McDonald's $MCD (-0,2 %) is one of my top 3 positions in the portfolio and not without reason:

The Group has stood for stability, strong dividends and global brand power for decades.

But even McDonald's is not immune to inflation, consumer restraint and macroeconomic headwinds.

In the following article, I categorize the Q1 figures based on the official earnings release [1] and supplementary statements from the earnings call/webcast [2].

In addition to the pure figures, it's also about loyalty programs, margin development, new menu strategies and my personal conclusion on the share.

Have fun!

_______________

McDonald's is starting the new year with a decline in sales and profits, with business weakening in the USA in particular. Nevertheless, the company is showing global resilience, particularly through its licensed markets and the rapidly growing loyalty program.

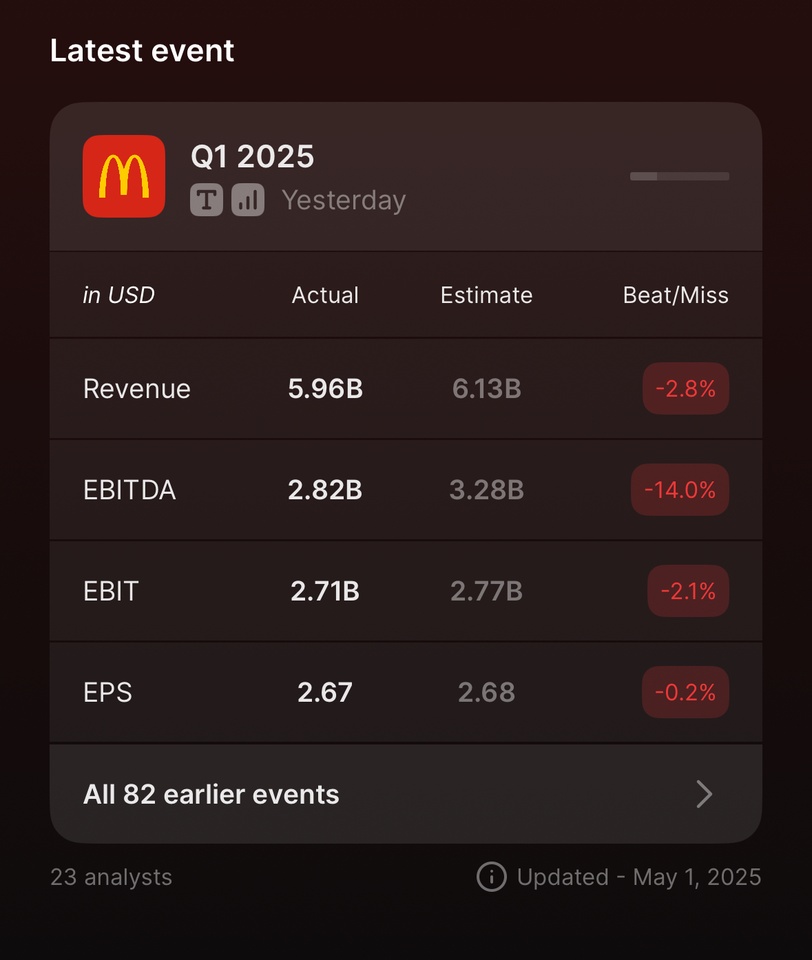

📊 ESTIMATES VS. REPORTED

*(According to the earnings report, operating profit (EBIT) amounted to $2.65 billion; the third-party provider Quartr states a slightly different figure of $2.71 billion, which may be due to rounding or other valuation measures).

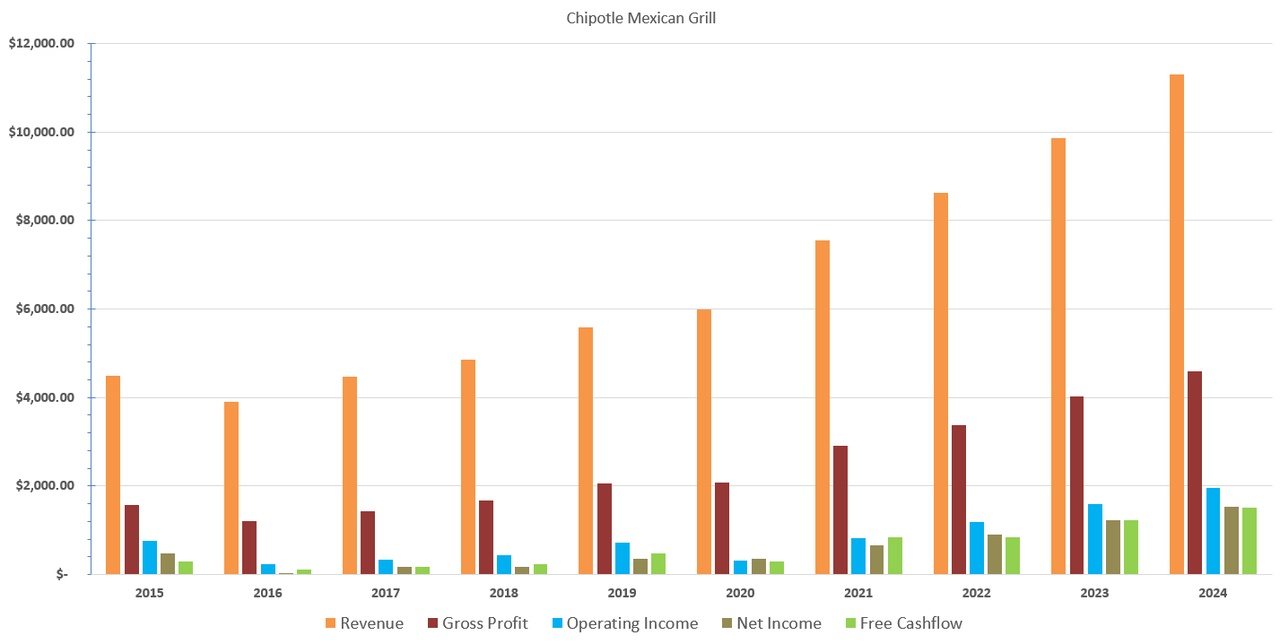

📊 Results Q1 2025

- Turnover$5.96 billion (previous year: $6.17 billion) -> decline of 3%

- Operating profit (EBIT): $2.65 billion (previous year: $2.74 billion) -> decrease of 3%

- Earnings per share (EPS):

- GAAP (incl. special effects): $2.60 (previous year: $2.66) → -2%

- Non-GAAP (adjusted): $2.67 (previous year: $2.70) → -1 %

What is GAAP vs. non-GAAP?

- GAAP: official accounting in accordance with US accounting rules

- Non-GAAP: adjusted figures, e.g. without special effects such as restructuring costs, often better suited to evaluate the "operating business"

💰 Margin & result

"Our adjusted operating margin was around 45.5%, despite declining sales."

- Operating margin down slightly (vs. 46.3% in FY 2024), but remains very robust given the environment

- Restaurant margins above $3.3 billion in Q1

- Declines in company-operated margins, especially in Europe (see brief digression)

EXCURSUS: Company-operated margin: (operating margin from company-owned restaurants)

...refers to the profit margin that McDonald's generates from the restaurants it operates itself, as opposed to franchise or licensed operations.

McDonald's operates two types of restaurants worldwide:

1 . Franchise restaurants (around 95%)

- Operated by independent entrepreneurs.

- McDonald's earns from this through franchise fees, rent and revenue sharing.

2 . Company-operated restaurants (approx. 5 %)

- Belong directly to McDonald's

- Sales and costs run entirely through the consolidated balance sheet.

Why is this margin important?

- It shows how profitable McDonald's own stores are.

- If, for example, costs for staff, food or energy rise, this puts pressure on this margin.

- In the earnings call, it was emphasized that company-operated margins were under pressure in Q1, particularly in Europe:

- cost inflation

- weaker demand

- unfavorable exchange rates

🌍 Global comparative figures (Comparable Sales):

- These are sales from existing restaurants that have been open for at least 13 months. They show organic growth without the effect of new locations.

- Worldwide: -1.0 %

- USA: -3.6 %

- International Operated Markets (IOM): -1.0 %

- International Developmental Licensed Markets (IDL): +3.5 %

What are IOM and IDL markets?

- IOM: Countries and regions in which McDonalds itself is more heavily involved (e.g. Germany, UK, France)

- IDL: Countries in which McDonald's does not operate its restaurants itself, but licenses them to local franchise partners. These partners pay fees to McDonald's but run the business independently. Examples: Japan, Middle East, parts of Asia and Africa.

📉 Why did things go worse in the USA?

The decline in sales in the USA (-3.6 % comparable sales) was mainly due to:

- Fewer guests (falling visitor numbers)

- Consumer restraint among lower income groups

- Price increases in the previous year, which are now increasingly deterring customers

- Fewer orders per visit & fewer premium products in the shopping basket (weaker product mix)

🌐 System-wide sales (system-wide sales):

- This comprises the total sales of all McDonald's restaurants, i.e. both existing and new locations, regardless of whether they are operated by McDonald's itself or by franchise partners.

- Q1 2025: -1 %

- but: +1 % at constant exchange rates

What does this mean?

Without the influence of fluctuating exchange rates, sales would have increased by 1 %. Calculated in US dollars, for example, a weak euro has a negative impact, even though the local business is stable.

🔁 Leap Day distorts comparison:

2024 was a leap year with February 29 (Leap Day), which means one more day of sales compared to 2025, making the previous year's base appear artificially higher. This makes the decline in sales appear larger than it actually is.

🎯 Loyalty program, McDonald's digital joker

Via the app or with a customer account, users receive loyalty points for their orders, which they can exchange for free products or discounts, similar to Payback but with burgers.

- $8 billion in sales in Q1 2025 with loyalty members

- $31 billion in the last 12 months

- 175 million active users (in the last 90 days), measured on a rolling basis

Why is the revenue from loyalty members higher than the Group revenue of $5.96 bn?

- The $8 billion are system sales (Systemwide Sales see above, i.e. the total sales of all McDonald's restaurants worldwide, including franchise operations.

- McDonald's Group revenue ($5.96 billion) only includes the revenue of the company itself (e.g. franchise fees & revenue from own stores).

➡ The high loyalty revenue shows how strong customer loyalty and app usage have become and how important this digital strategy is for McDonald's future.

➡️ Loyalty customers order more frequently, spend more and are less price-sensitive. The program helps McDonald's to stabilize sales and retain customers, especially in difficult economic times.

💳 Consumer climate & customer behavior

"In contrast to a few months ago, spending by middle-class consumers has now fallen almost as sharply as that of low-income households."

- Christopher Kempczinski, CEO

- Macroeconomic pressure & geopolitical uncertainty are impacting the QSR environment more than expected.

- Low- and middle-income customers are spending significantly less - especially in the USA.

- High-income customers remain relatively stable.

UnderstandingWhat is the QSR environment?

QSR = Quick Service Restaurant

This refers to the quick service restaurant sector, e.g. McDonald's, Burger King, Subway, KFC, etc.

When the "QSR industry" is mentioned in the earnings call, this refers to the competition and demand in the global fast food sector.

The "QSR environment" includes:

- Consumer behavior (how often do people go out to eat?)

- competitive pressure

- pricing strategies

- Costs (e.g. for raw materials, wages, rents)

🔎 Interim conclusion so far:

As expected, the figures show a challenging quarter with declines in sales and earnings in almost all core markets.

The USA in particular suffered from inflation, price pressure and weaker demand.

At the same time, McDonald's remains remarkably profitable with an operating margin of 45.5 %, which speaks for the resilience of the business model.

Growth in the licensed markets (IDL) and the strong loyalty program provide clear rays of hope.

For me, these are the first signs that McDonald's is structurally well positioned, even if the short-term momentum is currently slowing.

⚙️ Further initiatives & Strategy 2025:

Value-oriented menu strategy & McValue platform

"Leadership in price-performance is crucial in this environment."

- $5 Meal Deal in the USA

- EDAP menus (Every Day Affordable Price) in all 5 most important international markets

- Example France: Happy Meal for €4, menu cooperation with Ligue 1

- Example Germany: new McSmart Snacks program for price-conscious customers

Customer loyalty & marketing offensives

"Our Minecraft campaign is our biggest global campaign to date - with over 100 participating markets."

- Minecraft movie campaign with digital experience & in-store promos

- 50 years of breakfast in the US with McMuffin Day & bagel return

- In Canada: $1 coffee & field hockey promo with 50 million impressions

Innovation & new structure

"We are creating burger, chicken & beverage specialists as we compete more and more against specialized players (e.g. chains that focus only on chicken or beverages, such as Chick-fil-A or Starbucks) to develop targeted products and better compete in these segments."

- New Restaurant Experience Team

- Faster implementation thanks to integrated product/tech/supply approach

- CosMc's insights flow into new beverage tests in US stores

- New category managers for Beef, Chicken & Beverages

GBS = Global Business Services:

- McDonald's centralizes areas such as accounting, IT & controlling to save costs and work faster.

More focus on mobile orders & digitalization

- Mobile orders via app & kiosks make the ordering process more efficient, collect data and increase basket value

Investments:

- +$300-500 million CapEx planned annually until 2027

- Focus on new restaurants, modernization & technology

📉 Challenges:

- Inflation & reluctance to spend, especially in the USA & Europe

- Currency risks: Weak foreign currencies depress sales in US dollars

- Operating margin pressure: Rising costs coupled with falling visitor numbers

📌 Personal conclusion

In the first quarter, McDonald's showed that even a giant can come under pressure, especially in a weak economic environment with declining visitor numbers in the US and Europe.

Nevertheless, the share price has remained relatively stable.

At the same time, I am convinced by the long-term levers:

the strong loyalty program, targeted pricing models and the international expansion in licensed markets (IDL), which are growing solidly.

I am continuing to hold my position, as McDonald's remains a robust basic investment for me.

However, there will be no further acquisitions at the moment, as I would first like to see margins and customer numbers stabilize in the long term.

_____________

Thank you for reading! 🤝

_____________

Sources:

[1] https://corporate.mcdonalds.com/content/dam/sites/corp/nfl/pdf/Q1_25_Earnings_Release.pdf

[2] https://web.quartr.com/link/companies/5595/events/314423?targetTime=0.0

______________

$MCD (-0,2 %)

$YUM (+0,38 %)

$QSR (-0,21 %)

$WEN (+0,38 %)

$CMG (+0,16 %)

$SBUX (-0,19 %)

$DPZ (+0,1 %)

$JACK (+2,4 %)