15 I +20.4%

Combustibles: 5.4 +0% I +3.8%

Total: 9.3 +5.8% I +10.2%

RRP share: 42%

Gross profit

RRP: 2.7 +27.7% I + 33.1%

Combustibles: 3.5 +2% I +5.3%

Total: 6.3 +11.8% I +16%

RRP share: 43%

Operating income

Total: 3.5 +16.4% I +16%

EPS

RD EPS: 1.72$ +24.6%

AD EPS: 1.69$ +12.7%

AD EPS ex. Currency: 1.76$ +17.3%

PM has raised its guidance for 2025

AD EPS: 12-14%

US ZYN volume (doses): 800-840 mln

RRP

- Accounts for 42% of total net sales and 43% of gross profit.

- Strong growth: +14.4 % in delivery volumes, +15.0 % (20.4 % organic) in net sales, +27.7 % (33.1 % organic) in gross profit.

- Smoke-free products available in 95 markets, multi-category portfolio in 46 markets.

- IQOS: Second largest nicotine "brand" in existing markets, 9% share of the combined cigarette and HTU market (+1.0 percentage points). Dominates the heat-not-burn category with ~77% volume share.

- JapanIQOS IMS volume +9.3 %, market share +3.0 percentage points to 32.2 %. HTU category over 50 % nicotine share in 13 major cities and 8 prefectures.

- EuropeIQOS market share +1.2 percentage points to 11.4 %, IMS +7.4 %. Strong growth in Spain, Germany, Bulgaria, Greece; HTU share over 30 % in six cities (e.g. Budapest, Athens, Rome).

- E-Vapor: Doubling of delivery volumes, especially in Europe, with rising gross margin. VEEV is becoming more important for the multi-category strategy.

- ZYN: Delivery volumes +27.2 % (pouches), +31.0 % (cans), driven by ZYN in the USA (+53 %, >200 million cans). Production capacity increased earlier than planned, strong demand.

- Outside the USA: nicotine pouch volume +53 %, growth in emerging markets (Pakistan, South Africa) and new markets (UK, Poland, Italy).

Combustibles

- Volume growth and strong pricing, but negative regional mix; net sales stable (+3.8 % organic), gross profit +2.0 % (+5.3 % organic).

- Global brands (Marlboro) with market share gains, total share of cigarettes +0.4 % to 24.8 %.

- US cigarsNo divestment or spin-off planned following strategic review.

Titres populaires

Meilleurs créateurs cette semaine