Hello everyone,

I would like to wish everyone a happy holiday and a happy new year.

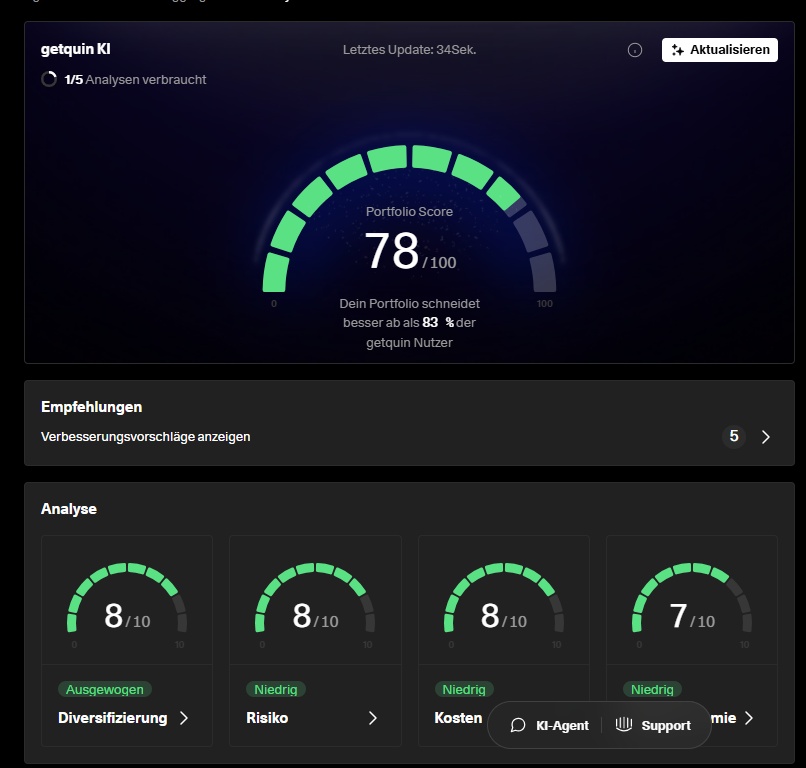

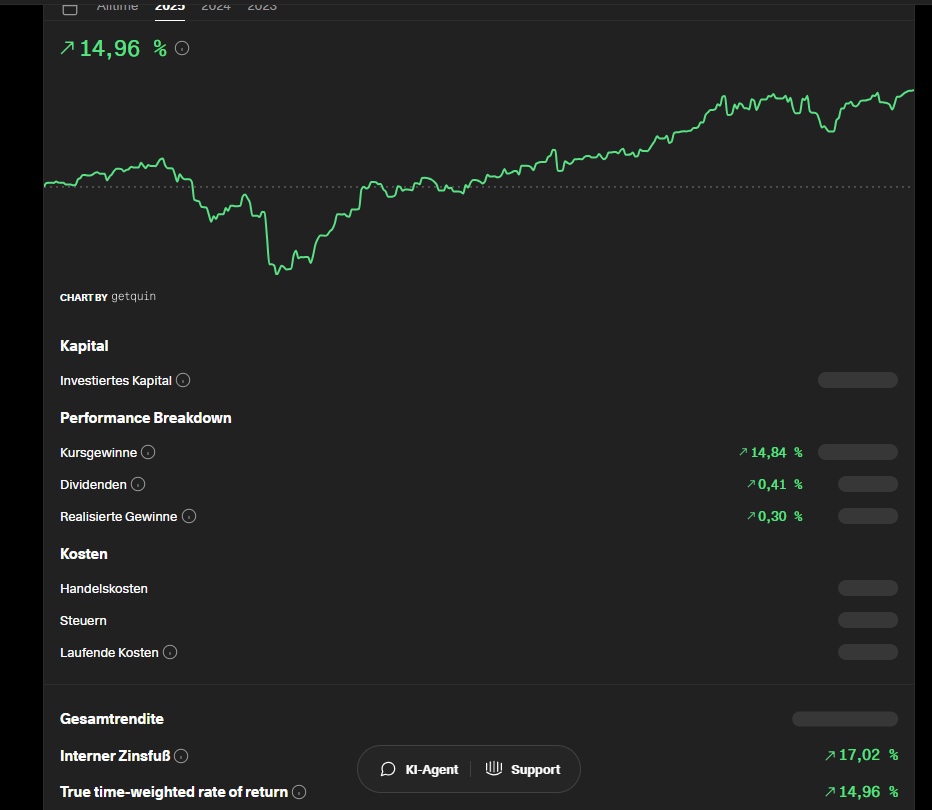

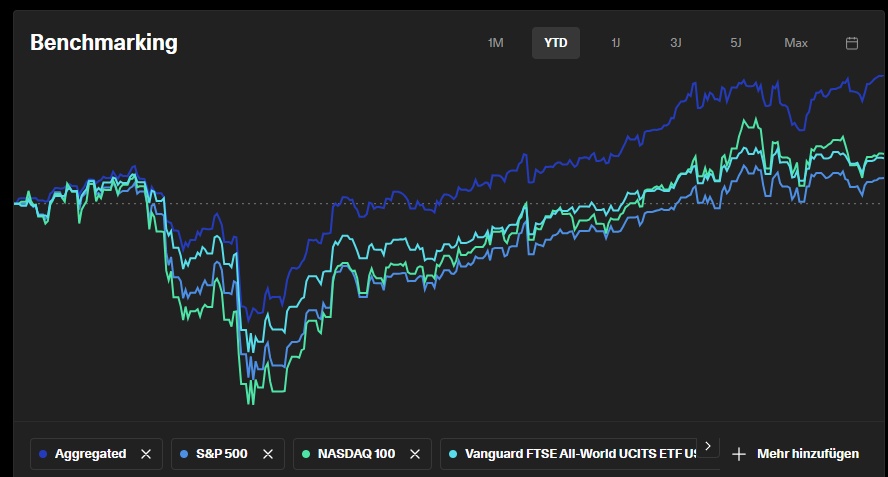

Here is my annual performance, which I am satisfied with, not only because of the return I achieved - some have achieved far more - but also because I was able to reduce my drawdown compared to my "comparison benchmarks".

I thought my 3 best stocks would be the ones I bought in the "Trump Crash". But the 3 best were the ones I bought before and simply held:

And also the ones I bought after the big carnage did well

However, the following did not go well at all

The surprise of the year for me was silver, which of course benefited my portfolio.

Best regards