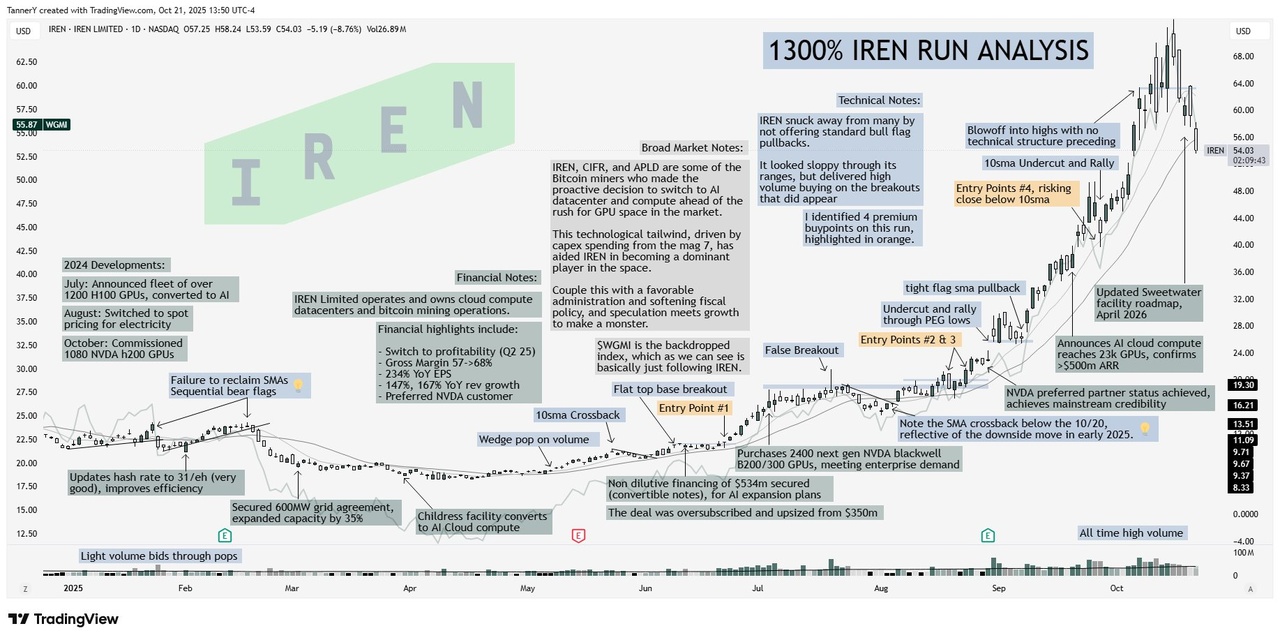

- Becoming profitable

- Triple-digit sales and EPS growth

- Bitcoin mining - > Data center conversion

- Misunderstood business

- Vertically integrated

- $NVDA (+1 %) Preferred partner

Graphic from TannersTrades on x

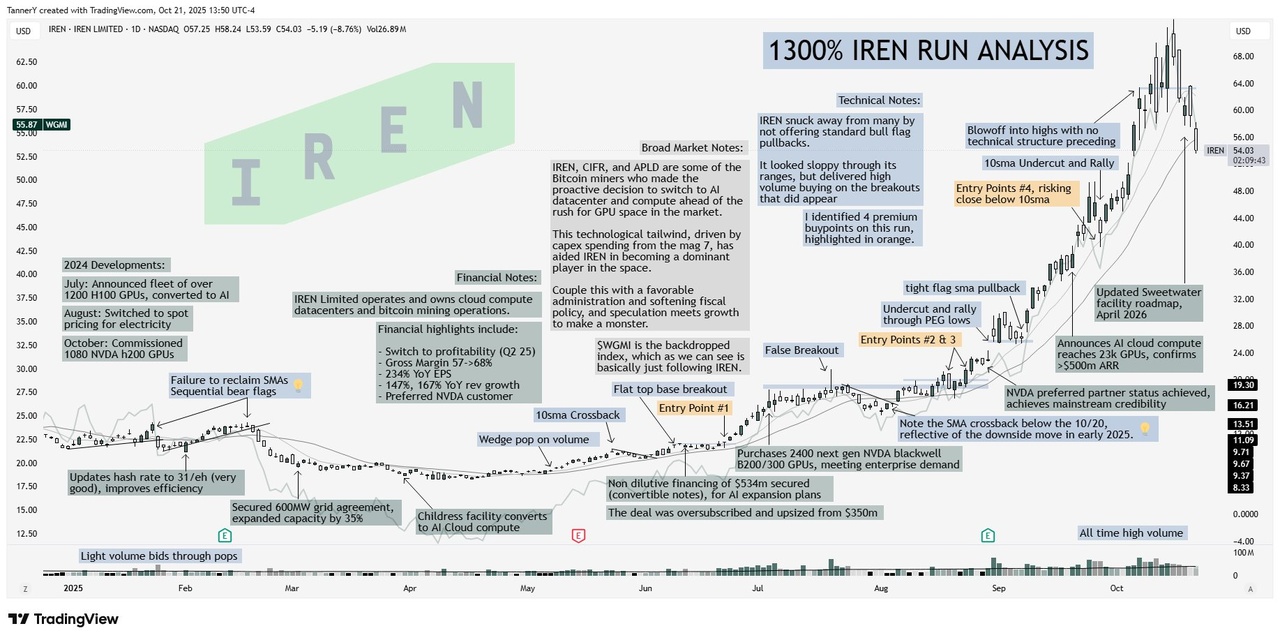

- Becoming profitable

- Triple-digit sales and EPS growth

- Bitcoin mining - > Data center conversion

- Misunderstood business

- Vertically integrated

- $NVDA (+1 %) Preferred partner

Graphic from TannersTrades on x