Brief overview

Introduction

Our history

Business areas

Business figures

Latest quarterly figures

Shopers Moat/Competition?

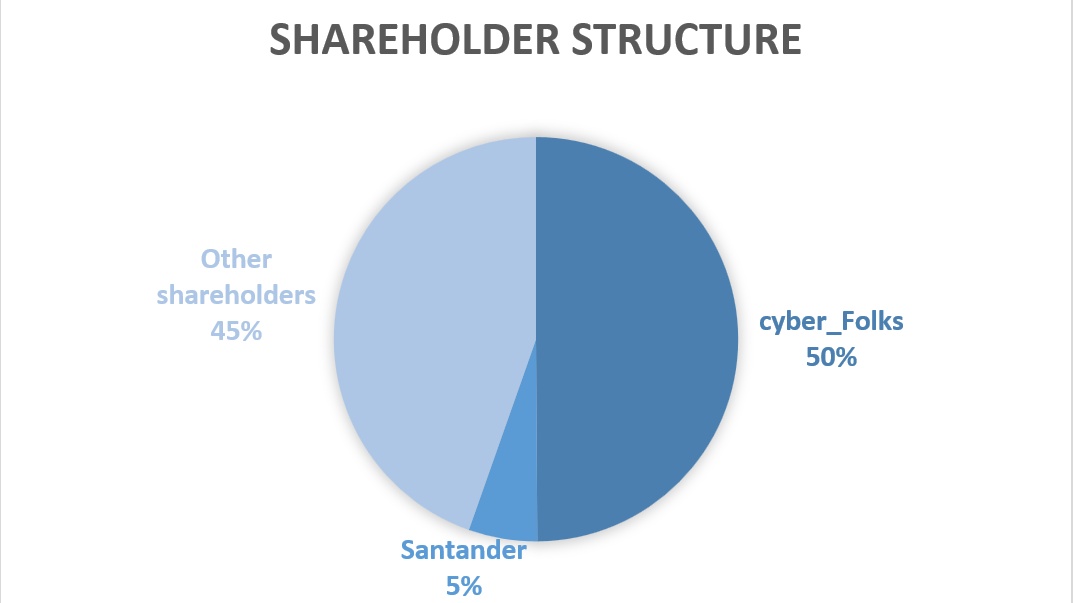

Shareholder structure

Valuation

Conclusion

Sources

Brief overview

Market capitalization: 1.36 billion zlotys (312.8 million euros)

KGV/KGVE: 37/30

annualized yield: -2 % p.a.

Analyst rating: Buy

Introduction

Shoper $SHO (+5,71 %) is a Polish B2B company that provides software and services for building and managing online stores. The company currently employs 243 people and its CEO is Jakub Dwernicki. Shoper also includes the companies Apilo (multi-channel sales management system), Shoplo (online store provider), Selium (marketplace agency) and Sempire (SEO marketing agency). Together, however, these only account for 10% of total sales (with a slight upward trend).

History

"Starting with the brand Shoper, our goal was to offer sellers Polish and affordable software."

Krzysztof Krawczyk, founder

The brothers Krzysztof Krawczyk and Rafal Krawczyk founded Shoper together in 2005. They previously had a computer equipment company. When they wanted to set up an online store, they realized that there was no provider with the right software. Shoper was born. Over time, the business became a subscription model and additional solutions were added. In 2021, the company successfully went public on the Warsaw Stock Exchange and was listed on the sWIG80 (Polish index for small companies).

Business areas

https://investors.shoper.pl/en

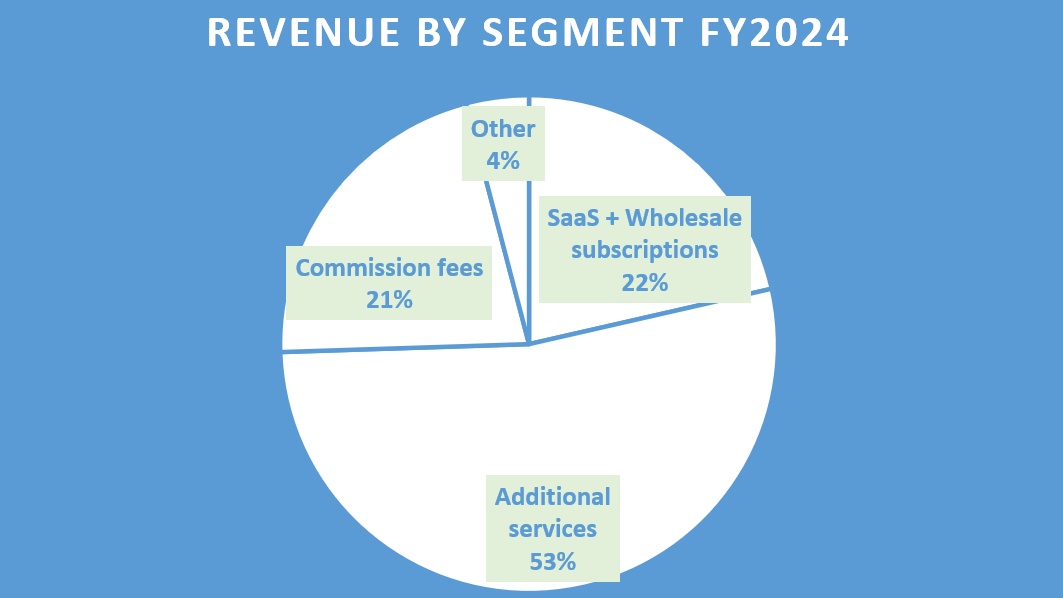

SAAS subscriptions: recurring revenue from subscriptions taken out by customers to create and operate an online store

Additional service: Corporate customers can take advantage of additional fee-based solutions to increase sales. This includes many different services:

Management of advertising campaigns and ads with Shoper in ...

-Search engines (Google Ads and Microsoft Ads)

- Social media (Instagram, Tik Tok and Facebook)

-Sales platforms (Allegro, Amazon)

Integrations and extensions

-Choice of various payment services

-Provision of complete logistics by the logistics company XBS Group

-uvm.

Omnichannel distribution

Shoper also offers the option of selling the products not only on its own website, but also on marketplaces such as Allegro, Ebay, Amazon, Kaufland and Etsy.

Advantages of omnichannel distribution

+ Management of your own products from one page

+ Price and inventory synchronization

+ Development of new markets (also abroad)

+ Independence from just one sales channel

Financial services

Additional financing through loans, bank accounts and payment terminals is available via Shoper's external partners. Shoper presumably receives a commission for every successful referral.

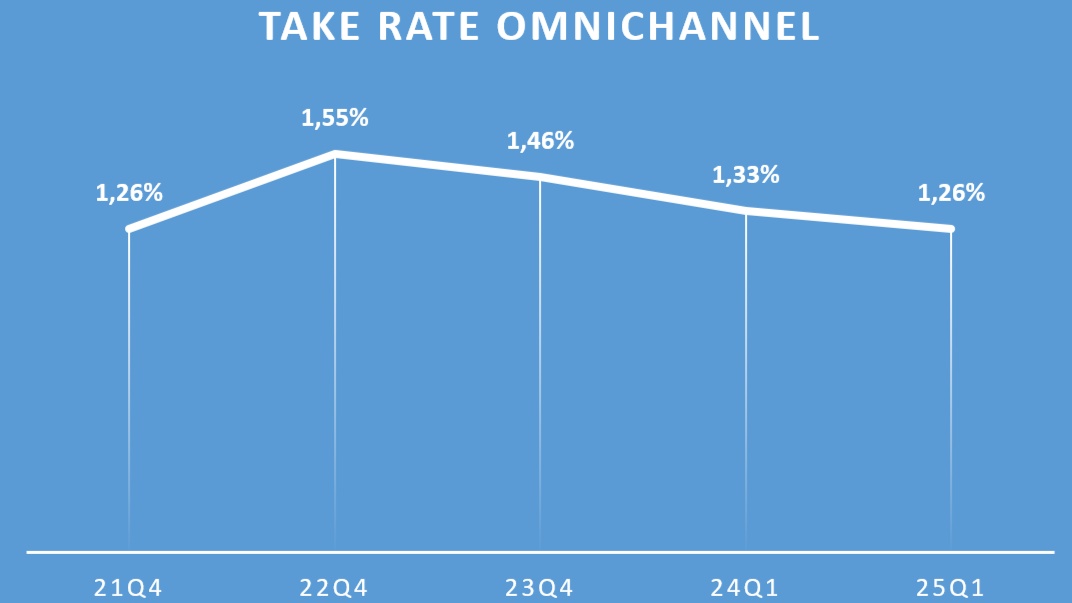

Commission fees: Shoper receives a share of the sales price. The current take rate for the online store is 1.9% and 1.26% for omnichannel.

https://investors.shoper.pl/en

https://investors.shoper.pl/en

Wholesale subscription: Revenue from the sale of subscriptions to partner companies

Other: Bundling of non-significant other areas

Business figures

Turnover and profit

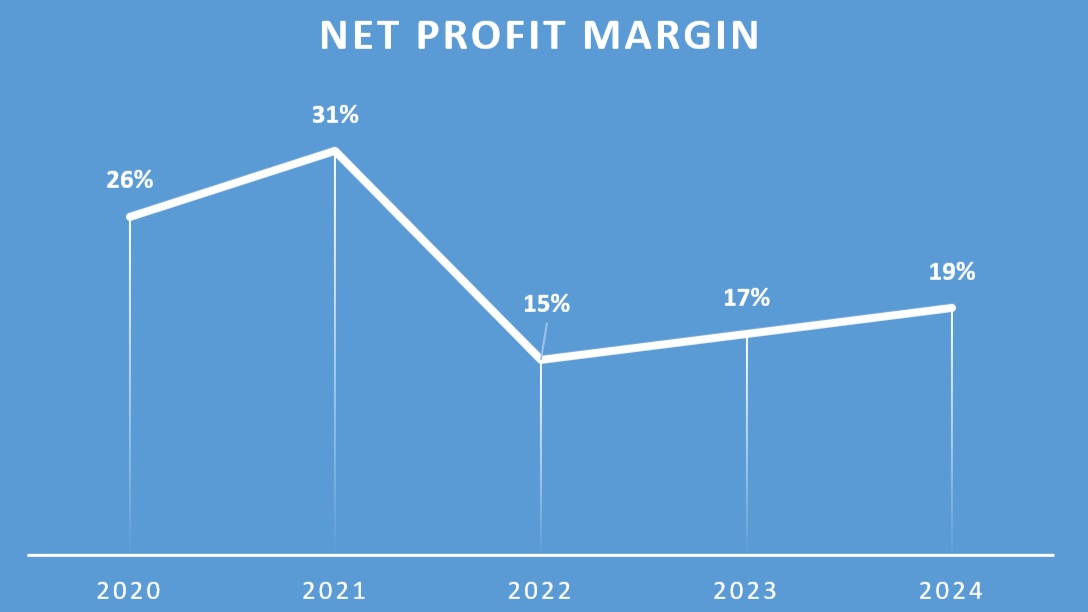

Shoper has been a high growth company in the past. In the last five years, turnover has increased by 34% annually. However, following the boom in e-commerce triggered by the coronavirus pandemic, growth slowed over the years from 70% to 26% in the last financial year.

However, profits only increased by 25% annually. The profit margin fell accordingly.

https://investors.shoper.pl/en

The reasons for this include the increased costs for salaries and social security contributions. At 38% p.a., they have grown disproportionately to turnover over the last five years. However, the high profit margin in 2021 can also be explained by a one-off effect amounting to złoty 10 million (derecognition of a financial asset).

Shoper is generally only represented in Poland, with only 4% of sales coming from other countries. Although there are no plans to expand into neighboring countries, this is a fairly obvious way of achieving continued high sales growth.

There is a dependency on a business partner called Autopay. Shoper offers integrated payment solutions for its customers, which then runs through Autopay. 13% of total turnover comes from this collaboration with Autopay. A year earlier it was 15%. As both companies benefit from this partnership, the risk of ending the cooperation is low.

Balance sheet

Despite the many acquisitions, Shoper has hardly any debt. The ratio of debt to annual EBITDA is only 0.3, meaning that Shoper can easily reduce its entire debt burden within a year. The cash position increased by 46% to 37 million złoty.

Shares and dividends

There are currently 28.134560 million shares. However, there has been no dilution of existing shareholders over the years. Instead of share buyback programs, Shoper relies on dividend distributions. This year, 1.03 złoty per share was distributed (dividend yield approx. 2.2%). The payout ratio amounted to an exceptional 77% of net profit. I do not know whether the company intends to continue paying out this amount in the coming years.

Last quarterly figures

On May 20, Shoper published its quarterly figures for the first quarter of this year. Turnover growth slowed to 17%, down from 26% last year.

https://investors.shoper.pl/en

One positive aspect, however, is the further improvement in margins. The profit margin improved by one percentage point because operating costs only grew by 14%.

What is not so good is that the cash flow from operating activities only grew by 9%. Capital expenditure slumped by 36% to around 3.5 million złoty. Both have an impact on free cash flow. Ultimately, these figures are only meaningful to a limited extent. For example, the investments could only have been postponed to the second quarter.

With the quarterly figures for the second quarter, it is therefore essential to look at the development of sales growth to see whether the sharp slowdown in the first quarter is only temporary or of a long-term nature. It also makes sense to take a look at the margins and the cash flow in general.

Shopers Moat/Competition?

Companies with a moat (sustainable competitive advantage) promise stability in times of crisis and higher returns. The following also applies: the less competition, the greater the Moat. This raises the question of whether Shoper has a competitive advantage.

Pro competitive advantage

-specialized only for Polish companies (e.g. integration of Allegro in the platform)

-Polish 24/7 support

-low subscription costs

-high margins

-high switching costs

-increasing take rate

Contra competitive advantage

-relatively unknown

-much well-known competition

-low take rate compared to international competition

Shareholder structure

https://investors.shoper.pl/en

cyber_Folks $CBF (+7,69 %)

: Polish technology company (full takeover unlikely in the medium term); generally positive due to cost sharing in the development area.

Santander: Investment fund management company

Free float: In the past, the founders and other investors held large stakes (72.9%). However, over time, driven by the acquisition of cyber_Folks, they were sold.

Disclaimer

This is not investment advice. These are personal assessments that cannot replace professional advice. You can find more stock analyses on my free substack (link in profile).

Conclusion

Apart from the development of the share price, Shoper has been very convincing in the past. Although the management has not yet spoken openly about expansion plans, the development of new markets in Eastern Europe is, as I said, very promising.

Sources