As some of you may have noticed, a few days ago the community project "Tenbagger of the future" was launched a few days ago (More details: https://getqu.in/cd6dCj/).

All the more exciting the reference from @MaxtheCat regarding an article by Agrippa Investments entitled "IREN: On the way to the hyperscaler", which I would like to summarize below:

🚀 Brief overview: What is IREN?

- $IREN (+2,17 %) comes originally from Bitcoin mininghas developed into one of the most profitable players there and is now

- is now building massive AI/HPC cloud capacities is building up.

- Core idea: IREN is basically a "electricity monetizer" with data centres - The aim is to extract as many dollars as possible per megawatt (MW).

- To achieve this, the company owns the entire physical chain itselfland, grid connections, substations, data centers, hardware.

_________________________

🏗️ Vertically integrated & "Power first"

According to the article, electricity is IREN's biggest lever:

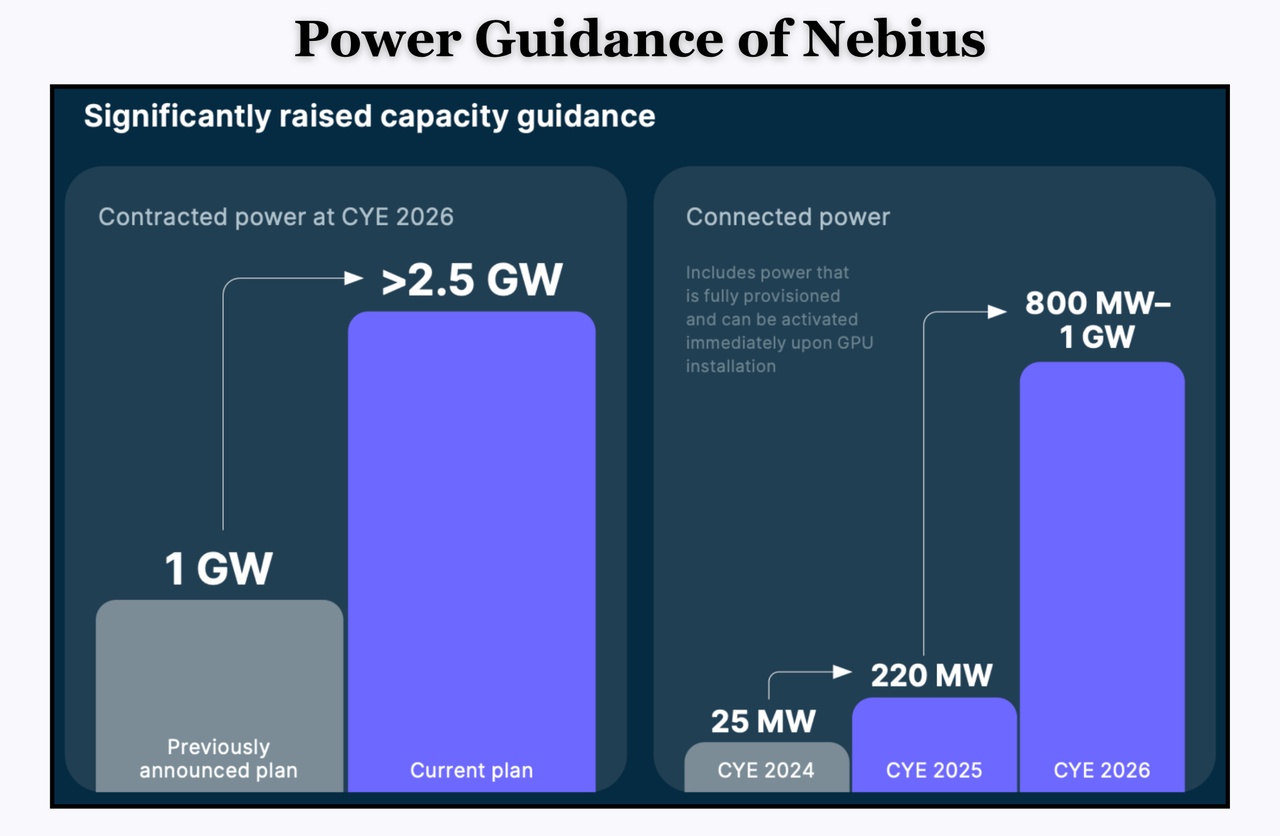

- Around 2.9 GW of secured, grid-connected capacity are already in the portfolio - in a world where data center power is becoming increasingly scarce.

- Many competitors work with "contracted power" (i.e. leased power). IREN, on the other hand, keeps the connections and locations owned by the company itself - This provides margin advantages and more control.

- The sites are primarily located in regions with a lot of wind and solar power (e.g. West Texas, Canada), which supports both the cost and ESG story.

Added to this is the construction moat:

- IREN develops land, negotiates with grid operators, builds high-voltage infrastructure and data centers largely in-house.

- According to the author, IREN is creating around 50 MW of new data center capacity per month - significantly more than is usual in the industry.

_________________________

⛏️ BTC mining: Stage 1 of the business model

The article clarifies: Bitcoin mining was just the entry pointnot the end goal.

- With its hashrate, IREN is one of the largest listed miners in the world.

- Instead of the HODL strategy, the mined BTC is largely sold directlyin order to:

- Expand the power portfolio,

- locations,

- and new data centers.

The giga-site strategy (e.g. several hundred MW at one location such as Childress) reduces running costs because there is no need to operate many small, expensive individual sites.

_________________________

🧠 From miner to AI hyperscaler

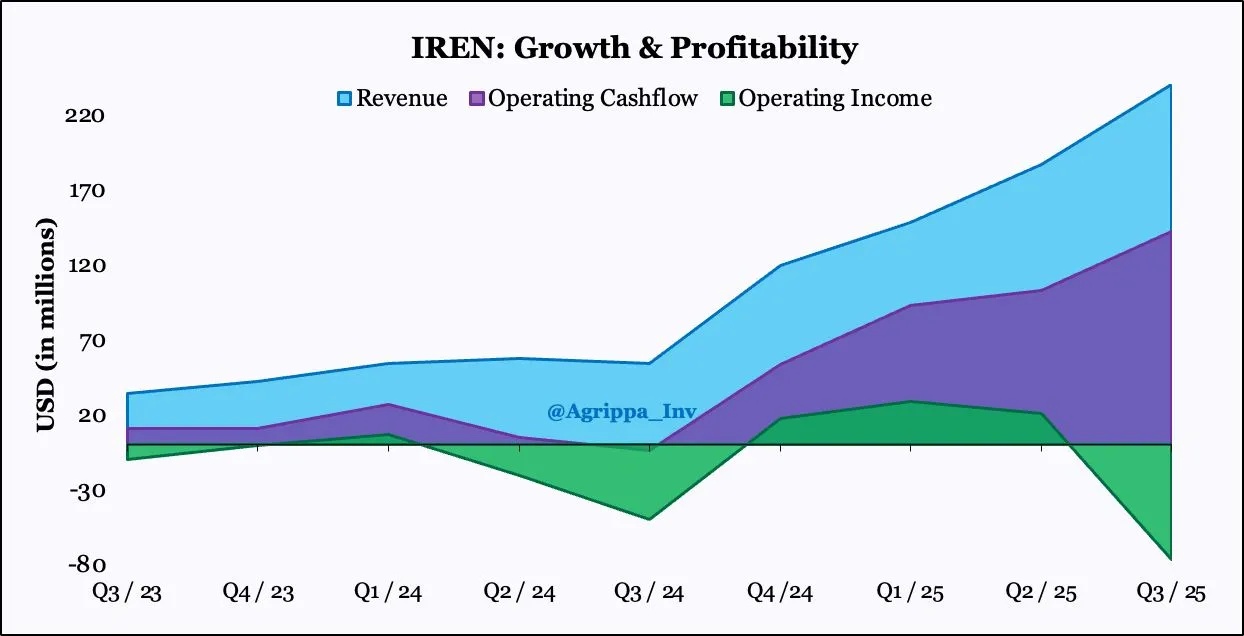

Since the end of 2023 / 2024, IREN has been accelerating strongly towards AI and HPC cloud:

- Coming tens of thousands of high-end GPUs are being used or have been ordered - including $NVDA (+0,31 %) H100/H200, Blackwell generations and $AMD (-0,01 %) -GPUs.

- The aim is to build up a very large GPU fleet by 2026 that can handle demanding AI and HPC workloads.

The highlight of the article is the Microsoft deal:

- A multi-year contract worth billions with with Microsoft is highlighted.

- A large proportion of the upcoming GPUs and the new "Horizon" clusters at the Childress site will be utilized in the long term as a result.

- For the author, this is a kind of "accolade"A major tech group is relying heavily on IREN as an infrastructure partner.

Financing approach:

- Instead of buying everything, IREN relies heavily on GPU leasing (24-36 months) with a purchase option.

- The aim is to finance growth without completely overloading the balance sheet.

_________________________

⚡ Why the model is exciting in the age of AI

The article draws a parallel: AI cloud is more similar to mining than you might think:

- In both cases:

- Extremely high capital requirements,

- hardware quickly becomes obsolete,

- if you are too slow, you are stuck with old technology.

There are two simplified paths to success:

Pricing power: Large software/service ecosystem with high margins (classic hyperscalers such as AWS, Azure, GCP).

Cost leadership: Brutally low costs due to:

- cheap electricity,

- own locations,

- high efficiency in construction and operation.

IREN is clearly aiming for Variant 2: Cost leader.

- Role as "Hyperscaler for hyperscalers":

- IREN offers bare-metal compute in large quantities in large quantities,

- addresses large customers (hyperscalers, AI companies, etc.),

- without having to build the large software ecosystem themselves.

- Traditional data center margins are also to be beaten in this way, because no additional colocation rents are incurred, but the entire chain is kept in-house.

_________________________

📊 Conclusion

Clear the stage for your discussions. The key points of the article are summarized:

- IREN is not "just" a Bitcoin minerbut is developing into a very vertically integrated data center and electricity playerwhich:

- controls huge amounts of power,

- can build data centers extremely quickly,

- and uses both mining and AI cloud as sources of revenue.

- The moat lies, according to the article, primarily in:

- the the quantity and quality of the secured electricity,

- the control over the entire physical infrastructure,

- and the construction and operating expertise (giga sites, high rack densities, air & liquid cooling).

- The Microsoft deal

$MSFT (-0,83 %) acts as a strong validation of the AI business and ensures that a large part of the planned GPU capacity is directly utilized. - On the other hand, risks clearly remain:

- high capital requirements and leasing obligations,

- rapid GPU generation changes,

- strong competition from established hyperscalers and other neo-cloud providers,

- and the question of how long the current AI euphoria will last in this form.

Source: https://www.agrippa.investments/p/copy-iren-a-hyperscaler-in-the-making