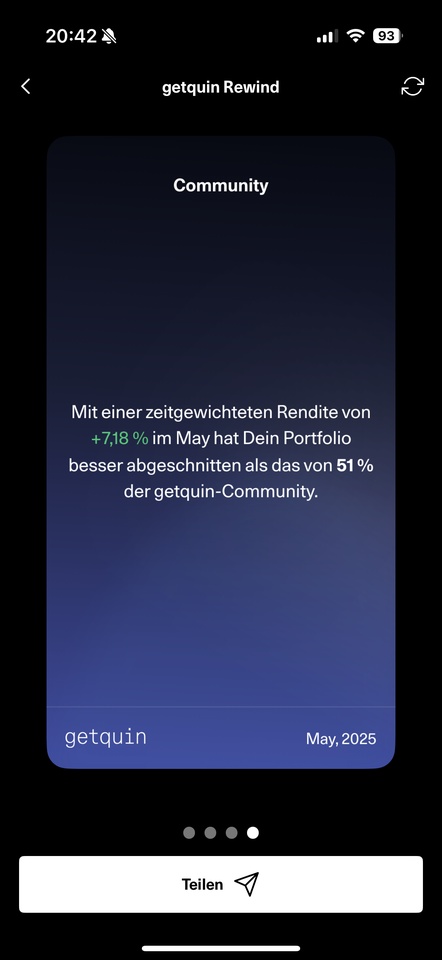

Absolute midfield in the GetQuin community (but you're good too!🫡😬)

I still have a cash quota of about 20%, from which I make weekly $VWRL (-0,39 %) and $VEUR (+0,49 %) (to specifically increase my European weighting).

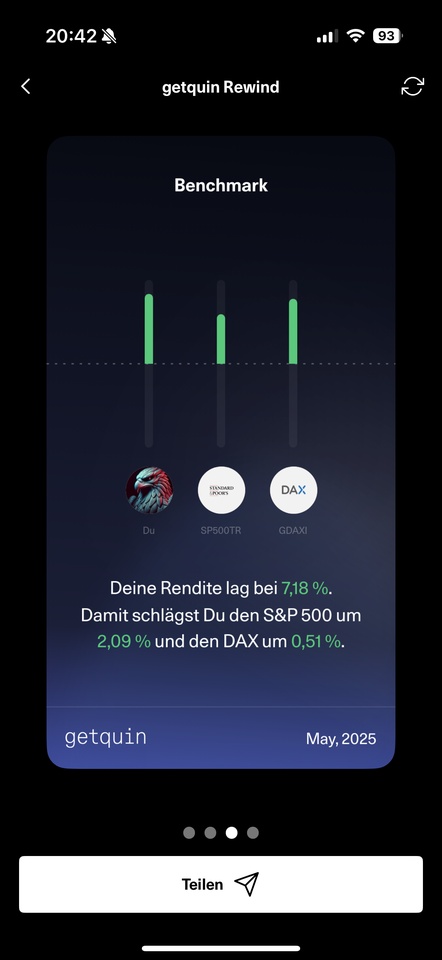

US markets are still historically expensive and a further depreciation of the USD could put additional pressure on the US portion of the portfolio.

I would use larger setbacks for one-off investments.

The 2.25% overnight interest rate at TR, or ~2.157% (thanks @Epi) at $XEON (+0,01 %) I am currently still happy to take it.

That's it already.

Keep going! 👍🚀