Good morning,

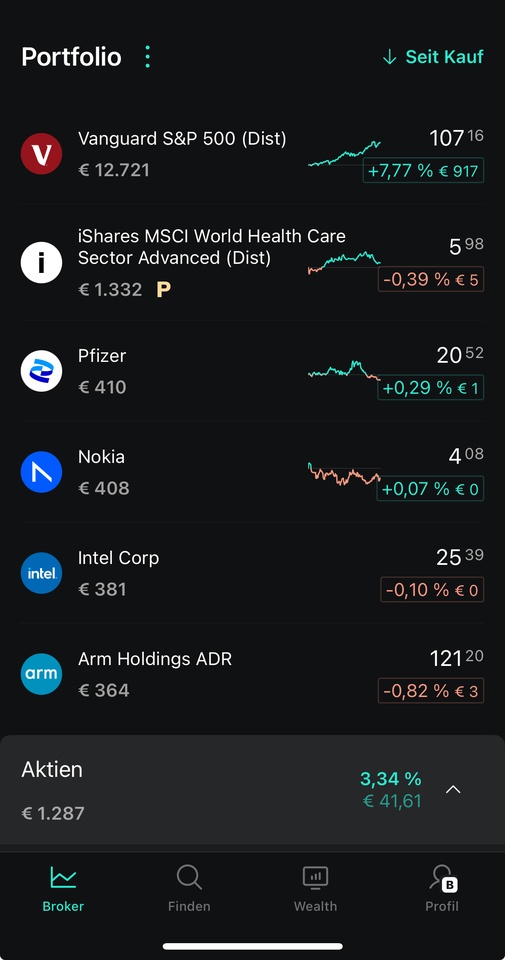

Today I actually bought the first tranche of the following shares:

Intel - Arm Holding - Nokia - Pfizer

---------------------------------------------------------------------------------------------

$INTC (-1,39 %) Nobody believes me, but I actually wanted to buy Intel last week before the significant rise, after the rise I speculated on a setback, which didn't turn out to be so strong and today I simply bought.

Why Intel? What distinguishes Intel from AMD and NVIDIA?

Intel is the only one that develops and also produces itself. Of course, this also entails risks, but it is also the case that Intel is the only non $MU (-9,22 %) is the only non-Asian chip manufacturer that has the latest ASML machines. Is that not one of the reasons why even Nvidia is now investing in Intel... By the way, I actually bought Micron today, simply to increase the size of the position.

In my opinion, anyone investing in Intel today should have a lot of patience. As you know, I don't have much of that, so maybe this will be my gym.

--------------------------------------------------------------------------------------------------------

$ARM (-6,26 %) Arm develops the Arm architecture for processors, which are particularly efficient and do not require cooling, which is why you find them as standard in smartphones, tablets and other devices, and sells the licenses to Qualcomm, Apple, Samsung and Nvidia, for example.

They are involved in almost all smartphone chips, earning money from the license without having to bear any production costs themselves.

The risks are a very high valuation, in which a lot of growth is already priced in. Strong dependence on the smartphone market, competitors could contest market shares and the company is very dependent on the Asian market.

--------------------------------------------------------------------------------------------------------

$NOKIA (+2 %) is quite well positioned and a leader in 5G network technology. For example, it controls over 29% of the 5G market outside China and is already in the lead in 6G... The business model is quite cyclical, investment intensive and the technological change is very fast.

--------------------------------------------------------------------------------------------------------

$PFE (+3,06 %) has made many strategic acquisitions in recent years. The acquisitions of Seagen and currently Metsera, among others, show that Pfizer is making targeted investments in growing and lucrative therapeutic areas. Whether the pipeline will be successful remains to be seen and is probably one of the greater risks.

--------------------------------------------------------------------------------------------------------

I have mentioned some of the risks, there are probably countless. The stocks fit into my portfolio quite well, as I mainly invest in boring ETFs and the weighting of these individual stocks is too low to significantly jeopardize my basic investment. If things go really badly, the money is gone, if things go reasonably badly, I have dividend stocks 🤪