Infineon $IFX (+1,65 %) is the global market leader in power semiconductors, i.e. the chips that are essential for powering data factories. Business is going better than ever before - but this is probably just the beginning. "The demand for power semiconductors for AI data centers is increasing massively," Infineon top manager Richard Kuncic told Handelsblatt.

The high investments are a blessing for Infineon in two respects.

Firstly, the company is benefiting from the sheer number of new server farms. In recent weeks, OpenAI has signed contracts worth billions with Oracle, Nvidia and AMD. "There is huge demand," said founder Sam Altman last week, but "we are so constrained by computing power."

Other companies are also investing unprecedented sums in data centers. Analysts at Jefferies speak of more than 300 major projects in the United States alone. The four largest hyperscalers, i.e. providers of computing power, would spend 90 billion dollars on new facilities every quarter.

Secondly, more and more power semiconductors are required to supply computers with energy. According to Kuncic, a server cabinet today contains such chips worth between 12,000 and 14,000 euros. This covers the energy requirements of 128 graphics processors, so-called GPUs. GPUs are supplied by companies such as NVIDIA $NVDA (+1,1 %) and AMD $AMD (-1,72 %) They are the core of AI computers.

According to Kuncic, engineers will accommodate 576 GPUs in the next generation of server racks. This will increase the value of the power semiconductors to more than 100,000 euros.

But that's not all. Kuncic: "More and more fields of application are emerging for AI. This is also increasing the demand for power semiconductors." Until now, companies such as OpenAI have mainly used the computers to train AI models at great expense. In the future, however, AI will be used much more frequently.

Europe's largest semiconductor manufacturer promised its investors sales of AI power semiconductors of 600 million euros for the past financial year, which ended on September 30. At the beginning of August, CEO Jochen Hanebeck said that this figure is set to rise to one billion euros in the new financial year.

It is possible that the CEO will increase this forecast in mid-November when he presents the latest results and ventures an outlook for the new financial year.

Infineon supplies the entire value chain with its power semiconductors, from the producers of transformers to computer manufacturers such as $DELL (-2,18 %) Dell , $DELTA (-1,12 %) Delta and $HPE (-6,13 %) HP, to operators such as $AMZN (-2,4 %) Amazon and $GOOGL (-0,86 %) Google.

Together with Nvidia, the world's most valuable corporation, the Munich-based company is developing the next generation of power supply systems for AI data centers. The company made the announcement this spring.

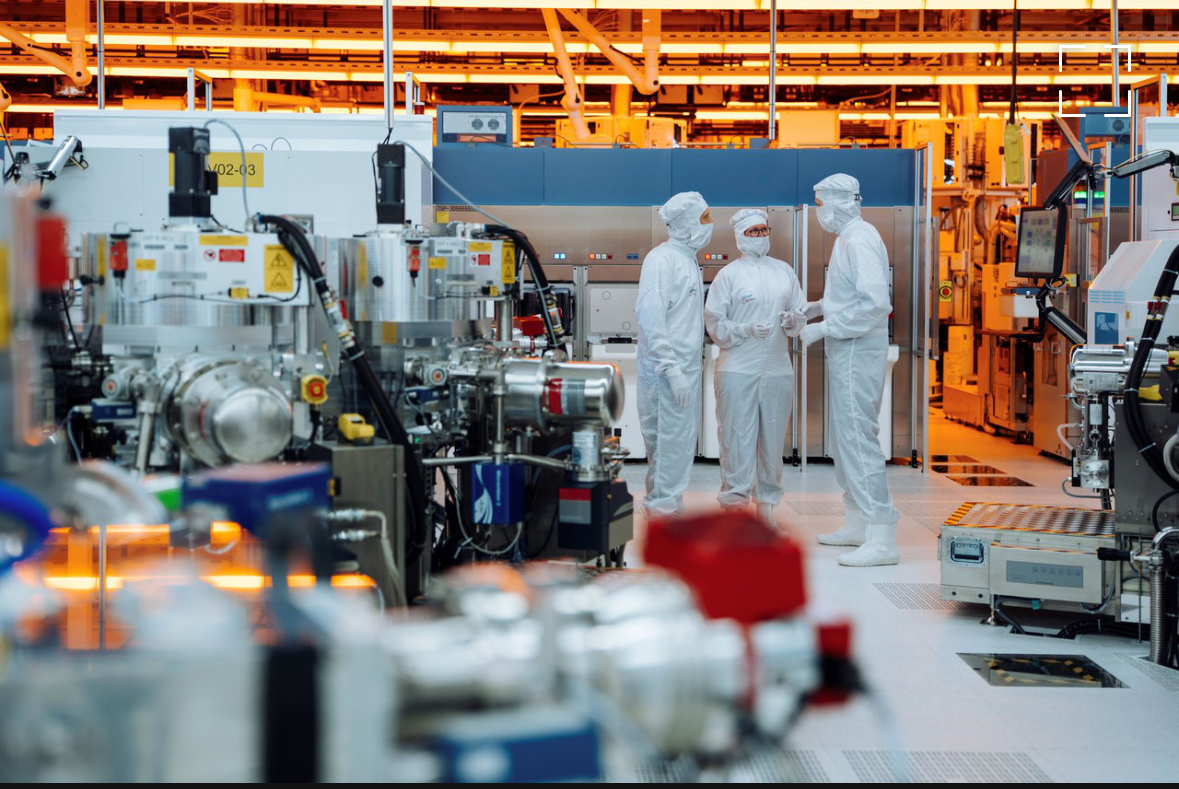

With a market share of just under 18 percent, Infineon is the world's top-selling supplier of power semiconductors. The number two, US competitor Onsemi $ON (-0,1 %)has around nine percent. Infineon is far ahead of its competitors in terms of technology and production, according to Deutsche Bank analyst Johannes Schaller last week.

Source text (excerpt) & graphic: Handelsblatt, 15.10.25