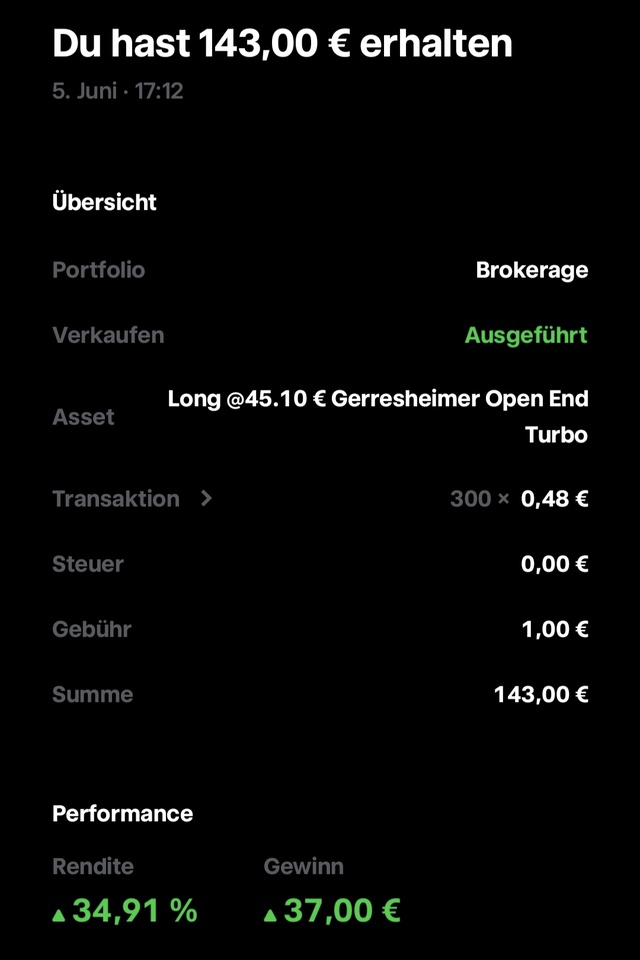

In Germany, too, there are criminal activities among listed companies. Only here are these companies allowed to remain in the selection index. $GXI (+0,77 %)

The specialty packaging manufacturer Gerresheimer cannot rest. Once again, the Düsseldorf-based company has to correct accounting errors and will postpone the annual report announced for February 26. In early trading, the SDAX stock again slips by a double-digit percentage.

The ongoing investigations initiated by the company require more time for the preparation and audit of the financial statements, according to a press release issued by Gerresheimer late Tuesday evening. Based on the current findings of the ongoing investigations and the audit of the financial statements, including the already announced corrections to bill-and-hold sales, there is currently a need for corrections totaling around EUR -35 million in sales and around EUR -24 million in adjusted EBITDA for the financial year 2024, it added.

The impairments have an impact on the forecast for 2025, with the decline in revenue expected to be at the upper end of the expected revenue decline of between two and four percent. In addition, Gerresheimer will have to bake smaller rolls with an adjusted EBITDA margin of 16.5 to 17.5 percent (previously: 18.5 to 19.0 percent).

For the financial year 2026, Gerresheimer is again forecasting rising profit margins: the adjusted EBITDA margin is expected to be between 18.0% and 19.0%. Sales are expected to be between EUR 2.3 and 2.4 billion (before M&A activities).

In order to get a better grip on costs, the Düsseldorf-based company has launched a transformation program. Among other things, the site in Chicago Heights is to be closed. However, a sale of the molded glass business is not expected in the short term. Instead, Gerresheimer intends to divest its US subsidiary Centor, which focuses on packaging systems for the dispensing of prescription drugs in the USA.