In June 2023, I started a savings plan on Philip Morris $PM (+0,63 %) and have been adding to it weekly via a savings plan ever since. Today, the savings plan on Philip Morris is being used for the 100th time executed.

Especially at the beginning, when the amounts were very small in relation to the rest of the portfolio, I could never have imagined that the small weekly amounts would grow into such a large position in my portfolio over a period of almost 2 years.

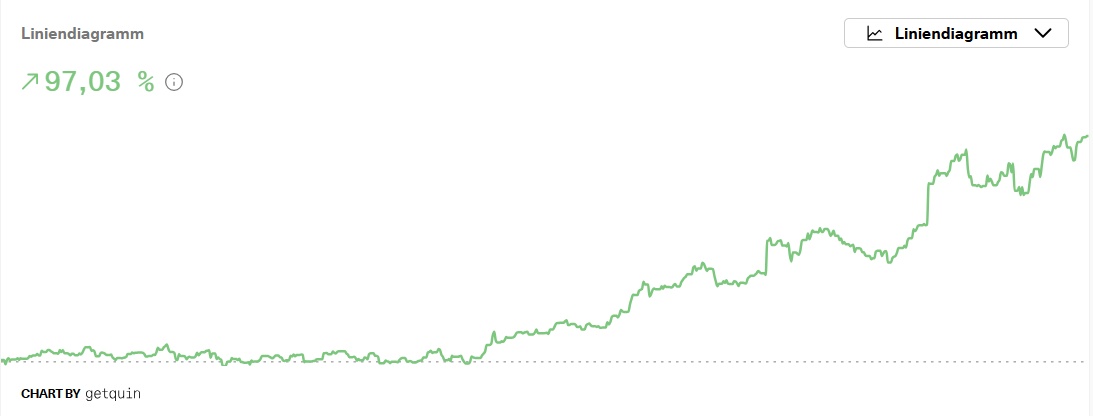

Just in time for the anniversary of the savings plan, I created the following chart:

The yellow dots mark the day the savings plan was executed and the price at which it was executed. Especially at the beginning, I was able to collect shares at comparatively low prices. Even after the share price only went in one direction (upwards), I remained loyal to the savings plan and continued to invest stubbornly on a weekly basis.

The result:

- average buy in103.05 USD

- Return through price gains: ~64%

- Total return (with dividends): ~71%

- TTWOR yield: ~97%

So just keep at it and invest regularly. Especially for people who want to keep things simple and uncomplicated, a savings plan in a broadly diversified ETF is the best way to turn small amounts into a substantial sum over time.

Stay tuned,

Yours Nico Uhlig