what are peoples current thoughts on the Marriott stock? Worth investing?

Discussion sur MAR

Postes

15April Rebalancing: Strategic Shifts in the Portfolio

The semi-annual rebalancing of the SPDR S&P Developed Quality Aristocrats ETF ($QDEV (-2,77 %) ) has just been completed, bringing notable changes to the composition of this quality-focused investment vehicle.

Outgoing Companies:

- RELX PLC$REL (+0,44 %)

- Keyence Corporation $6861 (-1,03 %)

- London Stock Exchange Group plc $LSEG (+0,99 %)

- Booking Holdings Inc. $BKNG (+0,36 %)

- Industria de Diseno Textil S.A. (Inditex) $ITX (-1,23 %)

- Texas Instruments Incorporated $TXN (-4,45 %)

- Cencora Inc.$COR (+0,7 %)

- Coloplast A/S Class B$COLO B (-3,29 %)

- Moncler SpA $MONC (-2,8 %)

- Cardinal Health Inc. $CAH (-0,68 %)

- CAR Group Limited $CAR (+0 %)

- Waters Corporat $WAT (-0,3 %)

- Nova Ltd. $NVMI (-6,44 %)

- Monolithic Power Systems Inc. $MPWR (-8,2 %)

Incoming Companies:

- Alphabet Inc. Class C$GOOG (-3,33 %)

- Nintendo Co. Ltd.$7974 (-4,43 %)

- S&P Global Inc. $SPGI (-1,05 %)

- InterContinental Hotels Group PLC $IHG (-1,42 %)

- Bristol-Myers Squibb Company $BMY (-2,36 %)

- Intercontinental Exchange Inc. $ICE (-1,75 %)

- Regeneron Pharmaceuticals Inc. $REGN (-1,38 %)

- Motorola Solutions Inc. $MSI (-0,81 %)

- Marriott International Inc. Class A $MAR (-3,51 %)

- Hilton Worldwide Holdings Inc. $HLT (-2,09 %)

- Industrivarden AB Class C$INDU C (-1,43 %)

- EMS-CHEMIE HOLDING AG$EMSN (-1,2 %)

- D'Ieteren Group SA/NV $DIE (-1,6 %)

- Electronic Arts Inc. $EA (-0,78 %)

- CK Infrastructure Holdings Limited $1038 (+0,35 %)

This rebalancing aligns QDEV with evolving market conditions while maintaining its focus on quality companies with strong financial foundations. For investors seeking exposure to financially robust global corporations, these changes appear strategically sound, particularly with the inclusion of resilient tech giants and hospitality leaders positioned for growth.

Will this prove to be a winning choice? The fundamentals certainly suggest so.

My favorites in the non-consumer goods sector 🏎️✨

Hermes $RMS (-3,96 %) (very expensive 🤑 )

Ferrari $RACE (-3,78 %)

Lululemon $LULU (-4,88 %)

Just do it $NKE (-4,98 %) (supposedly cheap at the moment, please do not reach into the falling knife)

Booking $BKNG (+0,36 %)

Marriott $MAR (-3,51 %)

Ulta Beaty $ULTA (-2,84 %) and/or L'Oreal $OR (-1,55 %) (much more expensive)

Mercadolibre $MELI (-6,22 %)

Texas Roadhouse $TXRH (-3,15 %)

Chipotle $CMG (-3,56 %)

Fast Retailing $9983 (+0,51 %)

(doesn't fit with the others on the list but I could imagine it as a speculative stock)

"Everything" very expensive, luxury.

I would be interested to know what your favorites are for a long-term investment?

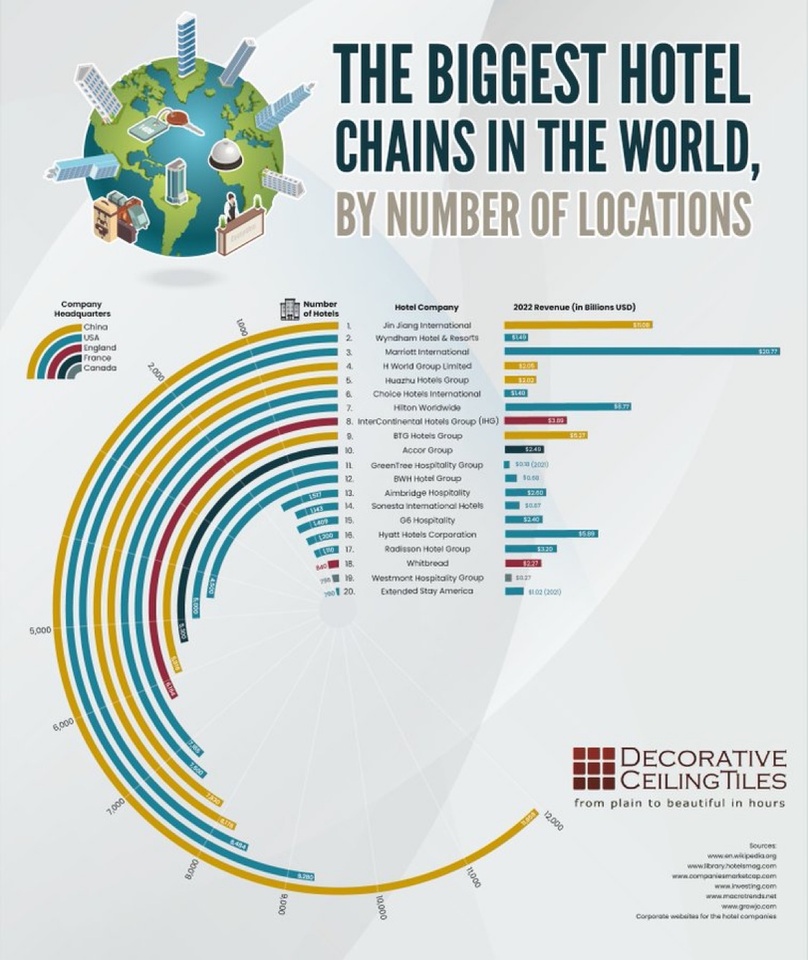

Sofi (Galileo) - WYNDHAM Hotels & Resorts

Galileo secures a major partnership with Wyndham Hotels, which has 114 million members worldwide! This is a great success for $SOFI (-10,55 %) & Galileo, extending its reach in the hospitality industry.

Wyndham is the second largest hotel chain in the world (after Jin Jiang) and the largest in North America in terms of number of hotels (although their revenue is lower than other chains).

Geoffrey A. Ballotti

CEO, Wyndham Hotels & Resorts:

Marriott Q4'24 Earnings Highlights

🔹 Adj EPS: $2.45 (Est. $2.37) 🟢

🔹 Revenue: $6.43B (Est. $6.38B) 🟢; UP +5% YoY

🔹 Adj EBITDA: $1.29B (Est. $1.25B) 🟢; UP +7% YoY

Q1'25 Guidance:

🔹 Adjusted EPS: $2.20-$2.26 (Est. $2.37) 🔴

🔹 RevPAR Growth: +3%-4% YoY

FY25 Guidance:

🔹 Adjusted EPS: $9.82-$10.19 (Est. $10.63) 🔴

🔹 RevPAR Growth: +2%-4% YoY

🔹 Adjusted EBITDA: $5.30B-$5.44B

Quarterly Operational Highlights:

🔹 Worldwide RevPAR: +5% YoY

🔹 U.S. & Canada RevPAR: +4.1% YoY

🔹 International RevPAR: +7.2% YoY

🔹 Net Rooms Growth: +6.8% YoY; Record gross room additions of 123,000

Fee Revenue:

🔹 $1.33B; UP +7% YoY

🔹 Base Management Fees: $333M; UP +4% YoY

🔹 Franchise Fees: $795M; UP +13% YoY

🔹 Incentive Management Fees: $206M; DOWN -6% YoY

Other Revenue:

🔹 Owned, Leased, and Other Revenue: $100M; DOWN -8% YoY

Strategic and Shareholder Updates:

🔸 Development Pipeline: Nearly 3,800 properties and 577,000 rooms globally

🔸 Capital Returns: $4.4B returned to shareholders in FY24, including $3.7B in share repurchases

🔸 Debt Position: Total debt of $14.4B; cash and equivalents of $0.4B

NH Hotels (Minor Hotels Europe & Americas) with enormous growth plans and great benefits for shareholders

Hello everyone,

First of all, thank you for the numerous comments and reactions to my first post here on Getquin. The whole thing has inspired me to share something with you again today that I personally like very much.

This is about the advantages for shareholders of the Minor Group and the $NHH share.

What does Minor Hotels do?

Minor Hotels is a hotel group such as $MAR (-3,51 %) or $H (-2,64 %) .

Here are a few facts:

- Over 340 hotels and 55,462 rooms worldwide

- Represented in over 30 countries (mainly Europe)

- Well-known brands such as NH Hotels and Anantara

- Strong investments in the expansion of the portfolio

Spain is currently the Group's strongest location with 84 hotels. However, the Group is also represented in Germany with currently 50 hotels.

While the majority of revenue (54%) comes from the hotel sector, a further 43% comes from the Minor Food division and 3% from the Minor Lifestyle division.

Key figures

- Turnover 2024: EUR 2.163 billion

- Market capitalization: EUR 1.99 billion

- Price/earnings ratio (P/E ratio): 14.25

- Price-to-book ratio (P/B ratio): 1.91

- Price/cash flow ratio (KCV): 3.32

- Earnings per share: EUR 0.29

- Book value per share: EUR 2.20

- Cash flow per share: EUR 1.26

Group investments

An article published in the Minor Hotels Newsroom on April 26, 2024 describes the Group's enormous growth plans. By the end of 2026, a further 200 hotels worldwide are to be added to the Minor Hotels portfolio.

Considering that the group currently has 350 hotels, it is clear that enormous growth is planned for the coming years. Over 50 of the 200 hotels are to be built in Europe, while new hotels are also to be built in America.

Advantages for shareholders

The group presented here is part of the Minor International Group. It has a total of 546 hotels worldwide, including famous brands such as Kempinski (including the Adlon in Berlin).

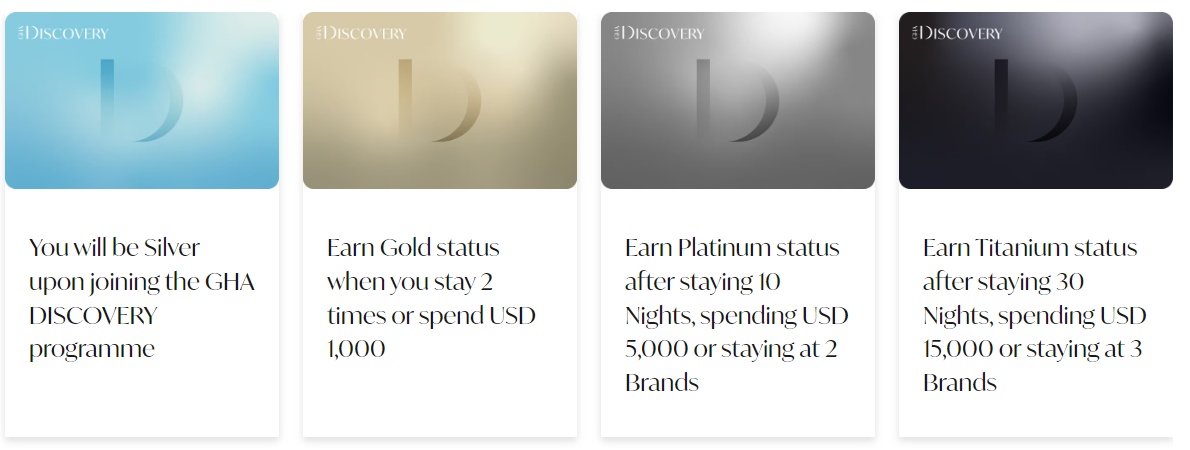

All 546 hotels benefit from the GHA Discovery hotel bonus program. This gives loyal customers exclusive benefits for their stays at Minor International Hotels through a ranking system.

Here is a list of the different ranks and the services required for them:

As you can see here, enormous annual sums are sometimes required to achieve a higher level. Although it is possible to achieve the highest rank with 3 stays at different brands of the group, it should be noted here that the group mainly has luxury hotels in its portfolio.

However, for shareholders the group offers a free upgrade up to the highest membership. In the following, I will show you the advantages of the ranks and the sums that you have to invest in the share in order to achieve the respective rank for free.

Silver ( Free for all)

- Partner Benefits

- 4% cashback in the form of credit for the hotels and their activities

- Free WLAN

- 10% discount on all bookings

- Exclusive offers

- Member Only activities

- Access to Member Only areas in hotels

Gold ( from 1 EUR)

- All the benefits of the previous levels

- 5% cashback in the form of credit for the hotels and their activities

Platinum ( From 2000 EUR)

- All benefits of the previous levels

- 6% cashback in the form of credit for the hotels and their activities

- Room upgrade (subject to availability)

- Check out until 3 pm (subject to availability)

- Welcome gift

Titanium (from 3000 EUR)

- All the benefits of the previous levels

- 7% cashback in the form of credit for the hotels and their activities

- Double room upgrade (subject to availability)

- Free breakfast in some hotels (number of participating hotels is increasing rapidly)

- Check in from 11 am

- Guaranteed room in the 48 hour period

- Free ASSMALLWORLD membership (otherwise 100 EUR per year)

(AttentionBy purchasing NH shares you will initially only receive NH Discovery status. However, this entitles you to the same membership in the GHA Discovery Program. Simply write/call the support team there and this should be sorted out quickly).

I personally got the Titanium membership last month and will try it out on my next hotel visit on Thursday. If you are interested in finding out what benefits I really got and whether it all worked, please feel free to follow me. I plan to upload an update as soon as possible after my vacation :)

End

That's it for this post. I hope I haven't forgotten anything. If you have, feel free to post your questions in the comments and I'll try to answer them as best I can.

I wish you a happy new year !!!

Is that still cheaper than booking.com, for example?

All of these shares reached new ALL-TIME HIGHS at some point today ⤵️

Nvidia $NVDA (-6,14 %)

Amazon $AMZN (-5,92 %)

Netflix $NFLX (-2,08 %)

Walmart $WMT (-0,92 %)

JPMorgan $JPM (-2,22 %)

Goldman Sachs $GOS0

Palantir $PLTR (-7,09 %)

Blackrock $BLK

American Express $AXP (-3,64 %)

Arista $ANET

Apollo $APO PR A

Blackstone $BX (-5,08 %)

Booking $BKNG (+0,36 %)

Instacart $INSTA (+0,18 %)

Caterpillar $CAT (-2,48 %)

Capital One $COF (-3,86 %)

Discover Financial $DFS

Electronic Arts $EA (-0,78 %)

GE Vernova $GEV (-5,3 %)

Hilton $HLT (-2,09 %)

Howmet $HWM (-3,03 %)

Interactive Brokers $IBKR (-5,42 %)

Cheniere $LNG (-2,16 %)

Morgan Stanley $MS (-3,39 %)

Marriot $MAR (-3,51 %)

Nasdaq $NDAQ (-2,85 %)

News Corp $NWSA (-3,06 %)

Oracle $ORCL (-3,03 %)

Palo Alto $PANW (-4,92 %)

ServiceNow $NOW (-3,24 %)

Steel Dynamics $STLD (-4,91 %)

Stryker $SYK (-2,46 %)

Royal Caribbean $RCL (-1,72 %)

Reddit $RDDT (-0,01 %)

Trade Desk $TTD (-5,03 %)

Visa $V (-2,33 %)

Wells Fargo $WFC (-3,48 %)

$MAR (-3,51 %) | Marriott International Q3 Earnings Highlights:

🔹 Adj EPS: $2.26 (Est. $2.31) 🔴

🔹 Revenue: $6.26B (Est. $6.27B) 😕; UP +6% YoY

🔹 Adj Net Income: $638M; UP slightly

🔹 Adj EBITDA: $1.229B

FY'24 Guidance:

🔹 Adj EPS: $9.19-$9.27 (Est. $9.36) 🔴

🔹 RevPAR Growth (Worldwide): 3%-4%

🔹 Gross Fee Revenue: $5.126B-$5.146B

🔹 Adjusted EBITDA: $4.93B-$4.96B

🔹 Net Rooms Growth: Approx. 6.5%

Q4'24 Outlook :

🔹 Adjusted EPS: $2.31-$2.39

🔹 RevPAR Growth (Worldwide): 2%-3%

Q3 Revenue Per Available Room (const-fx):

🔹 Worldwide: UP +3.0%

🔹 U.S. & Canada: UP +2.1%

🔹 International: UP +5.4%

Revenue Breakdown:

🔹 Base Management & Franchise Fees: $1.124B (UP +7% YoY, driven by RevPAR and unit growth)

🔹 Incentive Management Fees: $159M (UP +11% YoY, primarily from international managed hotels)

🔹 Owned, Leased & Other Revenue: $381M (UP +5% YoY)

Development Pipeline & Operational Metrics:

🔸 Net Room Additions: Approx. 16,000 rooms in Q3

🔸 Total Properties: Nearly 9,100 properties globally with 1,675,000 rooms

🔸 Worldwide Development Pipeline: 3,802 properties and 585,000 rooms, including 220,000 rooms under construction

🔸 Share Repurchases in Q3: 4.5M shares for $1.0B; YTD capital return of $3.9B through dividends and repurchases

Additional Financial Metrics:

🔹 Operating Income: $944M (DOWN -14% YoY)

🔹 Interest Expense, Net: $168M (UP due to higher debt balances)

🔹 General & Administrative Expenses: $276M (UP, mainly due to operating and litigation reserves)

CEO Commentary - Anthony Capuano:

🔸 "Marriott had another solid quarter with strong net room and fee growth. Our global RevPAR increased by 3%, with particularly strong gains in APEC and EMEA. Group RevPAR was a standout with a 10% rise in Q3, supporting our excellent business momentum."

Investing in demographic change: senior boom = portfolio boom?

Hello Community,

thank you once again for your positive response to my last article "Climate change - rising temperatures, rising depot".

Today I have a no less relevant topic for you: The megatrend of an ageing society.

Boring. Everyone knows it. Not interesting. Or is it?

There are trends that are omnipresent: AI, climate change, the war in Ukraine, etc.. The trend of an ageing society, on the other hand, is hardly ever heard in everyday life.

Why is that? I suspect that the story of an ageing society was already told many years ago. Every year, the population ages a little more. The frog is sitting in water that is slowly heating up. Only when it is too late does he realize how hot it is getting.

That's why it's interesting for me to look at potential profiteers right now. The hype train hasn't started yet - and perhaps it won't due to the linear development of age cohorts. But hardly any other trend is so certain and predictable - and yet still under the radar.

One request in advance: let's remain objective. Ageing is a sensitive topic that can be emotionally charged. In my view, however, moral or political discussions have no added value here as long as no investments can be derived from them. There are other platforms for that.

Background

For anyone who has not yet heard of demographic change: The baby boomer generation (born between 1946 and 1964) are also known as the "baby boomers". These generations can be found in both the USA and Europe. And this age cohort is gradually retiring. In addition, the proportion of young people in the population is decreasing, as birth rates are steadily declining after the baby boomers.

So there will be more "old people". Which companies could benefit from this development?

To keep things interesting for you, I will focus on less obvious players. Nursing homes, Big Pharma and the like, you probably already know that.

I'm interested in profiteers at second glance. Here we go.

1. tourism

An ageing society does not mean care, immobility and illness. Today's older people are much fitter than they were 20 years ago, for example. Tourism can be one of the beneficiaries here. Where do senior citizens hang out? Presumably on cruise ships 😉

Actually less interesting for me because it's "asset heavy". But cruise companies have been heavily penalized since Corona. They are also not interesting for the ESG community because they are dirty. So maybe interesting after all?

The big players $RCL (-1,72 %) Royal Caribbean Cruises, Norwegian Cruise Line and $CCL (-3,57 %) Carnival are probably familiar to most people. Caribbean is now also back above the pre-corona rates - in contrast to the other two. It is possible that they will follow suit.

If that's too hot for you, you could take a closer look at $MAR (-3,51 %) take a closer look at Marriott. This is the largest hotel chain in the world. It can be classified in the premium segment - which is interesting, as senior citizens can look back on an entire working life. And if they invest their money wisely, they will certainly want to (and be able to) enjoy the last stage of their lives in comfort.

Due to Corona, a look at the development of the key figures is a little distorted. Nevertheless, profits grew by around 13% p.a. over 5 years, while sales growth is estimated at 7.2% p.a..

In addition, there is a dividend yield of just under 1%, although there is still room for improvement with a payout ratio of just under 25% of free cash flow.

In my view, the stock is currently running a little too hot. Definitely something for the watch list if tourism should collapse - that happens regularly.

2. leisure & consumption

Brunswick Corporation

I had never heard of this company before my research. The company is active in the (sports) boat sector and is regarded as a leading manufacturer in this field. They sell boat electronics and drives as well as "finished" boats, from inflatable boats to large yachts.

Sales growth over 5 years: 9.4 % p.a.

Profit growth over 5 years: approx. 14 % p.a.

Plus a dividend yield of currently 2%.

Despite a cyclical industry, profit stability is 0.84.

That is strong. In addition, the share is currently trading at the level of 2022.

The leisure boat market is generally resilient and is also forecast to grow by around 5% p.a. Exciting niche value in my view.

Churchill Downs Incorporated (horse racing tracks)

$CHDN (-1,59 %) Churchill Downs operates horse racing tracks, casinos and betting facilities. They host the famous Kentucky Derby at their racetrack. In itself fun for young and old, although the cliché probably focuses more on the older customer. An exciting candidate that can also remain interesting for young customers due to its segments.

The figures are a real treat:

Sales growth over 5 years: approx. 16 % p.a.

Profit growth over 5 years: approx. 22 % p.a.

Despite strong price growth, the share is fundamentally fairly valued according to my research and still offers some potential due to the growth prospects.

If I wasn't already heavily invested in gambling, this would be a hot candidate for me.

Animal welfare is of course a critical point here. But please remember: This is supposed to be about shares and investments, not about moral debates.

Acushnet Holdings Corp

If horse racing is too exciting for you, you can take a look at Acushnet Holdings Corp. $GOLF (-3,58 %) . As the ticker says, it's all about golf (products). The company sells everything related to the sport.

And they have an impressive 14/15 points in the Traderfox quality check.

If you ask around in golf, you know how expensive the equipment can be. And the sport can be played well into old age.

Unfortunately, the candidate wasn't included in the share finder, so I haven't included that many key figures for you here. If you are interested, you can research the company in more detail (and perhaps share your findings here?).

3. medical care

Having dealt with two positive areas, we will now turn to the other side of the coin of ageing: the increased need for medical care. There is, of course, a wide range of companies here. I have brought along two candidates that I have repeatedly come across in my research:

Resmed

$RMD (-2,58 %) Resmed's main business lies in the treatment of sleeping disorders and respiratory diseases. However, a second - currently small - segment is very exciting for the trend discussed here: software solutions, which include remote monitoring tools to make patient care more efficient. There are not only more old people - there are also fewer young people. There will certainly be resource bottlenecks (shortage of specialists) when it comes to covering the increasing treatment requirements. Efficiency-enhancing options are important here.

Resmed's main business is developing magnificently. Another strong branch could be established with Software Solutions. A very exciting candidate for me.

The figures:

Sales growth over 5 years: 12.6 % p.a.

Profit growth over 5 years: 21 % p.a.

Was still very cheap six months ago. Will be on my watch list. I will get in if there is a setback.

Stryker

I have been looking for alternatives to $SYK (-2,46 %) Stryker for a long time, as Stryker is probably not one of the "second glance" profiteers. They are simply too well known for that. But there's no getting around the company. Even when I was specifically looking for specialists in hip and joint implants, no other company could come close to matching the quality of Stryker's figures. In the event of a setback, I would consider getting in. Or do you know of any alternatives?

4. nursing & patient care

Let's move on to the last category: care. Sooner or later, you will need care in old age. Care is not only provided on an inpatient basis, but also on an outpatient basis. You will no doubt have seen various small cars from outpatient care services in cities. There are no monopolistic structures here; there are many small providers on the market. So how can you benefit from care? I looked around for "shovel manufacturers":

Nexus AG

$NXU (+0,07 %) Nexus AG is a company for software systems for hospitals, care centers and medical practices. They optimize processes there and aim to improve patient care. In my view, this is more exciting than, for example, a player from its US counterpart ($MCK (+1,05 %) ), as Europe is more affected by demographic change than the USA. And Nexus AG has not yet performed as strongly as McKesson recently.

Estimated sales growth of just under 13% p.a., estimated earnings growth of 26% p.a.

For me, it is on the watch list alongside McKesson.

Cintas

The company $CTAS (-2,8 %) specializes in workwear and textiles. As boring as it sounds, the figures are impressive, as is the performance. Congratulations to all those who got in early.

In my view, the company is interesting because everyone involved and the (care) added value requires suitable (clean) workwear. And with blue-collar jobs like these, there is probably little risk that AI will make them obsolete in the next few years. After all, the company is not only active in the care textile industry.

However, despite its high quality, the company is far too expensive in my view. A P/E ratio of 44 with sales growth of <10% p.a. is high.

But: The company is also subject to a certain cyclicality. I will definitely put it on my watchlist - I will get in if there is a significant setback.

That was it, my ride through the demographic stocks.

Now it's your turn:

- Which companies do you think will benefit from demographic change?

- What effects do you see?

If you don't have an opinion, I would be delighted to receive any feedback on my article:

- Was it too short? Too long?

- Did you miss something?

- How could I make my posts more interesting overall?

I'm looking forward to your comments.

Your Money Man

Upcoming events for next week:

Monday:

- Arista Networks Inc. ($ANET ) and Cadence Design Systems Inc. ($CDNS (-9,81 %) ) report quarterly figures before.

- Monthly US federal budget statement (January).

Tuesday:

- Quarterly figures from Coca-Cola ($KO (+0,18 %) ), Moody's Corp. ($MCO (-2,16 %) ), Shopify Inc. ($SHOP (-9,54 %) ), Airbnb Inc. ($ABNB (-2,76 %) ) and Marriott International Inc. ($MAR (-3,51 %) ).

- Consumer Price Index (CPI) (January).

Wednesday:

- Quarterly figures from Cisco ($CSCO (-3,83 %) ), Sony Group Corp. ($6758 (-5,66 %) ) and Kraft Heinz Co. ($KHC (-0,09 %) ).

Thursday:

- Quarterly figures of Applied Materials Inc. ($AMAT (-6,65 %) ), Stellantis ($STLAM (-7,66 %) ), Occidental Petroleum Corp. ($OXY (-6,15 %) ), John Deere & Co. ($DE (-3,27 %) ), DoorDash Inc. ($DASH (-5,35 %) ), CBRE Group Inc. ($CBRE (-1,52 %) ), Coinbase Global Inc. ($COIN (-0 %) ) and DraftKings Inc. ($DKNG (-7,73 %) ).

- Initial claims for unemployment benefits (week ending February 10)

- US Retail Sales (January)

- Import Price Index (January)

- Industrial Production (January)

- Capacity utilization (January)

- Homebuilder confidence index (February)

Friday:

- Producer Price Index

(PPI) (January) - Building permits (January)

- Michigan Consumer Sentiment Index (Preliminary February)

Titres populaires

Meilleurs créateurs cette semaine