$OHI (-1,04 %) is simply doing what it should and the share price has also risen somewhat recently. After a favorable entry, I am up almost 30% and on top of that the regular nice dividends.

Together with the rest, the weekend is saved.

Postes

52$OHI (-1,04 %) is simply doing what it should and the share price has also risen somewhat recently. After a favorable entry, I am up almost 30% and on top of that the regular nice dividends.

Together with the rest, the weekend is saved.

Hello everyone!

My parents are in the process of selling my grandparents' house. It will probably fetch around €275,000. My parents will soon both be 60 years old.

They had initially considered buying another property nearby. But they have moved away again. The lack of flexibility and the time and risk involved with tenants put them off.

I also told them more about investing in the stock market. They were very open and interested, even though they said they had an unfounded fear of shares etc.

Now my question to you. What is the best way to invest the money? I think dividends would be very nice as my parents like the passive income like from a property. But it should also be very well diversified across countries and sectors.

I personally have developed 2 solutions. You can give your opinion as to whether you think the solutions are good or, of course, if you have completely different ideas.

1. the ETF solution

15% $XEOD (-0 %) Call money ETF. Div. 1.9%

15% $TDIV (-0,57 %) VanEck Divi Leaders. Div 3.5%

10% $TRET (-0,33 %) Global Real Estate. Div. 3.7%

7,5% $VHYL (-0,65 %) Allworld High Div Yi. Div 3.1%

7,5% $PEH (-1,49 %) FTSE RAFI EM. Div 3.9%

5% $EWG2 (+0,95 %) Gold

5% $SEDY (-1,49 %) iShares EM Dividend. Div 8.0%

5% $JEGP (-0,24 %) JPM Global Equity Inc Div 7.1%

5% $EEI (-0,86 %) WisTree Europ Equity Inc Div 6.3%

5% $IHYG (-0,16 %) High Yield Bond. Div 6.1%

5% $EXXW (-0,48 %) AsiaPac Select Div50 Div 5.5%

15% Rest German Divi Shares approx. div 2.5%

=100% with 3.7% dividend.

275k ×3,7% = 10.175€

With full taxation 27.99% = 7327€

On average per month: 610€ dividend

With 2k tax-free allowance: 657€ dividend per month

I find it very well diversified, you have overnight money, you have the USA and Europe well represented, but also 12.5% emerging markets ETF. In terms of sectors, finance will be at the forefront. Followed by real estate and energy. I think that's fine.

2. the equity solution

I have selected 34 strong dividend stocks. In the list they are roughly divided into GICS sectors.

15% $XEOD (-0 %) Overnight ETF. Div 1.9%

12% $EQQQ (-1,22 %) Nasdaq100 ETF. Div 0.4%

5% $EWG2 (+0,95 %) Gold

2% $O (-0,41 %) Realty Income 6.0%

2% $VICI (-0,28 %) Vici Properties 5.6%

2% $OHI (-1,04 %) Omega Healthcare 7.2%

2% $PLD (+0,7 %) Prologis 4.1%

2% $ALV (-2,5 %) Allianz 4.35%

2% $HNR1 (-1,5 %) Hannover Re 3.4%

2% $D05 (-1,2 %) DBS Group 5.5%

2% $ARCC (-1,09 %) Ares Capital 9.3

2% $6301 (+0,12 %) Komatsu. 4,2%

2% $1 (-1,18 %) CK Hutchison 4.6%

2% $AENA (-0,34 %) AENA. 4,2%

2% $LOG (+0,25 %) Logista 7.3%

1,5% $AIR (-1,5 %) Airbus 1.8%

1,5% $DHL (+0,32 %) DHL Group 4.8%

1,5% $8001 (-0,17 %) Itochu 2.8%

2% $RIO (-1,09 %) RioTinto plc 6.4%

2% $LIN (-0,66 %) Linde 1.3%

2% $ADN (-1,01 %) Acadian Timber 6.7%

3,5% $BATS (+0,4 %) BAT 7.0%

2% $KO (+0,41 %) Coca Cola 2.9

2% $HEN (+0,74 %) Henkel 3.0%

2% $KVUE (-0,33 %) Kenvue 4.1%

2% $ITX (-0,5 %) Inditex 3.6%

2% $MCD (-0,05 %) McDonalds 2.6%

2% $690D (-0,28 %) Haier Smart Home 5.6

3,5% $IBE (+0,22 %) Iberdrola. 4,1%

1,5% $AWK (+0,57 %) American Water Works 4.4%

1,5% $SHEL (-0,77 %) Shell 4.1%

1,5% $ENB (-0,93 %) Enbridge 6.5%

2% $DTE (+0,83 %) Deutsche Telekom 2.8%

2% $VZ (+0,07 %) Verizon 6.8%

2% $GSK (-1,53 %) GlaxoSmithKline 4.2

2% $AMGN (-0,52 %) Amgen 3.5%

2% $JNJ (+0,35 %) Johnson&Johnson 3.5%

= 100% with 3.5% dividend

275k ×3,5% = 9625€

With full taxation 27.99% = 6930€

On average per month: 577€ dividend

With 2k tax-free allowance: 624€ dividend per month

I also think this solution is cool because you can select the largest companies or strong dividend payers in the individual sectors or countries yourself. And of course you can also select shares with which you have a connection. However, I have focused on shares from the USA, England and Germany because of the withholding tax. Spain is also well represented because of my parents' ties to this country. It's also cool that the NasdaqETF also includes the Microsoft, Amazon, etc. compounders.

What do you think?

Especially in stressful times, it is important to relax, not have FOMO and collect dividends $OHI (-1,04 %)

$MPW (-1,65 %) is also in the portfolio and will be held!

The first quarter of 2025 is over. In March, real assets recorded declines, both in equities and ETFs and especially in cryptocurrencies. The markets have become increasingly volatile. While many are panicking, I have been enjoying the first signs of spring, hiking and continuing to winter bathe diligently.

For the past month of March 2025, I present the following points:

➡️ SHARES

➡️ ETFS

➡️ DISTRIBUTIONS

➡️ CASHBACK

➡️ AFTER-PURCHASES

➡️ P2P CREDITS

➡️ CRYPTO

➡️ AND OTHER?

➡️ OUTLOOK

➡️ Shares

There was a considerable setback in March, and not just in equities. The reason for this is the customs issue, on which I have already formulated my thesis, which many believe to be correct. To summarize briefly: Markets are being depressed to get investors into bonds, which lowers bond yields and allows US debt to be refinanced at a lower interest rate. After the refinancing of short-term US government bonds, the tariffs are put into perspective and the next upswing follows, which Trump can boast about. Whether this assumption is correct remains to be seen. However, it would make sense in the long term to slash US spending. Even if the D.O.G.E. does a good job, you can't cut everything without incurring the displeasure of the population.

A look at the depot shows the front-runner $AVGO (-2,53 %) and its companion $NFLX (-0,27 %) both currently only 150% up, despite a significant setback. I am unimpressed by this development, as the capital market is always facing worse times, which will be followed by better ones. According to André Kostolany, it is now the "shaky hands" that are significantly triggering the sell-off. Yes, change your perspective: the red sign in your portfolio is irrelevant, now is the time to buy more. Enormous overvaluations in tech stocks have been reduced and they may now be available at a fairer price. There are also attractive defensive value stocks on offer, ideal for a dividend portfolio.

Second and fourth place in my individual share portfolio are still occupied by $WMT (-0,18 %) and $SAP (-0,95 %) . Walmart can now prove that it acts as a stable anchor in the portfolio even in bad times. In sixth place is a stock that I did not expect to be in the top 10. Like me, many of you have shares in $WM (-0,52 %) but the stock I am looking for is its competitor: $RSG (-0,08 %) . I have been watching the rise of this stock even before the pressure from Trump and I am happy about it. This is an example of a defensive stock. Garbage collection is necessary and Republic Services, like Waste Management, will literally turn garbage into gold for shareholders 50 years from now. Anyone complaining about their portfolio being down 50% probably has too much tech and too little defensive. My overall portfolio currently stands at around -12%. That's OK in the current macro environment.

Which brings us to the subject of performance: $NKE0 (-1,01 %) and $DHR (-1,4 %) returned around -39% at the end of March.

➡️ ETFs

They are also recording significant losses. It is important to remain calm and continue investing. Such phases are part of the game. I will not repeat further details.

➡️ Distributions

In March, I received 31 distributions on 15 payout days. I am grateful for this additional income stream. Everyone should build up such additional income.

This time, the distributions from my three large ETFs were not made on March 31, but in the first few days of April. This means that there should theoretically be 34 distributions. Numerous corrections and cancellations of dividends from REITs were not taken into account. With $O (-0,41 %) , $OHI (-1,04 %) , $LTC (-0,17 %) and $STAG (-1,23 %) there were therefore some cancellations and new dividend distributions. Although this was a major bureaucratic effort, it was usually a cause for celebration. This is because the REITs initially distribute dividends from current net income. If there are then corrections in the following year, it is determined that a distribution is also made from the already taxed retained earnings. This subsequently reduces the company's tax burden and I have noticed that I pay less capital gains tax and solidarity surcharge. So more cash in my pocket for reinvestment.

➡️ Cashback

In March, I received a small amount of income from an expense report, which I invested directly in my custody account. More on this under subsequent purchases.

➡️ Subsequent purchases

The additional purchases were financed from the expense report and, above all, from the bonus paid out by my employer. I am grateful for this, as my employer is not doing well at the moment.

I made numerous additional purchases in several ETFs that are in my small old portfolios. I invested smaller sums $GGRP (-0,61 %) , $JEGP (-0,24 %) , $SPYW (-0,51 %) , $FGEQ (-0,89 %) and $SPYD (+0,19 %) and bought a larger sum in shares of the $IWDP. On the last Friday in March, I checked my portfolio and realized that, despite careful use of the surplus, there was more cash left than I had expected. I therefore made a small additional purchase in the $VNA (-1,09 %) . For me, Vonovia (like the REITs) is a kind of hedge against my own rising rent.

➡️ P2P loans

With my last P2P platform, Mintos, there were no interest or redemption payments. I still intend to withdraw all funds where released. I would even accept a full write-off to get out of the platform. The remaining amount is no longer relevant to me.

➡️ Crypto

Crypto investors continued to experience significant volatility in March. The double top predicted by some does not seem to be materializing and the indicators do not currently point to a steep rise. I am studying the charting and the macro environment for crypto, although I still have a lot to learn here. Patience and calm are still required. I am sticking to my cycle strategy, the macro situation confirms me, so there is no need for me to take any action.

➡️ And what else?

I'm currently deepening my knowledge of AI. The posts on my Instagram channel that I published in March (and others that will follow in April) were created with the help of AI. I explained my approaches, beliefs about finance and the frugal lifestyle, and my goals to AI. The AI then created suggestions for Instagram posts, including prompts and allowing for a week break at the end of the month.

There is still a lot for me to learn. I am using AI more and more intensively and deeply in my professional and private life. While colleagues are happy that an AI can write emails for them, I use it much more extensively, for example to have technical content and its effects on departments and companies explained to me at work or to have economic relationships explained to me in my private life. In addition to ChatGPT, I particularly like Grok by X, as this AI always asks questions and thus enables a fluid conversation. The AI doesn't just reproduce facts, but also evaluates my ideas and classifies them, for example whether I should already use part of my nest egg to buy more quality stocks at favorable prices. Her suggestion was perhaps to wait until after the refinancing of short-term US government debt, when there might be less downward volatility in the market. This recommendation is based on my thesis mentioned above.

March was also a month of fasting for me, not for religious reasons, but because I want to and always intend to. I like to use the time after fasting to change my habits, adjust my diet and vary my sports units and routines. For me, this is particularly easy after fasting - the time afterwards generally feels like a new beginning.

➡️ Outlook

In April we will continue to see negative signs in the portfolio. I have now placed a limit order, which I hope will be triggered. The annual electricity bill is also due. I'm curious to see how much will be returned, the refund will certainly go into the custody account. It will also become clear whether I will increase my discount due to higher electricity costs. Until then!

Links:

Social media links can be found in my profile, you can also take a look at the Instagram version of my review.

Then take a look at these packs for ideas. Some homework has been done when handpicking these and I review them from time to time.

REIT pack: https://www.trading212.com/pies/lua2LbG5mCkbey1Mr8oABEgUWZX2k

$PSA (-0,93 %)

$VICI (-0,28 %)

$ADC (-0,56 %)

$EPRT (-1,03 %)

$LTC (-0,17 %)

$OHI (-1,04 %)

$O (-0,41 %)

BDC pack: https://www.trading212.com/pies/lua2LbG5mCkbey1Mr8oFLkbICASIN

$MAIN (-1,06 %)

$ARCC (-1,09 %)

$BXSL (-1,21 %)

$GAIN (-1,44 %)

$HTGC (-1,32 %)

$OXLC (-4,05 %)

A reminder though that some of the products are very prone, for the better and the worse, to issues arising from macro problems, interest rates or inflation. None of this is financial advice, DYOR.

Hello dividend hunters, sharing 2 packs today. Feel free to share your thoughts. ~Not financial advice.

1. #reit - diversified REIT pack with 10 reits covering diferent sectors and specially the care sector (health and continuous care) which has a chance of being a growing sector over the next years - https://www.trading212.com/pies/lua2LbG5mCkbey1Mr8oABEgUWZX2k

$O (-0,41 %)

$VICI (-0,28 %)

$LTC (-0,17 %)

$UHT (-1 %)

$CHCT (-2,07 %)

$OHI (-1,04 %)

$CCI (-0,76 %)

$EPRT (-1,03 %)

$ARE (-0,98 %)

$PSA (-0,93 %)

2. #bdc - diversified BDC pack with 5 bdc stocks - https://www.trading212.com/pies/lua2LbG5mCkbey1Mr8oFLkbICASIN

$GAIN (-1,44 %)

$BXSL (-1,21 %)

$MAIN (-1,06 %)

$OXSQ (-3,18 %)

$ARCC (-1,09 %)

Good morning everyone,

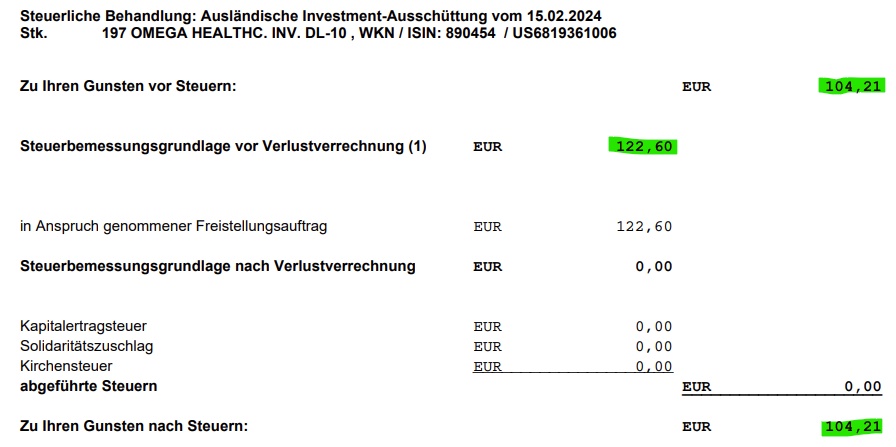

Can someone explain the difference to me?

I don't understand why something is deducted from the €122.60 so that I'm only left with €104.21.

In this case, we are talking about dividends of $OHI (-1,04 %) . But the same thing also occurs with $PG (+0,51 %) , etc.

I look forward to help and clarification :)

Hello everyone, #Finanzfritze here,

I have just had a look at the figures for $OHI (-1,04 %) and was shocked to see that the payout ratio is over 280%. As I understand it, dividends are being paid out with money that you don't even have. Can anyone here enlighten me or correct me? EDITDA is €650m and free cash flow is €-330m. The only way I can explain this is that reserves are being used up. But how much is still available would probably have to be found out from another source.

Hello

I wanted to present a more detailed text about my portfolio and my reasons behind each of my individual shares (wall of text incoming). My depot consists of 2 parts and 3 depots :

scalable capital depot ( my main depot) 47 k €trade republic: created sometime to collect the free share together with my sister 2,5 k € $IWDA (-1,17 %) + 0,25 $MBG (+1,15 %) sharesemployee share deposit 2k $EOAN (+0,08 %)

before that something short about me :

25 years old apprenticeship eletroniker made now a study support program (electrical engineering who guessed it :D ) from my employer due to special achievements.

besides running 2 small companies (1x IT/hardware things together with 2 friends runs okay is not enough to live but for the time used quite okay, as another hobby / business candle production-> not really good but I have joy in it) between training ud study 3/4 year as a journeyman worked.

investment horizon >20 years but soon partial withdrawal to the housing loan final sum repay (about 17 k since apartment in the training together with sister bought) [money for the apartment was up to 20 k of me or my sister earned apartment 50/50 my sister and I she pays back more and that she gets with the end of the loan already times proportionally back rest after the end of my studies loan amount was 100k on 2 people )

now to the relevant part( descending by size in aggregated getquindepot)

unfortunately no table possible therefore formatted as follows)

NAME of the share, share in the total depot, why did I choose it, savings plan available

$IWDA (-1,17 %) 9,35 %, will be steadily expanded later as an ageing investment+ constant growth, savings plan 80€

$ASML (-0,88 %) 7,12%, probably the strongest moat there can be+future of semiconductors is very safe, not saved

$EOAN (+0,08 %) 6,99% ->employee shares since 2 years with 360€ free per year(209 employee shares)+ bought a little bit by myself, not saved except in the frame of employee shares

$AVGO (-2,53 %) 6.01%, steady growth in almost every product with built-in wireless, not saved

$OHI (-1,04 %) 5.55%, retirement home reit grow old and die we will always constant distribution, not besparpart

$BAS (+0,61 %) 4,52% chemistry is important but difficult in germany i might switch soon to $LYB (-1,13 %) because the dutch take better care of their industire :D, not saved

$IUIT (-1,51 %) 4,07%, no getting past US IT companies,20€ savings plan

$FNTN (+0,07 %) 3,74%,8% dividend payout from reserves first time no KAP, not saved

$XEON (+0,02 %) 3,25%, money market etf as day money substitute-> no desire for day money account hopping,not saved

$EIMI (-1,66 %) 3,09%, in combination with the $IWDA (-1,17 %) to represent the whole world, 45€ savings plan

$SEMI (-1,14 %) ,2,84%, am strongly convinced of semiconductors therefore very gladly there also in addition to asml and broadcom a general overweighting,20€ savings plan

$BLK 2.72%, leading investment manager of large etf providers in my eyes good annual growth, 45€ savings plan because in my eyes currently relatively "favorable with a kgv of 19-20

$MBG (+1,15 %) 2.44%, there is nothing qualitatively what with the best or nothing can keep up already before the spinoff$DTG (-1,91 %) spinoff held therefore also 9 truck shares "get given in addition quite a nice div return, not bespart

$LHA (-1,47 %) 2.06% on the rebound after a long dry spell, but will probably be sold soon because too volatile and difficult business field, no savings plan

$ALV (-2,5 %) 1.85% a German constancy in the depot comes because of the ghröße worldwide almost no one past in particular it benefits very strongly from the riester pension contracts, etc., no savings plan

$CPXJ (-1,34 %) 1,65% as compensation for the much europe and USA in my depot, 22€ savings plan

$PEP (+0,46 %) 1,60% big food company nice growth big diversification not only beverages like $KO (+0,41 %) no savings plan

$MEUD (-1,1 %) 1.57% general europe does not hurt to reduce the usa share in the etfs, 25€ savings plan

$BAYN (-0,26 %) 1,48 %, pharma giant and fertilizer and seed makes no one on this planet can live permanently without bayer, no savings plan

$MUV2 (-1,82 %) 1,4% big reinsurance nice even growth but maybe a little too expensive maybe it will be sold soon and bought again later because currently >50% in plus, no savings plan

$TMV (-2,41 %) 1,36% bought for speculation but will be out soon because there is no moat and the product is too small and completely easy to replace-> don't ask me what made me buy it but it is currently even in plus :D, no savings plan

$AMAT (-1,73 %) 1.34% what would be semiconductors without waver?,no savings plan

$HOT (-2,16 %) 1.3% large construction company builds a lot for the public sector and they like to be ripped off the sit out has paid off after an interim -30%, no savings plan

$FORTUM (-1,77 %) 1.29% former $UN01 mother and since the uniper has once belonged to my employer knows thezum largely the Finnish state->can not go broke but unfortunately very high withholding tax and only partially refundable-> soon out, no savings plan

$VNA (-1,09 %) 1.28% actually already more getquin has once again synronisationsprobleme) with the housing shortage in germany a defacto nobrainer comes in my eyes to 110% with falling interest rates back to old nievau, about 50 € per month or even bissl more depending on what remains (but only if share is quoted below 20 € )

$AIR (-1,5 %) 1,26% , boing shoots itself down only one relevant civil aircraft manufacturer remains, no savings plan

$PMT (-1,99 %) 1.25% actually solid ride am currently not sure whether to sell or stock up meaningful -> bad of me what do you advise me? no savings plan

$MSFT (-0,73 %) 1.16% still from the early days but stocksolide mMn also better than $AAPL (-0,89 %) because much broader positioned and not only lives from the brand but also from the products Azure office + hardware + OS probably remains forever, no savings plan

$PBB (-2,04 %) 1,14% actually good business model currently suffers from few construction loans + high divrendite ohnje kapsteuer-> top up, irregular savings plan see $VNA (-1,09 %)

$DTE (+0,83 %) 1.13% only viable provider in germany regarding wireless network + most of us mobile , no savings plan

$DBK (-5,17 %) <1% wanted to have a bank in the depot could not decide therefore partly$DBK (-5,17 %) and partly $CBK (-2,89 %) bought commerzbank is good deutche bank rather less->deutsche bank flies out, no savings plan on either of them

$ULVR (+1,16 %) <1% lebnesmittelgroßklonzern remains forever very diversified, no savings plan

$MO (+0,14 %) <1% dead said live longer performance is ok may stay for now,no savings plan

$MTX (-2,34 %) <1% every fleiger needs at least 2 of them and there are only few relevant manufacturers of them, no savings plan

$SIE (-1,65 %) <1%, 100gramm Siemens 100€ immortal industrial giant remains forever in the depot, no savings plan

$TGT (-0,92 %) <1%,convinced that target will come back in some areas in the USA indispensable, sparplam 45€

$SHEL (-0,77 %) <1% has understood that oil is finite has meanwhile very large e-charging network and much renewable dirt (but brings due to the current political craze for renewable and sustainability protection insane subsidies and profits, no savings plan

$IBM (-0,64 %) <1% no one gets past enem IBM mainframe in banking+ very well back in quantum computing (possibly a rise to old glories soon ), no savings plan

$DPW (+0,32 %) <1%, logistik weltmarkführer in einem stark steigendem markt ->i should actually increase TM, no savings plan yet

$G (-1,55 %) <1%, eigentlich gute versicherung lohnt sich nicht aber aufgrund der italienischen steuer -> will be out soon, no savings plan

$LIN (-0,66 %) <1% gas giant similar to bayer and basf in its area constant growth could one times again increase if it falls again something, currently still no savings plan

$VOW3 (+1,44 %) <1%, one of the few old utokonzernen I trust a change just a pity for Mr. diess, no savings plan

$DTG (-1,91 %) <1%, spinoff from $MBG (+1,15 %) but runs well may therefore remain, no savings plan

$UN01 <1%, will hopefully come back after the war, will first be held, no savings plan

$SAP (-0,95 %) <1% absolutely shitty software but unfortunately almost every company has to use it because of the competition in particular $CRM (-1,31 %) still umpteen times worse unstable and weitausweniger powerful, no savings plan

$MMM (-1,32 %) <1% actually of me very loved company investment but only after completion of all the legal proceedings, no more savings plan

$FLXI (+0,08 %) <1% democratic country with more than 1000000000 inhabitants in the upswing , the hopefully soon new china( only economically seen ), savings plan 12€

$CCL (-1,7 %) <1%, vacation especially with rich very popular only debt ratio makes him very much to create undecided whether to be sold, no savings plan

$UNP (-0,34 %) <1%transnational rail traffic in USA sometime they will also(rediscover) the importance of the railroad, irregular savings plan

$AR4 <1% actually convinced but the management is a disaster actually out but i don't want to pay a low volume surcharge :D, definitely no savings plan

$QCOM (-1,02 %) <1%, there are ekine other performanten prozessoen for cell phones ( if one comes with mediatek please just be quiet they are snot) still builds a lot for us militä, sparpla for 2 months about 50€

$ORI (-0,89 %) <1% top versicherung jedoch innerhalb eines sparplanzyklus zu stark gestiegen(10%) damit derzeit zu teur sparplan ausgesetzt

wer es bis hier geschafft hatglückwunsch und danke fürs lesen

ich bin für sämltliche anregungen offen

zu dem punkt weshalb ich die von mir angesprochen en aktien die ich gerne verkaufen würde noch nicht verkauft hab.: bin mir noch nicht sicher was es genau anstelle dessen werden soll und solange gilt immer time in the market >timing the market.

therefore I am happy about suggestions what I should buy from the soon to be sold positions.

LG Drööd O Fant

The pasture land for my cash cows is slowly being increased

Meilleurs créateurs cette semaine