$IWVL (-0,29 %)

$VUAG (-0,24 %)

$IWDA (-0,27 %)

$EIMI (-1,1 %)

$WSML (-0,36 %)

$MVEU (+0,04 %)

$IWDP (-0,23 %)

$ZPRP (+0,26 %)

$COMM (-0,77 %)

$IGLN (-0,98 %)

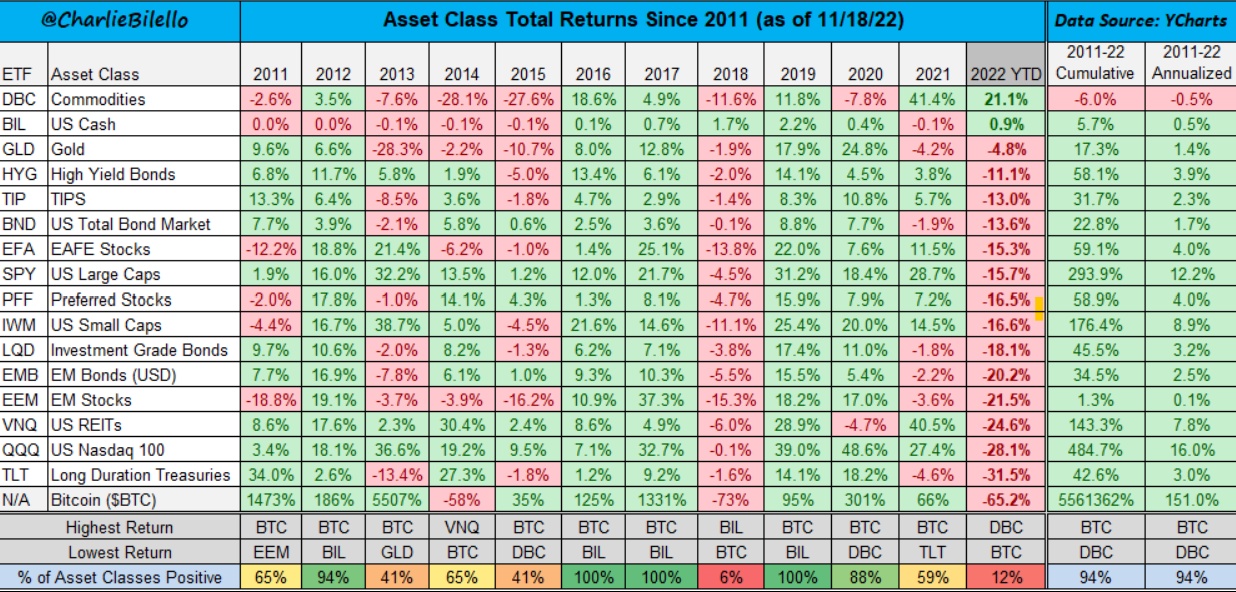

Does anyone care to give an opinion on my ETF allocation?

Feel free to dismiss my choices. I am looking for a better distribution long term - 20years + with reduced risk (20% drawdawn/year is acceptable to me, more is painfull).