- Anthropic is therefore in talks about a Google cloud partnership worth tens of billions of dollars

- The goal is to expand AI training and deployment capabilities significantly via Google's infrastructure

- Share price +2.9 % after the close

Postes

893- Anthropic is therefore in talks about a Google cloud partnership worth tens of billions of dollars

- The goal is to expand AI training and deployment capabilities significantly via Google's infrastructure

- Share price +2.9 % after the close

Today, October 21, 2025, global markets are mixed, but $BPE (+0,08 %) is absolutely dominating the scene. With a rally of +6.55%(at the open), the stock confirms itself as a pillar of my strategy.

While the $NSDQ100 loses momentum, BPER's performance in Milan—which is the fifth-largest holding in my portfolio—demonstrates how fundamental analysis can isolate specific stocks from macro fears.

🔎 Market & BPER Deep Dive

The Driver Behind the $BPE (+0,08 %) Rally:

The exceptional surge is fueled by strong positive sentiment related to optimistic corporate forecastsand the finalization of the Banca Popolare di Sondrio merger. Recent upward revisions of target pricesby analysts (like Barclays) and the bank's improved capital strength (CET1 Ratio) are insulating the stock from the concerns affecting other European banks. The market is rewarding efficiency and synergy realization.

Global Context: Is the Rally Sustainable?

Yesterday's risk-on rally is quickly losing steam:

Dollar Strength ($DXY$):The Dollar's return to strength is breaking the positive sentiment across nearly all risk assets and new tech.

Tech and Crypto:Following strong initial gains, $BTC (-2,46 %) , $ETH (-2,2 %) , and many Tech stocks ($GOOGL (+1,54 %) , $NVDA (-0,55 %) struggling) are undergoing a correction, confirming their vulnerability to risk-offsentiment.

Gold $GLD (+0,44 %) & Oil:Gold is sharply correcting, signaling that systemic fear is retreating. Meanwhile, oil hits 5-month lows due to supply concerns.

💼 My Strategy: Focus on Fundamentals

BPER's surge (6.55%) on a cautious global day reinforces the importance of selecting stocks based on strong fundamentalsover short-term sentiment. I continue to maintain my focus on:

1. Quality Stockswith strong, specific catalysts (like the BPER merger).

2. Strategic Technology($NVDA, $TSM$).

3. Active Risk Managementto absorb market shocks like last week's sell-off.

For daily real-time market insights, deep dives, and trading discussions, follow me on X: https://x.com/ThomasVioli

To copy my portfolio, strategies, and complete trade insights, you can follow me on eToro: https://www.etoro.com/people/farlys

⚠️ Disclaimer: Past performance is not indicative of future results. Investing involves risks, including the loss of capital.

🇺🇸 USA

$SPX500 — Futures indicate a slight decline, showing loss of momentum after yesterday's rally, driven by negative tech futures.

$DJ30 — Down slightly, affected by the cautious sentiment and renewed Dollar strength.

$NSDQ100 — Under pressure, the tech rally has faded, leading to pre-market weakness.

💻 Tech & Growth Snapshot

$NVDA (-0,55 %) — Down slightly (-0.10%), the chipmaker stock is struggling to hold onto yesterday's gains.

$GOOGL (+1,54 %) — Down (-0.44%), aligning with the cautious sentiment in the tech sector.

$AVGO (+1,29 %) — Up slightly (0.09%), showing resilience in the semiconductor space.

$META (+0,52 %) — Down slightly (-0.02%), the Communication Services sector is mixed.

$MSFT (+0,11 %) — Up slightly (0.02%), the stock is essentially flat.

$QBTS (-3,83 %) — Down (-0.53%), the quantum sector is actively correcting.

$RGTI (-8,5 %) — Down (-0.51%), in line with the broader *new techcorrection.

$TSM (+0 %) — Up (0.80%), showing strong resilience and helping to support the chip sector.

$RR. (+0,38 %) — Down slightly (-0.06%), the Industrial/Aerospace stock is mixed.

🛍️ Retail & Commerce

$AMZN (-0,43 %) — Up slightly (0.06%), essentially flat, following the mixed tech trend.

$BABA (-0,14 %) — Down (-1.99%), experiencing a clear drop, reflecting heavy selling in Chinese stocks.

$CVNA (+0,07 %) — Down slightly (-0.06%), losing ground.

$SHOP (-1,41 %) — Down (-0.64%), retail tech is under pressure.

⚕️ Health & Pharmaceutical

$LLY (-0,04 %) — Up slightly (0.01%), holding up better than the general market.

$HIMS (+0,73 %) — Stable (0.00%), in line with the cautious mood.

$INSM (-0,35 %) — Stable (0.00%), the biotech sector is mixed.

🇪🇺 Europe & Industrials

STOXX 600 — Opening solidly up, exceeding initial caution (resilience driven by defensive sectors).

GER40 — Up, showing resilience.

$LDO (+1,5 %) — Up slightly (0.38%), the defense sector is stable.

$IBE (-0,01 %) — Up (0.53%), the utilities sector is in the green, showing defensive appeal.

$OKLO — Down (-0.56%), the new tech stock is experiencing profit-taking.

🏦 Banking & Finance

$UCG (+0,39 %) — Up slightly (0.13%), Italian banks are mixed.

$ISP (-0,33 %) — Up slightly (0.16%), showing a modest gain.

$BAMI (+0,12 %)

$CE (+0,23 %) , $BPE (+0,08 %) — BPER Banca ($BPE.MI$) is in a massive rally (6.55%), strongly counter-trending the sector; $CE.MI$ is up $1.36\%$.

$BBVA (-0,04 %) — Down (-0.81%), showing clear pressure and vulnerability today.

$AXP (-0,15 %) — Down (-0.26%), ahead of today's earnings report.

$V (-0,07 %) — Down (-0.19%), following cautious sentiment in the payments sector.

$CS (+0,13 %) — Up slightly (0.15%), the financial services sector is mixed.

🌏 Asia

$JPN225 — Close in a solid gain, with the Nikkei hitting $50,000$.

$KOSPI — Close mixed/stable, Korean tech holds up.

$HK50 — Up, the index is recovering.

$CHINA50 — Up, tracking positive global sentiment.

💱 Forex

$EURUSD — Down, the Euro loses ground as the Dollar recovers.

$GBPUSD — Down, the Pound is under pressure.

$USDJPY — Solidly up, the Yen is falling as the Dollar makes a strong recovery.

$DXY — The Dollar Index is moving sharply higher, breaking the risk-on sentiment.

💎 Commodities & Precious Metals

$GLD (+0,44 %) — Stable (0.00%), gold is pausing after yesterday's correction.

$CDE (+0,51 %) — Stable (0.00%), following the gold correction.

$BRENT — Down slightly, oil drops to a 5-month low.

$WTI — Losing ground, in line with Brent.

💰 Crypto

$BTC (-2,46 %) — Down, crypto is undergoing a significant correction.

$ETH (-2,2 %) — Down, following Bitcoin.

$TRX (-0,82 %) — Down, the altcoin sector is negative.

$CRO (-2,72 %) — Down, in line with overall negative sentiment.

🚀 Space & New Tech

$RKLB (+0 %) — Up (2.75%), strong counter-trend move in high-beta growth stocks.

🔎 Deep Dive: The Market Divergence

The key theme today is divergence. US indices futures are soft, but specific European stocks are surging (BPER Banca is up over $6\%$) in a massive counter-trend move, highlighting local corporate strength despite global caution. The New Tech sector is mixed: $TSM$ is surprisingly up, while $NVDA$ is slightly down. The Dollar ($DXY$) continues its strength, penalizing risk assets like Bitcoin ($BTC$), while Utilities ($IBE.MC$) and specific banks demonstrate insulation. Today is a major test with $NFLX and $LMT reporting.

For daily real-time market insights, *deep dives*, and trading discussions, follow me on X: https://x.com/ThomasVioli

To copy my portfolio, strategies, and complete trade insights, you can follow me on eToro: https://www.etoro.com/people/farlys

⚠️ Disclaimer: Past performance is not indicative of future results. Investing involves risks, including the loss of capital.

🇺🇸 USA

$SPX500 — Futures indicate a decisive surge, with the market attempting to recover losses from last week's banking sell-off.

$DJ30 — Futures in a solid rise, showing generalized risk-on sentiment.

$NSDQ100 — Futures are strongly up, with tech leading the market rebound.

💻 Tech & Growth Snapshot

$NVDA (-0,55 %) — Up (0.55%), the stock is leading the semiconductor sector, confirming strong AI demand.

$GOOGL (+1,54 %) — Up (0.19%), the stock joins the positive Nasdaq trend.

$AVGO (+1,29 %) — Up (0.53%), the semiconductor sector benefits from renewed optimism.

$META (+0,52 %) — Up (0.48%), showing a strong recovery after recent weakness.

$MSFT (+0,11 %) — Up (0.36%), the stock regains momentum with positive sentiment.

$QBTS (-3,83 %) — Strongly up, quantum computing sentiment has turned positive amid the tech rebound.

$RGTI (-8,5 %) — Up sharply (3.08%), the quantum sector actively participates in the risk-on move.

$TSM (+0 %) — Up sharply (2.43%), boosted by optimism in the semiconductor sector.

🛍️ Retail & Commerce

$AMZN (-0,43 %) — Up (0.80%), strong pre-market recovery, led by tech.

$BABA (-0,14 %) — Down (-0.57%), counter-trending Western tech, affected by Asian uncertainties.

$CVNA (+0,07 %) — Up (0.57%), the stock gains ground following the broader market trend.

$SHOP (-1,41 %) — Solidly up, retail tech is driven by the general risk-on mood.

⚕️ Health & Pharmaceutical

$LLY (-0,04 %) — Up, tracking the general market rebound.

$HIMS (+0,73 %) — Stable (0.00%), the stock is steady after last week's volatility.

$INSM (-0,35 %) — Stable (0.00%), the biotech sector cautiously joins the rally.

🇪🇺 Europe

STOXX 600 — Opening solidly up, in line with global optimism.

GER40 — Decisively higher, the German market regains momentum.

$LDO (+1,5 %) — Stable (0.00%), the defense sector is neutral in this rebound phase.

$$IBE (-0,01 %) — Stable (0.00%), utilities are static in a risk-on environment.

$OKLO — Up sharply (1.73%), advanced nuclear technology continues its positive trend.

🏦 Banking & Finance

$$UCG (+0,39 %) — Stable (0.00%), Italian banks are trying to establish a base after heavy selling.

$$ISP (-0,33 %) — Stable (0.00%), awaiting clearer signals.

$$BAMI (+0,12 %) , $CE (+0,23 %) , $BPE (+0,08 %) — Stable (0.00%), the financial sector shows caution despite the risk-on trend.

$$BBVA (-0,04 %) — Stable (0.00%), the Spanish stock is leading the European banking recovery.

$AXP (-0,15 %) — Up (0.59%), the payments sector participates in the rebound.

$V (-0,07 %) — Up (0.07%), confirming its positive tone.

🌏 Asia

$JPN225 — Close in a solid rise, led by optimism in tech markets.

$KOSPI — Close up, Korean tech drives the index.

$HK50 — Up, tech stocks recover despite BABA's uncertainties.

$CHINA50 — Up, following positive global sentiment.

💱 Forex

$EURUSD — Up, the Dollar is losing momentum in a risk-on phase.

$GBPUSD — Up, the market positively assesses prospects for a stronger economy.

$USDJPY — Down, the Yen is gaining ground.

$DXY — The Dollar Index is showing clear weakness.

💎 Commodities & Precious Metals

$GLD (+0,44 %) — Down slightly (0.00%), gold consolidates as investors shift to riskier assets.

$CDE (+0,51 %) — Stable (0.00%), tracking the flat movement of gold.

$BRENT — Up, showing signs of demand recovery.

$WTI — Gaining ground, reflecting positive macroeconomic sentiment.

📈 Benchmark ETFs

$VOO (-0,02 %) — Tracking $SPX500$ futures higher.

$VGT (+0,11 %) — Up (0.00%), reflecting the strength of the technology sector.

$$CSNDX (+0,18 %) — Up (0.00%), tracking Nasdaq futures in positive territory.

$BND (-0,03 %) — Down (0.00%), reflecting rising yields.

💰 Crypto

$BTC (-2,46 %) — Strong recovery, the crypto sector bounces off the bottom and gains ground.

$ETH (-2,2 %) — Solidly up, following Bitcoin.

$TRX (-0,23 %) — Up (0.00%), the altcoin sector participates in the rally.

$CRO (-2,72 %) — Up, in line with overall positive sentiment.

🚀 Space & New Tech

$RKLB (+0 %) — Up, sentiment for growth stocks suggests a rebound.

🔎 Deep Dive: The Return of Risk-On

The week opens with a decisive "Risk-On" mood. Markets are clearly shrugging off (for now) last week's banking tensions, focusing instead on tech-led growth ($NVDA, $TSM$) and hopes for monetary easing. The strong rally in cryptocurrencies ($BTC, $ETH$) and the weakness of the Dollar ($DXY$) are clear indicators that liquidity is flowing back into riskier assets. European banks ($BBVA.MC$) and the semiconductor sector show unexpected strength, while gold ($GLD$) pauses, confirming the shift in focus from systemic risk to growth opportunities.

For daily real-time market insights, deep dives, and trading discussions, follow me on X: https://x.com/ThomasVioli

To copy my portfolio, strategies, and complete trade insights, you can follow me on eToro: https://www.etoro.com/people/farlys

⚠️ Disclaimer: Past performance is not indicative of future results. Investing involves risks, including the loss of capital.

Reading time: approx. 10 minutes

The last article was about leveraged daily ETFs - in other words, about momentum, short-term market movements and strategies where timing is crucial. Today it will be much quieter. It's about what remains when markets fluctuate and hypes fade: the fundamentals.

This article is aimed primarily at beginners and is intended to help them find their way through the ETF jungle - to understand which products are truly global, how they differ and how to build a stable core portfolio.

After all, long-term wealth accumulation does not start with the search for the highest return, but with a solid core. In my case, this core consists of three pillars:

These three positions form the backbone of my portfolio. The rest - i.e. rotation strategies, thematic investments or leveraged products - complement the foundation.

Why an ETF comparison is important

"World ETF" sounds like global diversification. In practice, however, many of these funds only cover industrialized countries. The difference between $XDWD (+0,15 %) (iShares MSCI World UCITS ETF), $ISAC (+0,21 %) (iShares MSCI ACWI UCITS ETF) and $VWCE (+0,16 %) (Vanguard FTSE All-World UCITS ETF) is not a marginal detail, but crucial for your own investment strategy.

Anyone who understands these differences quickly realizes how much the selection of the index determines the actual distribution in the portfolio - and how much "world" is actually in your own ETF.

The $ISAC (+0,21 %)

(iShares MSCI ACWI UCITS ETF)

The $ISAC (+0,21 %) tracks the MSCI All Country World Index - around 2,800 stocks from 47 countries, covering around 85% of global market capitalization.

Regional breakdown (as at October 2025):

This combines the $ISAC (+0,21 %) industrialized and emerging markets in one product - exactly what many investors replicate themselves with two ETFs (MSCI World + MSCI Emerging Markets).

The total expense ratio (TER) is currently 0.20% p.a. - extremely favorable for a global fund of this breadth.

I use it as a core building block because it combines global diversification with simplicity: one ETF, one decision, global participation.

$ISAC (+0,21 %)

vs. $XDWD (+0,15 %)

(iShares MSCI World)

The $XDWD (+0,15 %) (iShares MSCI World UCITS ETF) only tracks 23 industrialized countries - no emerging markets, no China, no India. It contains around 1,500 stocks and is heavily dominated by the USA.

The $ISAC (+0,21 %) (iShares MSCI ACWI UCITS ETF) expands this base to include 24 emerging markets and thus has around 2,800 stocks. This means:

In recent years, the MSCI World has been slightly ahead because the emerging markets have underperformed. In the long term, these phases tend to even out - and this is precisely where the ACWI shows its strength: It automatically grows with the global economy, even if the regional focus changes.

$ISAC (+0,21 %)

vs. $VWCE (+0,16 %)

(Vanguard FTSE All-World)

The $VWCE (+0,16 %) (Vanguard FTSE All-World UCITS ETF) is the best-known alternative to the $ISAC (+0,21 %) . It also combines industrialized and emerging markets, but according to the FTSE index methodology and with around 4,000 shares - i.e. somewhat broader.

Both funds fulfill the same purpose: global coverage in a single product. The differences lie in the details - for example in the country classification (e.g. South Korea is listed as an industrialized country in FTSE, but as an emerging country in MSCI).

The performance is also almost identical. The TER of the $VWCE (+0,16 %) at 0.19% p.a. is even slightly lower than that of the $ISAC (+0,21 %) . Both funds therefore offer an almost equivalent opportunity to invest globally over the long term.

Concentration in the $ISAC (+0,21 %)

Despite its breadth, the ACWI is also concentrated on a few heavyweights. The top 5 positions account for around 18% of the fund (as at October 2025):

This shows how strongly the US technology sector shapes the global markets. This weighting is not a disadvantage, but a true reflection of global market capitalization. I consciously accept this structure, but balance it out with my other core components: $BTC (-2,46 %) (Bitcoin) as an uncorrelated asset and $SEGA (+0 %) (iShares Core Euro Government Bond ETF) as an anchor of stability.

Five-year performance (as at October 2025)

The differences are manageable. The MSCI World benefited more from the dominance of the USA, while $ISAC (+0,21 %) and $VWCE (+0,16 %) are more broadly based. This global diversification can lead to more stable returns in the long term because it is less dependent on individual markets.

What newcomers can take away from this

In my opinion, an ETF is often sufficient. A global fund like the $ISAC (+0,21 %) covers almost all markets - ideal for getting started.

Keep an eye on costs. A TER of 0.20 % is very favorable for this breadth.

Global means USA-dominated. Around two thirds of the fund comes from the United States - and that is currently the market reality.

Simplicity is an advantage. Those who manage fewer products remain more consistent in the long term.

Time beats actionism. The compound interest effect unfolds its power over years - not months.

The $ISAC (+0,21 %) (iShares MSCI ACWI UCITS ETF) is the centerpiece of my portfolio. It stands for breadth, simplicity and global participation - and realistically reflects the global economy.

Together with the $BTC (-2,46 %) (Bitcoin) - which not only brings potential returns but also diversification to the portfolio - and the $SEGA (+0 %) (iShares Core Euro Government Bond ETF) as a defensive counterpart, a robust core setup is created that covers all dimensions: Growth, stability and risk diversification.

The rest - thematic or individual investments, rotation strategies or leveraged ideas - completes the foundation.

Questions at the end:

I'm excited to share an in-depth performance review of my eToro portfolio today. I've analyzed the last 12 months, and the results clearly show that a focused strategy can significantly beat the market.

Here are the final numbers, from October 2024 to today:

As the chart shows, not only did I beat the market, I more than doubled the performance of the strongest benchmark index, the Nasdaq 100! This result is proof that a targeted, high-conviction strategy can make a huge difference.

So, how did this happen? Let's break down the key pillars of my winning strategy:

1. Going Beyond the Benchmark

This year, passively investing in a Nasdaq ETF would have been a great move. But my strategy aimed higher. I focused on specific disruptive stocks within the biggest tech megatrends—names with a higher potential for exponential growth than the giants that dominate the index. This active selection is what created the real performance gap.

2. Using Volatility as Fuel

The chart is honest: during the market correction in April, my portfolio dipped lower than all the indices. That's the price of a concentrated growth portfolio. Many would have sold. I held firm, confident in my long-term thesis. The explosive recovery starting in May proved that patience and conviction were rewarded.

3. Active Selection, Not Passive Investing

These results don't come from just buying an ETF. They require active management: studying fundamentals, understanding the macro environment, and having the courage to invest in innovative companies like $RKLB, $OKLO, and $RGTI before they become mainstream.

4. Understanding the Market Narrative

The indices tell a clear story: tech ($NSDQ100) led the market, while industrial stocks ($DJ30) lagged. My strategy fully embraced this trend, concentrating capital where the real growth was happening.

Conclusion

Beating the market is tough. Beating its strongest sector is even tougher. This +53.63% return demonstrates the power of a focused strategy that accepts calculated risk to aim for extraordinary returns.

I'm proud of these results and will continue to share my journey and analysis with full transparency.

PS: The past is a lesson, not a guarantee. But the strategy remains the same: find the companies that will build our future and invest in them with conviction.

⚠️ Disclaimer: Past performance is not an indication of future results. Investing involves risks, including the loss of capital.

https://www.etoro.com/people/farlys

$SPX500 $NSDQ100 $DJ30

$AAPL (+0,01 %)

$MSFT (+0,11 %)

$GOOGL (+1,54 %)

$AMZN (-0,43 %)

$NVDA (-0,55 %)

$TSLA (+0,43 %)

$META (+0,52 %)

$RKLB (+0 %)

$OKLO

$RGTI (-8,5 %)

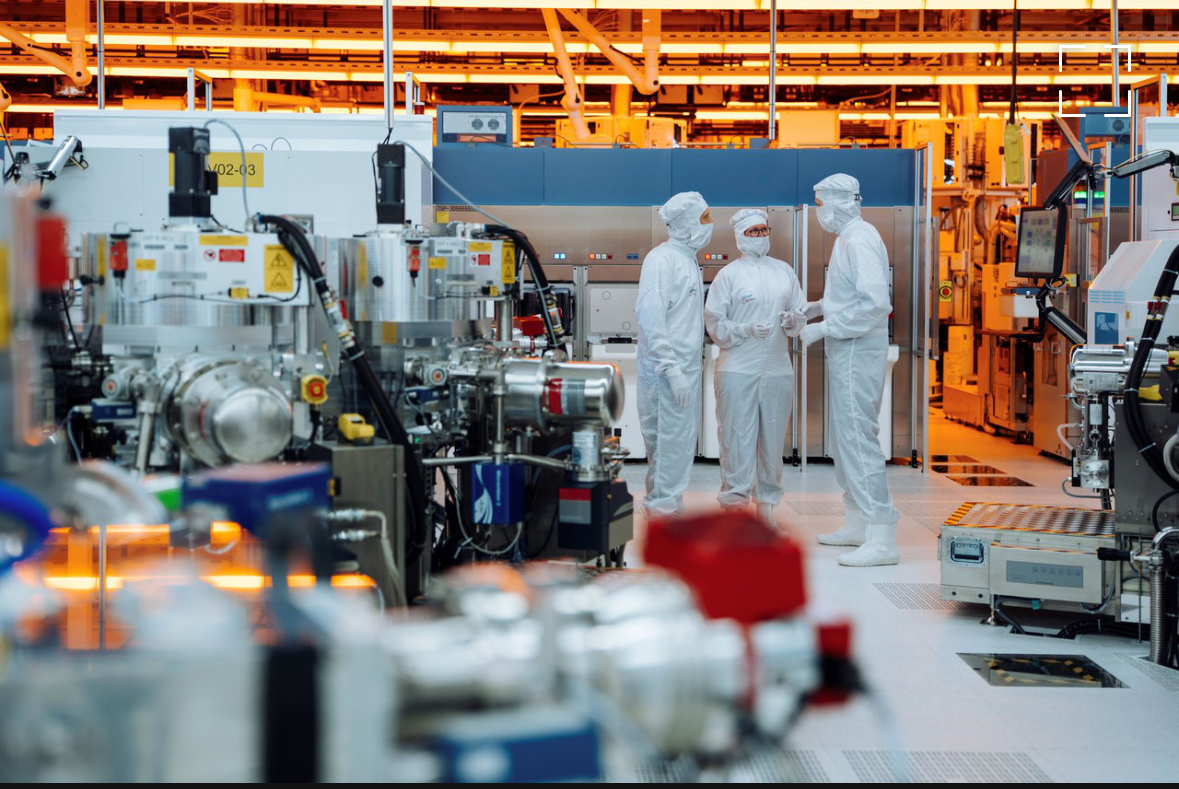

Infineon $IFX (-1,76 %) is the global market leader in power semiconductors, i.e. the chips that are essential for powering data factories. Business is going better than ever before - but this is probably just the beginning. "The demand for power semiconductors for AI data centers is increasing massively," Infineon top manager Richard Kuncic told Handelsblatt.

The high investments are a blessing for Infineon in two respects.

Firstly, the company is benefiting from the sheer number of new server farms. In recent weeks, OpenAI has signed contracts worth billions with Oracle, Nvidia and AMD. "There is huge demand," said founder Sam Altman last week, but "we are so constrained by computing power."

Other companies are also investing unprecedented sums in data centers. Analysts at Jefferies speak of more than 300 major projects in the United States alone. The four largest hyperscalers, i.e. providers of computing power, would spend 90 billion dollars on new facilities every quarter.

Secondly, more and more power semiconductors are required to supply computers with energy. According to Kuncic, a server cabinet today contains such chips worth between 12,000 and 14,000 euros. This covers the energy requirements of 128 graphics processors, so-called GPUs. GPUs are supplied by companies such as NVIDIA $NVDA (-0,55 %) and AMD $AMD (-1,21 %) They are the core of AI computers.

According to Kuncic, engineers will accommodate 576 GPUs in the next generation of server racks. This will increase the value of the power semiconductors to more than 100,000 euros.

But that's not all. Kuncic: "More and more fields of application are emerging for AI. This is also increasing the demand for power semiconductors." Until now, companies such as OpenAI have mainly used the computers to train AI models at great expense. In the future, however, AI will be used much more frequently.

Europe's largest semiconductor manufacturer promised its investors sales of AI power semiconductors of 600 million euros for the past financial year, which ended on September 30. At the beginning of August, CEO Jochen Hanebeck said that this figure is set to rise to one billion euros in the new financial year.

It is possible that the CEO will increase this forecast in mid-November when he presents the latest results and ventures an outlook for the new financial year.

Infineon supplies the entire value chain with its power semiconductors, from the producers of transformers to computer manufacturers such as $DELL (+1,7 %) Dell , $DELTA (-0,61 %) Delta and $HPE (+0,43 %) HP, to operators such as $AMZN (-0,43 %) Amazon and $GOOGL (+1,54 %) Google.

Together with Nvidia, the world's most valuable corporation, the Munich-based company is developing the next generation of power supply systems for AI data centers. The company made the announcement this spring.

With a market share of just under 18 percent, Infineon is the world's top-selling supplier of power semiconductors. The number two, US competitor Onsemi $ON (+0,77 %)has around nine percent. Infineon is far ahead of its competitors in terms of technology and production, according to Deutsche Bank analyst Johannes Schaller last week.

Source text (excerpt) & graphic: Handelsblatt, 15.10.25

Some suspect that Friday was just a Trump dip, others believe it was the start of the next bear market.

What are the B&H investors actually doing here on Getquin when $NVDA (-0,55 %),$META (+0,52 %), $GOOGL (+1,54 %), $BTC (-2,46 %) and Co. drop >30% over the year?

"Oh, I'll sit it out, what do I care about an annual performance of -30%? - Buy more cheaply!!!" or are you looking away from buy & hold and deviating from your strategy?

Picture: Business Insider

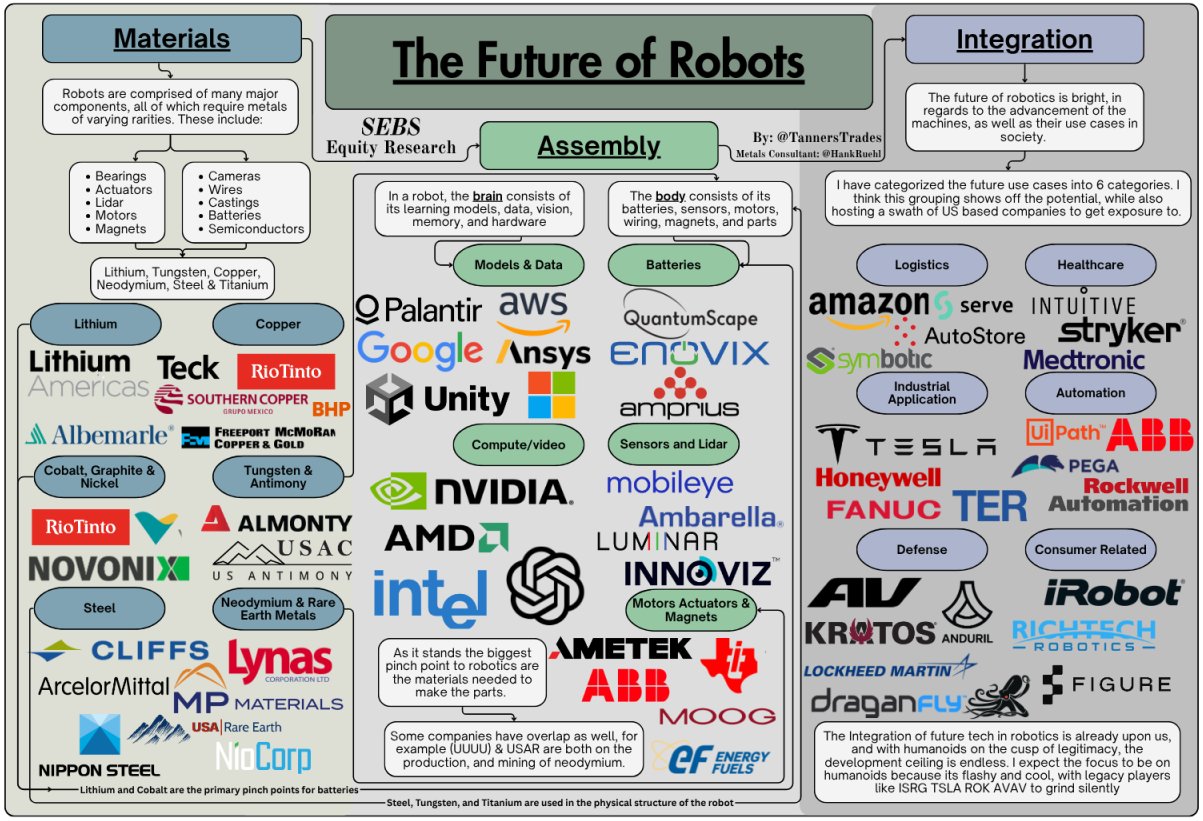

$ISRG (+0,03 %)

$PATH (-2,05 %)

$RR

Here is an exciting overview, for me the most attractive in terms of growth/potential of the stocks I know $RR

$PATH (-2,05 %) also $ISRG (+0,03 %) I would perhaps add to the portfolio again in the event of a correction. However, there are some stocks I don't know either.

What do you think are the most exciting stocks on the list, where should we perhaps take a closer look?

$AMZN (-0,43 %)

$MSFT (+0,11 %)

$NVDA (-0,55 %)

$AMD (-1,21 %)

$GOOGL (+1,54 %)

$GOOG (+1,37 %)

$RIO (-0,47 %)

$ALB (+0,22 %)

$INTC (-0,62 %)

$PLTR (-0,08 %)

$IRBT (+0,41 %)

$SYK (+0,11 %)

$MDT (+0,73 %)

$LMT (-0,12 %)

$DPRO (-1,29 %)

After the rally of$GOOGL (+1,54 %)

I sold 20% of the position to lock in profits.

I used the setback in $7974 (-0,54 %) Nintendo to enter the market and start to slowly diversify.

Focus remains on quality + balance between tech growth and stable cash flows.

Meilleurs créateurs cette semaine