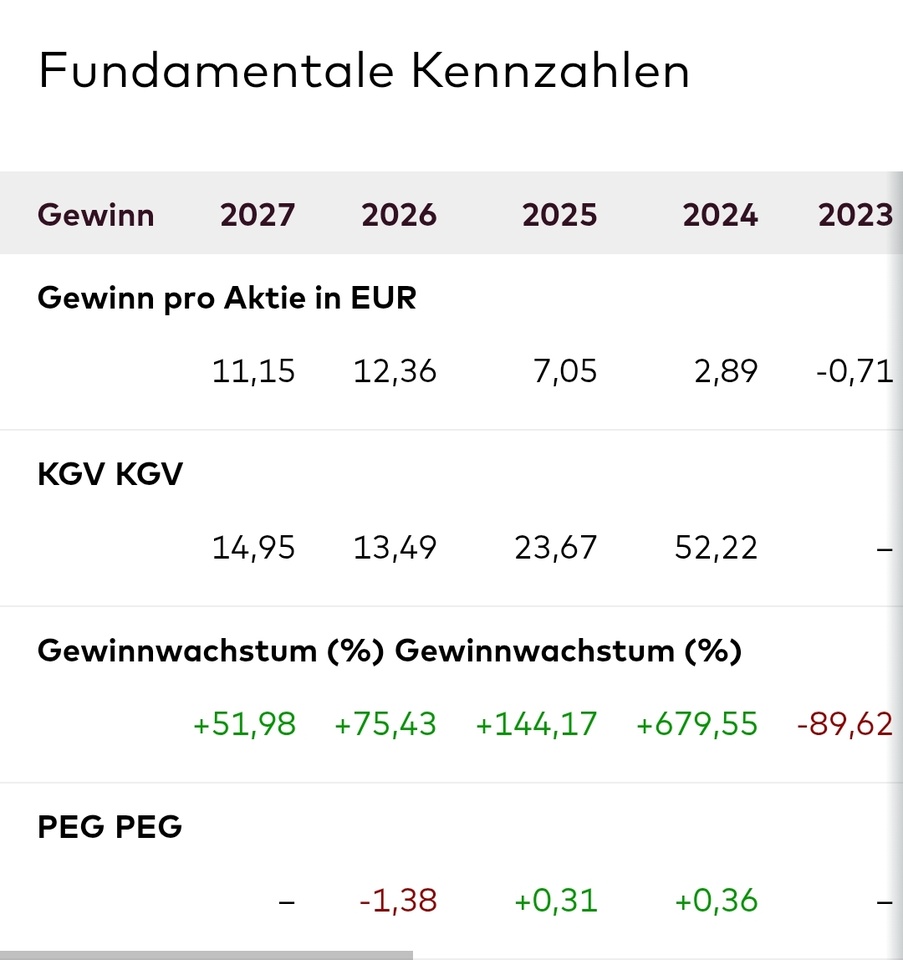

I remain invested due to the attractive valuation and the excellent earnings growth.

PITTSBURGH - The U.S. Food and Drug Administration (FDA) has approved a label expansion for Krystal Biotech's (NASDAQ:KRYS) VYJUVEK. The company announced on Monday that this expands the range of treatable patients to include newborns with dystrophic epidermolysis bullosa (DEB). The biotech company, which is currently valued at 4.16 billion US dollars, has recorded impressive sales growth of 116% in the last twelve months. According to an analysis by InvestingPro, the stock is trading below its fair value, indicating potential upside.

The updated approval also allows patients and caregivers to administer the treatment themselves. It also offers more flexibility in wound care, as dressings can now be removed at the next dressing change rather than after 24 hours.

VYJUVEK is a topical gene therapy that introduces copies of the COL7A1 gene directly into the wounds of DEB patients. This treats the disease-causing mechanism at its root by providing the skin cells with the template to produce the normal COL7 protein.

"By giving patients and their caregivers the ability to self-administer VYJUVEK, we have made it easier for them to integrate the treatment into their daily lives and lifestyles," said Krish S. Krishnan, Chairman and CEO of Krystal Biotech. The company has an exceptional gross profit margin of 93.37% and received a "VERY GOOD" rating from InvestingPro for its financial health. InvestingPro also provides comprehensive analysis and more than 10 other ProTips on the promising biotech company.

Brett Kopelan, CEO of debra of America, called the approval extension "a significant and impactful step forward for those living with DEB." He noted that it allows "more convenience without sacrificing safety".

The approval extension is based on real-world data collected since the launch of VYJUVEK in the US, as well as the results of an open-label extension study published earlier this year. This demonstrated long-term safety and efficacy in patients of all ages, including in cases where treatment was self-administered by patients or caregivers.

VYJUVEK is currently approved in the United States, Europe and Japan. According to the press release, the most common side effects reported include itching, chills, redness, rash, cough and rhinitis.

In other recent news, Krystal Biotech reported impressive results for the second quarter of 2025, with earnings per share (EPS) reaching 1.29 US dollars, exceeding the forecast of 1.22 US dollars. Revenue of USD 96.04 million also exceeded expectations of USD 92.24 million. Despite these strong results, management indicated that sales could be lower in the third quarter due to patient treatment pauses. This prompted BofA Securities to lower the price target to USD 182, although the Buy recommendation was maintained. At the same time, Krystal Biotech is advancing the development of its inhaled immunotherapy KB707 for the treatment of non-small cell lung cancer and has been granted an End of Phase 2 meeting by the FDA to discuss potential approval pathways. Chardan Capital Markets adjusted its price target to $216 following the company's strategic realignment to prioritize inhaled delivery of KB707 and maintained a Buy rating. H.C. Wainwright also reiterated its Buy rating with a price target of $240, supporting the company's focus on inhaled KB707 for the treatment of advanced non-small cell lung cancer. These developments underscore Krystal Biotech's continued efforts to drive innovation and adapt its strategies in response to market and trial data.