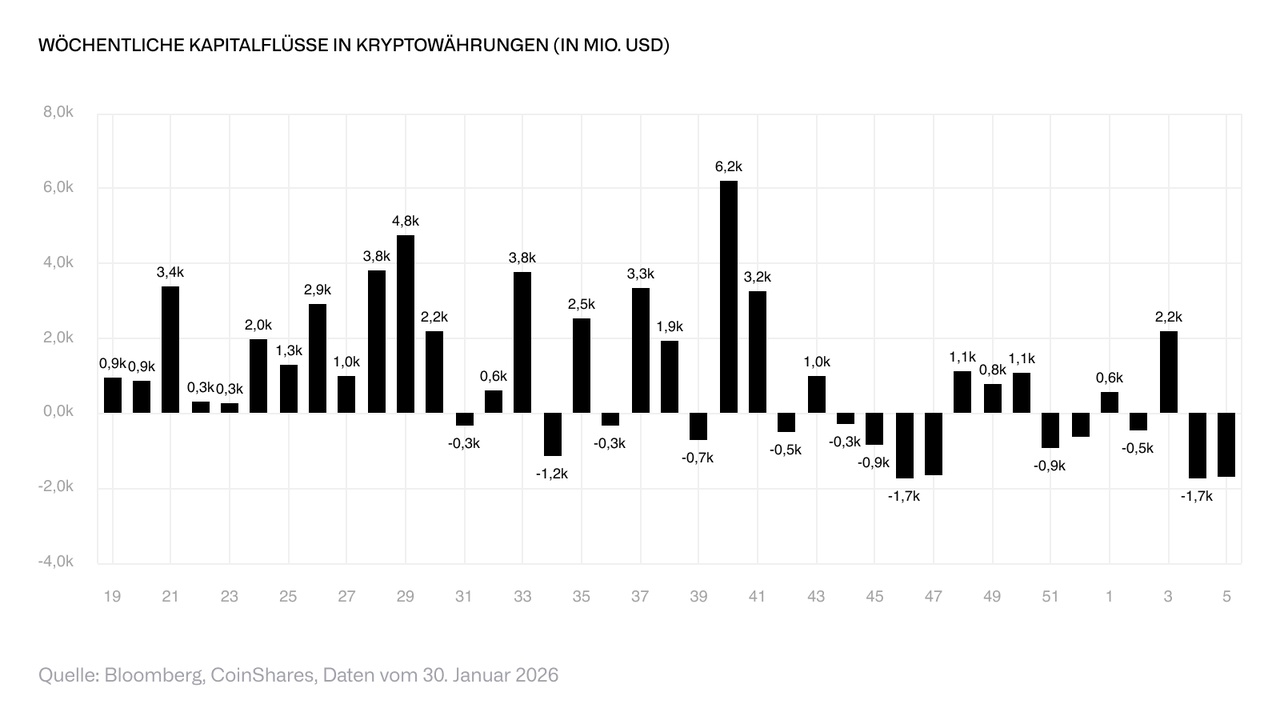

Digital investment products recorded a second consecutive week of outflows totaling USD 1.7 billion. This completely reversed the inflows achieved since the beginning of the year, resulting in a net global outflow of USD 1 billion since the start of the year. This indicates a noticeable deterioration in investor sentiment towards the asset class. In our view, this reflects a combination of factors, including the appointment of a more dovish Fed Chair, continued selling by large market participants in the context of the four-year cycle and increased geopolitical volatility. Since the price highs in October 2025, global assets under management (AuM) have fallen by USD 73 billion.

The negative sentiment was broad-based across individual assets. $BTC (+6,85 %) recorded outflows of 1.32 billion US dollars, $ETH (+11 %) of 308 million US dollars. The most recently favored assets $XRP (+8,11 %) and $SOL (+11,65 %) were also affected, with outflows of USD 43.7 million and USD 31.7 million respectively. Short Bitcoin products, on the other hand, recorded inflows of USD 14.5 million; assets under management here have risen by 8.1 percent since the beginning of the year.