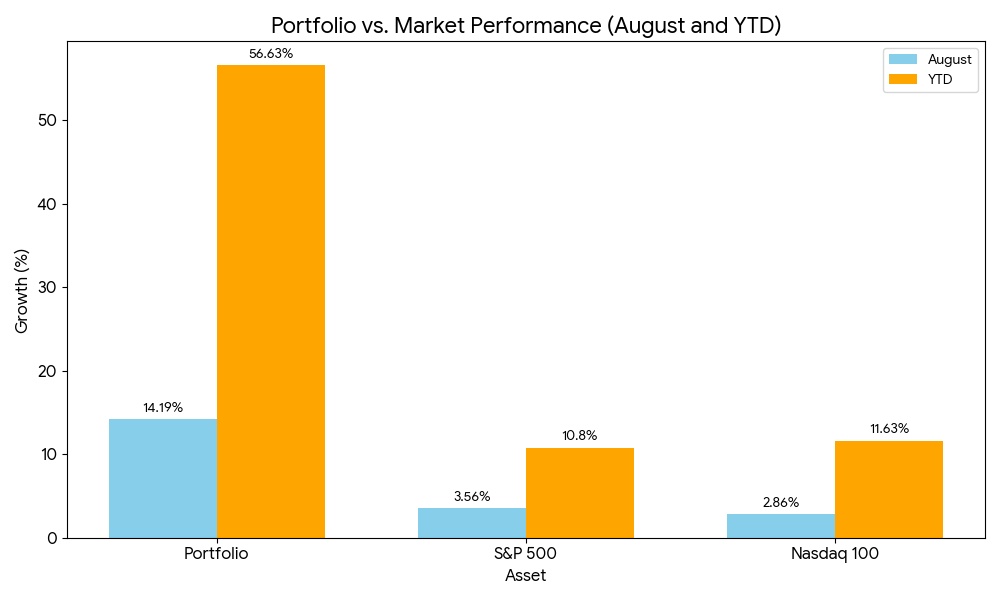

August was another outstanding month for my portfolio at eToro, closing with +14.19% growth.

S&P 500: +3.56% in August

Nasdaq 100: +2.86% in August

Looking at the bigger picture, my YTD performance is now +56.63%, while the:

S&P 500 is up around +10.80%

Nasdaq 100 is up around +11.63%

This clear gap shows that my investment formula – Fundamentals + Algorithm + Patience – is delivering results.

📈 Top performers in August:

Jumia ($DE000A2TSMN4 )

NIO ($9866 (-4,4 %) )

Crypto.com ($CRO (-0,74 %) )

PepsiCo ($PEP (+0,4 %) )

StoneCo ($STNE (-2,97 %) )

For September, my focus is on protecting the portfolio by diversifying further:

Expanding into Hong Kong

Adding exposure in Europe

Entering the UAE markets

This multi-market approach helps reduce risk while keeping opportunities open in different geographies.

👉 My strategy remains consistent: patience, fundamentals, and letting my algorithm highlight the right buying moments.

𝗧𝗵𝗶𝘀 𝗶𝘀 𝘁𝗵𝗲 𝗽𝗲𝗿𝗳𝗲𝗰𝘁 𝘁𝗶𝗺𝗲 𝘁𝗼 𝗰𝗼𝗽𝘆 𝗺𝗲 𝗼𝗻 𝗲𝗧𝗼𝗿𝗼—𝗱𝗼𝗻’𝘁 𝗺𝗶𝘀𝘀 𝘁𝗵𝗶𝘀 𝗼𝗽𝗽𝗼𝗿𝘁𝘂𝗻𝗶𝘁𝘆 𝘁𝗼 𝗴𝗿𝗼𝘄 𝗮𝗹𝗼𝗻𝗴𝘀𝗶𝗱𝗲 𝗺𝘆 𝘀𝘁𝗿𝗮𝘁𝗲𝗴𝘆.

😎 𝗗𝗶𝘀𝗰𝗹𝗮𝗶𝗺𝗲𝗿: This is my personal opinion and is for informational purposes only. You should not interpret this information as financial or investment advice.