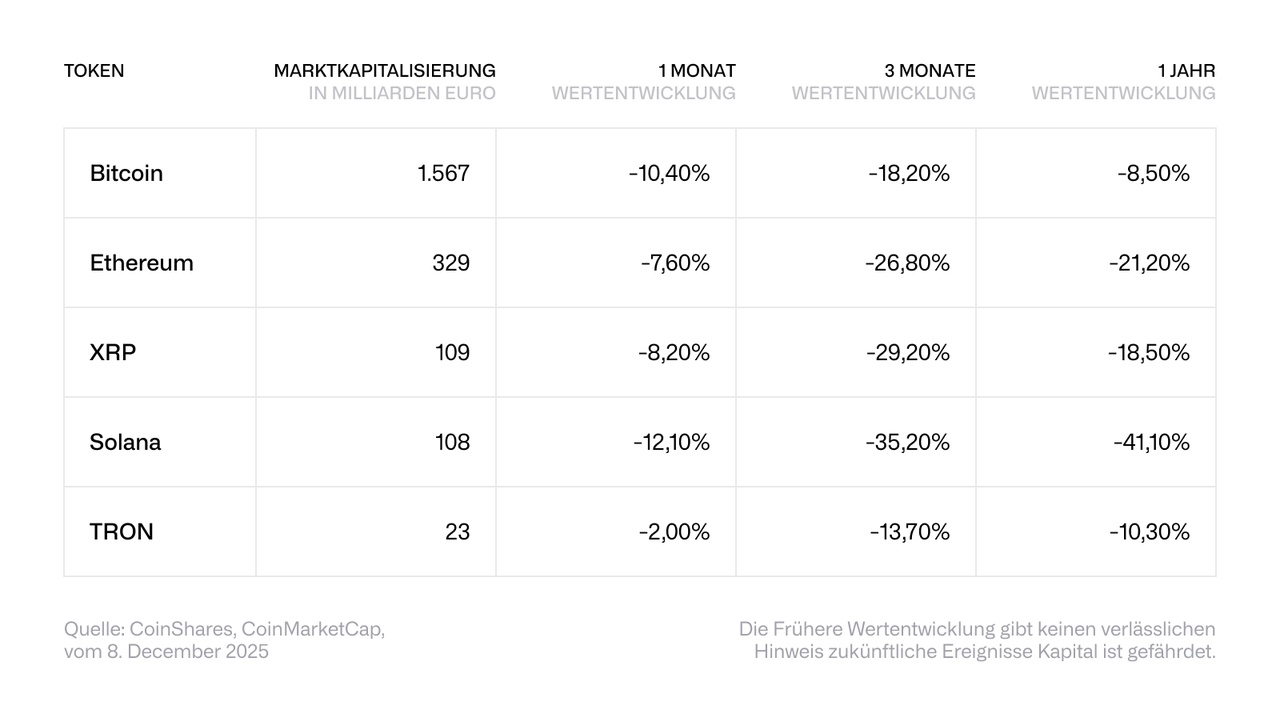

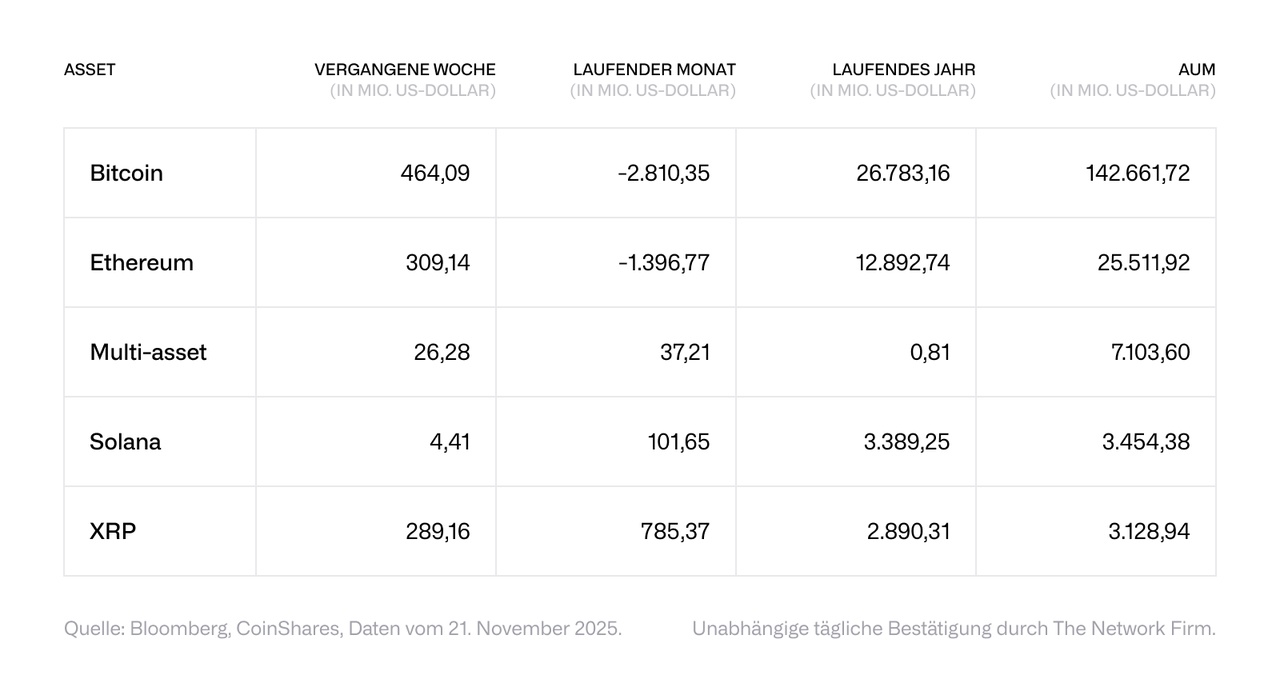

#xrp and #solana recorded the highest inflows last week, amounting to USD 70.2 million and USD 7.5 million respectively. Since the ETFs were launched in the US in mid-October, they have recorded inflows totaling USD 1.07 billion and USD 1.34 billion respectively, clearly bucking the negative sentiment for other asset classes. In contrast, Bitcoin and Ethereum saw outflows of USD 443 million and USD 59.5 million respectively last week. Since the launch of the XRP and Solana ETFs, Bitcoin and Ethereum have seen outflows totaling USD 2.8 billion and USD 1.6 billion respectively.

CoinShares Physical XRP

Price

Debate sobre XRRL

Puestos

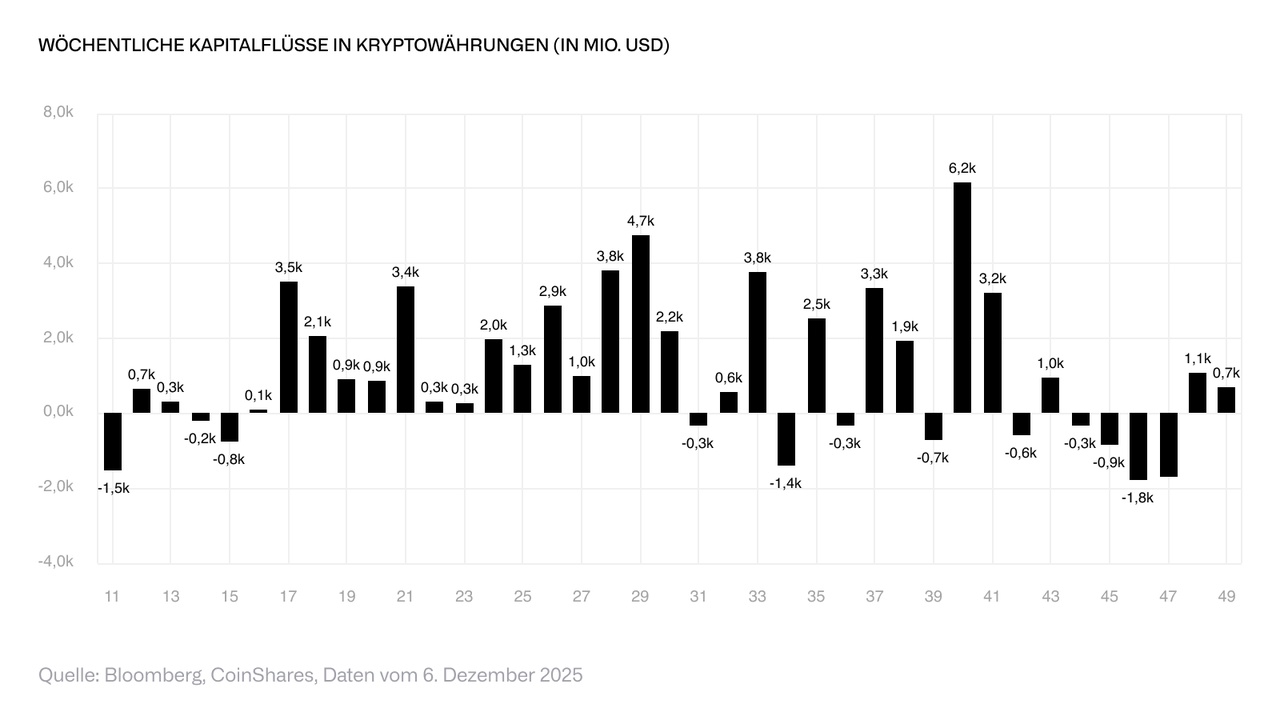

6Digital assets: second week of significant capital inflows

Digital asset investment products saw inflows of USD 716 million for the second week in a row as sentiment continued to improve. Daily data showed small outflows on Thursday and Friday, which we believe were a reaction to macroeconomic data from the United States indicating continued inflationary pressures. Total assets under management have increased by 7.9% to USD 180 billion since the November lows, but remain well below the record USD 264 billion.

#bitcoin was the main beneficiary, recording inflows of USD 352 million, bringing year-to-date inflows to USD 27.1 billion - well below the USD 41.6 billion reached in 2024. Short Bitcoin products saw outflows of USD 18.7 million, the largest since March 2025, when these outflows coincided with a similar price decline, suggesting that exchange-traded product investors believe the current period of negative sentiment may now have bottomed out.

#xrp continued to report strong inflows, totaling USD 245 million last week and bringing year-to-date inflows to USD 3.1 billion, easily surpassing the USD 608 million reported in 2024. Chainlink also received exceptionally high inflows totaling USD 52.8 million last week - the largest ever recorded - representing more than 54% of assets under management.

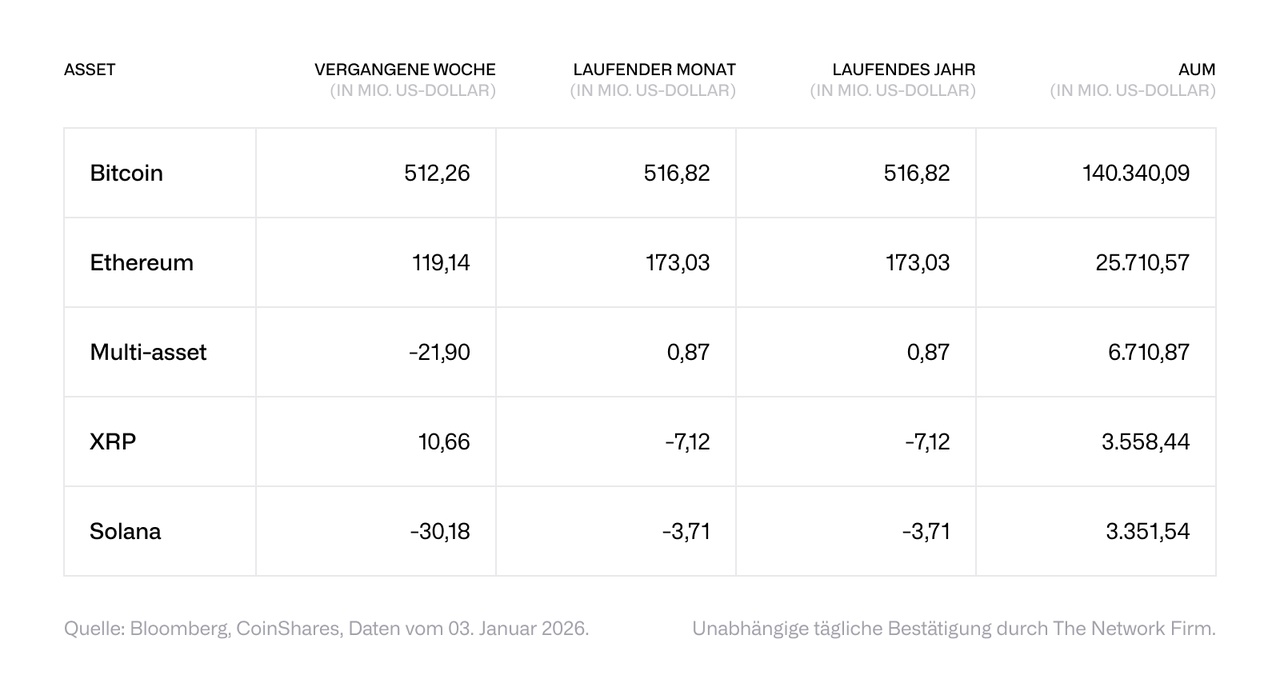

Bitcoin gains significantly again; XRP records highest weekly inflows since records began

#bitcoin recorded inflows of USD 464 million last week. At the same time, investors withdrew USD 1.9 million from short Bitcoin ETPs - a clear sign that bets on prices falling further are being withdrawn. Ethereum also benefited from the improved sentiment and saw inflows of USD 309 million.

#xrp Ethereum stood out with the highest weekly inflows since records began: A total of USD 289 million flowed in, and the series over the past six weeks now represents 29 percent of total assets under management. The trend is likely to be closely linked to the recent ETF launches in the United States. #cardano In contrast, the United States recorded outflows of 19.3 million US dollars, which corresponds to 23 percent of its assets under management.

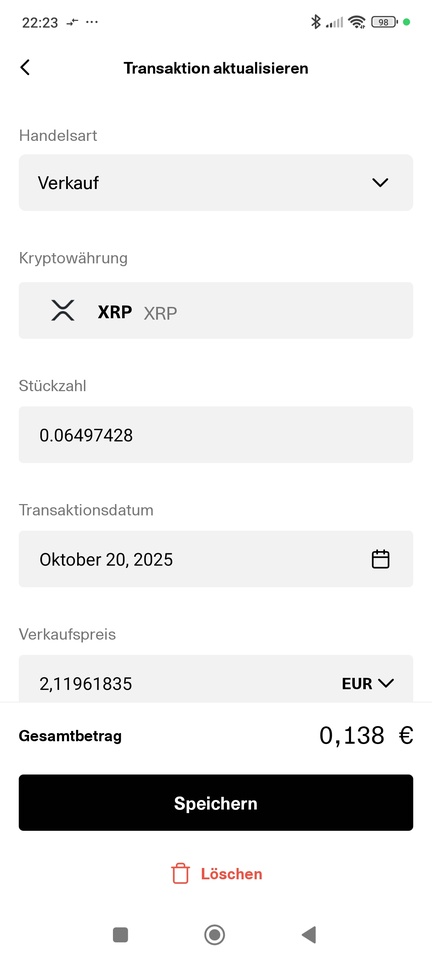

Mysterious sales of XRP

Dear gq community,

I have another question. Some time ago, as a test, I bought a mini position $XRRL (-2,06 %) at SC some time ago.

Now I keep observing sales that I did not initiate.

Can anyone explain this to me?

Meet CoinShares Physical Crypto ETPs

Why physically collateralized crypto ETPs are important

The global demand for regulated, transparent and simple ways to invest in cryptocurrencies is growing - especially in Germany. Many investors want to benefit from the performance of digital assets without having to deal with wallets, private keys or technical setup. This is exactly where CoinShares Physical ETPs come into play.

CoinShares is a European market leader in digital asset investments with offices in Switzerland, Jersey, the UK and Sweden. CoinShares Physical ETPs offer a simple, secure and transparent way to invest in assets such as Bitcoin, Ethereum and others - with the added benefit of physical collateralization that creates transparency and direct connection to the underlying asset.

What is an ETP and what does "physically backed" mean?

An ETP (Exchange Traded Product) is an exchange-traded financial product that tracks the price of an underlying asset - in this case cryptocurrencies such as Bitcoin or Ethereum.

A "physically backed" ETP means:

- Each ETP unit is directly backed by real crypto assets.

- The underlying coins are held in secure cold storage vaults.

- Investors have a claim to the underlying digital assets.

The main benefit: Investors receive direct price participation without having to hold or manage the assets themselves.

Why choose CoinShares Physical ETPs?

Security & custody

All coins backing the ETPs are stored in highly secure, institutional cold storage solutions. Custody is provided by reputable third-party providers such as Komainu - a joint venture between Nomura, Ledger and CoinShares.

Transparency

CoinShares publishes daily:

- The exact amount of cryptocurrencies held,

- The net asset value (NAV) of each ETP,

- The number of ETP units issued,

- The amount of staking income distributed to investors.

Investors can see what they own and how it is structured at any time.

Regulation & Structure

The CoinShares Physical ETPs:

- Are listed on European exchanges, including Xetra in Germany,

- Are issued in accordance with applicable EU financial regulation and are subject to ongoing supervision by competent authorities,

- Are domiciled in Jersey - a jurisdiction with strong financial control.

Physical Collateral & Coin Entitlement

Each ETP unit grants the holder an entitlement to a certain amount of cryptocurrency ("Coin Entitlement"). This amount is updated daily and published transparently on the CoinShares website. This means that investors are not only financially but also economically linked to the underlying crypto asset.

What products are currently available?

CoinShares offers a growing range of single asset ETPs, including:

- CoinShares Physical Bitcoin - $BITC (-1,86 %)

- CoinShares Physical Staked Ethereum - $CETH (-0,82 %)

- CoinShares Physical Litecoin - $CLTC (+0,26 %)

- CoinShares Physical XRP - $XRRL (-2,06 %)

- CoinShares Physical Staked Tezos - $XTZS (+0,05 %)

- CoinShares Physical Staked Polkadot - $CDOT (-1,42 %)

- CoinShares Physical Staked Cardano - $CSDA (-0,91 %)

- CoinShares Physical Staked Solana - $SLNC (-2,37 %)

- CoinShares Physical Staked Chainlink - $CCHA (-0,73 %)

- CoinShares Physical Uniswap - $CIWP

- CoinShares Physical Staked Cosmos - $COMS (+8,3 %)

- CoinShares Physical Staked Polygon - $CPYG (+12,83 %)

- CoinShares Physical Staked Algorand - $RAND (-0,49 %)

- CoinShares Physical Top 10 Crypto Market ETP - $CTEN (-1,25 %)

- CoinShares Physical Smart Contract Platform ETP - $CSSC (-0,83 %)

Advantages for investors in Germany

- Access via Xetra and brokers such as Trade Republic, Scalable Capital, ING etc.

- Transparent fee structure: no hidden costs - only a simple annual management fee

- Easy to declare for tax purposes thanks to treatment as a standard security

- Physically secured and held in institutional custody

- Staking rewards possible for selected ETPs

Conclusion: Simple, secure and regulated access to crypto

CoinShares Physical ETPs offer German investors one of the most trustworthy and transparent ways to invest in cryptocurrencies - without technical hurdles, without private keys, without wallet management. This means:

- Crypto as a portfolio component, just like shares or ETFs

- Ideal for long-term investors with a focus on security and regulation

- Available via leading German brokers and platforms

Valores en tendencia

Principales creadores de la semana