Reading time: approx. 5 min

In connection with shares, the term "growth shares" is often used. growth shares are often mentioned. These are said to be particularly fast-growing and deserve a higher valuation than so-called value shares or no-growth shares.

However, the question is what is a growth share is not so easy to answer. How strong must the growth be for a share to be considered a growth share? What growth are we even looking at? Which growth is the most important? What can we conclude about the company if it is growing in the various key figures? An overview.

Revenue Growth

When so-called high growth stocks we are often talking about companies that have been able to increase their sales very strongly. Revenue growth is probably the most easily tangible form of growth: more was sold, the number of customers increased, the products/services could be sold at a higher price and/or the market share increased.

Sales growth is important for a company because it often shows that the company's products/services have sold better. However, pure sales growth is only one type of growth. There are many more types of growth and the meanings of the different types of growth can say a lot about the underlying company.

Gross Profit Growth

The gross profit is the share of a company's turnover that remains after we have deducted the direct production costs (cost of goods sold) that are necessary to create the product. If we sell a product for €100 and it cost €20 to manufacture the product, the gross profit is €80.

If a company grows in turnover, the gross profit should ideally increase in step. It becomes particularly interesting when gross profit grows even faster than turnover. This is often an indicator that the company has high pricing power or that the business model is very efficient. is very efficient. In this case, it is also often referred to as operating leverage is often used. This occurs, for example, when production facilities are better utilized, production can be made more efficient or, in the case of software services, the customer base has exceeded a certain threshold so that hardly any new costs are incurred for the additional delivery of the software.

Operating profit growth

If the costs for research and development (R&D) research and development (R&D), depreciation and amortization as well as the costs for sales, general and administrative expenses (SG&A) we arrive at the so-called operating profit. Operating profit is a measure of a company's operational strength, as it includes all the costs required to sell a product or provide a service.

If operating profit grows faster than gross profit, this is often a sign of increasing efficiency in sales, administration, marketing and research work. For example, more products could be sold without increasing marketing costs to the same extent.

Net income growth

If we deduct so-called non-operating costs such as taxes or interest expenses from the operating profit, we obtain the net income.

If net income increases more than operating profit, this is a sign of increased efficiency in taxes and/or falling financing costs. A large gap between operating profit and net income, on the other hand, could indicate increasing debt or a deterioration in taxation.

Free cash flow growth

The free cash flow can be calculated from net income, which takes into account non-cash items such as depreciation and amortization or stock compensation and excludes capital expenditure (CapEx) are deducted. It is therefore an indicator of the free cash and cash equivalents that are actually available to a company after deducting investment expenditure. Ultimately, it is the amount of free cash and cash equivalents available to a company's shareholders from operating activities after deducting capital expenditure.

If free cash flow rises more strongly than net income, this is an indicator of better cash conversion. cash conversioni.e. the company is better able to convert "book profits" into cash available to shareholders.

If a company buys back its own shares in addition to increasing free cash flow, the free cash flow per share will increase more than the free cash flow. Each individual shareholder then benefits disproportionately to the actual free cash flow growth of the company.

At the same time, FCF/share is historically one of the best indicators of a share's long-term price performance, as FCF/share is the proportion per share of the company's annual free cash surplus. The company's management can then use this for investments, dividends, share buybacks or debt repayments.

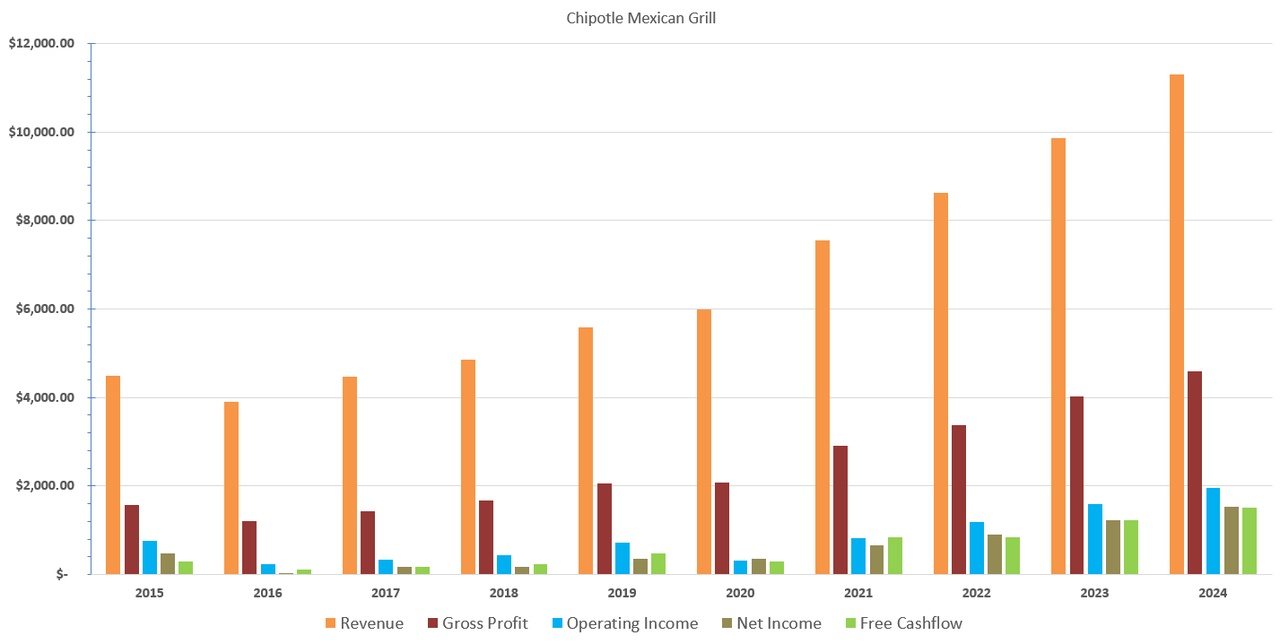

EXAMPLE: Let's look at an example of a company that has managed to grow in all of the growth metrics presented: Chipotle Mexican Grill

$CMG (-0,47 %). In the period from 2015 to today, the compound annual growth rate (CAGR) was as follows:

Revenue Growth: 10.8%

Gross profit growth: 12.7%

Operating profit growth: 11.0%

Net income growth: 13.9%

Free cash flow growth: 20.1%

FCF per share growth: 20.9%

Share price growth: 23.3%

Gross profit has therefore grown even faster than sales. We remember: this is often a sign of increasing efficiency in production or may involve a certain degree of pricing power. However, Chipotle was not entirely successful in converting the rising gross profit into rising operating profit. However, it still grew faster than sales, which is a sign of good operating leverage. operating leverage could be an indication of good operating leverage. However, net income grew more strongly than sales, gross profit and operating profit. Free cash flow increased significantly more than net income. Chipotle therefore succeeded disproportionately well in converting book profits into real cash and cash equivalents. Through share buybacks, the FCF per share increased even more than the actual free cash flow. An overview of Chipotle's key financial figures can be found in the following chart:

The share price performance in the same period is 23.3% CAGR is roughly on a par with the growth in FCF/share, which again underlines the fact that the growth in the share price is dominated by the growth in FCF/share in the long term.

Conclusion

We have seen that it is not the growth exists. Sales growth is one aspect of a healthy and growing company. However, we often underestimate the significance of other growth metrics. We can see from the Chipotle example that simply looking at sales growth is not a complete view of a company's growth story. There are many operational levers with which the management of a company can ensure the most important growth for us in the long term - growth in the share price. growth in the share price.

What are your favorite growth metrics and why?

Stay tuned,

Yours Nico Uhlig